Co-founder and Director of Studies Jane Pettigrew describes the remarkable evolution of the UK Tea Academy into an innovative global tea education resource that has emerged from the chaos of COVID-19.

- Caption: Jane Pettigrew, author, educator, historian, and tea retail expert

Hear the Interview

Online Adaptations Enhance and Expand Tea Education

By Dananjaya Silva | PMD Tea

The United Kingdom Tea Academy is recognized as a world authority for online tea education. Staffed by professional tutors the academy offers courses from beginner to advanced. I sit down with Co-founder and director of studies Jane Pettigrew, who is a leading author and speaker on tea, along with Suranga Perera, the chief instructor of the Ceylon tea program, who counts over 20 years of experience in tea and is the former CEO of Ceylon Tea Brokers PLC.

Dananjaya Silva: Will you explain the essential role that is performed by UKTA in the growth and expansion of specialty tea?

I think that what we’re doing is actually raising awareness amongst consumers of the possibilities of drinking better tea and also helping food service employees to deliver better tea and to know more about the sort of tea we’re hoping they will serve.

There’s an awful lot of people amongst the general public, but also working in restaurants and hotels and tea lounges, coffee bars, etc., who really don’t ever stop to think about tea as a suitable offering for what they’re doing.

And so I’m afraid tea has always been treated as a bit of a loss leader, a second cousin — twice removed.

It’s never really featured in a lot of people’s minds. Our aim is to raise people’s awareness of the fact that there is so much more than paper teabags.

“We have created a very, very exciting master class for Ceylon Tea where we will be tasting roughly 80 teas. Some of the sessions are live at the factory so that the audience can see the production line and talk with factory owners and managers for a greater understanding.“

– Suranga Perera

Dananjaya: Specialty tea is growing in popularity and there are more tea houses being established. Who are the courses that you offer aimed at and how do you deliver these courses?

Jane: So the people we aim at are specifically food and beverage. But of course, we are also found online by people who just love tea. About 15 years ago, shortly after the new Millennium up to about 2005, things really started to change. China opened up and people began drinking more Chinese tea again.

And a lot of completely non-tea people came into the tea business. There are many people who have been working in tea for a very long time, and I think a lot of these new people came into tea from just a completely different direction, either with outside experience and a business degree or because they traveled and they’d come across Chinese, Taiwanese, Japanese teas that they couldn’t get here.

Some of those people opened tea businesses so that they would make those teas available.

And as more people learned about teas, cafes, restaurants and hotel lounges started serving more teas, and they all began to realize that they actually didn’t know very much about tea.

So we try to be at least one step ahead, particularly with food service operations, to give them an insight into the different categories of tea which they’ve never heard about. We help them understand fine teas and help them brew the tea properly. We also help them answer clients’ questions about caffeine and why tea is good for us, and to talk about the different flavors.

I mean there is just so much to know, which obviously raises the profile of a really good restaurant or tea lounge or even a coffee bar.

In the past, we were classroom-based here in London which meant that people flew in to find us and sit with us in the classroom. Because of COVID, we had to reinvent ourselves into a completely online business.

There have been a lot of advantages of actually doing that. We of course now can reach people absolutely anywhere in the world.

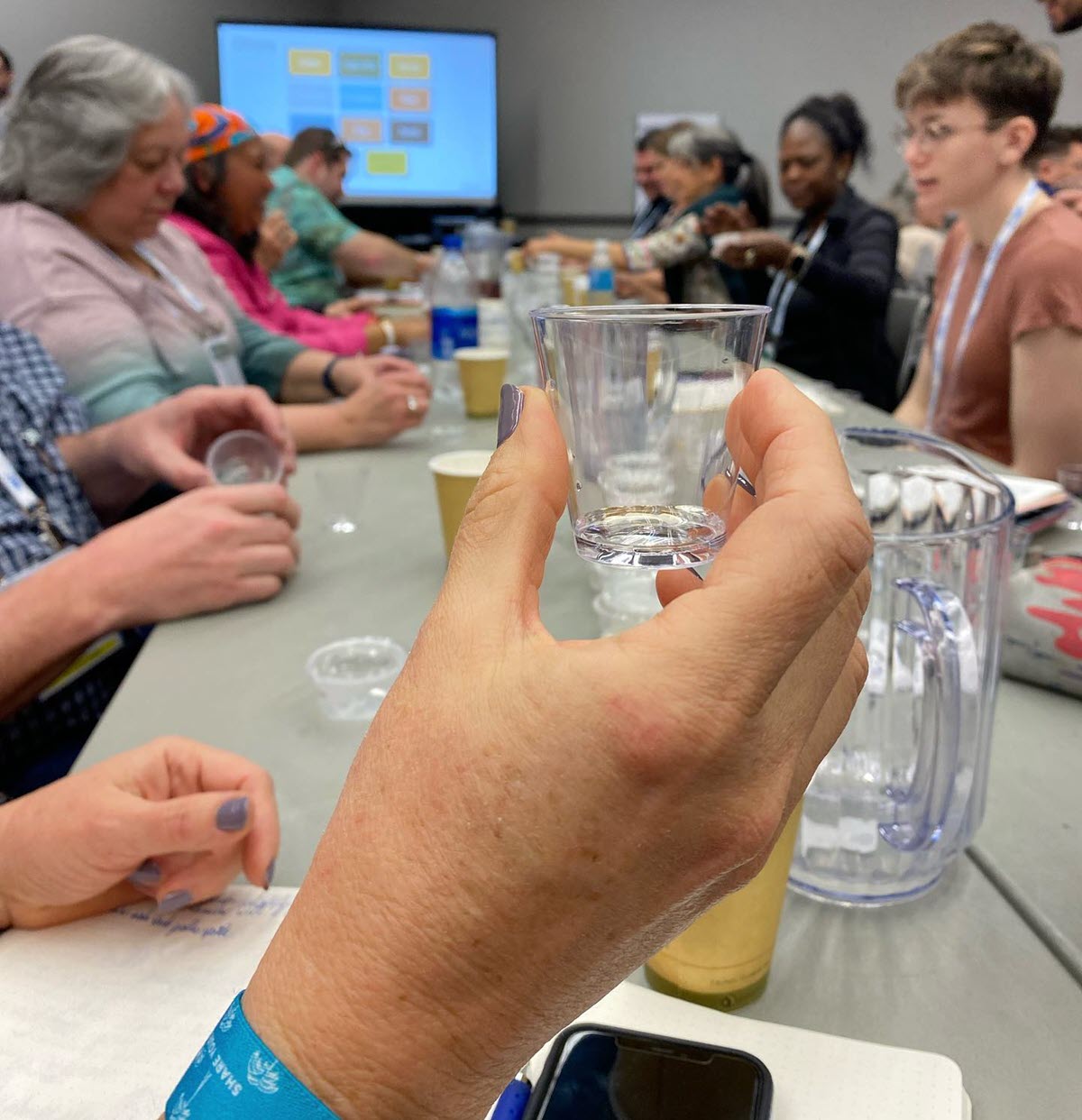

We try to gear our courses in two different time zones because if we’re teaching in Asia, they’re eight hours ahead, and if we’re teaching in West Coast America, we’re eight hours behind. So we try and find times that suit the different markets, which seems to be working really well. Instead of teaching for a whole day, now we teach in three-hour chunks or less, and the three hours absolutely fly by. Quite a lot of our courses include brewing together, discussing flavor and aroma profiles together, learning to talk about tea, and sound exciting.

There’s just so much to this that people gradually get very drawn in, and once they start with us, they tend to go through the different levels.

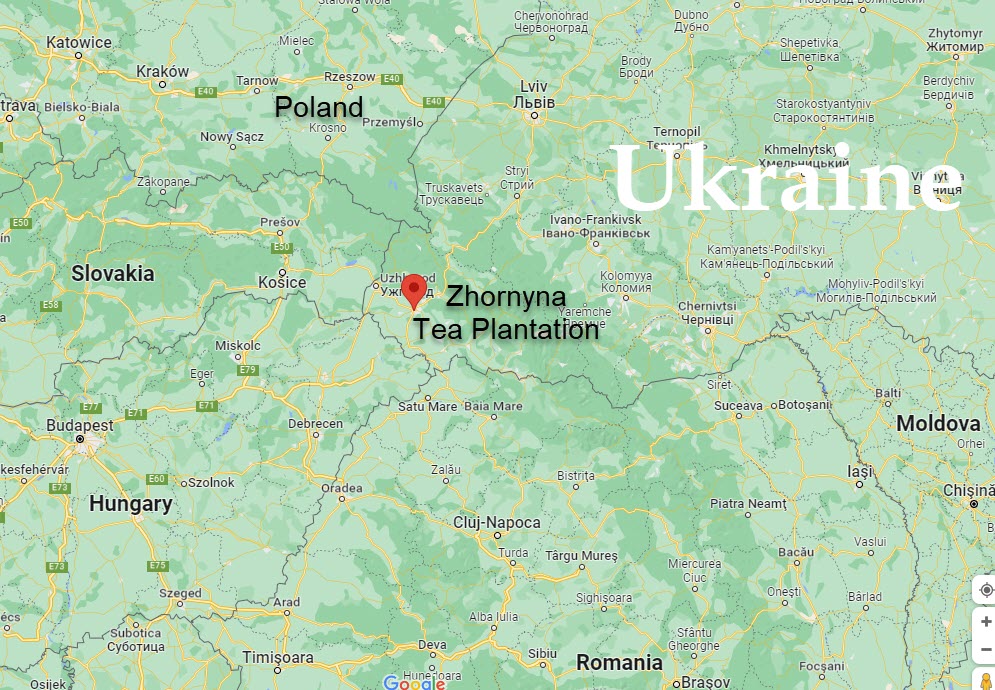

Dananjaya: You mentioned that it’s a global course. How does someone sitting in Australia or New Zealand receive those samples? Could you take us through the process?

Well, yes, of course. Our foundation level, what we call Tea Champion is taught in two segments, practical and sensory. We don’t have so many teas going out for that course.

For our Tea Sommelier class, which is the second level up we send out something like 170 teas. We’re not drinking all of those. We add things in for little quizzes on dry leaf recognition and for blind tastings.

We try to do as much as we used to do in the classroom, but of course, we have to plan ahead and allow a good month to get teas out — and not just to far off places but actually into Europe, which has since Brexit been a bit of a problem. So then we send them the recording of a class or event and they can listen along on their own and brew the teas on their own time.

We have a brilliant team now who are constantly packing teas for the next course. The students keep in touch with us to let us know whether or not they’ve received the teas. So with good planning and “military precision,” we can actually do this.

Dananjaya: So by the sounds of it, although COVID had a massive negative impact around the world for your organization, it’s actually allowed you to reinvent yourself and have a much wider scope, hasn’t it?

Jane: It’s been amazing Dananjaya because when we were teaching in class, particularly with the more advanced class, it was very, very intensive. We went through lots of material in four days, maybe with a day off in the middle, but we had to do it like that because people were flying in specially and they couldn’t keep coming back for the class.

They did well, but I think it was an awful lot of material for them to take in and with less time for revision, quizzes, and games.

So now that we’re teaching online, we can actually spread the classes out over four weeks, six weeks, and weekends, whatever we want to do. There is a longer gap between each module and the students are now brewing the teas themselves, which they never did in the classroom, and that means that they actually build up a much closer personal relationship with the tea.

And they have enough tea to brew more than once, so they’re getting a lot more, I think, that we delivered in the classroom. I’ve been running quite a lot of exams individually online, talking for about three hours. The results that we’ve been getting since we began teaching online have been absolutely phenomenal. You know, some people are absolutely word perfect. I think it is because they’ve had more time to build up not just their understanding, but their passion for tea. It’s not hard to develop a passion for tea. Everybody gets caught up in the whole thing.

Dananjaya: Yes, there’s so much to explore. What you’re saying is that participants needed to let the information brew for a while.

Jane: Yes, it’s assimilating it and making sure you’ve really understood it, and if they haven’t, having the time to go back and ask more questions. What we aim to do is give people the tools they need to go off on their own tea journey.

This is particularly true of the lower-level class. It is absolutely essential because tea is difficult to learn on your own. There’s a lot of stuff out there now, more than there used to be, but it’s still quite confusing if you don’t get the basics absolutely clear. We can then introduce the higher-level classes with some of the most amazing teas from all around the world. People just can’t believe the many options.

Ceylon Tea Masterclass and Diploma

Dananjaya: The UK Tea Academy is relaunching the Ceylon Tea Diploma course in July can you explain what the new course entails?

Suranga Perera: As Jane said, the main objective is to bridge that gap between the consumer and the producer. We have created a very, very exciting master class for Ceylon Tea. We have got some very exciting teas and gone into great depth. It’s roughly 10 hours long

The first session will be one hour. We will be tasting one or two teas just to break the ice and get people moving, and we’ll be talking about the history, of Ceylon teas. Then a current overview of production and discussions about certifications and Ceylon Lion logo in particular. There is a segment on ozone-friendly teas a discussion about the employment that Ceylon tea provides and an explanation of the auction system.

The second session is three hours long and covers what are known as the “high-grown” tea gardens on the island. There are some teas that we are tasting for the first time. For example, we are featuring a Mattekelle Golden Curl from a Japanese clone that is extremely flavorful, and quite different. Few have tested and tried it out. In this masterclass, we will be tasting roughly 80 teas.

The third session is also three hours long. it will focus on low-grown teas. We will cover teas from Sabaragamuwa, Galle, Deniyaya, Matugama, and other tea producing subdistricts. Having been a broker for 21 years I worked with these factories very, very closely and personally tasted these teas and picked the best at the time. Because teas change all the time due to weather and various reasons, we need to pick the right teas for the current season. We want to make it as current as possible and as precious as possible so it’s a dynamic masterclass. There are eight teas in this session to be tasted at home by participants.

The fourth and last session is about specialties, amazing teas that are not readily available. We see that a lot of factories are now getting into manufacturing specialties from which we have picked up the best available. Several of these factories are so, so, exciting, so authentic, so organic.

Some of the sessions are live at the factory so that the audience can see the production line and talk with factory owners and managers for greater understanding.

Bridging the gap to the best of our ability is what we are trying to do with this masterclass.

London-based Dananjaya Silva is the managing director of PMD Tea and a fourth-generation tea man whose family business, P.M. David Silva & Sons date to 1945 during the Plantation Raj in Ceylon’s Dimbula Valley. The company was founded on Brunswick Estate in the fertile Maskeliya Valley as a small independent Tea shop for tea plantation workers to gather, relax and enjoy a quality cup of tea.

Related

- Instagram: UK Tea Academy

Outstanding Education for Tea Professionals and Enthusiasts

The UK Tea Academy was established in 2015 to raise the standards of tea service in hospitality. One of the UKTA founders and director of studies, Jane Pettigrew, is a passionate advocate of high-quality tea, prepared correctly to draw the best flavor from the leaf. Jane is among the best-known and most highly respected professionals in the tea world. She has worked as a writer and educator for more than 35 years and is tirelessly committed to sharing her knowledge of tea with anyone who has an appreciation for this fabulous leaf. She teaches all over the world, has written 17 books on tea, and was awarded a BEM (British Empire Medal) for services to the tea industry.

A certificate from the UKTA is recognized in the hospitality industry as representing a high level of achievement and means the holder has attained a deep understanding and serious appreciation of quality tea. On completion of the introductory Level 1: Tea Champion, most of our students are inclined to develop an even greater knowledge of this fascinating world and enroll in Level 2: Tea Sommelier. Some go even further, to the ultimate challenge of Level 3: Tea Diploma.

UKTA Tutors

Tea experts living in the United Kingdom teaching live webinars

| Jane Pettigrew | Sam Kimmins | Kate Popham |

| Dr. Tim Bond | Beverly-Claire Wainwright | Carri Hecks |

| Asako Steward | Alex Probyn | Sunjin Lee |

| Chau-Jean Lin | Eunice Pallot | Juyan Webster |

Licensed Tutors

Teaching UKTA courses online in other languages

| HyunSei Yu, South Korea | Isaline Lannoy, France | Pilar Serrano, Spain |

| Sabine Gullatz, Germany | Stefania Gilardi, Italy | |

| Asako Steward, Japan | Gabriella Scarpa, Italy |

Online Study

Linktree: UK Tea Academy Courses

Link to share this post with your colleagues

Signup and receive Tea Biz weekly in your inbox.