Tea Industry News for the week of August 17

- Rising Prices

- Heavy Rainfall Wreaks Havoc

- AVPA Entry Deadline Nears

A shortfall in domestic production amid rising demand is boosting tea prices to record highs in India.

The Tea Board of India is reporting record prices at tea auctions. In Kolkata and Guwahati (Assam) prices are up INRs100 ($1.33/kg compared to last year. The price for CTC (crush, tear, curl), which is mainly used in making tea bags, recently averaged INRs 313.58 ($4.19/kg), up INRs129.99 per kilo.

Prabhat Bezboruah, the chairman of India’s Tea Board, said that a 12% price increase might compensate for the 10% crop loss. Green leaf prices in Tamil Nadu also rose from INRs14-17 to INRs22 ($0.29) in August.

Last week marked the fourth week of price gains in Mombasa, Kenya where the East African Tea Traders Association (EATTA) reports an average Ksh208 ($1.93) compared to Ksh194 ($1.80/kg) the previous week. Unlike India, where production has declined significantly, tea production is up 41% in Kenya due to good weather but is likely to plateau for the remainder of the year. Exports to primary trading partner Pakistan are up 14% and the UK purchased 66% more Kenyan tea than usual as a result of shortages elsewhere.

In Japan, the newspaper Chunichi Shimbun reported record low prices for Kagoshima Nibancha. Sales by global tea firm Ito En, the largest tea company in Japan, decreased by 8.5% from February through April due to the coronavirus.

“Tea auctions both in Shizuoka and Kagoshima declared that the price for second harvest tea was lower compared to last year. In Shizuoka, it is estimated that the price per kilogram for summer tea went down by 10-15% from JPY609/kg in 2019. In Kagoshima, the decrease is even steeper by 26% to JPY452/kg this year,” according to the Global Japanese Tea Association.

Over the past decade, tea prices have ranged from a low of $2.19/kg in January 2009 to a high of $3.29/kg in September 2017, but the long-run average price has stood at $2.85/kg, according to the Economist Economic Unit (EIU).

“Last year tea prices fell to $2.57/kg globally, due to ample supply, marking the weakest result since 2008. Although production prospects in most major tea producers are disappointing in 2020, weaker demand growth is likely to depress prices further,” according to EIU. Prices fell to $2.33/kg in the first quarter of 2020, which marked the weakest quarterly result in 11 years. “Although they rebounded to $2.57/kg in the second quarter, they remain 3% below year-earlier levels. We expect tea prices to average $2.50/kg in 2020. Even assuming that underlying conditions improve in 2021, we expect only a moderate rise in average prices, to $2.81/kg,” writes EIU.

Sri Lanka also reports increased prices at auction with some record-setting buys, defying on first appearance the rules of supply and demand.

Controversial Import Proposal

As domestic prices surge, India is weighing the possibility of importing tea from Kenya and Vietnam. The government currently imposes a 100% tariff on tea imports which discourages imports.

If the initiative advances, The Federation of All India Tea Traders Association (FAITTA) said that importing teas will be a one-time affair and that it will not push for imports in the coming years, according to a report in the Economic Times. FAITTA wants a one-year relaxation of tea tariffs.

FAITTA chairman Viren Shah said, “Prices have gone up significantly this year due to a shortage of supply. But we are not being able to pass on the price to our customers because the economic situation in the country is not conducive to increasing prices. The pandemic has created economic uncertainty everywhere.”

The debate is heated. Tea landed in India to this point is for re-export, which is not available in domestic markets where it competes with locally grown tea. Re-exports total only 9-10 million kilos annually. Planters, represented by the India Tea Association (ITA), strongly oppose lowering tariffs even for a limited time.

“We will move the commerce ministry with a request to stop the import of cheap teas if the traders try to do so,” said Vivek Goenka, chairman, ITA.

The price of CTC tea has increased by 48% year-on-year making imports less expensive than domestic teas. Even with a 100% duty, imported Kenyan tea at $1.84 per kilo or Vietnamese tea at $1.50 per kilo would be less expensive than the average INRs305 ($4.07) per kilo paid for CTC at the Kolkata Tea Auction.

India consumers purchase 1,100 million kilos annually. Much of this tea is from Assam and West Bengal where production is down 30% during the period January-July. Ultimately imports may be unavoidable as teas from overseas would stabilize domestic prices.

Drenched

Monsoons annually claim the lives of many tea workers and cause hundreds of millions in property damage. Ten days ago, 43 died in a mudslide that swept tea workers away in their sleep at the Kannan Devan Hills Plantations (KDHP) in Munnar, South India. Rescuers dug for two days but found no additional survivors amid the 20 homes that were lost. The garden employs 12,500 workers.

In Kerala, lowland floods claimed additional lives. This spring India’s tea production fell 26.4% compared to last year due to a combination of flooding and coronavirus lockdowns. Assam gardens reported serious flooding in May, June, and July which is the top tea producing month.

Indian Tea Association Secretary Sujit Patra, told Reuters that a recovery in crop totals was unlikely in the second half of the year. The shortfall has caused auction prices to rise up to a record average of IRNs232.60 ($3.12) per kilo last week, up 57% compared to the same period in 2019.

This week in Yunnan China, 14 died and 20 are still missing following flash floods caused by Typhoon Higos. Landslides killed five. The storm forced the relocation of 34,900 residents and affected 1.1 million people, causing at least $450 million in damage, according to China.Org. After an extended drought, rainfall averages are up 12.5% year-on-year. Across China 200 have died in weather-related incidents this year which have caused $25 billion in losses.

In July the Japanese island of Kyushu suffered severe flooding that damaged several tea farms. Production is down overall, in Shizuoka the normal harvest decreased by 20-30% from 7,616 metric tons in 2019, and likely will be the lowest since 1953, when the first of such data became available.

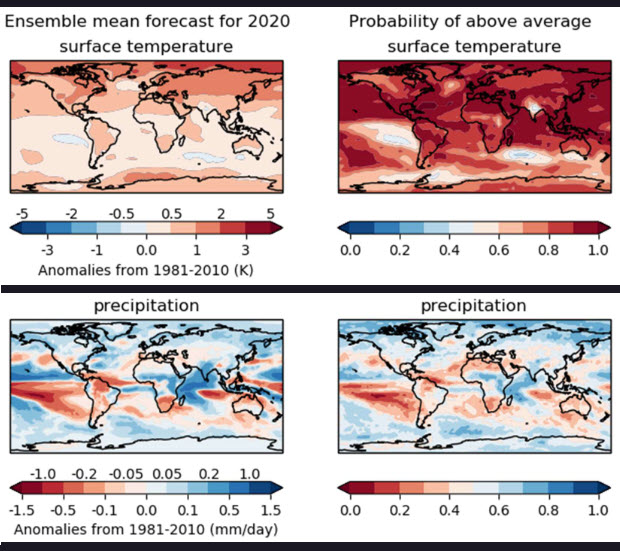

The World Meteorological Organization (WMO) predicts “high latitude regions and the Sahel* are likely to be wetter than the recent past whereas northern and eastern parts of South America are likely to be dryer” during the period 2020-2024.

“Most of Eurasia, eastern USA and central Africa have been wetter than average, with southern Africa, eastern Australia, Indonesia, north-east Brazil, and western Europe drier than average,” according to WMO’s five-year forecast.

“The annual global temperature is likely to be at least 1°C warmer than pre-industrial levels (defined as the 1850-1900 average) in each of the coming 5 years and is very likely to be within the range 0.91 – 1.59°C,” according to WMO.

“The smallest temperature change is expected in the tropics and in the mid-latitudes of the Southern Hemisphere,” according to WMO, but “it is likely (~70% chance) that one or more months during the next 5 years will be at least 1.5°C warmer than pre-industrial levels.

Click here to download WMO’s 16-page global weather update.

*The Sahel is the 1000-mile wide ecoclimatic and biogeographic zone of transition in Africa between the Sahara to the north and the Sudanian savanna to the south. Having a semi-arid climate, it stretches across the south-central latitudes of Northern Africa between the Atlantic Ocean and the Red Sea.

AVPA Teas of the World Competition

The deadline to enter the third annual Teas of the World competition, conducted by the Agency for the Valuation of Agricultural Products (AVPA) is Sept. 15, 2020. Prizes will be awarded Nov. 16 in Paris, France

The competition is open to producers who benefit from recognition of their exceptional quality, helps producers stand out from others growing and processing tea, and encourages producers to explore new tea markets.

The competition consists of “Monovarietal teas.” a category limited to Camellia Sinensis and “Infusions” which include beverages made with plants other than Camellia Sinensis including blends and favored teas.

Download the AVPA Monovarietal registration form.

Download the AVPA Infusions registration form.

Judges evaluate gastronomic rather than standardized refereeing, seeking a striking rather than consensual sensory profile. “This is the first time that an independent body in a consumer country promotes the good practices of production and trade actors,” writes AVPA.

Fees are €110 for individual producers, €550 for other tea professionals and €1,500 for collective organizations.

Click here to review contest rules.

Click here to see who won the 2019 competition.

AVPA is a non-governmental, non-profit organization of producers and enthusiasts. The organization annually conducts four international contests in addition to evaluating tea. These include “Coffees roasted at Origin”, “Chocolates pressed at Origin” and “World Edible Oils.”

Subscribe and receive Tea Biz weekly in your inbox.