Episode 155

Maritime Security Concerns Worsen in Suez and The Red Sea as Two Missiles Disable British Ship | Rising Operating Costs Close a Third of Uganda’s Tea Factories | Hydration Concerns Motivate Consumer Purchases

Tea News for the week ending February 16, 2024

Featured

“New tools and approaches are changing the game from always looking backward through the rear-view mirror to giving everyday tea professionals a new crystal ball that allows us to look around the corner and predict what’s coming,” observes Liam Brody, the new Committee on Sustainability Assessment CEO. Brody explains COSA’s role in intelligence-gathering and developing strategic tools that advance sustainable practices with “sound business” underpinnings. He also shares his vision of how artificial intelligence will revolutionize and influence consumer behavior and perception of sustainable practices.

Listen to the Interview

Powered by RedCircle

UK Retailers Concerned About Tea Supply

By Dan Bolton

Shipping company executives see no sign of improvement for vessels transiting the Red Sea, leading UK retailers and tea companies to take steps to minimize shortages.

As shipping costs surge, suppliers in Kenya and India face a more daunting challenge. Rates from Asia to Europe are up nearly five-fold, rising to $5,000 per 20-foot container. During the height of the pandemic, the expense of shipping containers of tea long distances exceeded the value of bulk tea within.

Three months into the crisis triggered by the war between Israel and Hamas terrorists, Yemen’s Houthi rebels continue their drone and missile attacks in both the Gulf of Aden and the Red Sea. On February 18, twin anti-ship missiles disabled a British-owned bulk cargo ship, forcing the crew to abandon the ship, which was taking on water and in danger of sinking.

Bloomberg reports that last week, ship arrivals in the Gulf of Aden were down about two-thirds compared to early December, according to Clarkson Research Services Ltd., a unit of the world’s largest shipbroker.

Executives of the largest shipping companies told Bloomberg TV that threat levels continue to escalate. The disruptions could last an entire year.

Maersk Chief Executive Officer Vincent Clerc told Bloomberg, “The amount and range of weapons being used for these attacks are expanding, and there is no clear line of sight to when and how the international community will be able to mobilize itself and guarantee safe passage.”

Half of the tea consumed in England is shipped from Kenya and India via the Suez Canal. This week, executives at Yorkshire Tea and Tetley Tea reassured the public they had implemented measures to minimize any disruption of the blending and manufacturing due to shipping delays.

A spokesperson for Tetley told the BBC, “At the moment, it’s much tighter than we would like it to be, but we’re pretty confident we can maintain supply levels. Our priority is to maintain our consistently high levels of service based on ordered and forecasted demand. We believe we can continue to deliver this, but acknowledge that this is a critical period which requires our constant attention.’

Spokesman Tom Holder of the British Retail Consortium, representing 200 retailers, reports temporary disruptions in the scheduled arrival of some black tea, but delays thus far amount to no more than a “blip.” Companies are adjusting orders and inventory to account for 10 to 14 additional days at sea. Sainsbury’s website assured customers of adequate supply but expressed concern should shipping firms experience lengthy delays.

According to Reuters, more ships are re-routing via the Cape of Good Hope than transiting the Red Sea via the Gulf of Aden.

BIZ INSIGHT – Britons drink about 100 million cups of tea daily, according to Sharon Hall, chief executive of the UK Tea and Infusions Association. The UK is the world’s fifth largest tea importer. Tea imports from outside the EU amounted to 104 million kilos in 2021. UK blenders export about 9.5 million kilos of tea valued at two million British pounds ($2.5 million in US dollars) annually, mainly to the European Union.

Rising Operating Costs Close a Third of Uganda’s Tea Factories

Uganda’s tea sector is in crisis with the closing of nine factories, about a third of the 28 in operation. Excess stocks of lower-quality tea following an aggressive expansion of acreage under tea are holding down prices amid spiking costs for electricity, which led to the closures.

Tea is an important crop supporting 80,000 smallholder families in 17 tea-growing districts. Each factory that closes jeopardizes the financial welfare of 7,000 to 10,000 families.

Trade minister David Bahati told the local press that the Prime Minister is personally chairing a cabinet-level committee that has drafted policies to address requests for immediate subsidies to lower the cost of electricity. Uganda has a low per capita consumption of electricity and one of the highest average unit electricity costs in the sub-Saharan region. Rural factories currently pay 3,470 shillings per kilowatt compared to an average cost of 1,900 shillings per kilowatt in industrial areas.

The policy recommendations will then be presented to the house, he said.

In addition to immediate subsidies, Dickson Kateshumbwa, NRM, a member of the Parliament representing Sheema Municipality, urged the government to implement policies enabling Uganda to compete better in the international market.

He told New Vision, “People pluck the leaves without guidance. That is why Uganda fetches the lowest amount of tea in the region, but not because we do not have fertile soils. We need that policy to improve our quality,” Kateshumbwa said.

Members of Parliament representing tea-growing regions are calling for a bailout like that, given sugar producers are facing similar high production costs. Tea is the fourth most important agricultural export after coffee, maize, and fish.

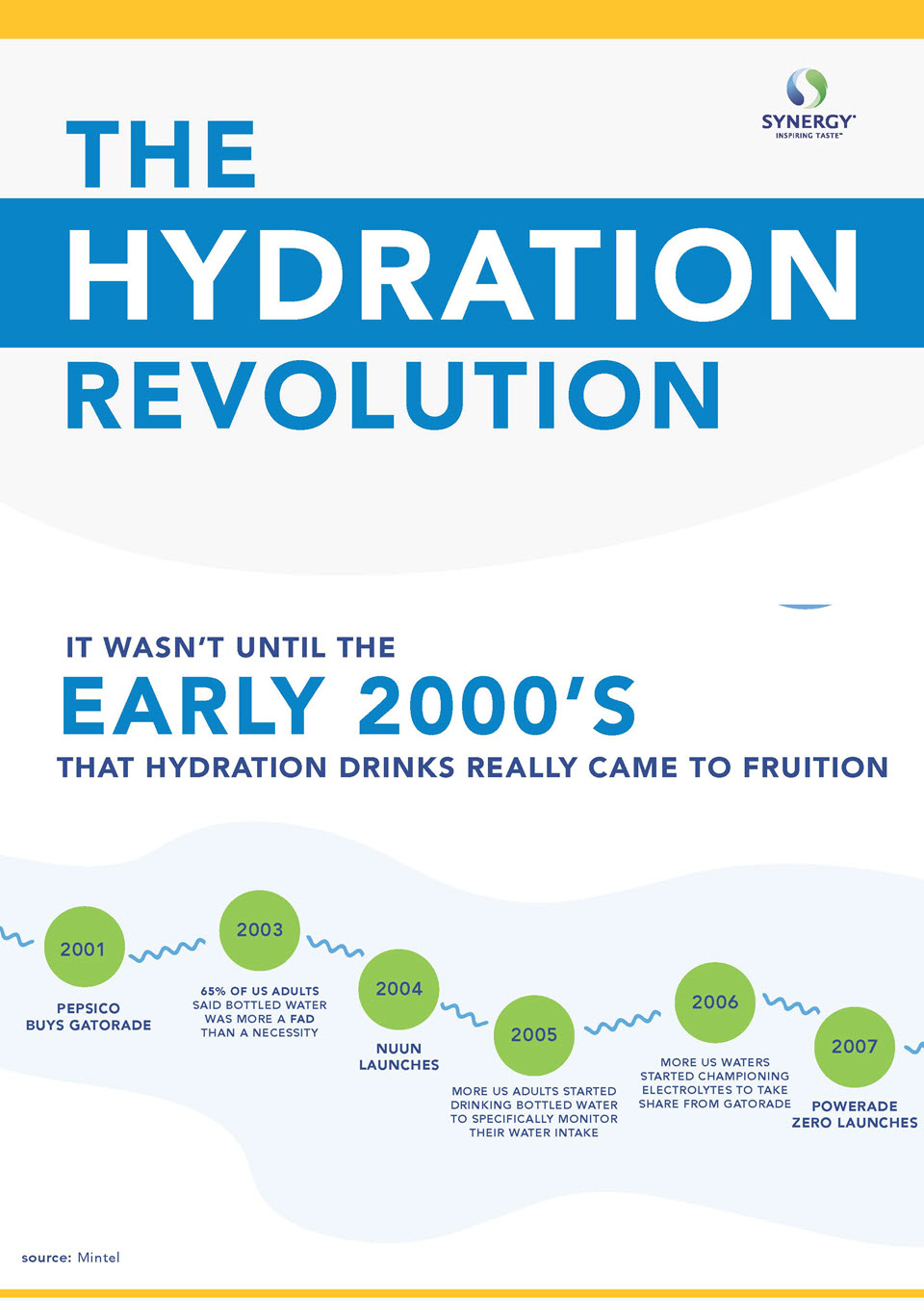

Hydration Concerns Motivate Consumer Purchases

Tea marketers should take note of studies showing rising consumer thirst for hydration.

Consumer interest in hydration intensified post-COVID, with 56% of US adults in 2023 reporting “they were better at staying hydrated this year.” Forty-eight percent did so because of increased physical activity, reports Synergy, a global manufacturer and supplier of flavorings, extracts, and essences.

In the US, 32% of adults feel more motivated to live a healthy lifestyle now than before COVID-19, which has led to a greater focus on self-care and overall wellness, according to Synergy.

“In the UK, 58% of bottled water users would like to learn more about their hydration needs, and 54% of French adults think drinking fortified water is an excellent way to boost your vitamin and mineral intake.

Sixty percent of Millennials, the most of four cohorts, are engaged with functional hydration drinks. According to Mintel International, Generation Z and Generation X follow, each with a 58% engagement rate, with Boomers indicating 44% engagement. Female Gen Zs are the biggest users of functional hydration beverages.

Consuming beverages fortified with electrolytes, first introduced in the 1960s, is top of mind for all four cohorts. Gen Z drinkers seek protein, while Millennials, GenX, and Boomers want multivitamins. The younger generation wants fat burners, while Boomers seek omega-3 and glucosamine.

Eighty-five percent of US bottled water drinkers say that staying hydrated keeps them productive at work. Seventy-three percent of UK Adults say optimal hydration is essential for mental performance.

BIZ INSIGHT – Water bottles have become a status symbol, a vital accessory to daily life, writes Synergy. Stanley’s Quencher has seen a 275% year-over-year increase in sales and has experienced a 215% increase in its best-selling category, hydration, according to Retail Dive. What you are most likely to find inside those bottles are citrus, summer fruits, and berry flavors, according to Synergy.

Visit the Synergy Hydration Blog or download their infographic to learn more.

FEATURE

Predictability is Around the Corner

By Dan Bolton

The Committee on Sustainability Assessment (COSA) was established to measure the massive quantity of precise data and the impact of harder-to-quantify, pragmatic ways of measuring sustainability, such as living income calculations, gender inclusion, and next-generation training.

In 2005, sustainability pioneers at the United Nations identified the need to harmonize sustainability metrics with science-based credibility. Seven years later, COSA became a not-for-profit public research organization to complete that work.

Daniele Giovannucci co-founded COSA to counter what he called “the fluff and ignorance masquerading as development and the colossal sums wasted by well-meaning funders.” He championed the “democratization of data,” devising standard metrics for the coffee industry in 2018.

COSA, supported by discerning philanthropists from the Bill & Melinda Gates Foundation to the InterAmerican Development Bank, has standardized sustainability metrics for leading brands, global frameworks, cutting-edge technologies, and governments for two decades. Giovannucci retired in mid-2023, and Liam Brody was named his successor. Liam explains COSA’s role in intelligence-gathering and developing strategic tools that advance sustainable practices with “sound business” underpinnings. He also shares his vision of how artificial intelligence will revolutionize and influence consumer behavior and perception of sustainable practices. Read more…

Listen to the Interview

Powered by RedCircle

Share this Post

Episode 155 | Maritime Security Concerns Worsen in Suez and The Red Sea as Two Missiles Sink British Ship | Rising Operating Costs Close a Third of Uganda’s Tea Factories | Hydration Concerns Motivate Consumer Purchases | PLUS Committee on Sustainability Assessment (COSA) CEO Liam Brody says “New tools and approaches are changing the game from always looking backward through the rear-view mirror to giving everyday tea professionals a new crystal ball that allows us to look around the corner and predict what’s coming.” | 16 Feb 2024

Sign up to receive Tea Biz weekly in your inbox.