Nicole Burris puts on a good show. During the past few years, she has applied her expertise in live events to successfully launch the Kansas City and Chicago Tea Festivals – both unforeseeably canceled this year due to the pandemic.

In their place, Burris and Babette Donaldson teamed up to combine the two local shows into the more expansive 2020 International Virtual Tea Festival. The festival goes live at 9 a.m. Saturday, Nov. 7, and continues through Sunday afternoon at 4 p.m., Nov. 8. Registration is free with 1,500 signed up through October. The deadline to register is 6 p.m. Nov. 6. All times are CST. Since the event attracts a global following times for registered attendees will be listed according to the settings of their personal computer or phone.

The two-day event features free and paid workshops and classes with real-time tastings “simulcast” into the homes of participants. The Tea Lover Pass ($25) sold out quickly along with the Deluxe Tea Lover Pass ($37) but there are many more activities including roundtable discussions, panels with tea professionals, virtual book signings with tea authors, a candlelight tea meditation with Suzette Hammond and the Tea Bloggers Roundtable to keep the crowd entertained.

On Saturday and Sunday there are live raffles and tea themed tea parties.

Attendees register here, creating an account that gives them access to events and a virtual vendor show floor. Access links are emailed to attendees who can then sign up for paid classes and workshops. Payment is by credit card. Donaldson advises that “you MUST have at least a free General Admission pass in order to take any classes or watch any pre-recorded free classes. There will be no refunds possible if you purchase a class without having a GA pass to the event itself.”

Classes may be purchased on the festival’s Shopify site

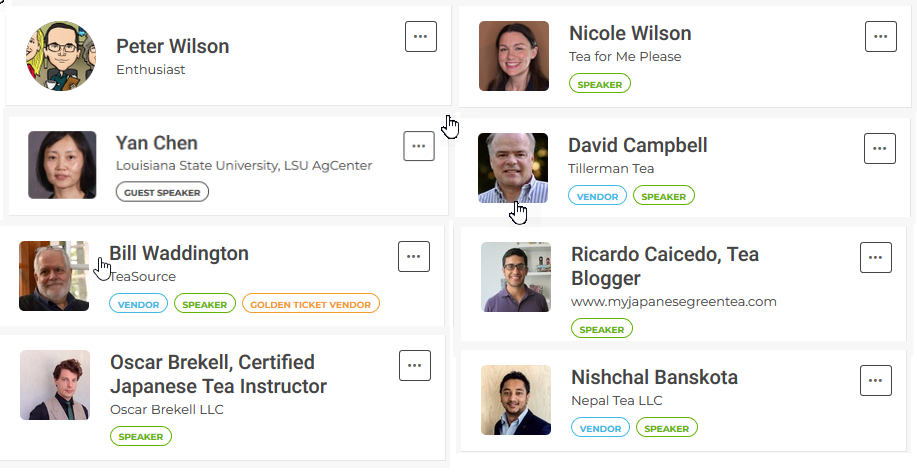

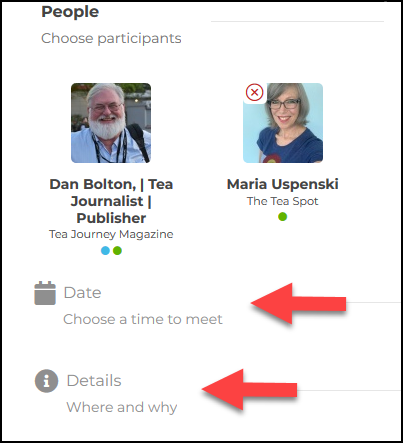

Meet and Greet Attendees

One of the more appealing features of this event is the visibility of attendee profiles

Use this option to schedule MeetUps with speakers, bloggers, vendors, or random enthusiasts. Meet old friends and make new friends in tea. Meetings can be scheduled in advance of the event. Attendees can also schedule visits to vendor booths during the hours they are open for business.

Paid livestream classes are recorded and available to watch on-demand until Jan 31, 2021. The All Classes Recorded package includes all the recordings of the free Main Stage | Free pre-recorded sessions | Paid pre-recorded presentations “and as many of the paid livestream classes as we can secure permission to include,” says Donaldson.

“Tea business owners, staff, and individuals seeking to master the many facets of tea can take part for months to come, organizing content to serve their needs.”

Babette Donaldson

Donaldson is responsible for programming. Burris is overseeing administrative tasks and working with the more than 40 vendors that purchased virtual booths.

“The event features 30 livestream classes, some pre-recorded, some live,” says Donaldson who manages the International Tea Sippers Society and owns T Ching, a tea education blog.

“A dozen of the livestream classes are tasting events where guests received kits in advance to prepare their tea along with the group,” she said. Registered attendees number 1,500 so far and include guests from Japan, Great Britain, Canada, Mexico, China, India and more,” she said.

Link to the festival bookstore. Meet authors James Norwood Pratt, Jane Pettigrew, Kevin Gascoyne, Judith Leavitt and Dr. Virginia Utermohlen-Lovelace for a chat.

A Friday night pre-show social begins at 6:15 p.m.

A limited number of $25 Tea Lover Passes are sold out, but class slots remain.

SCHEDULE OF MAIN STAGE AND LIVESTREAM EVENTS

MAIN STAGE

FRIDAY – Nov 6

Friday Night Pre-Show Tea Social

7 PM – 8 PM

SATURDAY – Nov 7

Opening Remarks & Announcement of ITCC Tasting Contest Winners

9 AM – 9:30 AM

Field to Cup (Shalini Agarwal)

9:30 AM

Japanese Ceramics (Gabriela Sorgenrey)

10: 30 AM

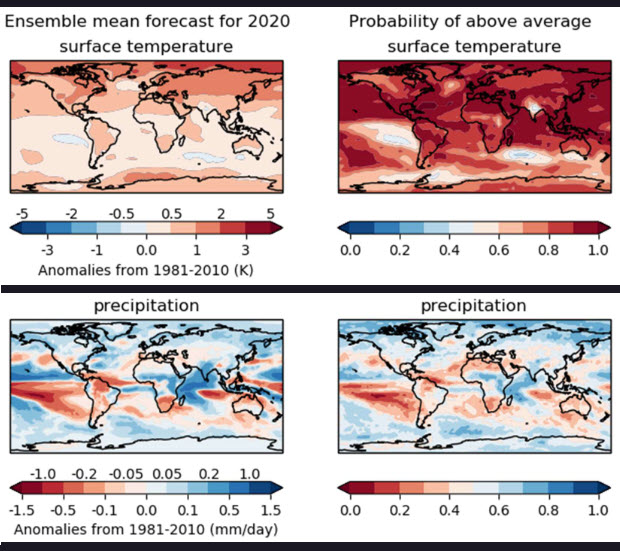

Tea in the Era of Climate Change (James Orrock)

11 AM

The First US Tea Festivals (James Norwood Pratt)

Noon

Golden Ticket Drawing Winner

12:30 PM

Tour Malwatte Valley Tea Estate

12:45 PM

Introduction to Japanese Tea (Spanish – Ricardo Caciedo)

1 PM

Growing for the Better – Organic Tea Projects (Daniel Mack)

2 PM

Good Tea Needs Good Water: Understanding Water Quality (Rie Tulali)

3 PM

Korean Tea (Sharyn Johnston)

4 PM

Tea Blogger Roundtable: Blogging Through A Brave New World

5 PM – 7 PM

LIVESTREAM

Why We’re Craving Tea in the Time of Corona (Maria Uspenski)

Understanding Japanese Tea Types (Ian Chun)

10 AM – 11 AM

Blending In to Stand Out: An Exploration of Unique Tea Blends (Leo Nima)

A Day in the Life of a Tea Garden (Nishchal Banskota)

11 AM – 12 PM

Afternoon Tea: How Did This Eccentric Ritual Evolve (Jane Pettigrew)

A Deeper Look into China’s Teas (Tim Smith and Lydia Kung)

NOON

How We Experience the Flavor of Tea (Virginia Utermohlen)

New Zealand Tea (Agnieszka Rapacz)

1 PM – 2 PM

Pu-er Tea: Immersion & Tasting (Dan Robertson)

15 Teas Every Tea Lover Should Taste (Lorna Reeves)

2 PM – 3 PM

Cooking with Tea: How to Infuse Your Recipes (Marlys & Alan Arnold)

Opening Remarks & Announcement of ITCC Tasting Contest Winners

3 PM – 4 PM

Discover Your Own Tea Blend (Brenda Hedrick)

A Word On Japanese Black Teas (Gabriela Sorgenfrey)

4 PM – 5 PM

Tea Cocktails (Agnieszka Rapacz)

Terroir and Cultivars of Japanese Green Tea (Akiko Ono)

5 PM – 6 PM

Candlelight Tea Meditation (Suzette Hammond)

How to Enjoy Tamaryokucha (Tomoe Watanabe)

6 PM – 7 PM

SUNDAY – Nov 8

MAIN STAGE

Health Benefits of Japanese Teas (Tomoe Watanabe)

9 AM – 10 AM

History of Matcha & Japanese Tea Ceremony (Asami Iba)

10 AM

Live Raffle (Must be present to win)

10: 30 AM

Drinking Tea at the Activist Teahouse (Panel Discussion)

11 AM

New European Tea Growers (Jane Pettigrew)

Noon

Matcha: Fact or Fiction (Noli Ergas)

1 PM

Early Days of Specialty Tea (Roy Fong)

2 PM

Musicali Tea (Dr. Sally Wei)

2:30 PM

Virtual WuWo Ceremony

3:30 PM

Closing Ceremony

4 PM

LIVESTREAM

The Perfect Tea Tasting Event (Jane Pettigrew)

Darjeeling Tea in Harmony With Seasons (Shalini Agarwal)

9 AM – 10 AM

What is Caffeine & What is it Doing in your Tea? (Virginia Utermohlen)

The Health Benefits of Tea & Tea Rituals (Emilie Jackson)

10 AM – 11 AM

How Mississippi Sunshine – Yellow Tea is Made (Stacie Robertson)

Women in Tea (Nishchal Banskota)

11 AM – 12 PM

The Real Skinny on Tea and Weight Loss (Jane Pettigrew)

A Deeper Look into China’s Teas (Tim Smith and Lydia Kung)

NOON

Hosting a Tea-Themed Party (Erika Shandoff)

A Study of Ceylon Black Tea (Lalilth Paranavitana)

1 PM – 2 PM

Essentials of Tea Tasting (Suzette Hammond)

Foundations of Professional Tea Cupping (Dan Robertson)

2 PM – 3 PM

Tea & Scones with Friends (Brenda Hedrick)

Examining Elevation-Oxidation-Roasting Taiwan Teas (David Campbell)

3 PM – 4 PM

Phoenix Dan Cong Oolong | Hundreds of Aromas (Rainy Huang)

The Rise of Single Estate Japanese Tea (Oscar Brekell)

4 PM – 5 PM

All About Earl Grey (Molly Nesham)

Introduction to Puer Teas (Jeffrey McIntosh)

5 PM – 6 PM

Donaldson and Burris organized the Chicago Tea Festival in November 2019 and worked together on the Kansas City Tea Festival. The parent company is Taste All the Teas at www.teafestivals.org | Email: [email protected]

Subscribe and receive Tea Biz weekly in your inbox.