India produces 20% of the world’s tea. Production, however, has stagnated for years. Costs are up, and prices and exports are flat. Professional tasters report a decline in quality. Marketing tea to domestic consumers is a promising way to move past the doldrums. Tea is found in every household and Indians drink an average of two cups per person per day, consuming 90% of the tea grown there — but mainly purchase lower grades. Per capita consumption is modest at 840 grams due to a preference for tea in blends. Until recently, India exported virtually all its best teas. Tea discovery there is discouraged as imports from China, Taiwan, and Japan are expensive due to high tariffs, but rising affluence is overcoming these obstacles.

- Caption: Jagjeet Kandal, country head, IDH, The Sustainable Trade Initiative

Realigning the Marketing of Indian Tea

By Aravinda Anantharaman

“When you look back, let’s say 30, 40 years, what has changed in the tea market? That’s the question we need to ask. And to me, there has been no great, no major earth-shattering change. Yes, we went from dabbas to paper boxes, tea bags, then poly packs… stuff like that. But the image of tea has not changed at all. And that, I think, is the basis of many problems,” says industry veteran Jagjeet Kandal, now country head, IDH, The Sustainable Trade Initiative.

Indian legislators are currently considering a draft Tea (Promotion and Development) Bill to remove colonial-era provisions regulating tea and re-direct the Tea Board of India’s resources to expand existing markets and promote tea domestically.

In this report, Tea Biz explores the challenges and opportunities of marketing Indian tea by examining:

- A legacy of marketing tea as a blended, heavily spiced low-cost commodity beverage for the masses.

- The rise of hundreds of direct-to-consumer (DTC) tea brands that rely on e-commerce as a promising and accessible retail platform.

- Expanding choices available to tea lovers and how consumer preferences have moved beyond chai.

Price as a factor

“I think marketers need to take some of that blame because what they’ve done is made tea a common man’s drink. It has been marketed as the cheapest drink. When you market anything as cheap, it’s going to be very difficult to take that perception people’s mind and then tell them to come and pay more for it. So it was a short-term strategy or whenever this whole marketing stint started, but that’s the basis of what needs to change,” says Kandal.

Price became a factor in sales, trumping taste. Brands fought on price. Across the country, orthodox tea is not consumed by the masses. South India, in particular, favors dust-grade teas. But every producer and every brand owner talks about how the per cup cost between a mediocre tea and a higher quality tea differs by only a few rupees. The point is convincing, but that message has not been communicated to consumers.

New to tea

A century after exports surged, generating substantial wealth, India was still not a big tea market. Seventy years ago, few Indians had ever tasted tea. In contrast, the Chinese have kept tea in their homes for 5,000 years.

Like other plantation colonies, tea was cultivated in India to cater to demand in Europe. Wars and economic slumps disrupted trade, leading to a glut of tea that forced England to find new markets. The British turned expertly to India’s domestic population, marketing aggressively and creating a tea culture. It was phenomenally successful as tea is now an Indian legacy with deep cultural connotations.

India was largely rural in 1960, with 82% of the population of 370 million housed away from cities. Household consumption as a percent of India’s gross domestic product peaked that year at 87.4% percent. Manufacturing was focused on domestic needs, and exports consisted mainly of raw goods. Tea was a vital source of foreign income.

In 1960 India exported 195 m.kgs of tea and consumed 115 m.kgs. Ten years later, exports remained flat at 200 m.kgs, while domestic consumption had increased to 212 m.kgs. Today Indian consumers drink 90% of the tea it produces totaling a billion kilos in 2020.

One would expect that this has reduced the producers’ dependence on the export market. It has not. But given how the COVID-19 pandemic, climate change, marketing costs, and now, war, have impacted trade, freight costs, and exports, the need to cultivate and nurture the domestic market has never been more urgent. There’s a need to nudge consumers towards better quality, higher-priced teas and even specialty tea. What producers seek is 1) convince consumers to look beyond CTC and chai, and even if they must stick to CTC, purchase a better-quality product at a marginally higher cost; and 2) how to increase per capita consumption by at least 100g from its current 750-850g per year.

There has been news of change brewing, with the Tea Board of India finally saying that they will no longer be a regulator but instead become a body that will market and promote tea. It’s a return to the Board’s original mandate, lost along the way and resurfacing now due to producers’ continuous demands. The Tea Board’s challenge will be to address India’s complex market.

Lessons from the past: The rise of packaged and branded tea

In the 1980s, television emerged as a mass media platform financed by consumer interest in packaged goods. That same decade, Tata Tea, helmed by Darbari Seth and Krishna Kumar, transitioned from bulk sales to branded tea from company gardens. Tata spent large sums marketing Tata Tea, Chakra Gold, and Tetley.

In 1984, Brooke Bond, India’s most popular and – certainly the oldest brand was acquired by Unilever. They had already diversified and merged with Liebig in 1968, generating $1 billion annually in sales. In 1984 PG Tips held 28% of the UK tea market by sales, and Tetley held 8%. Unilever, then the world’s largest packaged goods company, had acquired Lipton in 1977 but had no UK brands. In October 1984, Unilever spent $480 million to acquire 150 million shares, concluding a protracted and unfriendly takeover of Brooke Bond. Subsidiary Hindustan Unilever Ltd., (HUL) based in Mumbai, reported $5.3 billion in annual revenue in 2020.

Privately held Wagh Bakri, founded in 1919 and based in Ahmedabad, Gujarat, sold loose tea in wholesale and retail outlets until 1980 when it began distributing packaged tea. The company invests 10% of revenue on advertising has since grown to become India’s third nationally distributed packaged tea brand

In 1985, Atul Asthana, currently Managing Director, joined the Goodricke Group. The group was formed in 1978 and now owns 29 gardens in Darjeeling, Assam, and the Dooars. Some of the most prized teas in the world come from the Goodricke portfolio, including Margaret’s Hope and Castleton in Darjeeling. “Goodricke had to diversify,” says Asthana. At first, the company started packaging tea in 250g and 500g packets, with each of their gardens keeping aside a percentage of production to go into retail. Their focus was on serving the north and east India markets.

“It is different from buying other teas. When you buy from auctions, the tea is already 4-6 weeks old. From there it goes to the warehouse and then on to the blenders. When we pack our teas, it’s fresher, it’s more immediate and it reaches consumer quickly,” said Asthana.

Gardens have a fantastic advantage for retail, when going direct to consumer: By bypassing the auctions, they could bring consumers a fresher tea. Already leveraged by brands like Lipton, whose tagline was “direct from tea garden to the teapot,” it is surprising that more gardens did not take this up and aggressively brand and market their teas. The reason is that the wholesale market was robust, Asthana explains. In the 1980s, a heyday for the tea industry, demand outstripped supply. As Asthana says, everything that was being produced found a market. The Soviet Union absorbed all the tea produced in India. Few gardens found a need to retail to a domestic market.

With the disintegration of the Soviet Union, the tea industry, which had expanded to produce large volumes of tea, now struggled. As the share of exports declined, the domestic market discovered tea. Inexpensive and widely available, tea was a daily beverage that was easy to make and reasonably addictive. Before packaged teas, vendors sold loose-leaf in broken grades as blends customized to suit customer preferences (and local water conditions). Packaged blends delivered consistent taste, were cleaner and remained fresh in storage. Packaging was more appealing and convenient. Sales increased during the 1980s and 90s as the preference for branded tea grew. Ultimately a combination of factors, including higher disposable income, the proliferation of television, and other forms of advertising, along with the move toward trade liberalization. The only hitch was that this market was still extremely price-sensitive.

“The wholesale market was robust in the 1980s, a heyday for the tea industry, demand outstripped supply. Everything that was being produced found a market. The Soviet Union absorbed all the tea produced in India. Few gardens found a need to retail to a domestic market..“

– Atul Asthana, Managing Director, Goodricke Group

Next

- We end the two-part series with the questions needed to solve the mammoth task of rebranding the industry and realigning the domestic market toward quality tea.

How Tea Came to be Swadeshi

Swadesh was the call for independence – it translates roughly as our ‘own country.’ Mahatma Gandhi promoted swadeshi products to build national pride and self-reliance.

By Ramya Ramamurty

Tea was planted by the British in India to ensure an optional country of origin for their favorite beverage. China was the leading tea producer at the time. Tea plantations in India were an astute way for the British East India Company to de-risk this commodity in case the balance of trade with China was threatened by war or insurgency.

As the chapter on ‘Snacks and Biscuits’ in my second book Branded in History mentions, tea was seen as a ‘drug food’, and planted in India in Assam, West Bengal, and Tamil Nadu. Optimal conditions, conducive for the growth of tea, meant adequate rainfall, the right pH of the soil, and cool temperatures by Indian standards. The tea plantations were fairly oppressive under the colonial powers – indenture was common as a way to supply low-cost labor to the expanding plantations. But there were a few brands that came up in India with indigenous tea bushes or entrepreneurs.

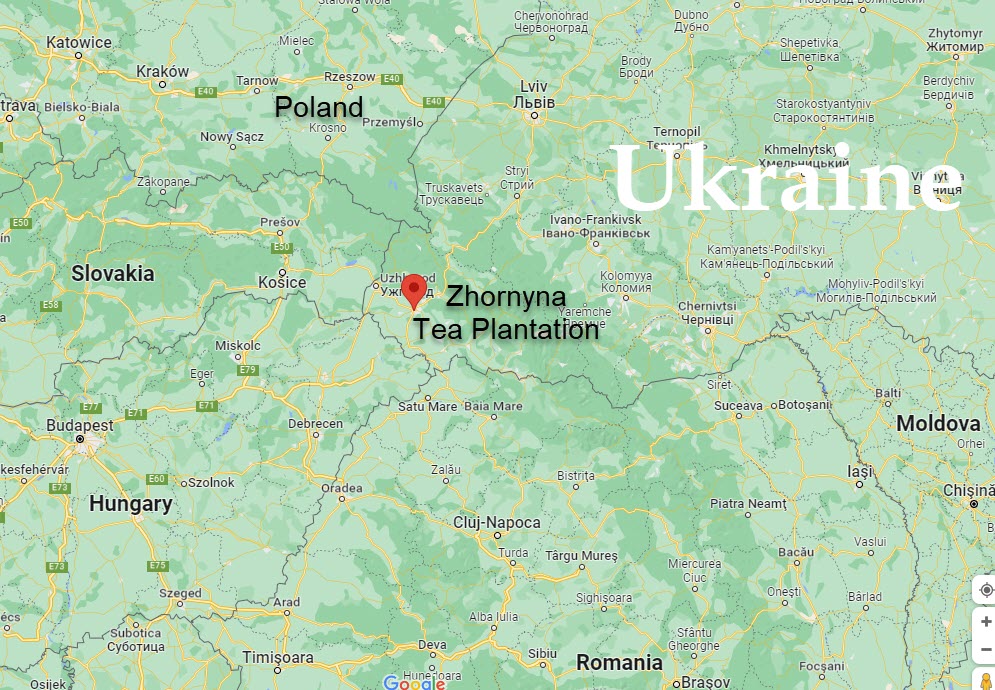

In 1823, Robert Bruce, a Scot who was wandering in the upper Brahmaputra Valley, near Rangpur in Assam, came across some wild bushes that changed the tea industry forever – it was the first discovery of indigenous tea. The Chinese imports had not taken as well as the British had hoped because of the summer heat in India. A couple of years later, 12 chests of Assam tea were sold for the first time at London auctions, paving the way for the foundation of the first tea plantation company in India: Assam Company India Ltd., (ACIL). The company was founded in London in 1839 and although they focused on tea, the management, which included dignitaries like Charles Alexander Bruce and Prince Dwarkanath Tagore, wanted to keep options open to trade in other commodities like lime, coal or oil so the word tea was not referred to in its name. The company is still around, with its registered office in Kolkata, off Bentinck Road, named after Lord William Bentinck who was the Governor General who set up the first tea committee in Calcutta.

Another company that was born in colonial India and survived the various political upheavals and is still going strong is Wagh Bakri. Its founder Narandas Desai owned 500 acres of a tea estate in South Africa. His experience of racism there forced him to move back home to India with nothing more than a few valuables and a reference letter from Gandhi, in which Desai was hailed as an honest and experienced tea planter in South Africa. Desai started the Wagh Bakri Tea Company with a retail shop in Ahmedabad in 1915 with a logo espousing their values of equality. It showed a wagh (tiger symbolizing the upper class) drinking tea from the same cup in harmony with the bakri (goat) lower class. These are just two of the brands that launched in that era. Clearly tea took off as India is now the second largest tea producer worldwide, with 13,000 tea gardens, employing more than two million people.

Back in the pre-independence era, tea drinking became more acceptable in certain strata of society, and in those pockets, it replaced alcohol as a social lubricant. By the 1940s, as calls for Indian independence reached fever pitch – tea was seen as synonymous with colonial oppression. Notably, Gandhi discouraged Indians from drinking it as he felt it legitimized British presence in the country. British tea brands like Lipton, Twinings or Tetley that were being patronized by the British in India were replaced by the local Assam and Darjeeling teas that became more popular as we moved to Swadeshi.

Link to share this post with your colleagues

Signup and receive Tea Biz weekly in your inbox.