Tea Industry News for the week of July 27

- Over the Cliff

- World Tea Expo Goes Virtual

- Made in America

- DMCC Expansion Plans

- Measuring Elements in Tea

Over the Cliff

Few tea ventures deployed parachutes capable of breaking the fall as the world’s economies catapulted over the second quarter cliff.

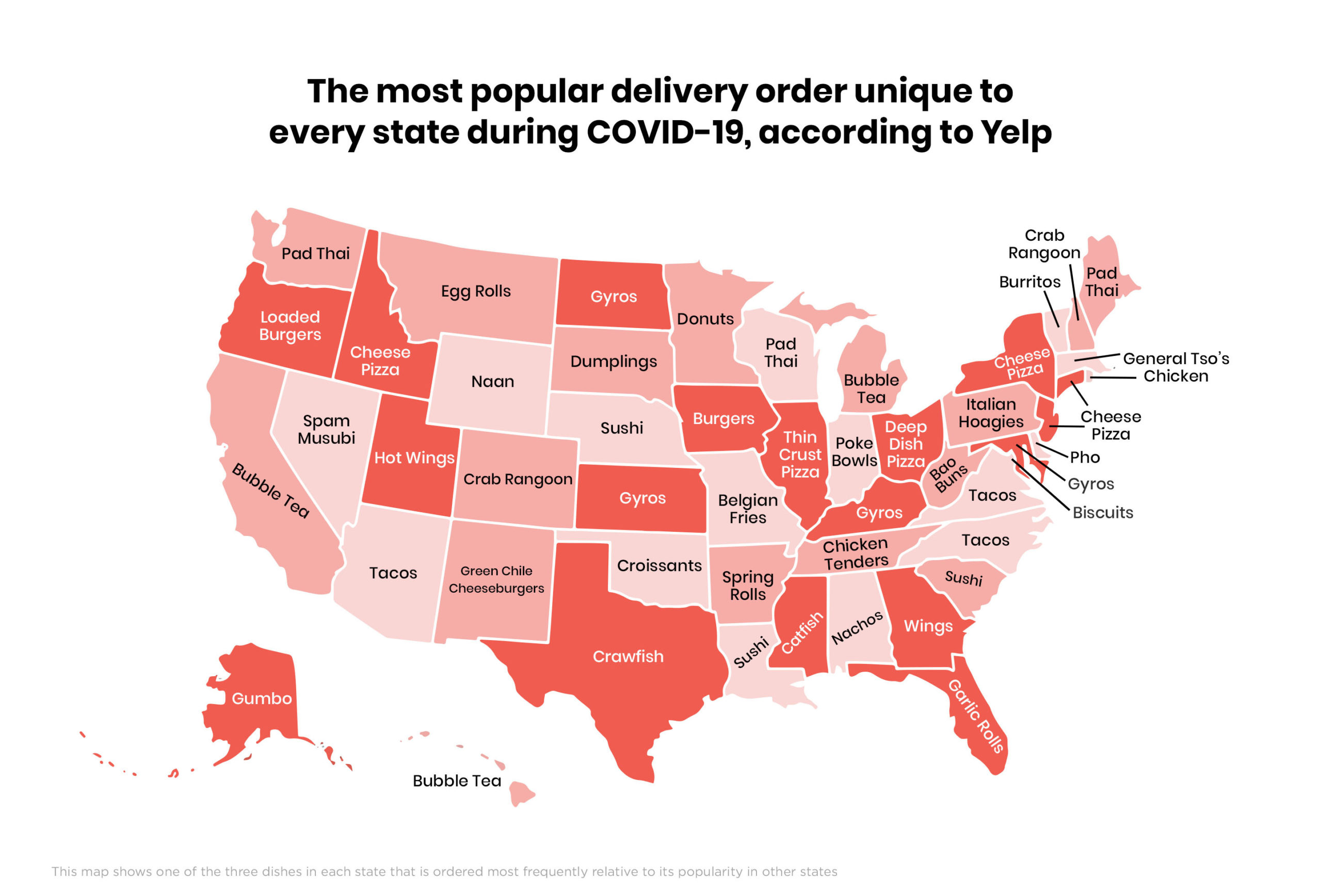

The result is the permanent closure of hundreds of high-profile tea locations in malls and tourist destinations as well as beloved Mainstreet independents like the 10-year-old Wenham Tea House in Massachusetts and 27-year-old Lucy’s Coffee & Tea in Birmingham, Ala.

The Samovar Tea Lounge’s three San Francisco locations are “hibernating” for an unspecified time and the Floating Mountain Tea House will relocate from New York’s upper west side to Croton-on-Hudson upstate. Restaurants that featured fine tea, including Augustine in New York’s Beekman hotel, Vaucluse on Park Avenue and “even the glitzy McDonald’s flagship store off Times Square closed,” according to a list maintained by Eater New York. In July DAVIDsTEA permanently shuttered 213 locations including 42 in the U.S. leaving only 18 in Canada.

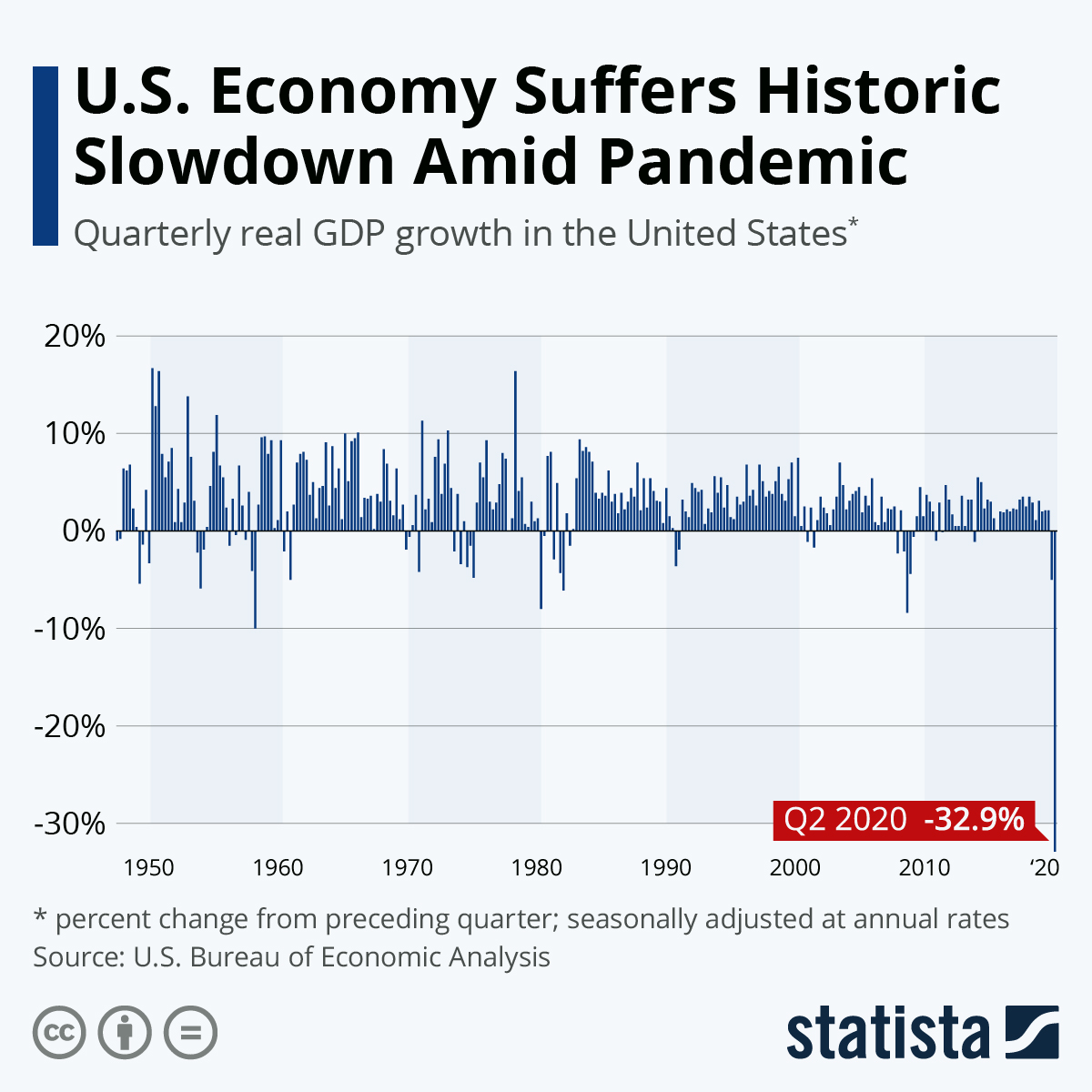

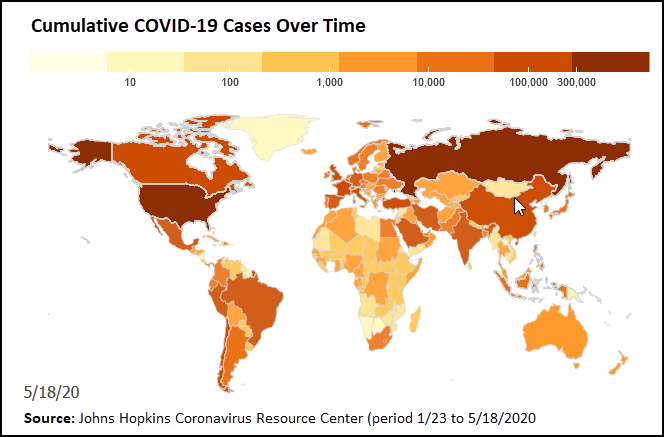

The U.S. experienced a record 9.5% drop in economic output, that if left unchecked before the year ends could lead to an unprecedented 32.9% annualized decline in GDP. Europe experienced a 12.1% decline, its worst contraction on record. Canada, which has suffered many fewer infections and COVID-19 deaths than the EU and US, estimates its economic activity will decline 12%, according to Statistics Canada. Retail sales in all the Western countries signal a deep recession with several segments, including food service, plummeting from the end of March and continuing their decline through April. Retail rallies began in May except in the U.S. where a new surge of infections led to a loss of steam by July.

The descent was especially rapid and painful in the U.S. It is difficult to get precise numbers on sales of tea in retail channels. Grocery sales figures are generally good as millions of customers that purchased tea at restaurants and cafes now brew at home. Online sales spiked last spring but are flattening. The tea shop category mirrors the fate that has befallen small independently owned cafes and bars with some segments such as Sunday afternoon tea in tony hotels and at cozy Victorian tearooms located in southern tourist towns virtually annihilated.

“Afternoon tea was devastated in the U.S. in particular—most of those businesses didn’t have a way to pivot online or offer tea-to-go,” writes Abraham Rowe, founder of Sinensis Research in Washington, D.C. Rowe observes that online sales proved to be a lifesaver, “people were loyal to some local shops, and are now shopping online from them.”

“Store closures are down a bit—I don’t have final figures, but hope to run another survey sometime to finalize it,” said Rowe.

As brick and mortar sales at tea merchants slipped over the precipice, online sales increased but not uniformly. An updraft enabled Amazon to glide to the bottom with a year-over-year increase of 34% in tea sales, totaling $29 million for the 52 weeks ending in May, according to Hinge Global. Walmart generated an unexpected $4 billion during the first quarter, up 4% over the same period compared to the previous year. The company announced it intends to become a “omnichannel” business. During the past year Walmart consolidated its online and physical store operations and is focused on expanding e-commerce rather than building new stores.

Amazon and Walmart are the exceptions amid a pandemic that devastated the retail sector. While customers ordered groceries online and had food delivered, very few tea ventures had time to deploy a Plan B. DAVIDsTEA, headquartered in Montreal, Canada, in March closed 231 locations eliminating $12.1 million in second quarter sales. Sales for the three months ended May 2 declined 27.3% to $32.2 million. Wholesale and online revenue climbed $9.3 million to $17.0 million. Online sales reflect the trend identified by Rowe at Sinensis Research: specialty tea buyers online remain loyal to their local tea shop whether in a mall or downtown.

“Sales in grocery stores and pharmacies across Canada continues solid growth,” according to Frank Zitella, who is both CFO and COO at DAVIDsTEA. He wrote in a July 31 earnings report that “with first quarter sales growth of over 120% year-over-year, we are extremely pleased that our loyal tea-loving customers have shifted to buying our teas online, and in supermarkets and drugstores. The strong performance of these sales channels provided us with the confidence that we are on the right path for the future.”

See: DAVIDsTEA Reorganizes for additional detail.

Calls to wholesalers confirm that while online sales have eased the painful loss of tea house closures, declining monthly orders from restaurants and hotels resulted in orders that are no where near pre-pandemic norms. The collapse of restaurant dining, which accounts for 20% of tea sales globally, is the biggest cause. Some 2.2 million restaurants worldwide are not expected to survive through 2020. Closings have a greater impact on coffee sales in the U.S. but in tea drinking nations like the UK and Russia the shift from away-from-home to at-home preparation has been significant.

McKinsey Small Business Forecast

“In a muted recovery, it could take more than five years for the most affected sectors to get back to 2019-level contributions to GDP,” according to McKinsey & Company. Small businesses, which are hard hit due to lower margins and limited reserves, constitute 68% of the food services and accommodations sector and are not expected to recover before the first quarter 2024 stretching into 2025. Arts, entertainment and recreation sectors will take even longer, according to U.S. Small Business Recovery After the COVID-19 Crisis.

“After the 2008 recession, larger companies recovered to their pre-crisis contribution to GDP in an average of four years, while smaller ones took an average of six,” writes McKinsey Global Institute.

“Improving operations and adapting business models can help small businesses in many industries recover,” observes McKinsey, but muted demand, operational challenges due to health and safety restrictions and new customer expectations all take time: “Finding the cash to do so may be a stretch.”

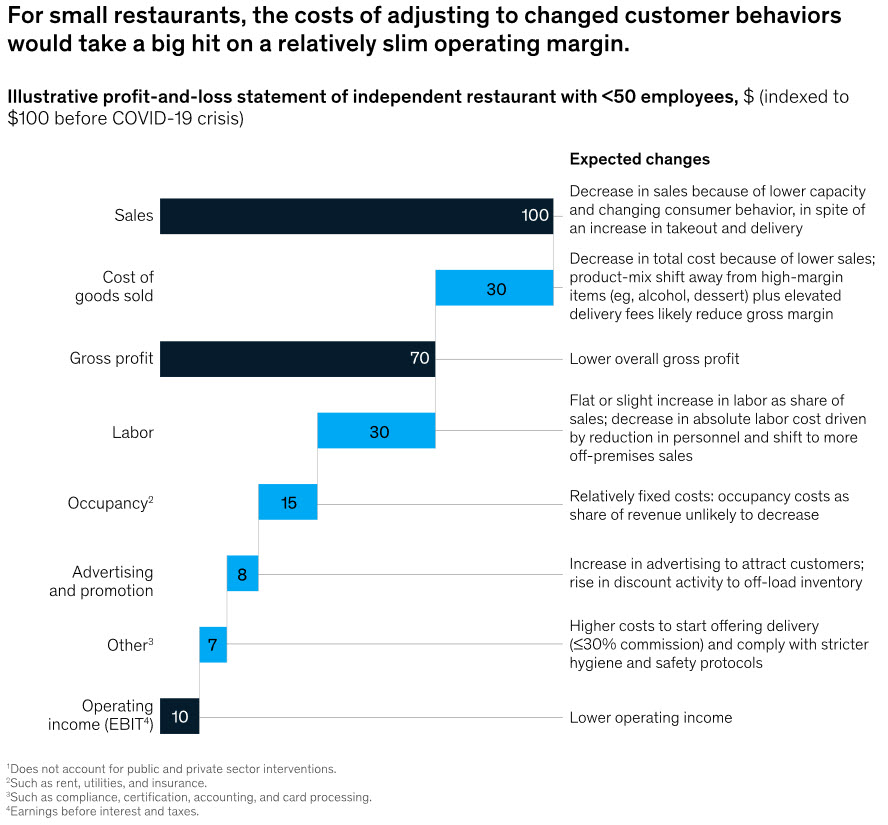

Working capital is often tied up in inventory and small businesses have added cost servicing their debt. A McKinsey survey of 1000 small firms finds the cost of servicing debt averages 30% of revenue. The shift to off-premise delivery and carryout “is likely to erode profitability and increase packaging costs and hinder their ability to sell high-margin items.” McKinsey found that nearly 40% of small businesses in the restaurant sector operate at a loss or break-even.

Solutions suggested in the report involve technology and marketing.

“Independent restaurants might digitize their businesses by using aggregators to increase their visibility, reach potential diners, and outsource their delivery,” write McKinsey authors Andre Dua, Deepa Mahajan, Lucienne Oyer and Sree Ramaswamy.

“Aggregators might help by offering additional on-boarding support or spotlighting small, independent restaurants on their platforms. Some combination of public and private aid may also be necessary for small restaurants, especially offering technical and financial support they’ll need to compete with larger ones that can build contact-less solutions at scale,” according to the report.

“The crisis has exposed financial frailties that have built over time, and the next normal could impose additional burdens,” according to the authors, who add, “The survival of US small businesses across the economy will require new business models and technology solutions that few have the resources to finance.”

World Tea Hosts Virtual Summit

Organizers of the World Tea Expo this week announced a virtual summit scheduled for the second week of October.

The World Tea Conference + Expo was postponed from June 14-16 to October. It was later canceled due to restrictions on events drawing large crowds to the Colorado Convention Center, in Denver Colo.

The World Tea Virtual Summit + Resources is scheduled for October 12-14.

“The virtual summit will introduce online networking and lead generation,” according to Questex, organizers of the event. Guests include Sebastian Michaelis, head of tea at Tata Global Beverages; Peter Goggi, president of the Tea Association of the USA, and Tony Tellin, co-founder of A. Tellin Co.

The agenda of three half days offers an opportunity to “learn from peers, share ideas, network virtually and safely, and support one another as we continue the shared journey through COVID.”

The next live, in-person event is scheduled for July 14-16, 2021.

Learn more: World Tea Conference + Expo

Made in America

Great quantities of tea are blended in America but according to the Made in America Act, a product manufactured in the US that claims to be American made, must contain at least 50% US ingredients.

A Lexology post this week discusses a class action suit “that calls out Bigelow Tea for pushing unpatriotic tea.”

The post summarizes a report by Linda Goldstein and Amy Ralph Mudge with the Washington D.C. based law firm Baker & Hostetler.

The complaint, filed in California’s Central District Court, by Kimberly Banks and Carol Cantwell, alleges that by promoting their tea as “Manufactured in the USA 100% American family owned” and “America’s classic” Bigelow violates provisions of the California Consumer Legal Remedies Act, False Advertising Law, Unfair Competition Law, and Breach of Express and Implied Warranty.

Plaintiffs allege themselves and other consumers, “purchased the Bigelow Tea products because they reasonably believed, based on the packaging and advertising, that these products are American-made. However, the products are comprised solely of foreign-sourced and processed tea.”

Had plaintiffs known the truth “they would have paid less for them or they would not have purchased them at all,” reads the complaint.

Bigelow Tea responded Friday with the following statement: “Bigelow unequivocally disputes the allegations in this California based lawsuit.”

“Every box with our statement of being “Manufactured in the USA” refers to the fact these teas are produced and distributed by one of our three Bigelow owned and operated manufacturing facilities, located in Connecticut, Kentucky, and Idaho. In addition, our packaging clearly states that our teas are “Blended and Packaged in the USA”. Bigelow continues to be open and transparent about our global sourcing of ingredients (many of which come from the United States) on both our website and the packaging of select varieties of our teas.”

“Frivolous lawsuits such as these are designed to purposefully damage the reputation and finances of the companies they target. Bigelow Tea is proud to be a 100% American family owned and operated manufacturing company and we are prepared to vigorously defend ourselves against this meritless lawsuit,” writes Bigelow.

While Bigelow owns the largest US tea farm, The Charleston Tea Garden, located in Charleston, South Carolina, the tea garden markets its tea under its own brand. The plantation website makes it clear that “Bigelow Teas are not made from any of the tea leaves grown or harvested here at the Charleston Tea Garden. Charleston Tea Garden teas are the only teas made from the tea leaves produced by the Camellia Sinensis plants grown in the fields of the Charleston Tea Garden.”

DMCC Expansion Plans

Fifteen years ago, Ahmed Bin Sulayem, executive chairman and chief executive officer of Dubai’s Multi Commodity Centre (DMCC) envisioned a tea trading hub that would service the world’s largest growing regions.

Today DMCC processes 48,000 metric tons of tea annually, accounting for 60% of global re-exports. The facility has processed 320 million kilos since its inception. The modern port facilities and airfreight capability attracted 800 new companies during the first half of 2020, said Bin Sulayem, adding that the months of May and June saw a “noticeable uptick despite an overall softer business climate.”

The tea center and atmospheric-controlled warehouse, which stores 5,000 metric tons, has a turnover of $184 million annually.

Commodity teas from 13 origins are blended for consistency and these blends, are often mixed to make herbal, floral inclusions sold as some of the world’s most popular teas. Examples include Earl Grey and the many breakfast blends distinct to markets in Ireland, Scotland, and England. Classic brands processed include Lipton and Red Rose as well as local blenders such as Tea Trading International DMCC, a Dubai-based British SME that markets brands Vertea and The Leaf to food-service catering, hotel, and resort customers.

DMCC’s tea and its new coffee center drew the attention recently of His Highness Sheikh Mohammed bin Rashid Al Maktoum, Vice President and Prime Minister of the UAE, during a visit reported by Gulf Today.

“Under the guidance of His Highness Sheikh Mohammed Bin Rashid Al Maktoum, Vice President and Prime Minister of the UAE and Ruler of Dubai, DMCC is fast becoming the global hub for the tea and coffee industry. Our ambitious plans to triple our capacity in the near future are strategically anchored in Dubai’s drive and ability to facilitate world trade,” said Bin Sulayem.

In a release by Arjun Katyal, of McLeod Russel Middle East DMCC, said, “The DMCC’s expansion plans are incredibly exciting, and represent a huge boost to Dubai’s status as a leading global trade hub. We have been a DMCC Tea Centre member since 2011, and have seen, first-hand, the expertise, experience and vision that has shaped the success of this facility. McLeod Russel Middle East DMCC has its sights set on continued growth, and we will continue to engage new markets and reach a wider customer base than ever before. The DMCC Tea Centre has an important role to play in our success story, and we congratulate them on their latest announcement.”

Since 2005 DMCC has become one of the fastest growing free zones in the world with more than 17,000 companies conducting business in a number of sectors including precious metals, tea and coffee, and food commodities. Establishments and individuals operating in DMCC are exempt from all taxes including income tax, for a period of 50 years.

Measuring Elements in Tea

Minerals are essential to the heath of tea plants and for tea drinkers to experience the full range of tea flavor, but too much of even the best of things in life can create problems.

Researchers Dr. Ying Guo, Dr. Seungjin Lee, and Dr. Tae Lee at Georgia Gwinnett College are currently engaged in testing five commonly available tea brands using a handheld Laser Induced Breakdown Spectroscopy (LIBS) unit manufactured by SciAps. The Z-300 analyzer detects very low concentrations of mineral and potentially harmful heavy elements.

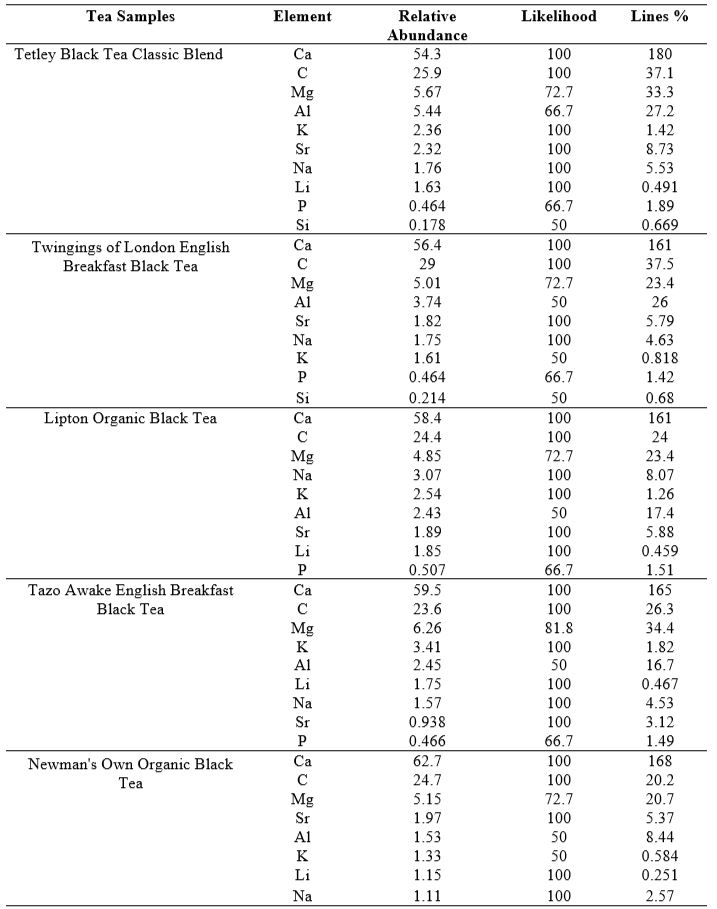

The team, whose lab work is temporarily suspended during the pandemic, detected all of the following minerals and alkali metals (Cs, K, Li, Na) in five popular tea brands. The three most common minerals were carbon, calcium, and magnesium in all five samples. Several heavy metals were also present in all five samples including Cd and Cr which are toxic in very low concentrations.

“(Before the shutdown), we obtained the spectra of tea samples and were able to qualitatively determine the elements present,” Guo says. The next step will be to calibrate and complete the quantitative analysis, she says.

| Element | Daily Intake Thresholds |

| Al (Aluminum) | 0.10–0.12 mg Al/kg/day for adult |

| C (Carbon) | None |

| Ca (Calcium) | 1300 mg/day [harmful > 1500 mg/day] |

| Cd (Cadmium) | FAO/WHO rules limit Cd to 0.2 mg/kg |

| Cr (Chromium) | 120 µg/day [harmful > 200 µg/dan |

| K (Potassium) | 4700 mg/day [harm depends on weight]* |

| Li (Lithium) | Lithium toxicity level is 1.5 mEq/L |

| Mg (Magnesium) | 320-420 mg/day (varies with age) |

| Na (Sodium) | Less than 2300 mg/day |

| P (Phosphorus) | 1000 mg/day [harmful > 250 mg] |

| Si (Silicon) | Elemental silicon is an inert material |

Researchers pelletized tea grains from each brand and measured the intensities of emission spectra at different wavelengths to determine the presence of elements of interest in the samples. Results were validated by inductively coupled plasma mass spectroscopy.

Analyzer manufacturer SciAps notes that “minerals play an important role in maintaining the human body. For example, Ca helps with the functions of muscle contraction, enzyme activity, healthy bones and teeth, blood clotting, transmission of nerve impulses, and regulating heartbeat. K can help reduce risks for certain diseases such as stroke, kidney stones, and hypertension. Even though those are beneficial elements to the human body, there is still a suggested daily intake limit.”

The article states that “additionally, tea may be contaminated by heavy metals, “either as a result of uptake from soil or from atmospheric dispersion due to vehicular or human activities,” according to Guo. This is what led them to investigate the levels of both the beneficial minerals

(e.g., potassium and calcium) and unwanted contaminant elements (e.g., cadmium and chromium) present in different tea brands. Heavy metals can be highly toxic even at a very low concentration. LIBS was able to detect the presence of these metals in all five samples.

The following table lists the quantities of each element by relative abundance for each tea brand.

The research has not been published, but once reviewed, “By comparing with recommended daily intake limits and reference dose, we’ll be able to provide insights on daily consumption limits of tea in order to avoid too much intake of toxic elements,” says Guo.

[Editor’s Note: Tea Biz will follow up once the research is published]

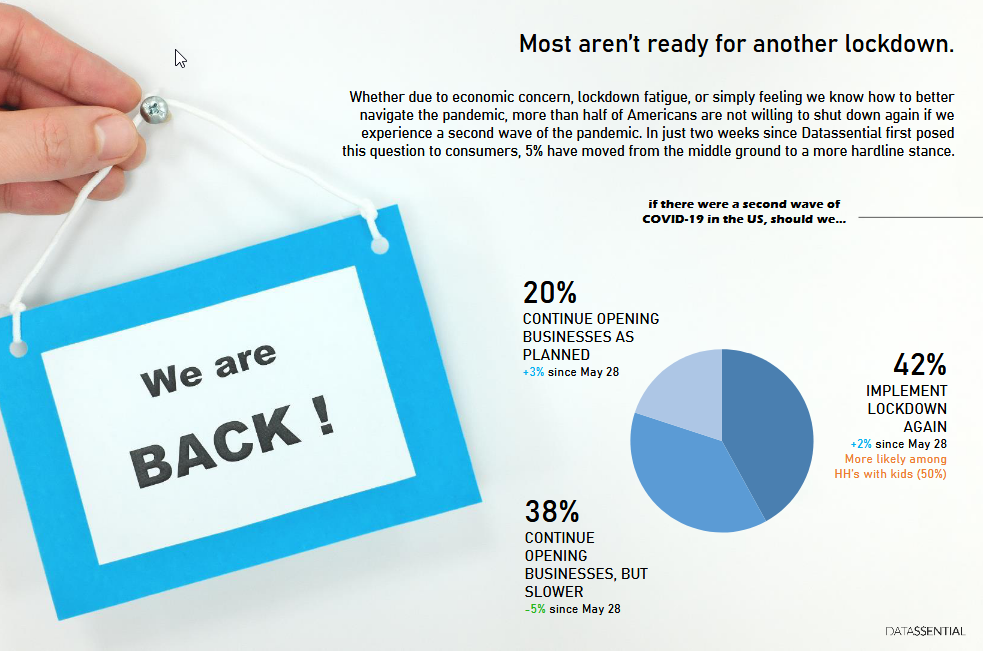

Reversal Forces New Lockdowns

After flattening the COVID curve in April and May it began sloping upward in June in the U.S. while Europe continued to suppress spread of the coronavirus. July has since become the worst month on record for COVID spread with 1.9 million new infections and 1,000 deaths per day, bringing the U.S. total to 4.5 million who have tested positive. The virus is now present in populations young and old in every state with infections rising in more than half the U.S. states. Globally there are more than 18 million cases with deaths approaching 700,000. About 6% of those who have tested positive perished. On a hopeful note, 94% (11 million) have recovered. The U.S. continues to lead country totals but Brazil (2.7 million) and India (1.8 million) are hot spots. The UK, Spain, Peru and Chile experienced death rates greater than 500 per 1 million population. More than 250,000 have died with a high of 6,900 per day in April that dipped for about a month before moving seven-day average of 5,600 globally in July.

Subscribe to receive Tea Biz weekly in your inbox.

stores to $818 million. Drug stores showed a 13.6% gain to $25 million and multi-outlet chain locations reported an amazing $1.3 billion in tea sales, up 7%. A decade ago grocery stores and supermarkets were the dominate sales channel. Very little tea was sold in drug stores. IRI does not break out sales by format so it is not possible to identify precisely how much of these category gains

stores to $818 million. Drug stores showed a 13.6% gain to $25 million and multi-outlet chain locations reported an amazing $1.3 billion in tea sales, up 7%. A decade ago grocery stores and supermarkets were the dominate sales channel. Very little tea was sold in drug stores. IRI does not break out sales by format so it is not possible to identify precisely how much of these category gains  are from K-Cup sales, but it seems likely that most of the bump in multi-channel and drug is from capsule sales, typically big brands. Another clue is that the big jump in sales occurred after Lipton, Twinings, Celestial Seasonings, Snapple and Bigelow began selling

are from K-Cup sales, but it seems likely that most of the bump in multi-channel and drug is from capsule sales, typically big brands. Another clue is that the big jump in sales occurred after Lipton, Twinings, Celestial Seasonings, Snapple and Bigelow began selling  K-Cups. Several report earning more than $20 million annually in K-Cup sales. Another indication: sales of instant tea (typically in jars) is plummeting. In drug stores category sales fell 31%; in multi-outlet stores sales of instant tea are down 9.3% and in drug stores sales of instant are down 8.9%.

K-Cups. Several report earning more than $20 million annually in K-Cup sales. Another indication: sales of instant tea (typically in jars) is plummeting. In drug stores category sales fell 31%; in multi-outlet stores sales of instant tea are down 9.3% and in drug stores sales of instant are down 8.9%.