Hear the Headlines | 15 November 2024

Argentina’s Tea Harvest is Off to a Good Start

By Dan Bolton

The Argentine tea harvest began in October, with good weather and high yields per hectare in Misiones, the heart of the country’s tea-producing region.

Automated harvesters and favorable terrain enable Argentina to supply about half of the black tea consumed in the US. The country has optimized production by adopting vegetative propagation using cultivars with yields as high as 2,500 kilos per hectare. For decades, the harvest averaged 70,000 to 90,000 metric tons annually. However, demand is declining as consumers drink less flavored, artificially colored, sweetened iced tea.

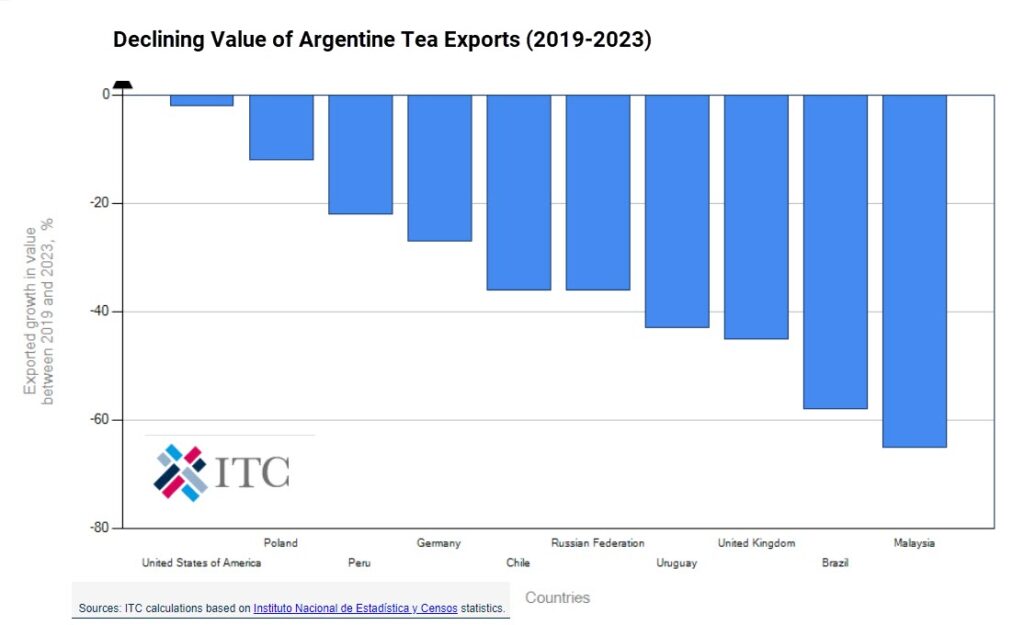

Argentina exported only 50,000 metric tons of tea last year. Export revenue fell to $58.5 million in 2023, down 10.6% from the previous year. Growers shut down production mid-season after fulfilling their contracts.

Now, Argentina needs to find new export markets to maintain previous volumes. The domestic market is limited as citizens favor yerba mate by a wide margin, consuming 5.9 kilos per capita annually compared to 250 grams of mainly black tea.

Sales and traffic manager Pedro Newell at Don Basilio SRL explains that long-term relationships with buyers enable producers to balance supply and demand accurately. He said, “Argentina tea producers have had good production for years. It was only last year that we had to finish harvesting before the season ended and only after we produced what was contracted.”

Don Basilio, owned by the Okulovich family, is a tea and yerba mate plantation with a history that dates to 1935. There is plenty of capacity to expand production, says Newell. “As long as the U.S. continues to demand iced tea, Argentina will remain a key supplier, drawing on decades of expertise and production capacity to meet this market’s needs. We are not prepared to move away from a market that, although no longer growing, still represents our highest volume demand,” he said. “At the same time, we are open to exploring new markets and co-developing products tailored to specific requirements,” he said.

He explains that the company is seeking export partners. Expanding into markets like the European Union presents particular challenges, as compliance with their strict PA regulations significantly raises our production costs.” Ensuring compliance requires manual field cleansing, involving teams of 50 to 70 people manually removing weeds across plantations, he said. Don Basilio supplies tea for iced tea blends to Unilever/Ekaterra.

One possibility is Chile, a big consumer of black tea that has been importing $50 to $75 million annually in the past three years. In 2021, Chile imported $7 million worth of Argentine tea, about 10% of the $63 million Chileans spent on tea imports that year. In contrast, Chile imported 74% of its yerba mate from Argentina last year.

BIZ INSIGHT – Argentina is a compelling example of how origins that conform to the demands of destination markets can shape their supply chains to prosper in every conceivable way—until the market does an about-face.

Episode 194

Dan Bolton | Podcast Host

Dan is a content creator who fosters genuine connections globally through informative, educational, and captivating conversations centered on tea. Tea Biz Blog | Podcast

Powered by RedCircle

Episodes 1-49

Episodes 50-96

Episodes 97-148