Hear the Headlines

| Kenya Exports Saturate Black Tea Market

| COVID Depresses Japanese Tea Business in Unique Ways

| Unilever is Recognized as the Top Food and Agriculture Benchmark

India Tea Price Watch

India Tea Price Watch | Aravinda Anantharaman

The Tea Board of India announced a mechanization subsidy for smallholders to address the problem of labor shortages in tea gardens. India’s Ministry of Commerce and Industry extended its tea development and promotion program through 2025-26 discontinuing subsidies for Orthodox production that includes $40 million for clearing subsidies in the tea sector. Learn more…

Features

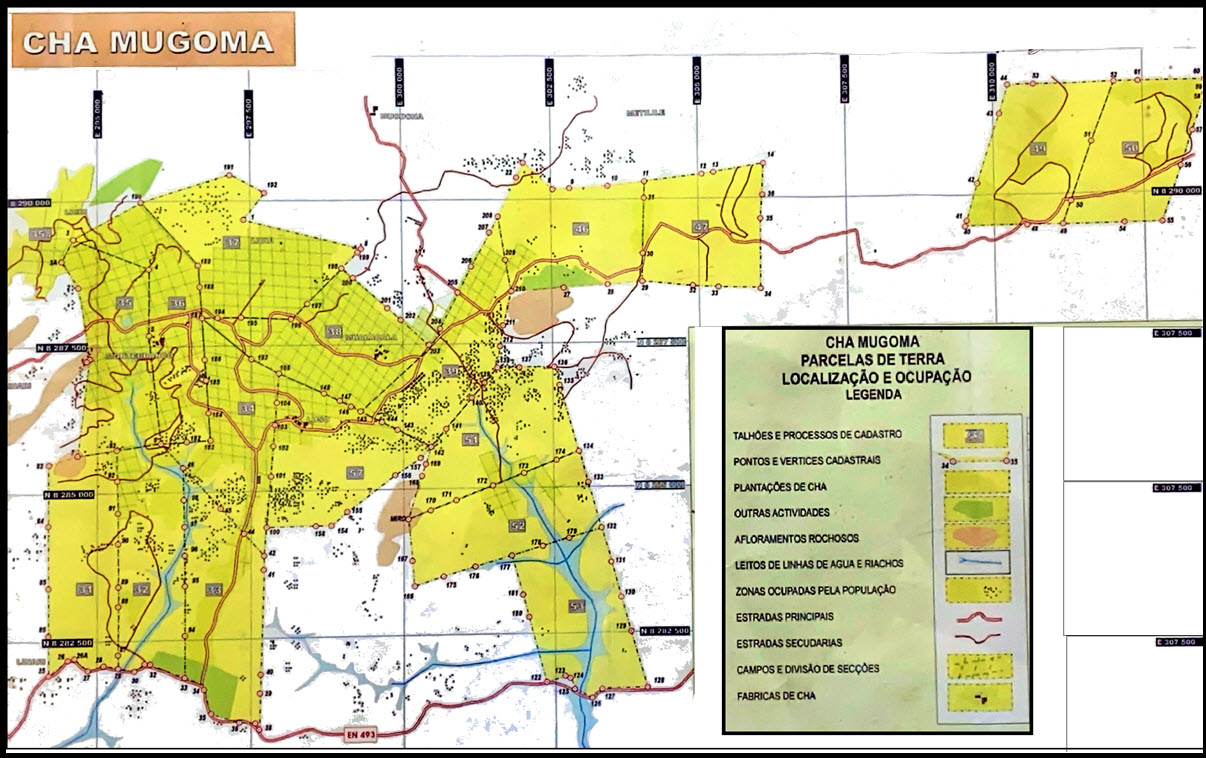

This week Tea Biz travels to Monte Metilile in Mozambique, a country along the southern coast of East Africa where Mohit Agarwal, Director of the Asian Tea Group, has revived an abandoned 15,000-acre tea estate to demonstrate the viability of organic farming at scale.

… and then we talk with supply chain and procurement expert John Snell about what makes Mozambique such an exceptional tea-producing region.

Organic Tea Farming at Scale

By Dan Bolton

Mozambique is the best-kept secret in the tea world, says Mohit Agarwal, Director of the Asian Tea Group, the company that owns Cha de Magoma and the Monte Metilile brand. Mohit is walking the garden as we speak via Zoom, describing the organic dairy herd, a forest of renewable eucalyptus used for fuel, the hydroelectric turbines that power the plantation’s three factories. Pointing to the brilliant green tea bushes that stretch as far as the eye can see he explains that during 15 years of civil war from 1977 until 1992 Mozambique’s tea plantations were abandoned. Read more…

Listen to the Interview

John Snell: Mozambique is God’s Country for Tea

By Dan Bolton

A century ago, when the Portuguese first planted tea in Gurúè, Mozambique they found gentle, well-drained slopes of rich red volcanic soils at 1,500 to 3,600 feet elevation – the same altitude as India’s Darjeeling mid-tier gardens. The climate there is cool and dry from May to September and hot and humid between October and April. Annual rainfall averages more than 3,000 millimeters. By 1950 production exceeded 20,000 metric tons a year and there was more land under tea in Mozambique than any country in Africa. Listen as procurement and supply chain expert John Snell explains why Mozambique is such a great place to source tea. Read more…

Listen to the Interview

News

Kenya Exports Saturate Black Tea Market

By Dan Bolton

Kenya reported a 19% increase in exports totaling almost 300 million kilos through June despite falling production totals. In September Kenya increased fertilizer subsidies following an August increase in payments for green leaf sold to Kenya Tea Development Agency (KTDA) factories. The combination will spur tea production and likely increase Kenya’s share of the global black tea market. Low prices led India to import 5 million kilos of Kenyan tea in the first half of 2021, compared to 1.5 million kilos during the previous year. Worldwide, tea supply continues to outstrip demand, continuing a downward trend dating to 2018. Read more…

COVID Depresses Japanese Tea Market in Unique Ways

By Dan Bolton

Like the rest of the world, Japanese tea growers suffered as restaurants closed, social gatherings were canceled, and safety precautions limited harvest days and processing.

The pandemic also inflicted setbacks unique to the market including a sharp decline in the gifting of tea at funerals.

Japan’s Agriculture, Forestry and Fisheries Ministry, reports that production of unrefined “aracha” declined by 15% in 2021 compared to the previous year. Year-on-year sales of first flush teas fell by 20% in Shizuoka prefecture and by 17% in Kagoshima, according to ministry figures.

The Japanese Association of Tea Production reports that total production of sencha declined by 15% in 2020, compared to 2019.

Japanese office workers are teleworking and drinking tea at home but tourism dollars are down 79% compared to 2019, despite the Olympiad and Japan’s popular rural ryokan inns are shuttered, according to the Japan Times.

An article published in Japan News identifies money spent on gifting tea at funeral services is down 90% from a peak of 13.6 million yen in 2015.

The publication quoted a tea association spokesperson, PAUSE “Even if the pandemic is brought under control, I doubt funeral services will ever go back to the way they were before.”

Biz Insight – To boost sales city and regional governments in tea growing regions are providing subsidies. Shizuoka’s prefectural government is offering producers ¥5 million yen (about $30,000) to develop new tea products and ¥3 million yen (about $45,000) to develop new sales channels.

Unilever Named Top Food and Agriculture Company by World Benchmarking Alliance

The World Benchmarking Alliance has named Unilever its top Food and Agricultural Benchmark. The alliance, established in 2018, encourages seven transformations considered essential to put society and the worldwide economy on a more sustainable path.

Annually the group evaluates 2000 of the world’s most influential businesses against its benchmarks.

In a first, the alliance assessed transformation in the Food and Agriculture system globally, ranking 350 companies from farm to fork. Criteria include transforming nutrition, addressing environmental issues, and social inclusion. According to the Alliance, the findings reveal worrying gaps in the industry’s adaptation to climate change, progress on human rights, and contribute to healthy diets.

“Only 26 of the 350 companies are working to reduce emissions from their direct activities through science-based targets set by the Paris Agreement,” writes the Alliance.

Unilever Benchmarks

Unilever, one of the world’s largest food companies, received a combined score of 71.7 out of 100, ranking ahead of Nestlé (which scored 68.5) and Danone (which scored 63.6). Retailer Tesco and beverage companies PepsiCo and Anheuser-Busch InBev were among the top 10. No foodservice company made it into the top 10. One hundred and nineteen companies scored between 10 and 25 points and 110 companies scored below 10 points out of 100.

Biz Insight – The Alliance writes that “while companies at the top of the ranking demonstrate that they are meeting societal expectations on a variety of topics, the overall average benchmark performance is low. Almost two-thirds of the companies in scope fail to obtain a quarter of total scores, demonstrating significant room for improvement across all measurement areas.”

— Dan Bolton

- Read more… links indicate the article continues. Learn more… links to additional information from sources.

Upcoming Events

October 2021

World Tea & Coffee Expo | India

Postponed to December 2-4 | Launched in 2013 and now operated by Messe Muenchen India, this hybrid virtual and in-person event for tea and coffee professionals is now scheduled for the Helipad Exhibition Centre, Gandhinagar, Gujarat, India. Website | Register

Click to view more upcoming events.

Share this episode with your friends in tea.

Listen to Tea Biz on Apple Podcasts

https://teabiz.sounder.fm/episode/news-01212021Subscribe and receive Tea Biz weekly in your inbox.