India Tea News for the week ending February 14, 2025

Powered by RedCircle

Darjeeling Faces A Challenging First Flush

In 2024, Darjeeling saw one of its most challenging years, reflected in the low production of 6 million kilos, the lowest in several years. The year has opened to a few challenges already. Media reports say that the Chief Minister, Mamata Banerjee, announced last week that the ceiling of land for non-tea use on tea gardens would be raised from 15% to 30%. Many gardens are using this option to explore hospitality as a revenue source. However, the news has not gone down well with the majority of the Gorkha population. Led by Ajoy Edwards, the newly minted political party, Indian Gorkha Janshakti Front staged a protest last week. Their issues relate to implementing minimum wages, an assurance of 20% as the annual bonus, and land rights. This is worrying as the tea board had announced 27th February as the date of plucking in the hills, following the winter closure of gardens. And protests could hinder the region’s most crucial harvest season. Of the 87 tea estates within the ambit of Darjeeling tea (protected by the GI), The Telegraph has reported that 12 have closed.

Growers Want 100% Tea in Auctions

Various members of the Indian tea industry associations, including the Indian Tea Association (ITA), Tea Association of India (TAI), and Confederation of Small Tea Growers Associations (CISTA), met in Kolkata last week to discuss current challenges. The small tea growers’ complained that the current price-sharing formula does not compensate for the cost of production. The associations also spoke about the current lack of bargaining power with producers. Consequently, the key takeaways were that one, a minimum sustainable price of made tea, indexed to the cost of production and quality, is to be introduced, and 100% of made teas should be sold via auctions – currently, 50% is mandated to be sold via auctions. Interestingly, Kenya introduced a minimum price for tea for its large and small tea grower segments in 2021. This was withdrawn in 2024 because of the 100mn kilos of unsold tea, as buyers refused to pay for poor quality tea at the minimum set prices. Mombasa auctions tea from a dozen competing African countries, giving buyers a choice of buying premium-grade tea at prices near or slightly above the minimum or purchasing lower-grade tea at much lower prices than the minimum.

Two Tea Brands Raise Funding

Two tea companies have had a successful fundraising round this fortnight. Upamanyu Borkakoty of Assam’s Woolah Tea pitched to the jury on Shark Tank India 4. He presented his patented green tea balls, which avoid the use of plastic or paper for single-serve tea. He has come away with an investment of Rs 50 million or USD 57,000 from Aman Gupta, co-founder of boAT speakers and sound systems. Upamanyu follows other tea brands like Tea Fit and Dorje Teas that have appeared on the show.

In the south, Croft Beverages has raised USD 125k in pre-seed funding. Last year, Croft set up its first farmer-owned mini factory in Billicombai, Nilgiris. The company plans to scale and build 100 mini-factories by 2030 to support a sustainable tea industry here.

Episode 205

Powered by RedCircle

Latest Tea News

- Darjeeling Faces A Challenging First Flush | Growers Ask for 100% Auction Sales | Two Tea Brands Raise Funding

- USAID Dismantled: Help Assess Impact on Tea Globally

- Red Sea Shipping Attacks Paused | Carlsberg Acquires UK Bottler Britvic | Kidney Mortality Rates Lower for Tea Drinkers Consuming Oxidized Tea

- Indian Tea Industry Flags Poor Imports | Chai Point Aims For Guinness Record at The Kumbha Mela | 2nd Inter Tea Garden Football Tournament in Assam This Week

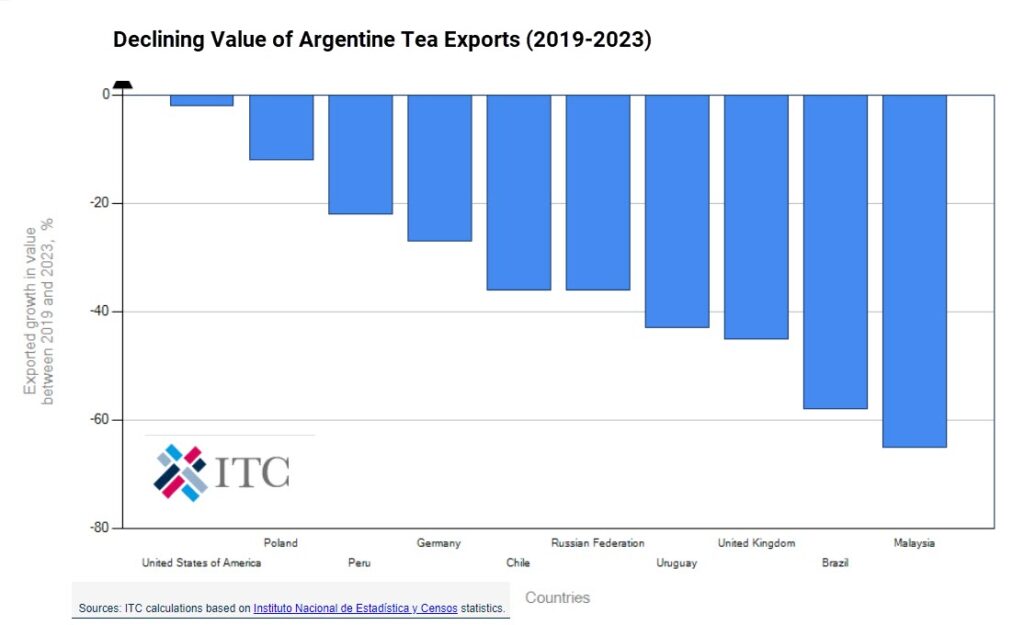

- Hot Tea Gains Marketing Momentum | FDA Bans Red Dye No. 3 | Argentine Tea Awarded GI Status