Episode 154 | 9 Feb 2024

Delegates from 44 countries (and 14 official observers) who attended The 25th Session of the United Nations Food and Agriculture Organization’s Intergovernmental Group on Tea (IGG Tea) on Jan. 31 expanded the organization’s mandate beyond trade aspects, ratifying initiatives addressing all three dimensions of sustainability – economic, social, and environmental. Joining us today is Peter Goggi, the IGG TEA delegate representing the US in his role as President of the Tea Association of the USA. Peter discusses #TeaPower, a new health and wellness campaign, FAO’s ongoing support of smallholders, and the economics of oversupply.

There is Too Much Tea in the World

By Dan Bolton

Peter Goggi began his career at Unilever, where he was the first American in the history of TJ Lipton to work as a tea taster. He retired after 32 years with Royal Estates Tea Co., where, as president, he was responsible for tea sourcing, blending, and quality assurance. His last assignment was as head of tea procurement, leading a team of supply managers and analysts who spent a billion dollars a year buying tea. His encore as president of the Tea Association of the USA, the Tea Council of the USA, and the Specialty Tea Institute marks a fourth decade of service to the industry. Peter is a champion of the health benefits of tea, a public speaker much in demand, and a spokesperson respected globally for his broad expertise. His annual State of the Tea Industry report is meticulously researched and rich with insights gleaned from a lifetime in tea. He attended the BATIC 2024 Bicentenary in Assam and then three days of IGG Tea beginning Jan. 31. For the past decade, Peter has been the US delegate to IGG, an influential body of cabinet ministers, tea board chairs, academics, tea association executives, and policymakers representing every tea-growing and major tea-consuming region globally.

Dan Bolton: The much-delayed IGG Tea gathering in the world’s largest tea-producing region showcased India. Delegates also adopted several important policy decisions to help ease a challenging time in tea. Will you tell us about the event?

Peter: The IGG is a fabulous opportunity for all interested parties on a governmental level to talk about the tea industry. It’s very important to express their views. They all have issues that they’re facing. The issues facing countries of origin are very, very different from those facing consuming countries. But ultimately, solutions that satisfy both need to be met.

The overriding concern of everyone in this business is the lack of profit throughout the entire supply chain. Unless the growers make money, you’re not going to have tea.

The challenge extends the entire length of the value chain. And it’s worse than it’s ever been. If you look at the price of tea over time, it hasn’t moved as fast as inflation. We’re paying the same amount for tea as in the 50s but without the margins essential to business.

What many people don’t realize, particularly here in the US or the West in general, is that millions of people are vested in producing the tea. They’re growing the leaf. They’re plucking the leaf. They’re manufacturing the leaf, preparing it for shipment, and getting it out of their countries of origin that benefit from foreign exchange.

We talk a lot about sustainability in the tea business. I look at it as a stool with three legs: environmental sustainability, social sustainability, which is the cultural weaving of importance to the local governments, local producers, local towns, and, importantly, there’s economic sustainability. Unless we have that, we are going to lose everything.

Many of the discussions focused on the smallholder not only at IGG Tea this year but also during BATIC 2024, which was the Bicentennial Assam convention celebrating 200 years of tea growing in Assam. Smallholders produce about 60% of the tea in the world today — the green leaf anyway and they are vitally important to the whole supply chain.

Everyone agrees that unless these smallholders get appropriate monies for the work that they do, then 10-15 years down the road, we’re all going to be struggling.

Dan: Yet the crisis among smallholders is not universal. Smallholders in China have demonstrated resilience over centuries. They enjoy good margins, provide for their families, and are rewarded for investing in growing their businesses over time. Smallholders operating as rural entrepreneurs maintain diverse farmscapes, which would provide a solid foundation for sustainable production.

Peter: China has done an absolutely fabulous job with its tea industry. If you’re in the tea business in China, you are wealthy. That model exists nowhere else in the world, unfortunately.

China is, in and of itself, a producer and a consumer. The percentage of exports is extremely small in comparison to what they produce. And what they do produce is really enjoyed by the population. In China, they drink tea; they know tea. Tea is interwoven into every aspect of their culture. Whether it’s health, wellness, or social. It’s a great model. I wish everybody would copy that one — but that’s just not the case.

What you’re seeing now is that smallholders are producing as best they can. But the world, quite frankly, is inundated with tea. The amount of tea produced over the last several years is greater than what’s been consumed. Tea doesn’t go away. It sits in a warehouse somewhere. So, we have too much tea. And this is what’s really dragging the price of tea down — except for the specialty segment.

Artisanal teas have great leaf, great flavor, great stories behind them, and well-thought-out manufacturing processes. They’re making money, but the quantities are relatively small – we’re talking on a volume basis of 8% to 12% of the world’s tea, but it’s responsible for probably 25% to 30% of the profit.

Dan: During the past 20 years, the volume of specialty tea has more than doubled. It is encouraging that demand is growing and that people prefer to drink healthful, better-tasting tea with its artisan story and third-party certifications. Drinking good tea is a reasonably priced personal choice with untold benefits. Teabags sell for pennies, and you get what you pay for, but spending a small sum of money, perhaps $3 per ounce, about 43 cents per serving, as a floor on which higher-quality tea, priced at $8 per ounce, is the tide to lift all boats.

Peter: That’s the hope. We saw some very good indications of a positive future coming out of COVID because, qualitatively, Gen Z was really turning to tea during COVID. They were buying specialty tea — to take your point about stories and tea’s artisanal aspects — they love that stuff. And they’re very keen on knowing that the dollar that they spend for a product is going back to help the person who actually produces the product.

So this is where knowledge of the value and supply chains are very important to this particular class demographic, and as they age, they will continue to drink tea.

It’s a known fact that as the population ages, the incidence of tea consumption increases. So I’m hoping that the habits they’ve grown to embrace as university students will carry through for the rest of their lives, and they’ll pass that on to the next generation.

That’s the good news. The bad news is that that habit was very true at home, not very true out-of-home, so they drank all their tea in their houses with their personal tea ceremonies, whether it’s a particular mug or whether it’s a particular teapot or how they did it or with their friends are watching their videos, loved it, consume more, and it was hot, which in the United States is important because we’re a tea drinking nation of iced tea, and they’re drinking more hot tea.

That’s a potential change as we go forward. But regrettably, as they go out-of-home, their incidence of tea drink drinking does not match up with what they do at home. So, this will be the challenge: How do we get that tea experience out of home?

Dan: During the 25th FAO Session, delegates formally adopted a coordinated global marketing campaign to promote the power of tea. The hashtag #TeaPower targets youth, portraying tea as a healthy, plant-based, beneficially bio-active beverage with scientifically demonstrated advantages over rival drinks.

Peter: We blazed the path of tea and health here in the United States. We made a conscious decision back in the 90s that anything we would say about tea and health had to be rooted in science. Beginning with the urging of Marty Kushner, we embarked on the Tea & Health path. Pollock Communications has been a tremendous partner in coordinating our symposiums and serving as a leader in our Social Media communications. As I said, all of our messaging is rooted in science, and we’ve been lucky to have two key individuals working with us: at the beginning was Dr. John Weisburger, and for the last several years, there has been Dr. Jeffrey Blumberg.

We’ve held six international symposiums on the science of tea and health, and they’ve all generated interest. They’ve all generated tremendous knowledge about tea and have shown different areas in which tea positively impacts human health.

So #TeaPower is a marketing effort born out of FAO that sits on a lot of the work we’ve done, not only here in the US but also picked up internationally. I believe everybody at the FAO IGG agrees that tea and health is one of the big levers to press to help drive consumption to help people pick up and take notice that “Oh!” tea is good for you.

Hashtags

- #TeaPower #UnlockYourPotential #TeaTime

- #Flavan3ols #SportAndFitnessBenefitsofTea

- #YoungerGenerationsHealthAndPerformance

And as you mentioned, there are a lot of bio-actives in tea. It’s plant-based, it’s natural, calorie-free. You have black, green, oolong, white, and dark teas that all come from the same bush; it is just a matter of how it’s processed. And when we use the word process, people need to understand that tea is very lightly processed. It’s not that we’re adding anything. It’s just we’re changing how we manipulate the leaf for the amount of time that we let it sit in a room to oxidize. The whole process is natural.

This provides another great platform to discuss why it is healthy and how consuming as little as two or three cups of tea throughout the day can positively impact human health.

So yeah, I’m excited.

The FDA is very clear on what you can say about the health aspects of any food. The Holy Grail of tea continues to be what is known as a structure-function claim, which says: “If you drink tea, it’ll stop cancer, or if you drink tea, you’ll stop a heart attack. And that’s what we continue to seek. And more and more of the research indicates that we’re on the right path.

That’s what we hope for in the tea business. That’s why we continue to encourage scientists to study tea, and we’ve seen progress in quite a few areas of human health.

We just need some more studies to get us to the endpoint.

International Tea Day 2024

The Working Group on Tea & Health has the opportunity to use the established science to develop language around the topic of sport and fitness, targeting a younger generation as well as the importance of flavan-3-ols in healthy living. The language would include hashtags all organizations could use to amplify the messaging on various media platforms. International Tea Day, 21 May, would provide the perfect platform for the campaign, with all interested parties agreeing to harmonized messaging and campaign timings running up to and culminating on the day of observance.

Dan: Is there a future for green tea in the US? Is that a style of tea that can expand?

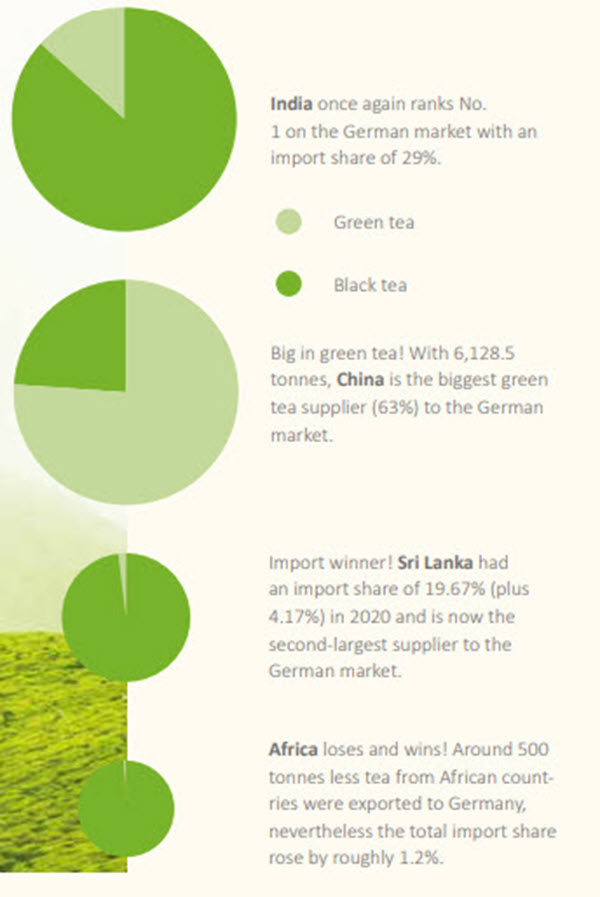

Peter: It’s a mixed story. Pre 1998, I worked for Unilever / Lipton in the US, and we were probably the largest green tea bag manufacturer and seller, but the total imports into the US were somewhere in the neighborhood of 3% of total tea.

Then a study about tea drinkers in Japan was published in Reader’s Digest in 1998. That study talked about lowering the incidence of liver cancers, and the only thing they could attribute it to was a particular area in Japan. Shizuoka is the largest green tea growing area in Japan. People there consume much more green tea than the rest of Japan. They had a much lower incidence of that particular cancer, and when it came out in Reader’s Digest well, green tea sales exploded. I mean, you couldn’t find enough green tea to meet consumer demand. During the next few years, you saw a very steep curve. Green tea increased to about 20% of imports over the next four or five years and has been coming down ever since.

So right now, green tea represents about 14% of tea imported into the US. I really think that, like anything else, you can tell someone that it is good for you until you’re blue in the face, but if it doesn’t taste good, they’re not going to consume it. And green tea just doesn’t fit the Western palate.

Now a lot of caveats go along with that. Number one is that most people probably make their green tea incorrectly. They probably use the same amount of tea as black tea — you shouldn’t use as much. It would be best if you use about half. They’re probably steeping it in boiling water, which you shouldn’t do. Instead, you should bring the water to a boil and let it cool down to about 185 degrees Fahrenheit. Let it cool before steeping.

Those two components alone make green tea much more consumable, much less astringent, and far sweeter than you would normally get if you produce it the other way.

The other thing that people don’t understand about green tea is that there are two ways of fixing green tea or actually stopping the process of oxidation. The Chinese use pan firing on a very hot surface that the tea leaf passes over, destroying the Polyphenol oxidase, which is the ingredient that turns tea from green to black and oxidizes all the other constituent parts of the leaf. The Japanese use steam, and those two processes develop completely different flavor profiles. Japanese tea tends to be far more astringent with a bit more fishy taste, whereas Chinese tea tends to be sweeter and smoother.

Those two processing elements alone drive a big flavor differential. But to your point, what can help make green tea more accepted? Clearly, we’re seeing the addition of botanicals mellowing out the tea. It’s important to keep enough of the “good stuff” (True Tea) to deliver human health aspects. That is really the way to go. Green tea blends have been well-received for years, but I think there is more interest in tea being blended with mint, or citrus fruits, or rose hips, etc. You’re getting a much more layered offering in terms of taste than you will with just green tea alone.

It’s very interesting to see the innovation that’s going on right now in green tea and the use of botanicals and other components that help reach the consumer and create a better-tasting, more acceptable product.

“The overriding concern of everyone in this business is the lack of profit throughout the entire supply chain.”

– Peter Goggi

Dan: Innovation isn’t an option when facing a diverse, aggressively promoted, competitive marketplace. You must innovate constantly because everybody with a beverage on the shelf is innovating, right?

Peter: Yeah, I mean, this whole aspect of innovation, bringing new ways of thinking to produce a product, will help drive any industry, not just the tea industry.

What you’ve been talking about, though, is generally limited to the country in which they’re doing it. I haven’t seen too much of that being exported simply because they haven’t had an opportunity to make as much.

Peter: Yeah. I mean, this is what I was talking about before this particular project that you’re talking about. What do you have? You have economic sustainability; you have social sustainability. And you have ecological, which follows anyway because they’re probably diversifying their portfolio of crops that they’re growing because now they’re making more money from tea, they can maybe grow maize or something else that will help feed their family.

You know, I mean, this is exactly what it is, and really, part of that model is copied from the KTDA (Kenya Tea Development Authority), which probably has the strictest plucking standards of any small holder that I can see and guess what, they always get the best prices, you know because they’re two leaves in a bud. And so, this, in my view, addresses several things. Number one is you get better quality. If you produce better quality, you get better prices, and everybody makes more money. But even more importantly, and that’s looking at the larger universe of tea, is that if you’re doing fine plucking, your yields go down, and if your yields go down, that means the balance between supply and demand will come more into play. And then the whole boat gets lifted, to use your metaphor, because a high tide lifts all boats, and that’s what we want.

If we were in a much closer balance of supply and demand, it would be better, best for everyone. Everyone wins when you have a balance.

Dan: At the heart of that balance is quality. Cultivate only lands that produce great tea. Then, limit what the factory will accept and process. Buds and a few leaves bring a better price at lower volumes. Leave the coarse leaves to reduce plant stress and minimize sorting costs. Harvest frequently to increase the concentration of tender fresh leaves. Hand pluck in steep terrain at altitude but use more selective optical “smart shears” elsewhere. Mechanization in the field and ahead of the sorting table lowers cost. Cultivate fewer hectares to deliver less to the withering trough. Invest in fermentation cabinets to achieve greater control and more distinctive tasting tea.

Peter: All great ideas.

This goes back to how they made tea in the 40s, 50s, 60s, and early 70s. It’s not rocket science, folks. Quality leaf means quality, which means you’re giving the highest potential to the factory to make good tea coming out. And if they treat that leaf well during their manufacturing process, you will have the best possible product. It’s just common sense.

Dan: Why do you think so much effort, time, and money is being spent on producing a surplus?

Peter: This is, you know, is one of the things that make you want to shoot yourself in the head. As a consumer nation, we’re saying listen, there’s only so much we can do to drive share of throat. You know, let’s face it, people can only consume X number of liters of liquid a day. That’s it.

If, at origin, you decide to do just what we said to increase the quality of the pluck, make sure that you don’t chase markets when prices do go up and produce more tea to take advantage of that. Then everything falls into place as we can see in some of these demonstrated models. The challenge is that tea has been in a boom-bust cycle since I’ve been in business, and I got into the business in 1979.

You can go back and look at historical records, and everything else to find that everybody freaks out whenever the price of tea starts going up. Producers turn on the tap and make more tea. One of the big problems with tea is that overnight, you can produce 20% more leaf just by picking more leaves further down the bush, or you forego pruning. Usually, 20% of your tea bushes are leafless and not producing. Growers stop pruning when prices go up that’s 20% more volume right there. Or you tell the pluckers to go a little bit further down the bush, and suddenly, you have all this lower-quality tea flowing into the market and depressing prices.

Dan: A factory focused on quality over quantity will say, look, that’s a cheap way to increase volume, but the advantage is lost at auction when tea sells for so much less. A disciplined specialty grower will insist: Unless you give me the top three leaves, volume doesn’t matter.

Peter: The factory can say that, but the dollar incentive too often overrides logic because there’s an opportunity to make a lot of money quickly.

They have been under economic pressure for so long that an opportunity has come for them to make money to help fill the voids they’ve been accruing over the last several years. I’d take that opportunity. I mean, that’s just the laws of economics, and whether you like it or not, you feel for them.

These are things that could be prevented. You mentioned Tanzania, their minister of agriculture came out a few months ago and said they are going to triple production to 90 million kilos by 2030. So, they’re planting new tea. Why? Why are they doing this? I mean, there’s no export demand and no domestic market that can consume all that tea in an effective, profitable way. We’re going to be in trouble for many, many years.

Peter: Now, each country has its problems, and I don’t want to make snap judgments and say they’re wrong. They’re doing what they think is best for their people. And that’s what counts, but one can’t deny the laws of supply and demand, which is the most overarching issue we’re facing.

There’s just too much tea in the world; if we can fix that, everything else will fall into place.

Related

Committe on Commodity Problems (24th Session)

Powered by RedCircle

Share this post

Episode 154 | Peter Goggi, the UN FAO IGG TEA delegate representing the US in his role as President of the Tea Association of the USA, discusses #TeaPower, a new health and wellness campaign, FAO’s ongoing support of smallholders, and the economics of oversupply. | Episode 154 | | 9 Feb 2024