Starbucks weathered an unprecedented technical failure Friday… Matcha Madness coast-to-coast.

POS Failure

Thousands of company-operated Starbucks locations in the U.S. and Canada experienced a catastrophic POS (point of sale) crash Friday that tested the coffee giant’s spirit of generosity. A momentary outage can be frustrating but with no word on when the system would be restored store managers recognized the opportunity to offer customers free drinks and food. When it became clear repairs would take hours, managers closed the stores. There is no estimate on how much this cost the company in lost sales, but Starbucks serves 54 million people a day. The outage was caused “by an internal failure during a daily system refresh and was not the result of an external breach,” according to the company which worked overnight to repair the system. By Saturday the more than 8,000 Starbucks locations that experienced the failure as well as Teavana and Evolution Fresh locations tied into the POS were open.

Matcha Madness

Soon after the nation’s collegiate basketball frenzy passed newspapers and magazines coast to coast proclaimed “matcha madness” affording tea retailers a great opportunity to generate additional greenbacks from the emerald powder.

The stir dates to late last year when the New York Times featured the 1000-year-old Japanese tea in an article on Ippodo Tea, an authentic Koyoto establishment that selected New York City as the site of its first store outside Japan. A stream of recipes and blog posts followed. This month TIME Magazine, the Associated Press and, here in Canada, the National Post all devoted major coverage to Westernized adaptations.

“Matcha shots were the ‘it beverage’ at New York Fashion Week according to Fast Company which reported “at last month’s New York Fashion Week, models were spotted sipping bright green matcha instead of Red Bull. Matcha is on the menu at eateries across the city: David Chang sprinkles matcha powder on dishes in his tasting menu at Momofuku Ko; Voila Chocolat serves it on top of hot chocolate, while Maman offers a matcha-infused almond latte; you can have it prepared according to the rituals of a Japanese tea ceremony at Cha-an or Ippodo. Williamsburg, naturally, is now host to the nation’s first dedicated matcha cafe, MatchaBar.”

“Matcha shots were the ‘it beverage’ at New York Fashion Week according to Fast Company which reported “at last month’s New York Fashion Week, models were spotted sipping bright green matcha instead of Red Bull. Matcha is on the menu at eateries across the city: David Chang sprinkles matcha powder on dishes in his tasting menu at Momofuku Ko; Voila Chocolat serves it on top of hot chocolate, while Maman offers a matcha-infused almond latte; you can have it prepared according to the rituals of a Japanese tea ceremony at Cha-an or Ippodo. Williamsburg, naturally, is now host to the nation’s first dedicated matcha cafe, MatchaBar.”

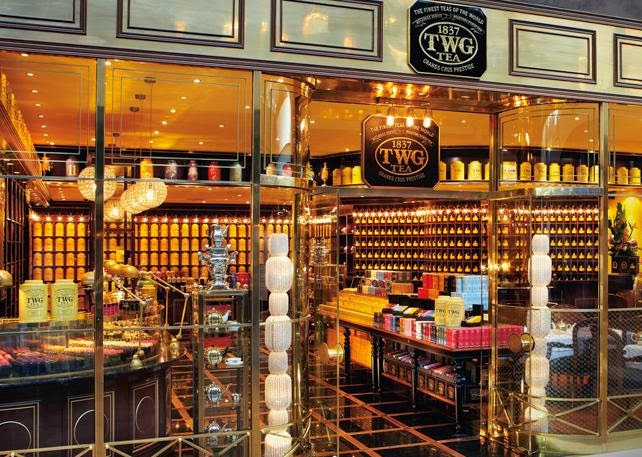

When 300-year-old Ippodo Tea Co. of Kyoto opened in Manhattan in April 2013 it staffed the store with sommeliers trained in the Urasenke tradition of sharing. They eagerly explained and sampled matcha to the curious. Before long the small store front was crowded with afternoon office workers and weekend diners at the Michelin-starred Kajitsu restaurant. Tea drinkers must take their beverage to go as seats are reserved for dinner guests.

The tea bar offers shaken matcha ($3.25) and a matcha slushy ($4.25) along with difficult-to-find Iribancha (a smoky tea originating in Kyoto). The subdued lighting, bamboo counter and merchandise on display reflect the Japanese view that matcha is a ceremonial drink shared quietly to facilitate meditation.

Across the Pacific, Japan hasn’t been immune to the forces of cultural adaptation. “Matcha cake, matcha chocolate, matcha macaroons. Matcha sweets are everywhere,” Kenichi Kano, Ippodo’s international director told the Associated Press. In Japan Ippodo reported annual sales growth of 25%.

MatchaBar is a western interpretation with a mission “to uplift and motivate our community with the power of matcha,” according to founders Graham and Max Fortgang. The Brooklyn shop opened last fall. The website www.matchabarnyc.com promotes the health benefits of matcha’s antioxidants, L-Theanine, catechins and EGCg. A 30-gram tin of classic matcha used in blends sells for $22 and the premium matcha taken “straight” costs $30. MatchaBar offers classes for $85 which includes a starter tin and bamboo whisk (chasen), ceramic holder and bamboo spoon. Shoppers can opt for the convenience of an Aerolatte Electronic Whisk.

Brian Keating, principal at Sage Group in Seattle, published The Matcha Report (www.teareport.com) as a business resource for importers, formulators, chefs and manufacturers who see a big opportunity.

“Over the last 20 years younger generations of Japanese bypassed matcha, replacing it with ready-to-drink carbonated soda, iced teas, coffee, and energy drinks,” explains Keating.

“During this consumption shift within Japan, an eager North American and European specialty tea industry started to import more matcha and the word spread. Creative tea cafes began making concentrated matcha steamed with milk to create ‘matcha lattes,’” said Keating. Starbucks soon caught the wave placing it on menus nationwide where it became a daily habit. Hundreds of firms now offer matcha shakes, smoothies and matcha edibles.

Click this link to see a Teavana sommelier demonstrate the traditional method of preparation.

Keating cautions retailers that “as with any rising star consumer product, cheaper imitators started appearing over the last few years.” Most originate in China as powdered tea that lacks the brilliant green color and sweetness of Japanese matcha.

Beware of “wholesale pricing far below the authentic Japanese matcha,” he said.

Authentic matcha is produced from tea plants shaded for about 10 days before harvest. Leaves develop greater concentration of phytochemicals that deliver better flavor and texture. The finest are hand plucked steamed to halt decay and then dried and aged in cold storage, which deepens the flavor. Stems and veins are removed during drying and the tea is then pulverized in slow moving stone-grinders. The fine powder that emerges is measured in microns. This insures the full benefit of the leaf is ingested.

Matcha has a distinctive, grassy flavor that reminds me of chewing on blades of alfalfa. It is rich in umami a sensation that westerners find appealing in moderation. The tea’s tannins can leave a bitter aftertaste which is why most served in North America is sweetened and blended with milk.

Keating, who has followed the growth of matcha since 2005, believes it will continue to experience fast growth. He documents his reasons in the 64-page The Matcha Report.

“Matcha has yet to reach millions of consumers worldwide. When this untapped multitude begins to respond, a burgeoning specialty tea industry will benefit from the enhanced demand. Prices for authentic Japanese Matcha will inevitably rise — significantly — over the coming years, potentially placing a strain on supplies of the finest, ceremonial, and organic grades of the tea,” he said.

Learn more: www.teareport.com

Correction: Ippodo is located in the Manhattan Borough of New York City, not Williamsburg.

? ? ?

Tea Biz serves a core audience of beverage professionals in the belief that insightful journalism informs good decision-making in business. Tea Biz reports what matters along the entire supply chain, emphasizing trustworthy sources and sound market research while discarding fluff and ignoring puffery.

Tea Biz posts are available to use in your company newsletter or website. Purchase reprint and distribution rights for single articles or commission original content. Click here for details.