Episode 175

Lindsay Lohan TV Ad Advocates Office Tea Breaks | Suez Shipping Disruptions Intensify | Botanists Identify the Gene that Causes Tea Leaf Droopiness | PLUS Revitalizing Kumaon | A century ago, Kumaon’s high-mountain estates were abandoned. The formerly productive tea fields lay fallow until an enterprising young entrepreneur marshaled the resources of US-based Frontier Co-op and USAID’s Cooperative Development Program to benefit hundreds of tea smallholders.

Tea News for the week ending July 5, 2024

Powered by RedCircle

India Tea News

Featured

Raj Vable, founder of Young Mountain Tea in Marquette, Mich., inspired the villagers in the Kumar region to create a new era of economic resiliency and autonomy. The solar-powered factory with state-of-the-art equipment will process regeneratively grown certified organic tea in four styles available in retail locations by November. Vable writes, “We hope our model serves as a blueprint that can be replicated and improved upon so we can all collectively raise the bar on transparent sourcing, regenerative agriculture, and smallholder farmer equity.”

Powered by RedCircle

Listen to the Interview

Pure Leaf TV Ad Advocates Office Tea Breaks

By Dan Bolton

Actress and producer Lindsay Lohan appears in a new television commercial and social media campaign urging tea drinkers to take a break at work. The commercial, financed by the Pepsi Lipton Tea Partnership, features Pure Leaf, the top-selling ready-to-drink tea brand in the US.

The minute-plus spot is the first national multimillion-dollar tea advertising campaign since the pandemic.

The Pure Leaf brand also launched a US-only coupon giveaway of a free bottle to enjoy on your next tea break. Text 737-377-3774 between June 27 and July 25 to receive a bottle or visit. PureLeaf.com/TeaBreak

Try: Tea break recipes

In the commercial, Lohan, who has starred in several Netflix original films in the past few years and is currently filming Freaky Friday 2 with Jamie Lee Curtis, asks, QUOTE “When was the last time you took a break? I mean a real break. It’s like we forgot breaks even exist. Standing on an office coffee table, she shouts “it’s time for a tea break.” We all deserve a moment to recharge and revitalize ourselves. Soon the office staff is headed out the door chanting “tea break, tea break” and chugging Pure Leaf.

Edelman made the humorous 90-second spot, supported by research that reveals “three in five workers struggle to take breaks during the workday, and more than half of workers feel too busy or interrupted by work to take a refreshing break. Nearly two-thirds of the 1010 full-time workers surveyed feel mentally, physically, and emotionally exhausted. However, sixty-three percent (63%) of workers surveyed noted that when they take quality breaks, they return recharged for what’s next*.

Pure Leaf sales exceeded $985 million in mass market and convenience outlets in 2023, compared to competitors Arizona’s $956 million and Lipton’s $561 million. Globally, the RTD market is forecast to increase by $27.7 billion, a 25% growth rate, from 2024 to an estimated $138.15 billion in 2028.

An accompanying press release explains, “The Pure Leaf Tea Break campaign encourages workers to challenge today’s hustle culture with a centuries-old workplace ritual—a quality tea break—and the first bottle is Pure Leaf Iced Tea.

Lindsay Lohan said, “We owe it to ourselves to take a moment each day to pause, recharge, and revitalize. I’m proud to partner with Pure Leaf to promote the importance of taking a daily tea break because no matter what you do, we all deserve the time to reset and refresh. For me, prioritizing breaks is essential for all of the roles I juggle, allowing me to return stronger and more restored.”

Pure Leaf and Mind Share Partners are providing tips for making the most of work breaks and posting examples of “away on a break” messages online.

“To support the cultural shift toward better breaks at an organizational level, Pure Leaf is also launching the Pure Leaf Tea Break Grant program in partnership with Mind Share Partners. This initiative will provide funding for small businesses and non-profits to implement break initiatives aimed at promoting employee revitalization,” according to the release.

Julie Raheja-Perera, General Manager/VP – Pepsi Lipton Partnership North America, says, “At Pure Leaf, we are intentional about how we craft our delicious real brewed iced teas so you can feel refreshed and revitalized. We know many people are not taking enough quality breaks during the workday, so we’re launching the Pure Leaf Tea Break to remind people that a moment to reset is very important. Revitalization is just a sip away with our delicious, iced teas made from a few high-quality, simple ingredients and naturally occurring caffeine from tea leaves.”

Suez Shipping Disruptions Intensify

The Red Sea skirmishes, a significant factor in the ongoing shipping crisis, have increased sinkings, indicating that the crisis is far from over.

A surge in global freight rates, reaching over $4,200 per 40ft container in May 2024 – the highest on record – has put a significant financial strain on tea exports and other goods since October 2023.

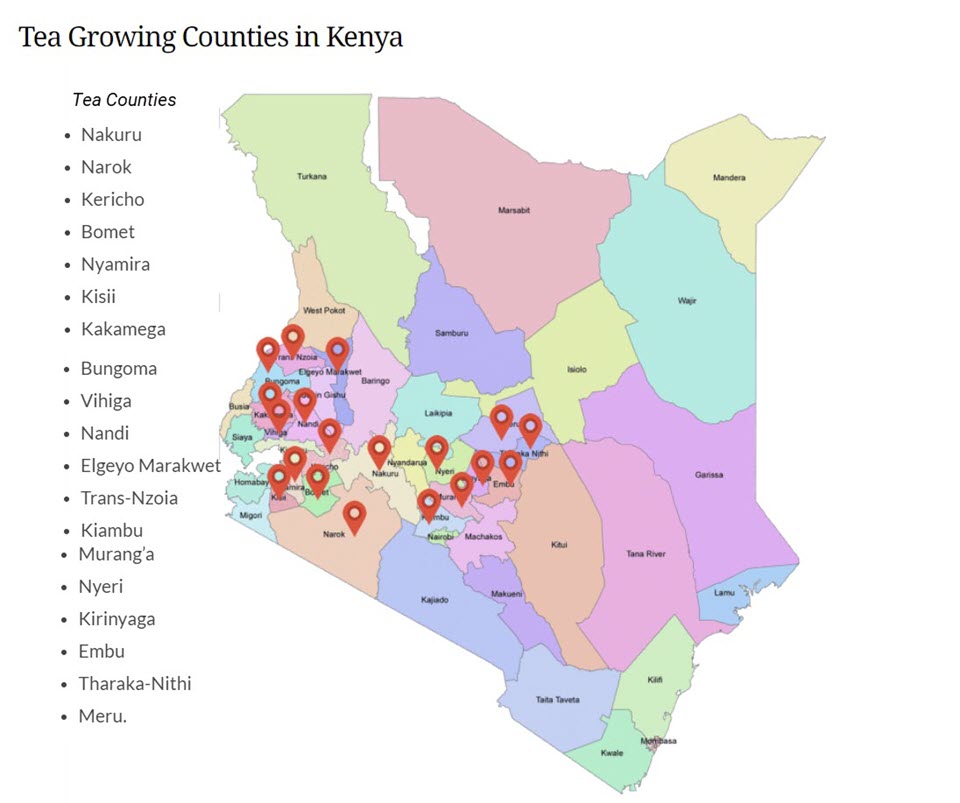

Tea exports are currently at their peak following the spring harvest. India’s peak is from April through June, Sri Lanka’s is from May through August, and Kenya’s is from January to June.

Demand for tea in Europe is slack, which has helped avoid a serious shortage of tea imports, but the added cost of landing tea from Africa, South Asia, and the Far East cannot be ignored. One German-based retailer told Tea Biz that they are shipping tea by rail from China, which is faster and cheaper than shipping tea around Africa.

Since the beginning of the year, the Drewry composite container index has averaged $3,579 per 40-ft container, $831 higher than the 10-year average. Containers are in short supply and out of place because ships are not transporting empties. The cost of shipping tea from China to the US ports has also increased by 69% from April through May 24.

The Houthis have launched 50 missile and drone attacks since October, killing four. In the latest, the Yemen-based, Iran-backed militants used explosive-laden drone boats to slow or disable large vessels that are then targeted by ballistic missiles. A “double tap” on June 19 destroyed the Tudor, a bulk carrier. Two more successful missile attacks followed, disabling another bulk carrier. The Houthis sank their first ship in March.

Fuel and insurance costs have increased due to higher risk and because ships spend more days at sea. Lloyd’s of London reports a £1.1 billion expense associated with underwriting unrecoverable planes and cargoes in Ukraine since the onset of the war.

Only 4% of war claims have been processed.

Egyptian authorities say revenue plummeted by several hundred million dollars due to the Red Sea skirmishes.

According to Egypt’s Minister of Finance, traffic through the Suez Canal declined by 64% in May, lowering revenue to $334 million, more than 50% lower year-over-year. Losses in late 2023 amounted to $150 million.

Only 1,111 ships traversed the canal in May, compared to 2,396 ships in May 2023. Tonnage is down 68.5% to 45 million tons. About 15% of trade by volume transits the canal annually. The canal is the shortest maritime route between Europe and Asia.

According to the International Monetary Fund, ship traffic transiting the Cape of Good Hope has surged 74% above 2023 totals. A drought that limits the capacity of ships transiting the Panama Canal, where trade volume is down 32% compared to 2023, further complicates the situation for shippers.

Botanists Identify the Gene that Causes Tea Leaf Droop

Researchers at the Tea Research Institute of the Chinese Academy of Agricultural Sciences report finding a gene that could transform the tea industry’s approach to mechanical harvesting.

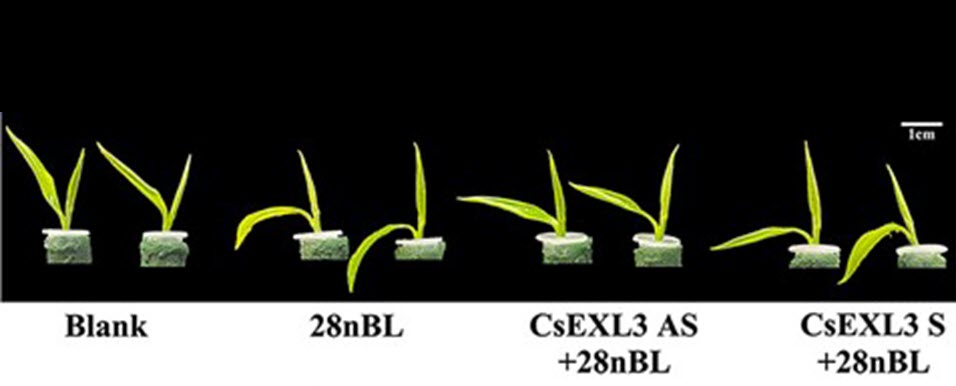

An estimated 70% of the world’s tea is now sheared or mechanically plucked, but in most instances, the leaves gathered are damaged, yielding a relatively small percentage of “perfectly plucked” two leaves and a bud. Instead of snipping whole leaves at their base, leaves on stems that bend or droop are cut into small pieces and later discarded during the sorting process.

The study identified the CsEXL3 gene and gene regulator CsBES1.2 as the source of weak stems. Their findings, first published in the peer-reviewed journal Horticulture Research, could improve harvesting by minimizing leaf damage, leading to better-tasting tea.

Planters turn to mechanical harvesters to reduce labor expenses and improve efficiency by increasing the number of rounds while lowering costs.

One of the lead researchers, Dr. Jiedan Chen, writes that discovering the gene and its regulatory pathway “offers a promising genetic target for breeding tea plants better suited for mechanical harvesting, potentially revolutionizing the tea industry.”

Haoran Liu et al. explain that CsEXL3 regulates mechanical harvest-related droopy leaves under the transcriptional activation of CsBES1.2 in tea plants, Horticulture Research (2024). DOI: 10.1093/hr/uhae074

BIZ INSIGHT – In 1952, Agronomist Norman Borlaug learned of the sturdy stems of dwarf wheat in Japan. For his experiments, he obtained seeds with the stem-strengthening gene. Working with a USDA plant breeder at Washington State University, he developed disease-resistant plants that yielded more wheat per acre than any known cultivar. The wheat was first planted in Mexico, and by 1956, Mexico was producing enough wheat to be self-sufficient. Borlaug’s cultivars, which produced 14 times more wheat than previous cultivars, were introduced worldwide, averting famine and saving an estimated one billion lives, including several million people in India’s great famine. Borlaug would earn a Nobel Prize and became known as the father of the Green Revolution.

FEATURE

Tea Rebellion: Anatomy of a Purpose-Driven Brand

By Dan Bolton

Raj Vable, founder of Young Mountain Tea in Marquette, Mich., inspired the villagers of Kumaon to create a new era of economic resiliency and autonomy. The solar-powered factory with state-of-the-art equipment will process regeneratively grown certified organic tea in four styles available in retail locations by November. Vable writes, “We hope our model serves as a blueprint that can be replicated and improved upon so we can all collectively raise the bar on transparent sourcing, regenerative agriculture, and smallholder farmer equity.”

Raj founded Young Mountain Tea in 2013 as a social enterprise to provide a sustainable future for farmers, 90% of whom are women. He graduated from the University of Michigan and later earned an MS in environmental science from the University of Oregon. He first traveled to Kumaon as a Global Partner with AVANI, spending a year developing a permaculture tea cultivation program involving 300 farmers. He was named a Fulbright-Nehru Scholar in 2013 and worked in Almora, India, before returning to the US as a Rural Venture Catalyst in Oregon’s Regional Accelerator Innovation Network.

Listen to the Interview

Powered by RedCircle

Share this post so that others can benefit

Lindsay Lohan TV Ad Advocates Office Tea Breaks | Suez Shipping Disruptions Intensify | Botanists Identify the Gene that Causes Tea Leaf Droopiness | PLUS Revitalizing Kumaon | A century ago, Kumaon’s high-mountain estates were abandoned. The formerly productive tea fields lay fallow until an enterprising young entrepreneur marshaled the resources of US-based Frontier Co-op and USAID’s Cooperative Development Program to benefit hundreds of tea smallholders. | Episode 175 | 5 July 2024

Sign up to receive Tea Biz weekly in your inbox.