Tea Industry News for the Week of June 15

- Retail is Rebounding

- Breakfast: Deflated Daypart

- Reopening: Millennials Lead the Way

- E-commerce Sales of Specialty Tea Spike

- India Extends Lockdown | Exports Declined in 2019

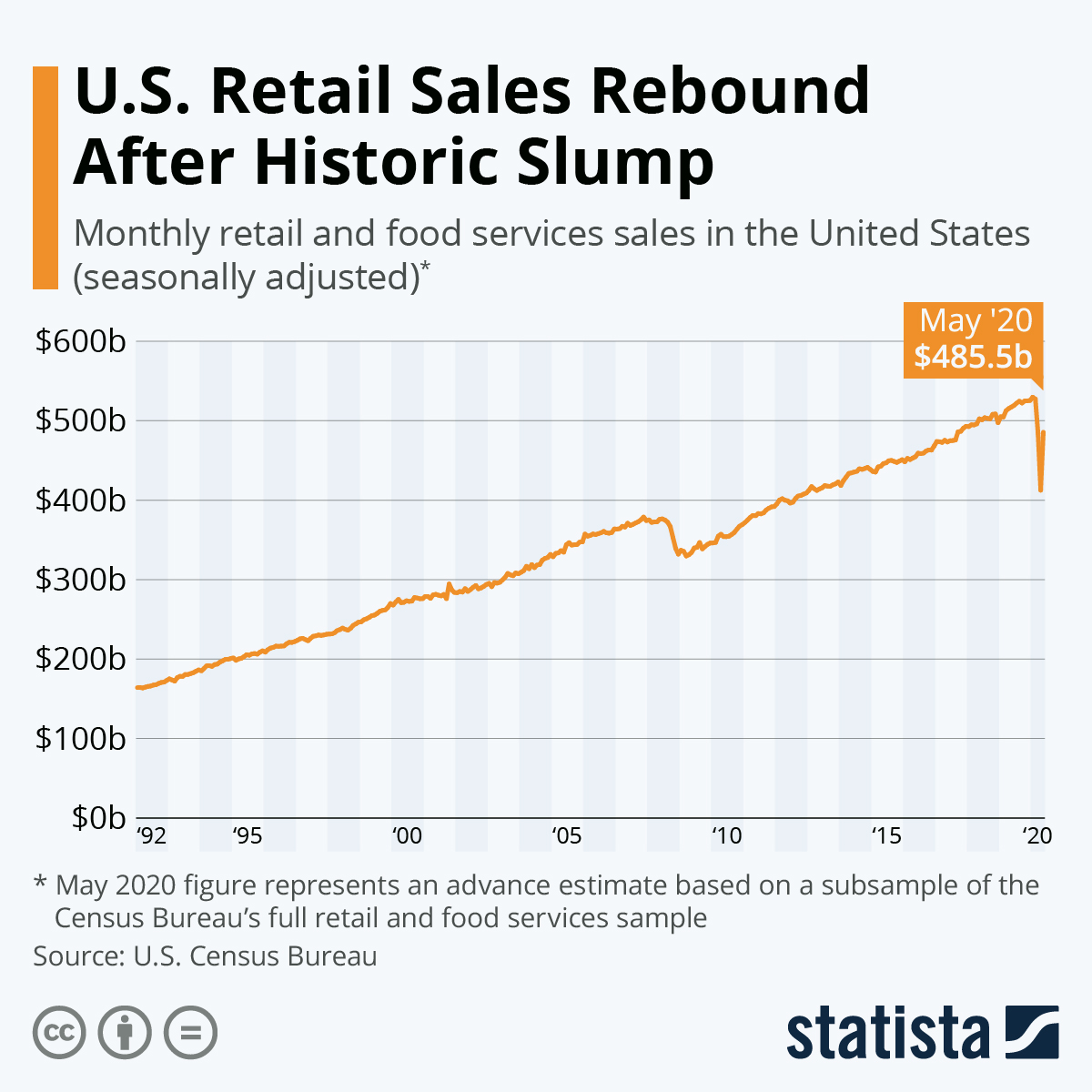

Retail Rebounds

Tea wholesalers report foodservice customers are once again placing orders. Iced tea, a seasonal favorite, is in demand. Online sales that spiked amid the lockdown remain at higher levels than the first of the year.

The sales slump that began in March is easing. Still, inventory packaged for foodservice customers remains high and, unlike pent up demand for fashion, household furnishings, and other non-essential products, the food and beverage category is regaining traction slowly, in fits and starts.

Food sales did not decline during the scariest months of the pandemic ? everyone must eat. Grocery sales grew 33% overall, leading all traditional channels in dollar sales growth, with the food and beverage category up 32.5% compared to the previous year, according to IRI, a Chicago based market research firm. The purchase of food online increased by 49.7%. The question now is how soon consumers will begin dining-in, re-inflating the $181 billion on-site beverage category that includes tea.

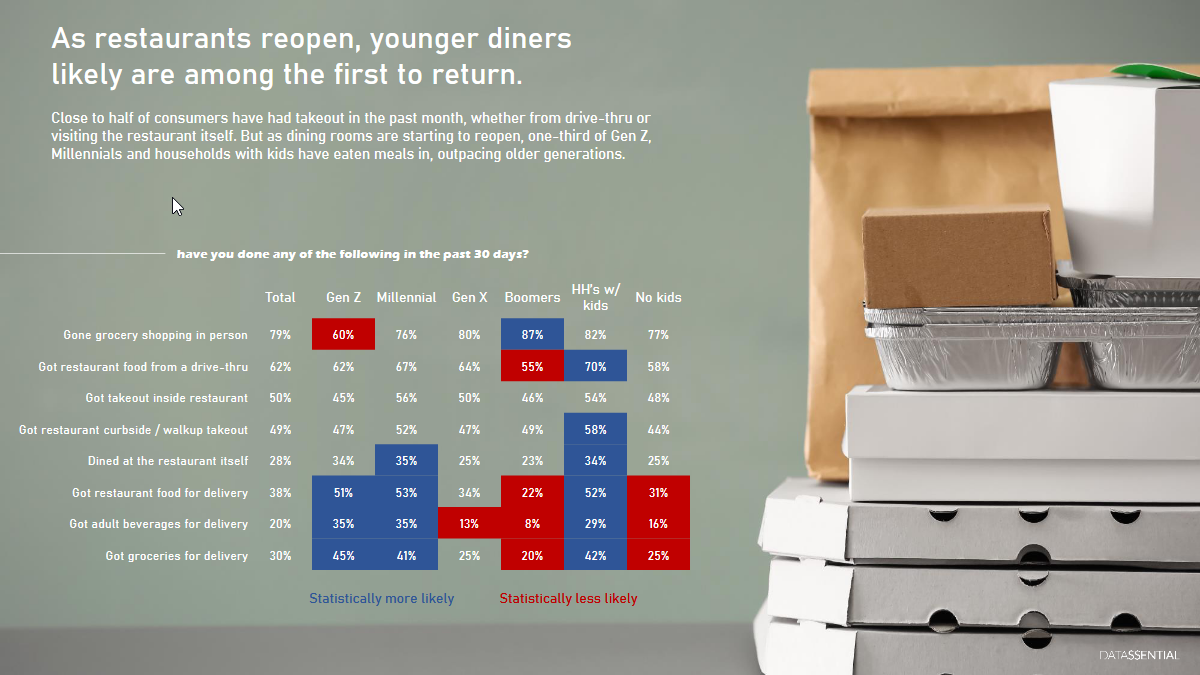

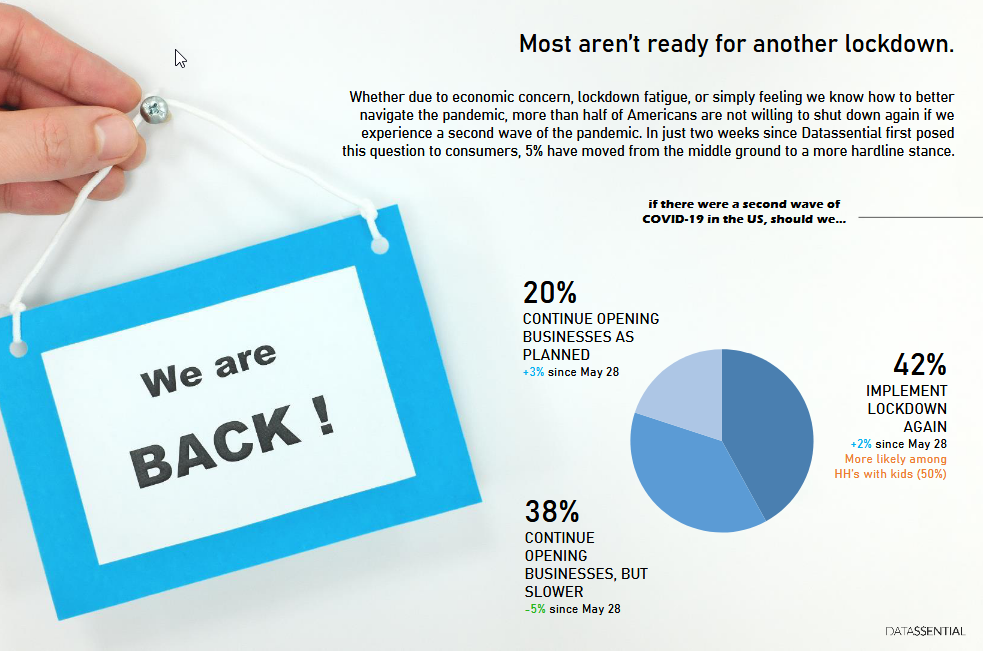

Market research shared by Datassential indicates millennials are leading the way back to dining-in at restaurants but the majority prefer drive-thru and curbside pickup, and contactless delivery.

Datassential managing director Jack Li told webinar participants that consumer fears are abating. “Coronavirus concern is way down from its peak, closer to early-pandemic levels,” he said. In April at the height of lockdowns, infections, and COVID-19 deaths, 67% of consumers said they were “very concerned,” about dining-in and 28% were “somewhat concerned.” By mid-June, the combined 95% who earlier said that they were concerned had declined to 86%, but with 44% still “very concerned.”

How this fear translates into behavior is critical to the tea industry. Beverages generate about 20% of restaurant sales but constitute far less of the transaction price when consumers place orders for curbside pickup, takeaway, or delivery. When ordering food to eat at home, consumers raid the fridge for their favorites. Beverages maintain their important slice of the transaction when customers order takeaway for office breaks and visit drive-thrus when food is consumed in the car.

Datassential found that avoidance of dining-in is inching down, but slowly. As restaurants began opening their dining rooms in May and early June only 22% of consumers said they have “no concerns whatsoever” about dining out. Almost half, 47% say they will “definitely avoid eating out,” a total that has increased 2% since June 5. Another 31% say they are “nervous but will still eat out.” Boomers, at 59%, are the most fearful. Those in the Gen Z cohort are the least fearful, with only 34% saying they will “definitely avoid” eating out. Datassential, in a survey conducted on June 9, found that 42% of Millennials will also “definitely avoid” eating out.

For now, health concerns remain the top priority, writes Li, “but economic worries have been rising” with 46% of the nation more concerned about the economic crisis (up 1% since June 3 and up 9% since April 7) compared to 54% of the 4,000 adults surveyed who say they are more concerned about the public-health crisis.

Breakfast: Deflated Daypart

Morning meals and snacks suffered the steepest transaction declines during the coronavirus crisis, according to The NPD Group. Millions of at-home workers agree on one thing: no one misses early-morning commutes enough to jump in the car and wait in line for breakfast.

The number of transactions at breakfast locations was down 18% the week of June 7 compared to the same period last year, according to Restaurant Dive. Lunch transactions declined by 11%, and customer transactions fell 12% at dinner during that same period, according to The NPD Group.

FSR Magazine reports that Revenue Management Solutions, using insights based on point-of-sale data, estimates total US breakfast traffic year-over-year slipped between negative 30–35%. Traffic has since leveled out around negative 15%. According to Datassential, customers’ trips to restaurants break down as follows:

Traffic by Daypart

| Breakfast/Brunch | 6% |

| Lunch | 26% |

| Dinner | 64% |

| Snack | 3% |

| Late Night | 1% |

The reversal is dramatic as breakfast is the only restaurant daypart that has experienced sustained growth in visits during the past few years. In January and February with the nation at full employment, hundreds of thousands of workers visited quick-service chains every day, accounting for a 5% category growth during the past five years.

In a January press release, NPD reported Americans consumed 102 billion breakfasts and another 50 billion morning snacks in 2019. “The future of breakfast looks rosy too with forecast growth of breakfast goods,” according to the market researcher firm which published its “Future of Morning” study prior to the pandemic.

Sending two-thirds of the nations’ workers home dimmed that optimism in record time. Breakfast was the easiest meal to convert at home and suffered the steepest transaction declines as McDonald’s, Taco Bell, Dunkin’, and Burger King saw comp sales slump during March, April, and May. Wendy’s, which spent significant marketing dollars promoting breakfast, reported same-store sales finally turned positive the last week of May.

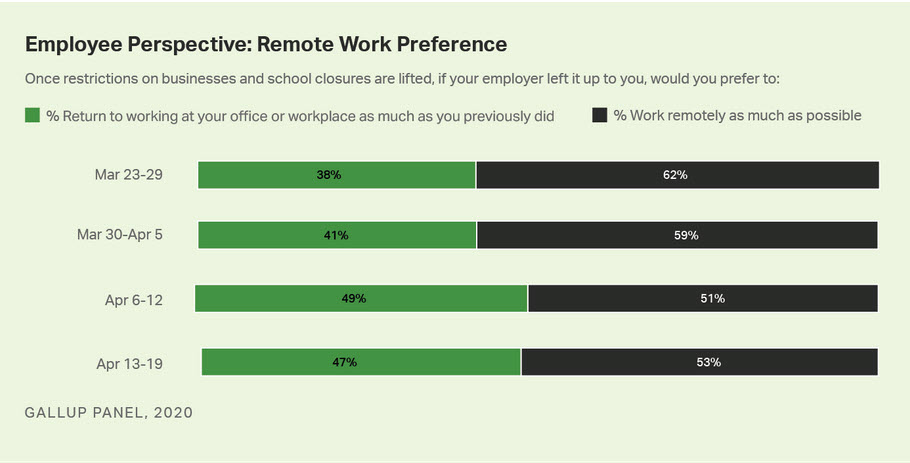

Breakfast is an important hot tea occasion. Gallup has monitored employee preferences on working at home for several weeks, asking workers, “if your employer left it up to you, would you prefer to return to working at your office as much as you previously did, or, work remotely a much as possible.”

No one knows the full impact of stay-at-home orders on buying behavior, but it’s clear that if half of the office workers no longer commute daily to offices on a fixed schedule, the morning routine will be altered for the duration of the pandemic — and likely forever.

Millennials Lead the Way

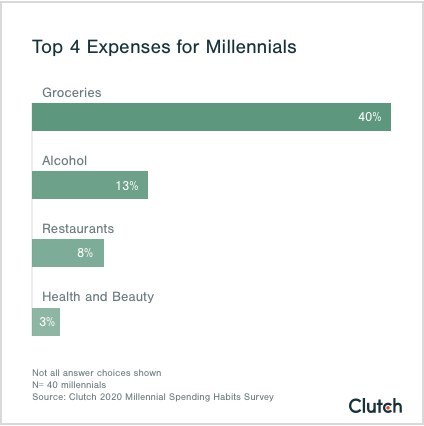

A majority of Millennials (60%) reduced their spending during the early months of the pandemic, according to a survey by Clutch, a B2B ratings and review platform.

Recession-wary after 2009, they contributed to an unprecedented US savings rate of 33% in April. Only 5% of Millennials reported spending more money than the previous month during March and April.

Food was the exception. Groceries were the top expense for 40% of Millennials, reports Clutch. Half the Millennials surveyed reported spending less dining out, but 50% say they are still eating takeout and ordering delivery. Only 28% have not used food pickup and delivery options since the start of the pandemic reports Clutch.

E-Commerce Sales Surge

The most popular product category purchased online last month was restaurant delivery or takeaway, boosted by a surge in restaurants offering curbside service.

E-commerce sales of food or beverages by American adults increased from 27% in February to 36% in April, according to Bizrate Insights.

The number of customers ordering food online is even higher among frequent internet users (61.5%), according to a consumer survey by Red Points on the “Impact of COVID-19 on Ecommerce Sales.”

In April, 44% of Amazon Prime members ordered food or beverages.

Mo Sardella, marketing director at GS Haly, told Forbes that online sales of specialty tea and herbs spiked during the early days of the pandemic.

“We have seen a huge spike in home tea consumption via grocery and online outlets. Our customers with a well-established online presence are doing exceedingly well,” says Sardella, adding that “customers saw between a 100% to 300% increase in online sales in April alone.”

Lockdowns Wind Down

Sixty-nine percent of restaurant units are located in geographies that permit some level of on-premise dining, and the number should increase to 74% in the week ending June 14, according to The NPD Group. At the height of the pandemic, only 25% were operating. Transactions at full-service restaurants were down 14% the week of June 7 versus a year ago, a 29% gain since April 12.

Quick service restaurants fared better during the pandemic “and continue to do so,” according to NPD. QSR transactions are down 13% the week of June 7, compared to the same period in 2019.

Now that restrictions are easing Millennials and Gen Zers, are eager to eat out for the social benefits and convenience. Datassential reports that 82% of Americans say they know which precautions to take and how to stay safe from COVID exposure, and 60% say “COVID safety precautions have become second nature.”

“Diners are excited to eat in at restaurants again, understand the importance of new precautions, and are willing to make the necessary sacrifices. Yet they’ll also be the first to tell you that seeing servers in masks and needing to comply with social distancing measures do not exactly allow them a complete mental escape,” writes Datassential’s Jack Li.

Tea Yields and Exports Decline

Local shortages of Assam tea for auction has increased prices 15% compared to last year. Growers there lost three weeks of harvest beginning in late March. Plucking was to resume April 12, but by then tea plants required maintenance pruning. Gardens that opened were restricted in how many workers they employ. The combination of these events will result in at least 140 million fewer kilos of tea and may discourage exports.

Meanwhile lockdowns that were previously lifted will be extended in the West Bengal tea lands as the coronavirus continues to threaten India. Rajiv Lochan, the founder of Lochan Tea, shared a local newspaper clipping describing a surge in cases in Siliguri, a center of tea commerce at the foot of the Himalayas.

Tea exports dipped 5.6% in the financial year ending March 31, known as AY 2019-20. The new AY 2020-21 began April 1. Volume fell to 240 million kilos from the 245.5 million kilos exported in AY 2018-19. Russia and the surrounding CIS countries remain the most significant tea trading partners, importing 47 million kilos in 2019-20. Iran emerged as second due to a sharp decline from 15 million kilos to 3 million kilos exported to Pakistan due to hostilities between the two countries.

Exporters told The Economic Times they are concerned Iran will purchase much less tea than last year due to deteriorating economic conditions in that country. Iran bought 54 million kilos of tea from India in 2019. Exporters say that volume could decline to 45 million kilos. Russia is also experiencing a sustained economic decline.

China will overtake the US as the largest retail market in 2020. Despite a 4% decline this year in retail sales, China’s retail market is expected to rise to over $5 trillion in sales, while the US is expected to reach $4.8 trillion by the end of the year.

Postponed Chinese New Year purchases will drive this latest rise in consumer spending. Luxury items have been selling well since China eased restrictions. China’s unemployment is much lower than the US, which saw 1.5 million workers file for benefits in June, bringing the total to 21.5 million out of work.

Source: CCInsight COVID-19 Commerce Summary (June 15)