COVID-19 2nd Wave Strikes Blow to Rural India

Rural India is home to 895 million of the nation’s 1.35 billion people, most of whom live in small villages and towns.

Last year the coronavirus pandemic plunged India’s economy into a recession for the first time in nearly a quarter of a century. Domestic consumption decline so severely that the economy contractedd by an estimated 7.7% according to the OECD’s Economic Outlook 2021.

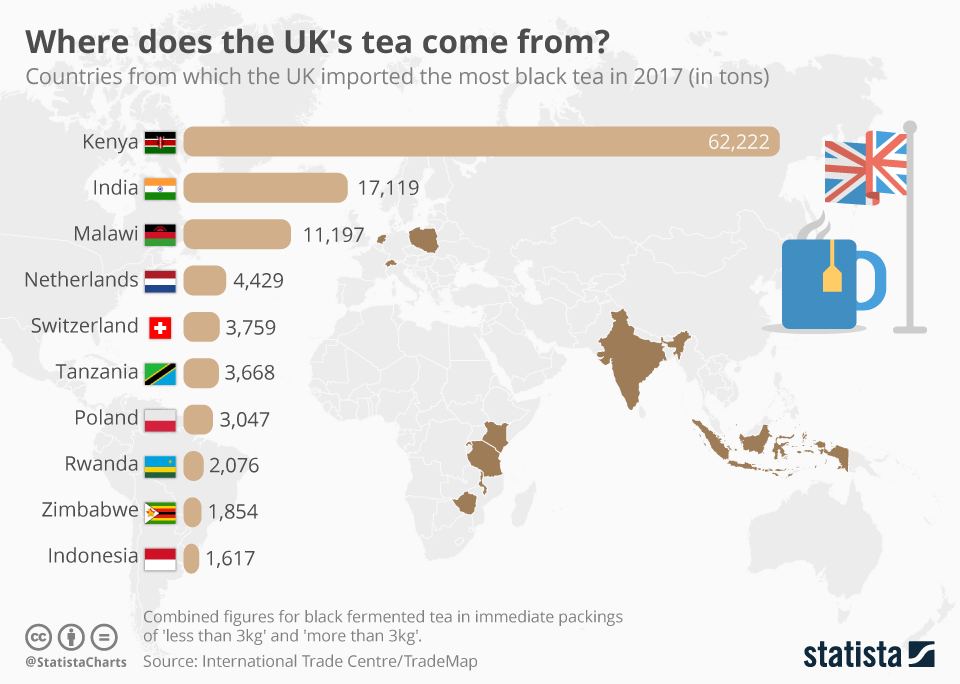

Agriculture accounts for a third of India’s gross domestic product and tea production, tea exports and tea retail all suffered. Agrarian workers, however, were largely spared the high death counts experienced in the nation’s cities.

That is no longer the case as the COVID 2nd Wave crests. India’s tea industry employs 3.5 million workers who reside in small homes and are reliant on crowded vans for transport, resulting in much higher rates of infection this spring than in 2020.

Although the tea industry is designated essential and therefore exempt from the strict lockdowns ordered in 2020, containment zones are in place at more than half of Assam’s 800 registered gardens. A combination of dry weather and reductions in labor due to COVID restrictions depressed harvest totals during the first six months of 2021.

The situation is less dire in the Nilgiris following a major push by Minister for Medical and Family Welfare Ma. Subramanian. The state ministry prioritized tea workers and reported June 28 that all tea estate workers and factory workers have received a first shot and that 21,500 of 27,500 tea workers in tribal communities had been vaccinated. The ministry has vaccinated 289,000 individuals to date and will soon begin administering booster shots.

Situation summary

- Daily wage earners face reduced hours and fewer work days harvesting and processing tea. Declines of INRs 250-500 daily are common. As a result, many now find it difficult to meet daily food and loan obligations. Pay varies by region and there are incentives for the most productive workers, but wages are low at INRs 7,000 ($96) per month.

- Testing is inadquate. Rapid antigen tests are available but workers, most without vehicles, must travel long distances to testing centers. Traffic restrictions limit travel between districts.

- Hospitalization is expensive. Sugarcane grower Dattatray Bagal, told The Economic Times that a hospital bill of INRs 820,000 ($11,191) to care for his father, who died of COVID-19, “not only exhausted our savings but also forced us to borrow from relatives.” Some farmers were hit so badly that they don’t have money to buy seeds and fertilizers to plant summer-sown crops such as corn and soybean, according to the newspaper.

- Accustomed to malaria (6.7 milllion cases in India, 9,620 deaths annually), tuberculosis (440,000 deaths annually) many workers are far more fearful of diseses they know. Mandatory quarantines and isolation during hospitalization lead to rumors that once someone is taken away, COVID victims never return.

- Hospitals in the tea growing regions are small and generally equipped to provide only first aid and basic medical care. Few are staffed with full-time doctors and nurses. Medicines for fever, headaches, stomachaches are in short supply.

- Many who fall ill restort to home remedies, fearful they will be sent to a COVID Care Centre (mandatory in Assam). Standard contact tracing often identifies family members who work at the estate, as well as neighbors and friends of those who test positive, leading to 15-day quarantines and loss of wages.

- Tea workers do not receive paid leave. Central and state governments have issued pandemic guidelines for paid leave. West Bengal’s Department of Personnel and Training instituted its paid leave policy June 7. Categories include commuted leave, special casual leave, earned leave, half-pay leave for any government worker who tests positive for COVID. Tea Estates are asked to consider the same.

Christian Kharia, who lives at Nagasuree tea garden and is the president of the UBCSS (Uttar Bangal Chai Shramik Sangathan) said that “People in the tea gardens are very casual about COVID. They treat it like any other sickness. People are not following COVID protocols.”

Workers Face Long Term Financial Setback

In India, in 2019, there were are an estimated 138 million subsistence households earning $1,000 to $5,000 a year, ($85 to $400 per month), according to Statista. The impact of COVID-19 on household income will slow that growth due to lost hours and a significant decline in commerce due to lockdowns.

Prior to the pandemic, income growth was projected at 5% in rural India with the lower middle class expected to expand to 131 million households earning $5,000 to $10,000 annually by 2022, up from 92 million households in 2019. The 30 million rural households earning $10,000 to $25,000 were estimated to grow to 48 million by 2022, according to Statista market research.

The pandemic dashed that promising outlook, taking its toll in every sector.

Deaths Due to COVID-19

| COVID-19 Impact | Assam | West Bengal | Karnataka | Kerala | Tamil Nadu |

| Population (2020 in Millions) | 35.997296 | 96.786848 | 68.8096 | 37.96128 | 88.32544 |

| Population Density (per k2) | 397 | 1,029 | 320 | 860 | 550 |

| Tea Garden Workers (registered) | |||||

| Tea Smallholders | 1.3 million | ||||

| Infections (curent) | 39,837 | ||||

| Confirmed Cases (total) | 466,590 | 100,437 | |||

| Positives per 100 tests (Positivity) | |||||

| COVID Deaths | 4,038 | 7,663 |

Assam

Update 6-29: Assam is reporting that a high percentage (12%) of those testing positive are young people under 18 with 5,778 under five years of age, according to the National Health Mission. Deaths number 34 since April. During the second wave 280,504 have so far tested positive in Assam. The Deccan Herald writes that 28,851 of those who tested positive were between the ages of 6-18 years.

Dibrugarh reported 2,430 cases among children, which was 12.19% of total cases. Nagaon was third with 2,288 cases (14.38%) followed by Kamrup (2,023) and Sonitpur (1,839). During the first wave, 8% of those who tested positive were younger than 18 years, according to the National Health Mission.

Update 6-28: Vaccination sites are active at 415 tea estates as of June 22. In Assam 99,701 tea workers have received a first shot and 6,027 have received a second shot. A total of 508 tea estates reported COVID cases. Those with 20 or more were ordered to designate containment zones and activate COVID Care Centres.

During the period May 18-28 Assam recorded a 300% spike in COVID cases, according to Bidyananda Barkakoty, adviser at the North Eastern Tea Association (NETA). He said that the number of workers in the factory and fields was reduced by half. Workers who tested positive are forced to stay at Covid Centres to prevent spreading the virus to their families.

OVERVIEW

Assam’s 800 registered tea estates and 1.3 million smallholders produced 725,000 metric tons in 2019. Last year Assam’s big gardens produced 336,000 metric tons and smallholders produced 290,0000 metric tons for a combined 626,000 metric tons. Production is expected to decline by 20-25% as a result of dry weather and COVID mandates that reduce the first flush production by 60,000 metric tons. About 18% of Assam’s population works in tea.

Assam (Tea Estate Workers)

| Location | Tea Workers Active Cases | Tea Wokers Total Cases | Tea Workers Recovered | Deceased Tea Workers |

| Dibugrah | N/A | N/A | N/A | |

| Jorhat | N/A | N/A | N/A | |

| Guwaharti | N/A | N/A | N/A | |

| xxxx | N/A | N/A | N/A | |

| Total | 2,817 | 13,229 | 10,410 | 102 |

Tamil Nadu (Nilgiris)

Updated 6-23 Active cases stand at 6,895 for the Nilgiris. The state government has also placed Nilgiris on the priority list for vaccinations, as the drive continues.

Supriya Sahu (IAS), COVID Monitoring Officer for the Nilgiris said, “The population of tribals in the Nilgiris stands at 27,000 of which 21,500 are 18 years and older. We have so far vaccinated 15,414 tribals. We are involving Primary Health Centres (PHC) and Block Medical Officers completely in the planning. Everyday, they inform the NGOs about the number of vaccine doses that are coming in so that the NGO teams can mobilise people in different villages. The PHCs then follow that list in a true example of bottom up community-owned planning. We had launched an awareness programme with NGOs to break the vaccine hesitancy. Key was to try and mobilise the entire village and not just individuals so that we can achieve 100% coverage in a village.”

Tamil Nadu (Nilgiris Tea Estate Workers)

| Location | Active Cases | Tea Workers Hospitalized | Deceased Tea Workers |

| Coonoor | 549 | 63 | 7 |

| Udhagamandalam | 67 | 4 | 0 |

| Kotagiri | 97 | 13 | 1 |

| Gudalur | 294 | 33 | 3 |

| Total | 1,007 | 113 | 11 |

Kerala

Updated 6-23: According to the state COVID portal, on 1st April, Kerala had recorded 4,632 deaths from COVID-19 and active cases were at 26,201. The first reported death was 30th March, 2020. On 22nd June, the number of active cases were 100,437 with fatalities between 1st April, 2021 and 22nd June, 2021 reported at 7,663.

The main tea-growing districts of Wayanad and Idukki saw slightly lower numbers than other districts in the state. The two districts combined report 331 deaths and have 9019 active cases as of 22nd June 2021. Vaccinations are underway with 28.17% vaccinated at present. Palakkad and Thiruvananthapuram districts on the other hand, were more severely affected. Palakkad reported over 1000 deaths from COVID so far, with 7,320 active cases as of 22nd June, 2021. Thiruvananthapuram was the worst affected district and currently has nearly 100,000 active cases. Reported fatalities stood at 2,562 in this district.

Ashok Dugar of Chinnar Tea said that the 2nd Wave saw more cases and the workers were reluctant to shift to the isolation centres. So at their estate, the 30-bed hospital was converted to a District COVID Care Centre in May. They are also preparing for the 3rd Wave now. The disruption in production that came with the first wave was not there in the second wave as tea was exempted from lockdown.

He added that estate managements who have large infrastructure and ready machinery should come forward to set up and upgrade their facilities to take care of not only their own but neighbouring patients in the remote rural areas, which will be great relief to the government’s much-stressed resources .

Kerala (Tea Estate Workers)

| Location | Active Cases | Tea Workers Hospitalized | Deceased Tea Workers |

| Idukki | 5,244 | N/A | N/A |

| Wayanad | 3,215 | N/A | N/A |

| Total | 8,659 | N/A | 331 |

West Bengal

Updated 6-1: In West Bengal, more than 4,500 cases have been recorded across 300 of the state’s 800 tea gardens, according to government data, as reported by Thomas Reuters Foundation.

West Bengal (Tea Estate Workers)

| Location | Active Cases | Tea Workers Hospitalized | Deceased Tea Workers |

| Darjeeling | N/A | N/A | N/A |

| Dooars | N/A | N/A | N/A |

| Terai | N/A | N/A | N/A |

| xxxxx | N/A | N/A | N/A |

| Total | N/A | N/A | N/A |

Regional Updates

Tea Biz welcomes COVID updates from tea estates, labor unions, tea associations, medical and and government authorities. Write Dan Bolton, Aravinda Anantharaman (Nilgiris), or Roopak Goswami (Assam)

Share this post with your colleagues

Signup to receive Tea Biz weekly in your inbox.