Tea Industry News for the Week of May 11.

- Tea & Tariffs

- Export Value of Tea Declined in 2019

- U.S. Consumers Remain Wary of Reopening

- Tea is Piling up

- Attend the SofaSummit on International Tea Day

Tea Export Value Declined in 2019

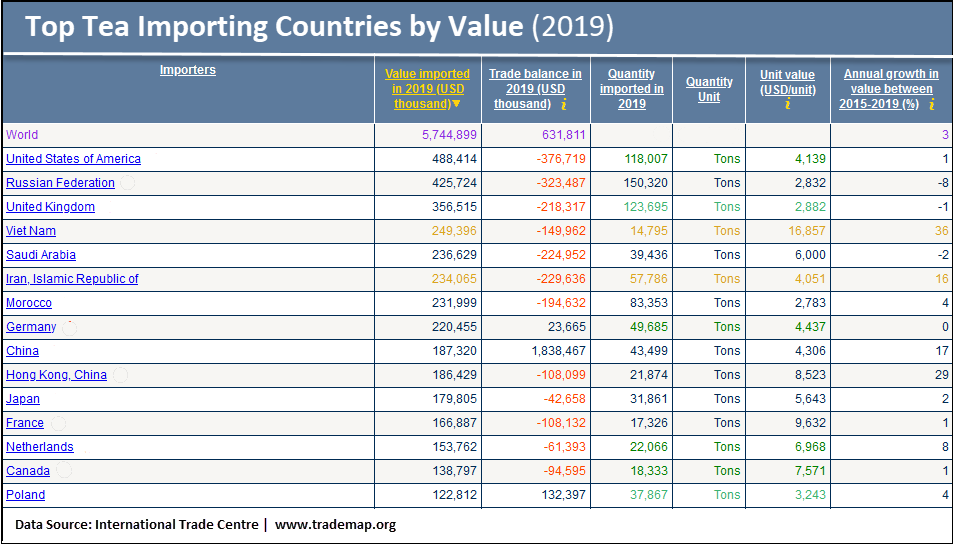

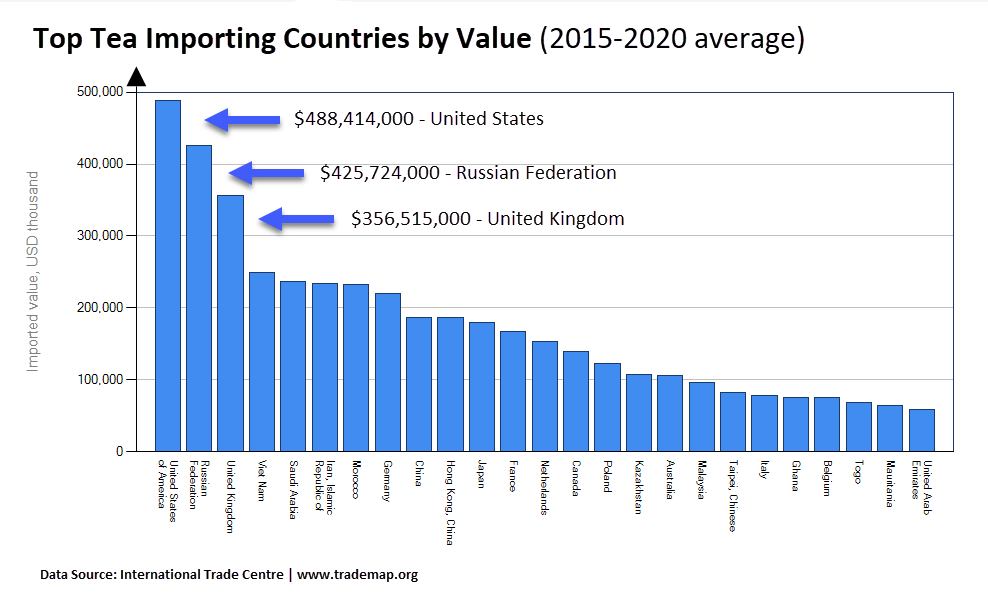

Logistical hurdles in tea producing countries greatly complicated export this quarter as demand declines and prices remain low. Recessions in Russia, Europe, and North America dim prospects of a profitable return for the export segment where sales have declined in value by an average 12.8% since 2015.

The declared value of global tea exports depreciated 18.8% year-over-year in 2019.

Sales from tea exports totaled only $6.4 billion in 2019, according to analyst Daniel Workman at World’s Top Exports. Tea shipments worldwide were valued at $7.3 billion five years ago.

China, at $2 billion in sales, remains the leading tea exporter, accounting for 31.8% of total exports by value, up 13.5% compared to 2018.

China faced several impediments to growth prior to the coronavirus outbreak but retained its rank as the top tea exporter globally in 2019. Green tea exports, the main tea crop, totaled 304,000 metric tons and were valued at $2.02 billion. The average price of exported green tea was $4.34 per kilo in 2019.

China’s tea exports were generally stable and of improved quality, despite the U.S.-China trade dispute and uncertainties in the world economy, according to agricultural and trade officials. Tea exports to the U.S. in 2019 were down 5.1% to 15,000 metric tons, but this was easily offset by a 15.6% increase in purchases by ASEAN nations. The 23,000 metric tons sold to ASEAN countries was valued at $400 million, up 55.7% compared to 2018.

China reported a 13.6% overall revenue increase year-over-year. Black tea exports were up 6.7% to 35,000 metric tons increasing in value by 24.5% to $350 million, according to China customs statistics. Black tea averaged $9.92 per kilo, up 16.72% year-on-year.

Yu Lu, vice president of the China Chamber of Commerce of Import and Export of Foodstuffs, Native Produce and Animal By-Products (CFNA) said the average annual compound growth rate of exports was 3% during the past three years. Green tea accounts for 82.8% of the total volume, which topped 367,000 metric tons last year.

Trade with countries along the Belt and Road increased 4% last year, earning China $560 million, a year-on-year increase of 307%, according to Yu Lu.

India exported $803 million worth of tea in 2019, up 4.6% compared to the prior year. India set a production record in 2019 growing by 3.8% thanks mostly to smallholders, but while volume reached 1,390 million kilos, the country accounted for only 12.6% of tea exports by value.

Sri Lanka’s 11.3% market share by value and Kenya’s 5.7% share also contribute significant volume, but each saw steep declines in value as prices for cut, tea, curl CTC grades fell. During the past five years (2015-20), the value of Kenyan tea exports declined by 71.3%. During that same period, the value of tea sold for export by Taiwan increased 131.3%; sales of Japanese tea are up 59.6%, and the value of Chinese tea for export is up 46.5%, according to World’s Top Exports.

Selling to domestic consumers is appealing in China and Japan, where higher prices are the norm, but India may benefit most from increasing domestic consumption.

Tea & Tariffs

The economic impact of the pandemic makes it unlikely that China will meet the expectations of a “phase one” agreement negotiated with the U.S. in January. As a result, U.S. President Donald Trump said he might initiate another round of tariffs targeting China.

Or maybe, not.

“I’m very torn, I have not decided yet, if you want to know the truth,” President Trump told reporters last week.

On Friday, to keep what have been productive discussions on track, the U.S. Trade Representatives’ office released this statement: “In spite of the current global health emergency, both countries fully expect to meet their obligations under the agreement in a timely manner.”

In January, China agreed to a 2020 increase of $76.7 billion over 2017 imports. China has since purchased less than $25 billion of U.S. goods, which is a decline of 5.9% through April compared to 2019, reports Bloomberg. The 2020 goal is almost $200 billion in sales.

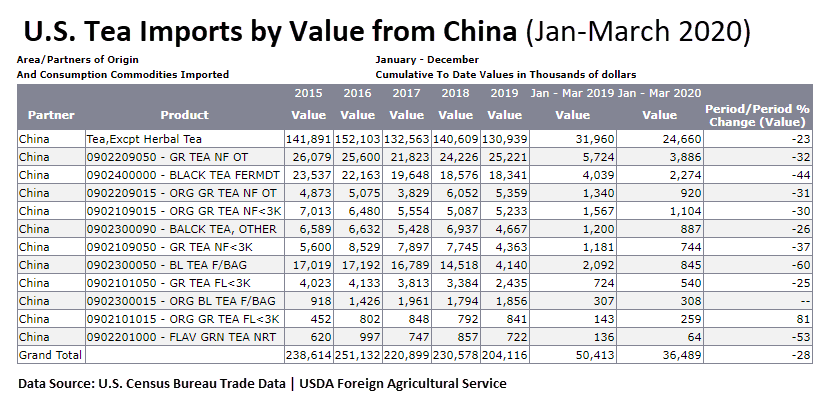

U.S. trade plunged in March. Overall the U.S. bought 6.5% fewer goods than during the same period in 2019. Imports of Chinese tea through March 2020 declined 23% compared to the same period in 2019, according to the Global Agricultural Trade System database (GATS). Lower sales are due, in part, to a 15% tariff imposed in September 2019. The duty was later reduced to 7.5% in February 2020, but by then, many blenders had switched suppliers. During the first quarter in 2019, the U.S. imported Chinese tea valued at $32 million, a total that declined to $24.7 million during the same period in 2020.

Volume is down 31% from 8.7 million metric tons to 6 million metric tons through March. China is predominately a green tea exporter, but volumes of every category slid, except organic flavored green tea.

Jason Walker, marketing director at Firsd Tea in New Jersey, the U.S. offices of China’s largest tea exporter, writes that while “U.S. imports of Chinese black tea have generally declined over the past five years. More recently, the U.S.-China trade war and coronavirus pandemic have contributed to this slowdown. However, organic black tea imports from China have been rising, with a 66% increase in volume.”

Since workers were able to return to the fields before April, tea production China was spared the pandemic-associated drop in yield experienced in India and Sri Lanka. Imports recorded during the first quarter include little of the spring harvest. Second-quarter statistics will be more revealing as they will reflect the logistical challenges that are still rippling through the supply chain.

“Firsd Tea has been watching the activity at U.S. ports for indications of delays and disruptions. We have not seen any to date,” writes Walker. “In terms of containers leaving China, we have not seen any disruptions since normal business resumed around the end of February in China. At this point, China operations have implemented monitoring systems and PPE (personal protection equipment) requirements for workers. We are watching for indications of flare-ups, but so far, we don’t see evidence of another wave of infection,” writes Walker.

Blenders initially found themselves racing to meet the demand for packaged goods, particularly private label for grocery, but orders for foodservice grades has virtually disappeared due to the unprecedented restaurant and retail tea closures. This alone will substantially reduce tea imports from every producing country.

Specialty tea importers receiving Chinese tea this spring say that demand remains steady despite a three-fold increase in airfreight, which is a far greater expense than the 7.5% tariff.

“Importers were working with a three-fold increase in air freight delivery in April. Rates are still high, but at least cargo is moving faster now,” writes Andrew McNeill with Seven Cups Fine Chinese Tea in Tucson, Ariz.

China recognizes the desirability of retaining a presence in the U.S. market as Europe is likely to experience a more severe recession than the rest of the world. The European Commission last Wednesday released projections that show economic activity shrinking by 7.4% in the 27-nation bloc, according to the New York Times. Economists predict the deepest economic recession in EU history.

While the U.S. administration is angry at China, the escalation of retaliatory measures challenges the prevailing business assumptions guiding American companies in China. U.S. companies invested $14 billion in new factories and other long-term investments in China last year, according to the National Committee on U.S.-China Relations and the Rhodium Group, a consultancy that tracks foreign direct investment flows.

Shawn Donnan, writing in Bloomberg Supply Lines, suggests, “it’s worth remembering every so often that it is still businesses and not governments that really make the decisions that drive globalization and supply chains and that they aren’t decoupling yet.”

Reenergize Local Consumption

Pradyumna Barbora, a specialty tea producer in Assam, points to a straightforward solution: Increasing average per capita consumption from 750 to 800 grams will “uplift the Assam tea industry,” he writes.

“If every tea lover in the country increases their consumption by a mere 50 grams per month, and starts sourcing their tea locally, the gardens will be able to meet their expected minimum wages whilst creating a better living environment for themselves,” writes Barbora, spokesman for Tea for Unity, a group of Assam planters. “We are losing focus on a high-quality heritage product which fetches much more and is more valuable than commercially mass-produced tea,” writes Barbora. The tea industry employs more than a million workers,” he explains, “Investment will improve the mindset of the workforce, translating into greater efficiency and quality.”

Learn more: Tea for Unity

Tea is Piling Up

Processed tea is piling up as demand declines, and transport is interrupted. Globally, warehouses usually empty by the start of the spring harvest. An abundance of tea stored in 2019 is compounding problems in India. Consider the 21 villages in Champawat, a tea-growing region where warehouses are bulging because drivers are not permitted to travel.

Tea, valued at INRs360,000 ($4,700), was ready to be sent for auction in April, “but we have not been able to transport it due to the lockdown. If the stock is not sent to Kolkata soon, those involved in tea plantation and its selling may face a financial strain,” Desmond Brikbeck, manager of several local tea gardens, told the Times of India.

U.S. Consumers Remain Wary of Reopening

Datassential continues its weekly series of webinars tracking consumer behavior during the pandemic. The COVID-19 series is free and hosted by managing director Jack Li, whose company pioneered the use of menu data to predict flavor trends.

The topic May 8 was “The Next Phase” (download PDF).

Reopening is underway led by Starbucks, which announced that 85% of its corporate stores would soon resume operations.

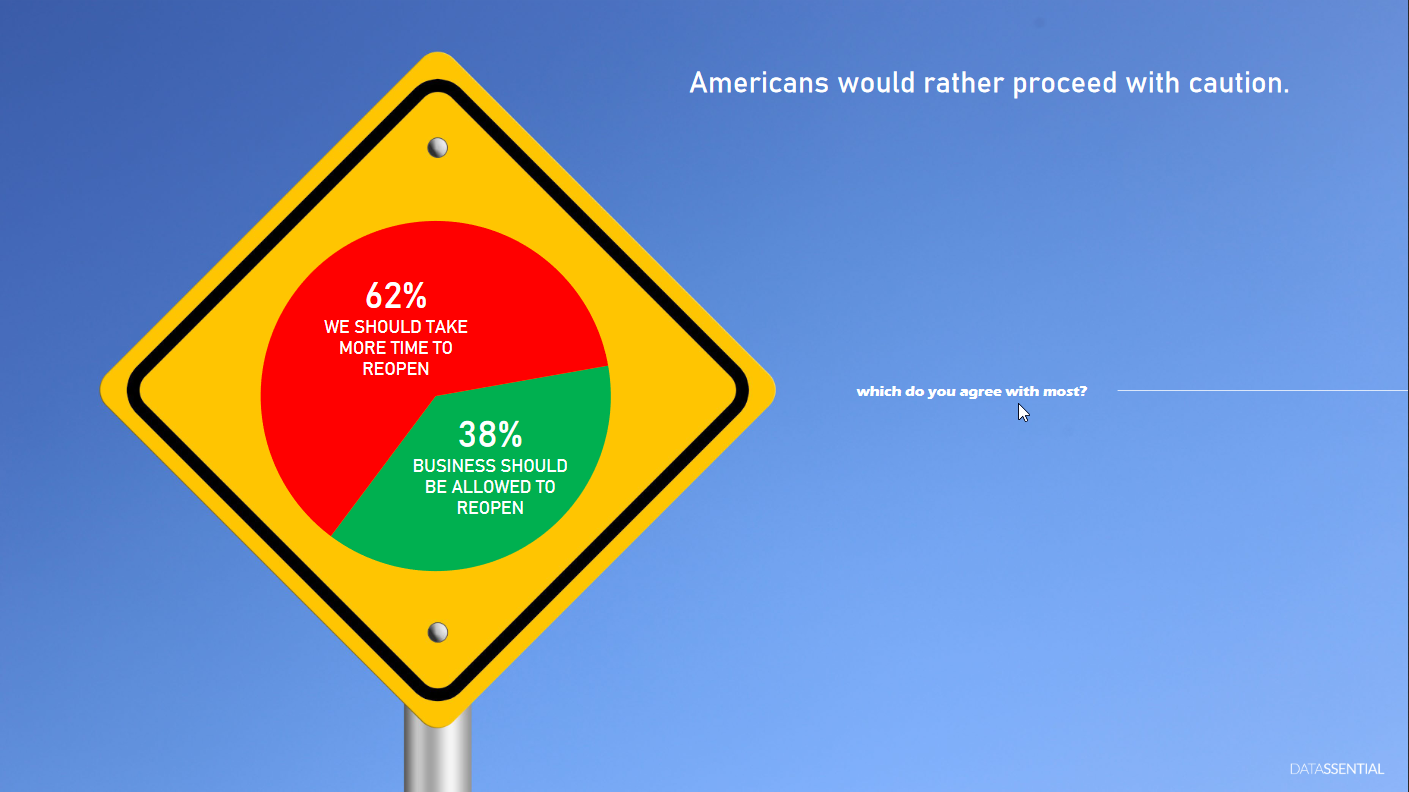

Li notes that concern has declined somewhat as some states reopen, “but America is still anxious, with slightly more than half of the people feeling very concerned and hugely worried about their own personal health.”

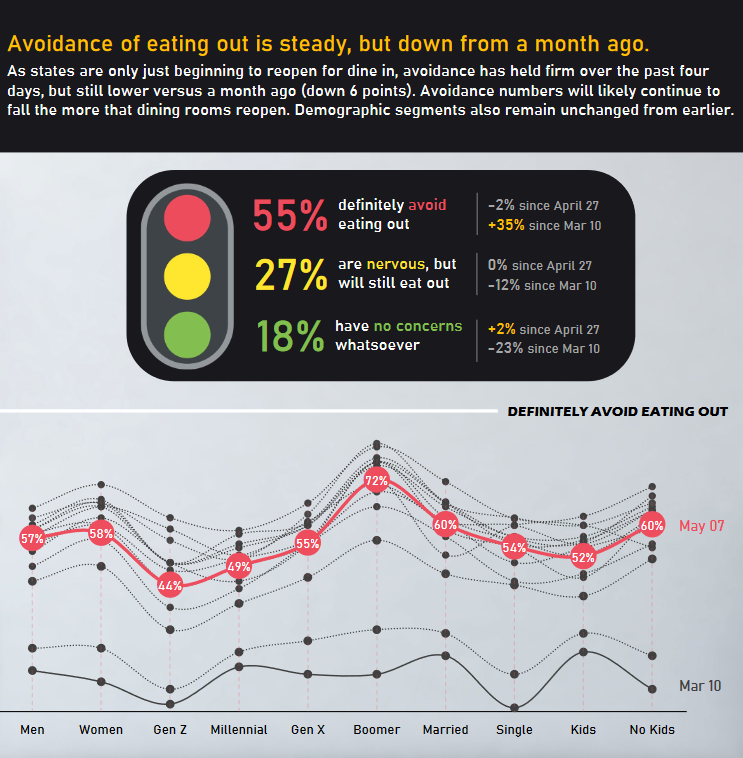

“Avoidance of eating out is steady, but down from a month ago with 55% of those surveyed saying they will “definitely avoid going out” and 27% saying they are “nervous but will still eat out.” The number of individuals reporting “no concerns whatsoever” increased to 18%, up 2% since April 27 but down 23% since March 10, according to Datassential.

Health remains the top concern, but economic worries are intensifying, according to Li, who found that 57% of respondents are more concerned about the public-health crisis (down 2% since April 27 and down 6% since April 10). Those who say they are most concerned about the economic crisis increased 2% from April 27 to 43% of respondents.

“Not much has changed in the past month. America is still at home and still longing to get back out,” writes Li. “People are excited to get back to activities like dinner and a movie, or lunch and shopping at the mall,” he said.

When asked: “Which of the following food & drink places or activities are you most excited to get back to?” 45% selected “dining at my favorite sit-down restaurant,” and 42% selected “visiting recreational places” with 39% longing to “meet family and friends at restaurants.”

Going to coffee shops (20%) and drinking at bars (19%) ranked in the middle. Visiting nightclubs, concerts, and lounges appealed to only 10%. Visiting cafeterias (5%) was the least exciting activity.

Editor’s note: Unemployment increased to 14.7% in April, the highest since the Great Depression. New claims topped 26.5 million during the five weeks ending April. The proportion of employed working-age adults (51.3%) is the lowest on record. Datassential found that 16% of survey respondents are still going to school or working as usual, with 16% stuck at home due to layoffs and furloughs. An additional 33% of those taking part in the weekly survey are working or attending school remotely, with 35% not working overall.

Next episode: “What Consumers Want Right Now.”

EVENTS

Attend the SofaSummit on International Tea Day

Thursday, May 21, is International Tea Day, a global event declared by the United Nations that will, for the first time, be celebrated in every county. The U.N. organized the event to elevate tea by drawing attention to “the importance of tea for rural development and sustainable livelihoods, and to improve the tea value chain to contribute to the 2030 Agenda for Sustainable Development.”

To celebrate, the Tea & Herbal Association of Canada, in coordination with many prominent industry leaders, is hosting an all-day tribute May 21, beginning at 9 a.m. through 7 p.m. EST. The tea and chat will “circumnavigate the globe,” spanning 14 time zones with participants from 13 countries. Watch on YouTube live – no registration required.

Shabnam Weber will host on THAC’s YouTube Channel: http://tiny.cc/gyqdoz

Click to learn more: International Tea Day.

Raising Our Cup to All Tea Drinkers

The

Participants (in order of appearance) include:

Yu Lu, China Chamber of Commerce CCFNA

Rajah Banerjee, Makaibari

Arun Singh, Tea Vision

Ketan Patel, Jalinga Tea

Stephen Twining, Twinings

Alfred Njage, KTDA

Cindi Bigelow, Bigelow Tea

Gabriella Lombardi, Cha Tea Atelier

Joyce Maina, Cambridge Tea Academy

Will Battle, Fine Tea Merchants

Joe Panter, Camellia PLC

Ramaz Chanturiya, Tea Masters Cup (Russia)

Carolina Okulovich, Don Basilio

Rona Tison, ItoEn

James Norwood Pratt, Author

Jane Pettigrew, UK Tea Academy

Kevin Gascoyne, Camellia Sinensis

Jeff Fuchs, Tea Horse Road

Tania Stacey & David Lyons, Cuppa Cha & AUSTCS

Cecilia Corral, Tian Té Mexico

Fred Yoo, Myung Wong Cultural Foundation

*Corrected 9/13 to clarify this event was organized solely by the THAC.

Virtual Tea Tasting

The Ceylon Artisan Tea Association is hosting its third in a series of virtual tea tasting webinars. Amba Estate was featured on April 30. This week features Forest Hill Tea, which was recently profiled in Tea Journey magazine.

Click this link to join the meeting: https://us02web.zoom.us/j/9997849844

Meeting ID: 999 784 9844

The Zoom event begins at 5.30 p.m. Wednesday, May 13 in Colombo Sri Lanka (India|Asia) | 8 a.m. EST (New York) | 1 p.m. (London) | 2 p.m. (EU) | 8 p.m. (Singapore and Hong Kong) | 9 p.m. (Japan and Korea)

If you miss the live event, recordings of these webinars are available for viewing at no charge.

Enhance your well-being with tea. Tea Journey is a bridge connecting those who craft handmade teas in 35 countries with the growing number of premium tea consumers globally. Tea Journey educates readers not only in the selection and preparation of healthy whole leaf tea but also in the manufacture of authentic teaware and utensils designed to enhance the tea experience.

Curious about tea? Subscribe free to Tea Journey Magazine

One response to “Tea Export Values Declined in 2019”

Hope the situation normalises soon – and services can continue to move tea worldwide again.