Tea Industry News for the week of July 20

- Drink Plants

- Tea Outlook Promising

- New Teatulia Tea CEO

- Enshi Floods

- Bigelow Wellness

Drink Plants

“Consumers across all generations are re-shaping the landscape for beverage product development,” according to a Cargill Insights Report titled Blending, Brewing, and Blurring the Lines… Creating a New Breed of Beverages.

“Traditional beverage categorizations are losing relevance, which is blurring the lines of classic categories and creating opportunities—especially for coffee and tea manufacturers—to meet these demands at the expense of soft drinks,” Cargill writes.

Tea is the go-to beverage in the nonalcoholic market which is estimated at $854 billion globally. Euromonitor estimates the value of RTD (ready-to-drink) tea at $67 billion globally.

“Beverages that are inherently functional have seen growing momentum, which has paved the way for new beverage products touting specific health benefits, according to The Hartman Group’s report, “Modern Beverage Culture.” Consumers are increasingly conscious of beverage calories, and they now want a drink to do more—such as provide energy, added protein, or provide other nutritional benefits,” according to the Insights Report.

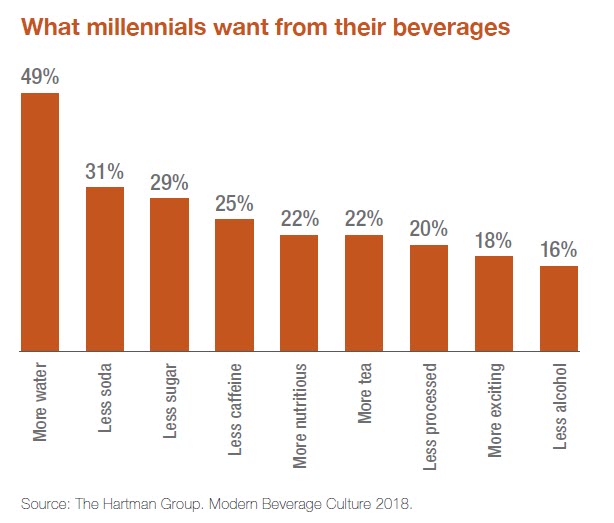

“Millennials are the poster children of this new beverage era. Their demands and aspirations are driving much of this emerging beverage culture,” according to The Hartman Group. A consumer survey by Hartman reveals “nearly three in four millennials (73%) always have a beverage on hand, compared to Gen Xers (63%) and Boomer (58%).”

“Millennials say that beverages play an important role in their health and wellness and that they like beverages to do something — such as provide energy or nutrients,” according to Cargill. “The win-win may be to address consumers’ changing and variable aspirations for beverage consumption with new drinks that mix both function and fun (think tea-beer combos or hard kombucha). These products will likely see a growing appeal, especially among younger consumers,” according to Cargill.

“More than half of consumers are now using products made with plant-based ingredients, and this trend is only going to increase,” according to Cargill. “Powerhouse beverage categories like coffee and tea are leading the way by working to provide new consumption options while addressing health and wellness trends. Coffee and tea have existing health halos; they have been able to capitalize on this to support the creation of healthier energy drinks, while also serving as a better-for-you flavoring or mixer in high-end cocktails.”

Tea on Trend

Non-alcoholic beverages will generate $10 billion more in sales this year, reaching $160 billion, according to market research contained in The U.S. Beverage Market Outlook 2020.

Proprietory surveys by Packaged Facts show significant changes in retail channel trends and consumer motivations across eight retail channels.

“Despite the economic impact of the coronavirus pandemic, large segments of the U.S. food and beverage industry have managed to balance losses in the foodservice sector with gains on the retail side as consumers even now continue to shift their food and beverage spending from restaurants to stocking groceries at home,” according to Packaged Facts.

“We predict sales will spike in 2020 due to the impact of the coronavirus but will likely decline in 2021 as demand reverts back to more normal levels before returning to typical growth patterns from 2022 to 2024,” says Jennifer Mapes-Christ, food industry publisher for Packaged Facts. The study predicts US nonalcoholic beverage sales of $170 billion in 2024.

Plant-Based Beverages are Trending

Plant-based beverages are a hot trend in the market as consumers increasingly integrate plant-based foods and drinks into their diets, according to Packaged Facts.

What’s driving new interest in the segment:

? consumer demand for healthier, natural products

? consumer demand for more and better protein sources

? the consumer perception that plant-based food is more environmentally sustainable

? the increasing number of people who identify as flexitarians, consuming more vegetarian or vegan meals but not exclusively eating that way

The report also cites the popularity of functional and wellness beverages, specifically tea.

“As with all food categories, consumers are demanding more from beverages. Beyond reduced sugar and cleaner labels, people want drinks to make them feel better, stay healthier, and perform at higher levels. The coronavirus pandemic has further elevated people’s desire for products that help keep them healthy. Immunity-boosting products and ingredients had been trending over the last several years already and have been jumping off the shelves as people look to stay healthy amidst the coronavirus pandemic,” according to the report.

“Turmeric has been perhaps the hottest ingredient to boost immunity and is a cornerstone of many new products, along with ingredients such as ginger and Echinacea. Beyond these, marketers continue to enhance drink functionality with ingredients such as antioxidants, adaptogens, vitamins, probiotics, Coenzyme Q10, and BCAAs (branched-chain amino acids),” according to the report.

Teatulia Names New CEO

Co-founder Linda Appel Lipsius is stepping down as CEO of Teatulia Organic Teas. COO Tim Bradley will take her place.

Denver-based Teatulia, founded in 2006, partners with growers in Bangladesh to supply organic teas and herbs used in making a range of hot teas, iced teas, and canned teas, including a newly introduced sparkling soda sold in foodservice and grocery.

The company also operates the Teatulia Tea & Coffee Bar next to its Denver, Colo., headquarters.

“Lipsius has built a universally-respected brand known for doing things better: From the 3,000-acre regenerative garden itself to Teatulia’s stunningly sustainable packaging to the long list of awards Teatulia has received for quality and using business as a force for good,” according to the company.

Bradley previously worked 10 years as COO at Open Road Snacks in Centennial, Colo. He joined Teatulia in July 2017. A former consultant, he is endorsed for his work in sales and marketing and brand management.

“We are grateful beyond words for her contributions over her many years at the helm, and excited to foster the mission and continue the growth Linda nurtured as founder and CEO,” writes Bradley.

“Linda and I have worked together for the last three years to create a team that is truly positioned to take this company to new heights,” he said.

Lipsius credited “a mighty team of the most passionate, creative, tenacious and intelligent individuals I have ever known” for the company’s success during her tenture, as well as “my most extraordinary partners throughout the journey – Kazi Anis Ahmed, Kazi Inam Ahmed, and Kazi Nabil Ahmed MP.”

Too Much Rain Relief

The tea-growing region drained by the Lancang (Mekong) River is humid, with annual rainfall greater than 800 millimeters annually, yet a 10-year drought persists. Last year the region received 888.4 millimeters of rainfall according to meteorologists, but 180 reservoirs remain bone dry and 100 rivers ceased flowing as of April 15, according to the Yunnan Water Resource Department.

Near constant rainfall since the beginning of the month promises relief but at a high cost. On July 3 Kunming was drenched, leading to several deaths, and the displacement of thousands as well as significant crop loss along the Baishui river (which rose 27-feet overnight).

Enshi, the center of tea production in Hubei Province, has seen the worst flooding in decades with 10,000 along the Yangtze River trapped in their homes. Damage is estimated at $11.5 billion with 28,000 homes lost. The water level at the Three Gorges Dam, the world’s largest hydroelectric facility, is 50 feet above its flood-limit level with inflows of 61 million liters a second, according to the Xinhua News Agency.

Yunnan, which is home to 46 million people, sits on a rugged mountainous plateau sloping from the northern highlands south. During the period 1950 to 2012, the Province, experienced 59 drought years, half considered severe.

Droughts have occurred more frequently in recent years, a condition attributed to global climate change. More than 80% of Yunnan’s rainfall now occurs during the period of May through October. Winters are dry and getting warmer. There is insufficient capacity in reservoirs to supply agricultural needs during periods of unusually high temperatures. The drought, which began in June 2019 resulted in shortages of drinking water in Menghai County and lowered yields of Pu’er by a third according to some growers.

In past years the north and eastern sections of the province were more susceptible to dry weather. Now the tea-rich hills in the southwest are hardest hit. Annual precipitation in the Lancang River basin in 2019 was 680.4 mm, according to the China Meteorological Agency. The total is about 25% less than its long-term average, according to a report by CGTN.

A studio published in the journal Ambio reveals that during the period 1978-1996, cultivated land increased 6.1% (167,400 hectares) in Yunnan. A report describing the impact of droughts on reservoirs and streamflow found the frequency of severe and exceptional droughts in the Lancang-Mekong River Basin has increased over the past 119 years, and all countries in the upstream and downstream of the basin have been severely affected.

As the downpour continues, Song Lianchun, director of China’s National Climate Center, told reporters that the number of days of heavy rain in China has risen by roughly 4% each decade over the past six decades.

Bigelow Botanicals

Bigelow Tea® has introduced a new line of cold water infused botanicals. Bigelow Botanicals™ Cold Water Infusions use real fruit and herbal combinations to inspire everyone to stay healthy and hydrated throughout the day, according to the company. The infusions are a “healthy alternative to sugary drinks, are zero-calorie, caffeine-free, and contain no artificial anything.”

Easily infused by the glass or on-the-go, tea drinkers simply place a tea bag in cold water for a few minutes, squeeze the bag and stir, or leave in for more flavor.

Bigelow Tea uses only high-quality ingredients and has specially curated the following botanical infusions that slowly come alive once cold water is added. Flavors include:

- Watermelon Cucumber Mint

- Blackberry Raspberry Hibiscus

- Cranberry Lime Honeysuckle

- Blueberry Citrus Basil

- Strawberry Lemon Orange Blossom

To ensure each cold-water infusion makes a positive impact on the environment Bigelow uses minimal packaging and no plastic bottles (waste reduction is a top priority at this certified B Corporation). The overwrap used to hold each bag works to keep each flavor fresh until sipped by the glass or used with reusable water bottles for the on-the-go consumer.

Cindi Bigelow, third-generation president & CEO writes that “With today’s growing awareness and need to live a healthy lifestyle, we created these beautiful cold water infusion blends to support your wellness choices.”

“It’s truly unlike anything else and really does help you to drink more water throughout the day,” writes Bigelow. The range is gluten-free and non-GMO. The botanicals are sold in boxes of 18 individually-wrapped bags at a suggested retail price of $3.99, about 22-cents per serving.

Learn more at www.bigelowtea.com.