Hear the Headlines

| Economic Forecasters Predict Higher Tea Prices in 2022

| As Holiday Orders Ease, a Delivery Crisis Looms

| Germans Tea Drinkers Set a Consumption Record

PLUS Frugal Innovation, Part 1

Caption: Scanning tea fields at different wavelengths to assess plant conditions. Using cameras to monitor crop conditions, in order to identify threats from disease and pests at an early stage, enables a more targeted (and effective) use of pesticides, lifting productivity and profits.

Features

Tea Biz this week travels to Assam, India to explore “Frugal Innovations” that utilize simple technology to address some of the most vexing challenges facing the tea industry. In Part 1 of the series, Aravinda Anantharaman talks with Abhijeet Hazarika @TeaSigma, an IT analyst and former head of process innovation at Tata Global Beverages, and with growers Saurav Berlia and Shekib Ahmed on cost-efficient experiments and pilots that demonstrate why tea producers should embrace simple technologies with scalable impact.

Bringing Technology into the Tea Value Chain

By Aravinda Anantharaman

There are few entry barriers to tea. It does not demand heavy infrastructure. But a complaint shared by smallholders selling raw leaf to large-scale tea producers operating multiple factories is that for the past decade, farmgate prices are not commensurate with costs. Now the economics of the tea trade is gradually shifting from oversupply to scarcity. At the same time, some quiet work underway in India is yielding encouraging results that lower the cost of tea production, improve quality, and ease a shortage of labor. The most powerful driver for change is revenue. Prices globally, on average, increased by $0.21 cents per kilo during 2021, according to Trading Economics. Abhijeet Hazarika, IT analyst @TeaSigma and former head of process innovation at Tata Global Beverages, observed that “Tea is not a very high profit yielding commodity and will not be so in the foreseeable future until some tech breakthrough happens.” The frugal innovations described in this series, combined with higher prices may herald that breakthrough. Read more…

Listen to the interview (Part 1)

Frugal Innovation

In Part 2, Aravinda Anantharaman explores the application of Frugal Innovation in the tea garden and factories. Shekib Ahmed of Koliabur Tea Estate explains that “Objective data changes the conversation in the factory from vague concepts to thresholds and parameters. It makes operations scientific so that we can improve.” Listen to Episode 48 of the Tea Biz Podcast

News

Higher Tea Prices Forecast for 2022

By Dan Bolton

Globally tea export prices are edging upward, driven by combined spikes in transportation and logistics, more costly fuel and petroleum-derived fertilizer, and increased labor expense.

Regionally the trend is mixed. Exports through September are down 10% by volume but up in value in India, which produces 20% of the world’s tea. India reports falling domestic prices following a pandemic year that boosted prices through the first half of 2021. In November, auction prices for CTC in Kolkata fell to an average of $2.78 (INRs209) per kilo, down from $2.97 during the same period in 2020.

In contrast, last week Kenya auctioned tea at a five-year high of $2.40 (KSH271) per kilo, according to the East African Tea Traders Association (EATTA). Production there is also down 10% overall.

Declines in production are an early sign that the economics of the tea trade is gradually shifting from oversupply to scarcity. The Economist Intelligence Unit (EIU) predicts output globally will increase slightly to 6.279 million metric tons (6.3 billion kilos) while consumption rises to 6.538 million metric tons, creating a deficit of 260,000 metric tons. That deficit will increase to 363,000 metric tons in 2022.

There remains a glut of low-grade tea, but demand for inferior tea is slack.

Globally, tea prices, led by China, have increased by $0.21 per kilo since the beginning of 2021, up 7.32% according to Trading Economics. The analytics firm, using macro models and analyst expectations, based on benchmark CFDs, predicts tea will trade at $3.30 per kilo in 2022. A contract for difference (CFD) is an agreement between a buyer and seller stipulating that the buyer will pay the seller the difference between the current value of an asset and its value at contract time (if the difference is negative, then the seller pays instead). Trading Economics forecasts tea prices could reach an average of $4.10 per kilo by year-end.

If that comes to pass it will be only the second time tea has crossed the $4 per kilo threshold in the past decade. More likely is that rising prices will trigger increases in production. A study by the Indonesian Board of Trade using United Nations FAO data calculated the impact of increased production on prices.

“If there is an overreaction to recent high prices which, for example, would result in a 5% increase in production, the results can be quite different…. the clearing price would be 17% less than the baseline price at $2.54 per kg,” writes Iwan Cahyo Suryadi, Chairperson, Board of Commissioners Indonesia Board of Trade

“If the reaction to the current high prices is even stronger, resulting in a 10% increase in production over the baseline increase, then prices could be 38% lower,” according to Suryadi.

EIU estimates a price increase that is close to the long-term average, “we expect concerns about supply and a gradual recovery in demand in some markets (particularly in Europe and North America) to provide some support to prices in the remainder of 2021. We estimate that prices will average $2.69 per kilo in full-year 2021, representing a 0.5% decline from 2020. We are forecasting an 8.7% increase in average prices in 2022, to $2.92 per kilo.”

Biz Insight – The long-term average price of commodity tea at auction is $2.85 per kilo. Quality tea is more likely to be sold direct and at significantly higher prices. Sales of tea exported by all countries totaled $7.1 billion in 2020, down 4.3% by value since 2016. Year-over-year the value worldwide of tea exports declined an average of 8.6% from 2019 to 2020, according to the website World’s Top Exports. China (dominant in green tea) accounts for 29% of global sales of tea exports by value followed by Kenya with a 16% market share (dominant in black tea), Sri Lanka 10%, and India 9.7% both have about a 10% share.

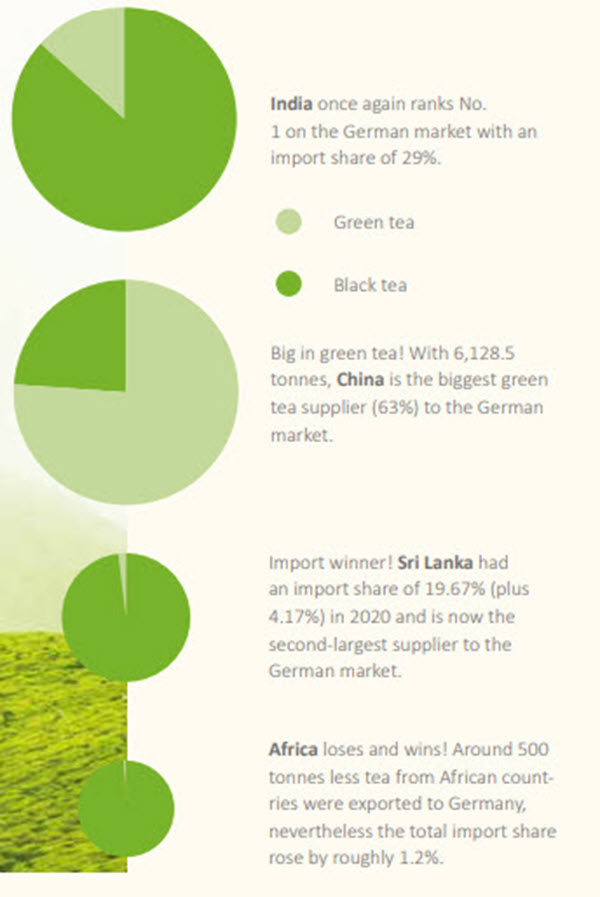

Germany Reports Record Tea Consumption

The German Tea & Herbal Tea Association (Teeverband), based in Hamburg, reports that consumption of tea grew by two liters per capita in 2020 to a record of 70 liters per capita. East Frisians averaged an astonishing 300 liters per capita during the stay-at-home year. These totals include the consumption of black, green, herbals, and fruit teas. The report’s authors write that declines in out-of-home consumption, “triggered by the pandemic-induced closure of hotels, restaurants and canteens, were offset by increased demand in food stores, chemists and specialist shops.”

Hamburg is a global hub for the tea trade, importing 41 million kilos and shipping 22 million kilos of teas to 108 countries. India is Germany’s most important tea trading partner, sending 6.7 million kilos so far this year, China and Sri Lanka follow. The tea association’s managing director Maximilian Wittig said that organic certified black teas now account for a 12.9% share of the market. Organic herbal teas increased their market share to 13.5% a 2.5% gain compared to 2019.

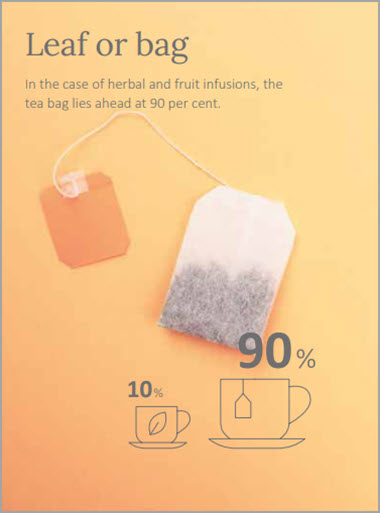

Black tea is favored by 73% of Germans with 90% steeped in tea bags. Germans buy 57% of their tea in grocery and department stores and 12.4% at tea shops with the biggest increase in channel purchases online at 8.2%.

Download the 20-page Teeverband report on the Tea Biz blog.

As Holiday Orders Ease, a Delivery Crisis Looms

Logistics experts in November who predicted everything that could possibly go wrong ? were right.

Jason Walker at Firsd Tea, the US office of the world’s largest green tea exporter, writes that “the burden of moving holiday retail goods has shifted from the ships to the warehouses and trucks. Major players and industry experts still do not anticipate any significant, overall easing of rates and more reliable delivery speed until at least Q1 of 2022.”

Until then buyers are advised to place their orders months in advance, be willing to pay exorbitant rates ($10,000 for a 20-foot trans-pacific container), and order tea in much larger quantities than in past years to ensure sufficient inventory. Wholesalers report waiting 62 days for shipments to arrive from China. Bloomberg writes that ports serving Southern California by November had offloaded a record 17 million 20-foot equivalent units and then loaded 3.3 million empty containers for the return trip. Los Angeles has 2 billion square feet of warehouse space that is now renting at a 30% premium. An additional 20 million square feet is under construction.

Deliveries that took truckers two days in 2019 now take up to 10 days before arriving in Chicago as congestion at ports and warehouses and a shortage of drivers combine to more than double delivery times. Walker cites a shortage of warehouse workers and the added expense of overtime as the ports, as requested by President Biden now operate 24/7. On-time arrival is virtually impossible unless delivered by air freight, in which case it’s unaffordable.

When will it end? Ship jams are now visible at ports in Japan, Taiwan, and Mexico. November marks a turning point. But experts predict the transport crisis will remain through spring and once again ? they’re probably right.

– Dan Bolton

- Read more… indicates the article continues. Learn more… links to reliable outside sources.

India Tea Price Watch | Sale 48

Responding to the tea producers’ concerns over rising imports against declining exports, the Tea Board of India passed an order on November 11, by which tea importers are mandated to mention the origin of the tea on the sale invoices. Importers cannot blend imported tea with GI-protected Indian tea (Darjeeling, Kangra, Assam (orthodox), Nilgiris (orthodox)) and pass it off as Indian-origin tea. Producers of Darjeeling tea have been asked not to procure green leaf from outside the GI area. This is expected to act as a clampdown on cheap imports into India from Nepal and Vietnam, and allow Indian exports to keep their quality, markets, and prices. Read more…

Upcoming Events

January 2021

Tea and Beyond! | GTI 7th Annual Colloquium | January 13 | UC Davis | Day-Long Virtual | Tea and Beyond: Bridging Science and Culture, Time and Space, exploring differences between tea and herbal infusions around the world and in terms of medicine and health, ceremony, traditions, sustainability, marketing, and more. | Program | Register FREE (Zoom)

Share this episode with your friends in tea.

Listen to Tea Biz on Apple Podcasts

Subscribe and receive Tea Biz weekly in your inbox.