Hear the Headlines

| TEAIN22: Bulk and Specialty Tea Prices Diverge

| France Will Pay €1 Million to GI Certify Ceylon Tea

| Sotheby’s Inaugural Tea & Teaware Auctions Total HDK8 Million

PLUS Frugal Innovation, Part 2

Caption: A few of the 24 rare Puerh cakes and aged teas that were auctioned at Sotheby’s first tea auction. Photo replicated from Sotheby’s auction website.

Features

This week Tea Biz travels to Asheville, North Carolina to meet teaware potter and ceramist Mary Cotterman who discusses the artisan spirit and state of mind of those embracing native clay and how COVID-19 lockdowns focused her attention like a monk…

…and then to Assam, India to hear Part 2 of the series Frugal Innovation. In this segment, Aravinda Anantharaman explores the application of Frugal Innovation in the tea garden and factories. Shekib Ahmed of Koliabur Tea Estate explains that “Objective data changes the conversation in the factory from vague concepts to thresholds and parameters. It makes operations scientific so that we can improve.”

Aritisan Teaware Born from Native Mud

By Dan Bolton

Mary Cotterman was 12 when she learned to throw clay on a potter’s wheel. In the decades since, that wheel has never stopped spinning for this accomplished teaware artisan. She describes the foundation of her work as functionality, “because for me, no matter how it looks, if I’m making a piece of teaware it needs to be a precise tool for pouring tea, so a lot of my design I take from traditional Chinese vessels, but I have learned small techniques and vernacular from all over.” Read more…

Listen to the interview

Embracing Simple Technology with Scalable Impact

By Aravinda Anantharaman

Frugal innovations utilize simple technology to address some of the most vexing challenges facing the tea industry. It’s an umbrella term for innovations that do not require much capital, carry a low financial risk, and can be done safely with high reliability. Abhijeet Hazarika, former head of process innovation at Tata Global Beverages, describes several innovations that have moved from the drawing board to become successful pilots at partner estates. explores the application of frugal innovations in the tea garden. Shekib Ahmed of Koliabur Tea Estate in Assam talks about experimenting with frugal innovations in the field, but it’s in the factory, he says, where these simple technologies show the biggest impact. Read more…

Listen to the interview

Frugal Innovation

In Part 1, Aravinda Anantharaman explores the application of Frugal Innovation in buying and selling tea with Abhijeet Hazarika, former head of process innovation at Tata Global Beverages. Listen to Part 1 in Episode 47 of the Tea Biz Podcast

News

TEAIN22: Bulk and Specialty Tea Prices Diverge

By Dan Bolton

The combined annual growth rate (CAGR) predicted for tea in 2022 suggests consumer preference for health enhancements and premium taste will widen the profitability gap separating bulk CTC (cut, tear, curl) from whole leaf and specialty grades.

The fortunes of the tea industry are cyclical with better prices ahead.

Demand in recent decades has been resilient, including during the Great Recession – some would say relentless. During the five years ending 2019, demand grew at around 4.5% per year. The pandemic slowed that pace but consumption in 2022 will top 6.5 billion kilos, enough to make three billion cups a day. Until recently growers managed to quench that thirst.

What disrupted that equilibrium in 2020 is that tea output declined for the first time in 20 years. The resulting scarcity in domestic markets including India and China boosted prices. ICRA, a division of Moody’s Financial Ratings, in October 2020 predicted correctly that the bulk tea segment would report the highest operating profits in recent history.

In 2021 the situation reversed as more tea became available and prices declined.

Compounding the supply-demand equilibrium is the fact that consumer behavior rapidly changed consumption habits as office drinkers vanished, foodservice sales plummeted, and health and well-being became a daily concern.

Better tasting teas triumphed

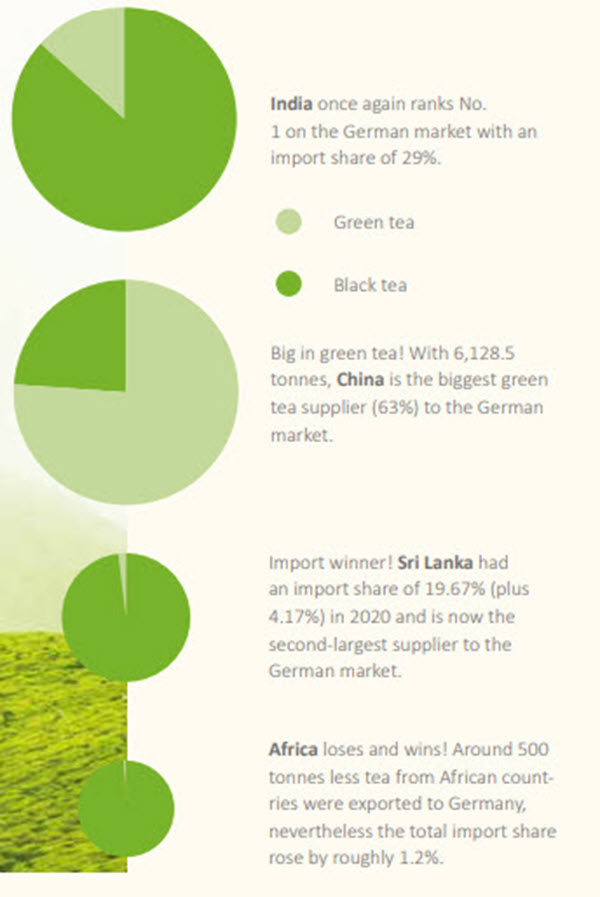

Once content with commodity offerings at the office and in restaurants, the pandemic accelerated growth in the residential segment. Sales of botanicals and blends in grocery and online spiked. In Germany for example, per capita consumption of teas and botanicals increased by an average of two liters to 70 liters per person per year.

Market research firm Techanvio writes that “consumption of tea for residential use is significantly growing as consumers are continuously seeking changes in their lifestyles and food habits and experimenting with cuisines & beverages. Moreover, the rising at-home consumption of tea is expected to grow at a steady rate owing to increasing urbanization and the changing eating habits of consumers across the world.”

Technavio predicts recent growth rates of 3% to 4.5% per year will accelerate to 6%+ (or greater) for the specialty tea market through 2026. The segment will add $5.5 billion in sales from 2021-2026, according to Techanvio.

In contrast, bulk tea is predicted to have a challenging year, according to ICRA and The Associated Chambers of Commerce of India (ASSOCHAM). In a joint report titled Tea Industry at the Cross Road, ASSOCHAM predicts that declining prices and increasing energy and labor costs will be a drag on financial performance.

ICRA Vice President of Corporate Sector Ratings, Kaushik Das says, “Players who are focused on producing quality teas are likely to witness a much lower decline this year as average auction prices of teas manufactured from own garden leaves of the top 50 estates of Assam and Dooars have witnessed a decline of only 8.5% against 25% for the overall auction average during the first half of the fiscal year 2022.”

In North India prices during the first half of the fiscal year declined 23% year-over-year, a drop of 60 rupees per kilo on average compared to 2020. Declines are even more severe in the bought leaf segment, dominated by smallholders. Averages in that segment fell 77 rupees per kilo, down 33% year-over-year. In Kenya, auction prices dropped 8% to $2.18 per kilo in the 12 months ending July 1.

Globally tea production has now returned to pre-pandemic totals, increasing 13% during the first six months of 2021 as growers in India and Sri Lanka adjusted to the pandemic. Output in 2021 is expected to top 15% in Sri Lanka and India has so far produced 100 million more kilos of tea than during the same period last year. Output declined by 10% in Kenya but exports grew 19% helping keep demand and supply in balance.

Biz Insight – The Economist Intelligence Unit first reported tea deficits in 2019 and 2020 and now forecasts demand will exceed supply in 2022 and 2023 by 427,000 metric tons. Warehouses are filled with tea so a shortfall of a few hundred thousand metric tons will not lead to shortages in the grocery aisle, but when combined with the cumulative harm from climate change and with food inflation at record levels, disrupting the long-standing equilibrium will certainly firm up prices that had fallen well below the long-term average of US$2.85 per kilo.

TEAIN22 is one of a dozen New Year Tea Biz forecasts

Sotheby’s Inaugural Tea Sale

Legendary auction house Sotheby’s concluded its first rare tea and teaware auctions in Hong Kong this week. Sales totaled HDK$4 million for the teas. Reserve prices approached $1 million Hong Kong dollars for Puerh, some aged for more than a century. Teaware as old as 1000 years was featured in a parallel auction titled Echoes of Fragrance: Tea Culture from the Tang to the Qing Dynasties. Sales of teaware totaled HDK$4.3 million (about $552,000 in US dollars)

The online catalog included a 1900 Chen Yun Hao puer cake and a 1950 Jia Ji Blue Label Tea that sold for HKD562,500 ($72,000). Bids for a 1937 basket of Sun Yi Shun (aged Liu An) opened at HKD $240,000 and sold for HDK300,000 ($38,000). A bid of $500,000 Hong Kong dollars is equivalent to about $65,000 US dollars and while that threshold was met for only the rarest of teas, all but two of the 24 lots were sold. Several of the more recent teas including a 1985 Snow Label sold for $112,500 Hong Kong dollars (about $14,000 US).

The companion teaware auction featured 63 lots including a Jian black-glazed bowl dating back eight hundred years to the Song Dynasty and a rare iron-red crane cup dated to the reign of Emperor Jiajing in the 1500s. Temmoku patterns include a “hare’s fur” (that sold for HDK189,000) and a “partridge feather” (that sold for HDK403,200). Also purchased were celadon cups and stands, Yixing teapots, and a carved Tixi lacquered tea bowl that sold for HDK529,200 (about $70,000 in US dollars). During the Tang Dynasty, beginning about 1,400 years ago, tea was boiled and served as a soup with condiments. Examples from that period include conical tea bowls, unique utensils, tea caddies, trays. Winning bids ranged from HDK 25,000 to HDK50,000 (about $6,000 US)

? By Dan Bolton

HKD562,500

(Five tickets) 1937 – HKD300,000

France Will Pay €1 Million to GI Certify Ceylon Teas

The French Development Agency (AFD) and CIRAD (the French Agricultural Research Center for International Development) announced a $1 million Euro grant to qualify Ceylon tea as a protected Geographical Indication (GI).

The four-year grant finances technical assistance to enable the Sri Lanka Tea Board (SLTB) to protect its national brand from counterfeiters while assisting the Ceylon tea value chain “to become more productive, inclusive and sustainable,” reads the AFD press release.

Eric Lavertu, Ambassador of France to Sri Lanka, said that “France has been a pioneer in the establishment of Geographical Indications to create added value to its quality products and to preserve the reputation of French gastronomy over the world. I am confident that the solid experience of CIRAD in partnership with the… [tea board] will allow a broad endorsement of the Geographic Indication by all stakeholders, based on high-level product quality, together with sound environmental and social standards.”

Currently, Ceylon tea does not have protection to uphold and authenticate its quality, resulting in counterfeit sales in various consumer countries.

Biz Insight – Sri Lanka is Heading for a Fall | Fertilizer banned earlier in the year is now available but the cost has risen from SLRs1500 rupees a kilo to SLRs6600 rupees, about $33 US dollars per kilo and rising. A ban on the herbicide Glyphosate that was eased in November was reversed in December. Output recovered in 2021 but that recovery is highly unlikely to continue due to ongoing economic problems with widespread protests by farmers over the cost of food and unions pressing for a big wage increase. Sri Lanka, where tea is hand plucked, has the highest cost of production in the world, averaging SLRs 269 ($1.33) per kilo.

– Dan Bolton

- Read more… indicates the article continues. Learn more… links to reliable outside sources.

India Tea Price Watch | Sale 49

Kolkata Sale 49 saw good demand for all teas. The Middle East was active for orthodox tea. Sales of Darjeeling and Dust relied on local buyers. Hindustan Unilever was active in Dust. Prices dropped marginally when compared with Sale 48; Darjeeling saw the biggest price drop of INRs 50. However, there were fewer out-lots of Darjeeling this week, compared to Sale 48. In Guwahati, the market opened to good demand with major blenders active for both CTC leaf and dust. Read more…

Upcoming Events

January 2022

Tea and Beyond! | GTI 7th Annual Colloquium | January 13 | UC Davis | Day-Long Virtual | Tea and Beyond: Bridging Science and Culture, Time and Space, exploring differences between tea and herbal infusions around the world and in terms of medicine and health, ceremony, traditions, sustainability, marketing, and more. | Program | Register FREE (Zoom)

Share this episode with your friends in tea.

Listen to Tea Biz on Apple Podcasts

Subscribe and receive Tea Biz weekly in your inbox.