The tea industry has seen significant growth over the past few years. More consumers are looking for unique and high-quality tea products.

Tea business owners must create a customer-centric approach (Gascoyne, 2023). Such an approach requires understanding consumer intent (Bailey, 2023). Combining intent-based advertising and experiential retail can fuel growth for your tea brand.

We will delve into the following:

- the importance of understanding consumer intent and matching content with intent and context (Bailey, 2023),

- creating an immersive customer experience through experiential retail (Gascoyne, 2023), and

- leveraging the power of word-of-mouth marketing.

This article summarizes a few key insights from the 2023 World Tea Expo. By the end of this article, you will gain clarity into creating a successful tea business.

The Customer is King

The success of any business depends on its customers.

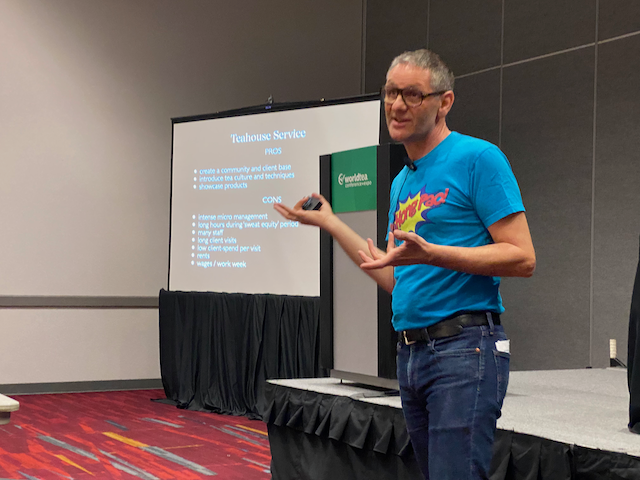

Kevin Gascoyne, Tea Buyer & Taster of Camellia Sinensis Teahouse, points out that the tea business is 90% selling and 10% buying (2023). So, a customer-centric approach is crucial to succeeding in the industry.

This means:

- understanding your customers’ preferences,

- maximizing customer value, and

- creating a personalized experience that meets their needs.

By focusing on the customer, tea brand owners can:

- identify their target audience,

- create products that match their preferences, and

- tailor marketing strategies.

Understanding customer intent (Bailey, 2023) is critical to this approach.

This means understanding the motive behind a customer’s action, like scrolling on social media or doing a Google search.

Identify whether customers are:

- looking for something specific (search intent), or

- open to new content (discovery intent).

Identifying these intent signals allows your tea brands to create content matching customer needs and context (Bailey, 2023). Some of the content your tea brand may need to create include:

- social media posts,

- blog posts,

- ads,

- product pages, and more

Key Takeaway: A customer-centric approach is essential for tea brand owners looking to succeed in the industry. Tea brands can create personalized experiences that meet customer needs, driving growth. Creating these personalized experiences requires understanding customers’ preferences and identifying their intent.

Narrow Definition of Excellence

Focusing on a narrow definition of excellence is critical to creating a successful tea brand.

Kevin Gascoyne (2023) suggests that claiming to sell ‘the best tea’ is not enough. Instead, tea brands must focus on delivering the best product for a specific type of tea and price point.

“We focus on a narrow definition of excellence. For example, offering the best Chinese curl leaf tea that we can sell for $10.” – Kevin Gascoyne, Tea Buyer & Taster, Camellia Sinensis Teahouse

Brands can differentiate themselves from others in the tea market by specializing in particular teas and segmenting the tea market.

Specialization also allows tea brands to focus on delivering consistent quality. Customers can expect the same high-quality tea every time they buy from the brand. This expectation of quality within the customer base leads to loyalty and repeat business.

Focusing on a narrow definition of excellence allows tea brands to become thought leaders in their niche. They create a trickle-down marketing effect (Gascoyne, 2023).

Key Takeaway: Tea brand owners must focus on a narrow definition of excellence to succeed in the industry. Tea brands can differentiate by specializing in a particular tea segment and delivering consistent quality.

Intent-Based Advertising

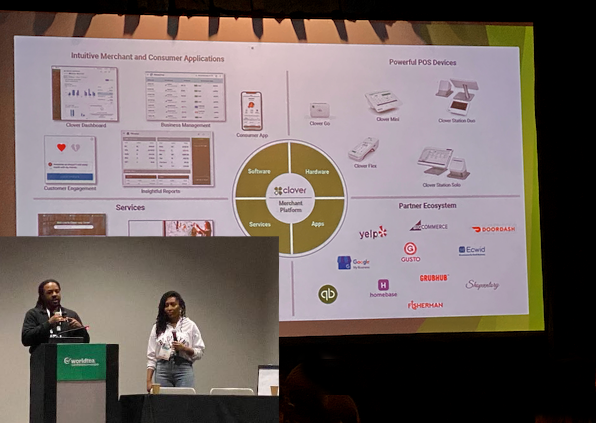

Understanding consumer intent is crucial to creating successful campaigns for tea brands. So, Mackenzie Bailey (2023), Founder of Steeped Content, suggests intent-based advertising and marketing.

Intent-based marketing involves creating content that matches consumer intent and context.

She suggests:

- producing blog posts that align with keyword intent

- creating social media content and ads aligned with the platform’s intent

- using local SEO to capture the search intent of nearby customers

Matching content with intent and context allows tea brands to create personalized experiences. These experiences meet their customers’ needs.

For instance, a customer may be searching for a specific type of tea (e.g., hibiscus). A tea brand can create an ad or blog post highlighting that tea. Such content may highlight the tea’s benefits and features.

On the other hand, a customer is open to trying new teas without actively searching for something. In such cases, your tea brand can create content introducing new teas. Use social media posts or emails to encourage customers to explore novel products.

Identifying and meeting consumer intent is crucial for marketing tea. Intent-based marketing helps your tea brand to:

- attract and retain customers,

- increase brand awareness, and

- drive sales.

“Intent-based advertising is not just about reaching more customers, it’s about reaching the right customers at the right time with the right message. By understanding and meeting consumer intent, tea brands can create personalized experiences that fuel their growth” – Mackenzie Bailey, Founder, Steeped Content

“Building community through social media is one of the many ways entrepreneurs can use technology to build a successful teashop.” -Ellen Kanner, Teahouse Owner

Key Takeaway: Intent-based marketing is critical to a successful tea brand’s marketing strategy.

The Power of Experiential Retail

Experiential retail is a powerful tool for tea brands looking to create an immersive customer experience. Kevin Gascoyne (2023) suggests that creating an immersive experience is crucial to:

- engage customers,

- create loyalty, and

- driving sales.

Experiential retail involves creating a physical space where customers interact with the brand and products.

For tea brands, this could mean creating a tea shop where customers can:

- taste different teas,

- attend tea ceremonies, or

- learn about the tea-making process.

Creating an immersive experience helps tea brands differentiate themselves from other brands. They create a personalized experience for customers and drive sales.

Experiential retail experiences may be more likely to be shared by tea drinkers. This can help improve your brand awareness and lower customer acquisition costs (existing customers are promoting you to new potential customers for free).

“Camellia Sinensis Teahouse has updated our tea shop to an experienced-based retail store. Since doing so, we have seen user-generated content double, helping our brand awareness.” – Francois Marchand, Marketing Director, Camellia Sinensis Teahouse.

The role of storytelling in experiential retail is also crucial. It creates an emotional connection with customers and inspires them to engage with the brand.

Such brand stories may include:

- the history of the brand,

- the tea-making process, or

- the sourcing of tea leaves.

Key Takeaway: Experiential retail can help tea brands drive industry growth. By creating an immersive customer experience, tea brands can differentiate themselves from others.

Trickle-Down Marketing Effect

The trickle-down marketing effect occurs in specialized, successful tea businesses. Kevin Gascoyne (2023) suggests that specialized tea businesses can create a ripple effect in the industry. They influence the market and drive demand for high-quality teas.

Specialized tea businesses focus on the following:

- delivering a narrow definition of excellence,

- creating an immersive customer experience through experiential retail,

- offering exceptional products,

- Understanding and intentionally meeting customer needs

By doing so, they create a loyal customer base that becomes a source of word-of-mouth marketing. This word-of-mouth can lead to an increase in demand for high-quality teas.

Specialized tea businesses can become thought leaders in their niche. They can create a reputation for delivering high-quality tea. This reputation attracts customers looking for such products. This can help the tea market evolve by gradually growing demand for these premium teas.

“We stock a range of special teas at different price points. For example, we carry twelve sencha teas. In some cases, some sencha differ on the cultivar level. Such granular differentiation helps tea drinkers gain rich product knowledge. It often builds a visceral connection to the product, tea.” Kevin Gascoyne, Tea Taster & Buyer, Camellia Sinensis Teahouse

Key Takeaway: Specialized tea businesses can create a trickle-down marketing effect in the industry. They drive demand for high-quality teas.

Driving Growth in the Tea Industry

To drive growth in the tea industry, brands can combine intent-based advertising and experiential retail. This combination creates a personalized and immersive customer experience.

By understanding consumer intent, (Bailey, 2023) and matching content with intent and context, tea brands can create personalized experiences. These experiences meet their customers’ needs and drive sales.

Experiential retail allows tea brands to create an immersive customer experience that differentiates them from other brands in the market (Gascoyne, 2023).

Creating a physical space where customers can interact with the brand and its products helps your tea company. By doing so, tea brands can create loyalty, generate word-of-mouth marketing, and drive sales.

The trickle-down marketing effect (Gascoyne, 2023) can drive growth in the tea industry. It creates demand for high-quality teas. Specialized tea businesses can become thought leaders in their niche. They can create a reputation for delivering high-quality tea, drive word-of-mouth, and help the industry evolve.

Driving growth in the tea industry requires tea brands to adopt a customer-focused approach. This approach necessitates understanding consumer intent (Bailey, 2023).

Combining intent-based advertising and experiential retail, tea brands can differentiate themselves from others.

Key Takeaway: Tea brand owners must focus on creating a customer-centric approach (Gascoyne, 2023) and understanding consumer intent (Bailey, 2023) to drive growth.