What tea professionals need to start the week of Sept. 22, 2014 —

North American Tea Conference trends and impressions… Tony Gebely leaves Chicago to fly with an extraordinary Phoenix in San Francisco… IRI Worldwide data indicates capsule tea is making big gains.

Troubling Tea Trends

The North American Tea Conference annually brings together industry executives, growers, government officials from producing countries, marketers and suppliers, making it a good occasion to discern trends and concerns among those who view the US and Canadian market with interest.

Traditionally the ones watching the market most closely are Indian, African and Chinese tea industry representatives, all of whom report increased sales to North American wholesalers and, in some instances, increasing sales from retailers buying direct from growers large and small.

I filled a notebook attending three days of sessions that range from food service trends to discussions on global supply and tea and health to advice on attracting millennials to tea.

That’s too much to cover in one post. I’ll elaborate on several trends in the days ahead but here are three topics to get the conversation started.

Production

Dr. Norman Kelly, the newly named chairman of the International Tea Committee in London, was attending for the first time. He replaces Sir Michael Bunston who served many years leading the ITC, which operates as the industry’s statistician. Tea at one level is a game of numbers.

Kelly shared two important observations. One can point with enthusiasm to the charts detailing tea production increases of the past 30 years. Supply is clearly anticipating increased demand and while some new acreage is under tea, most of the gains are through improved agricultural practices. There is much work ahead extending these practices to the smallholders who produce most of the world’s tea, but the largest tea gardens are models of efficiency, making greater use of mechanized harvesting equipment (35% of the total harvest); introducing new cultivars to resist drought and pests and innovative techniques such as Integrated Pest Management (IPM) adapted to the diverse regions in which tea is grown.

China is particular has put its foot on the accelerator at 1,924 million metric tons, most of which is consumed domestically. India reached 1,200 million kilos and Kenya reported 432 million kilos of processed tea last year. Combined production by these three tops all others tracked by ITC.

What is quite extraordinary is that racing as hard as they are at turning out more tea, both China and India are just keeping up with internal demand “leaving less and less for export,” said Kelly.

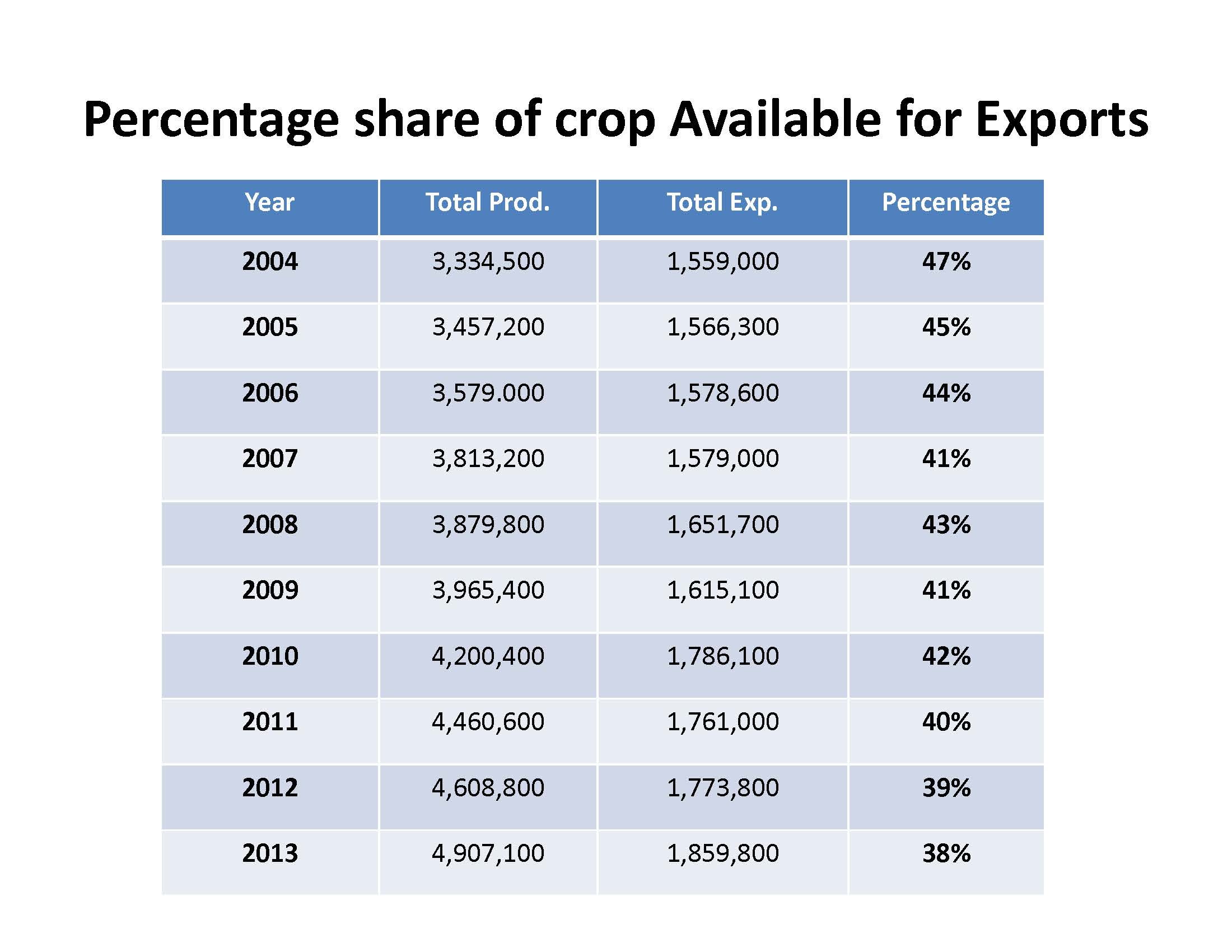

Production remains ahead of demand but “supply might tighten and it is not beyond the possibility of exceeding supply,” he said. Note in the chart above that only 38% of the tea produced is available for export, down from 47% available in 2004. Per capita tea consumption is rising in both China and India and Kenya is making greater efforts to interest domestic tea drinkers.

Pricing

Pricing is closely tied to production and Richard Darlington, managing director of AVT in London, pointed out that the abundance of land and desire to produce additional quantities will keep China in the lead globally despite the fact that “practically all the new tea is consumed internally.”

It seems remarkable, but it’s true – 90% of the new tea produced is consumed by the countries in which it is grown, according to Darlington. Classic economics suggests an abundance of tea will lead to soft prices and while that is true in some markets, much of the world’s tea is selling at a premium.

There is “a paucity of good tea – hence prices are high” while “there is too much medium and low tea around – hence prices coming down,” Darlington explains.

He predicted consumption increases will continue to come from established tea producing countries.

On the topic of production inputs, costs are rising and government support “is vital to the sustainability of tea in many producing countries,” said Darlington.

The situation in Sri Lanka is noteworthy as it illustrates the extreme.

Colombo auction prices are very high and have risen entirely due to a supply squeeze, said Darlington. “The crop has not kept ahead of very strong demand for orthodox tea at a time when India is cutting back on orthodox tea production,” he said.

“The cost of production in Sri Lanka has risen from $1.35 per kilo in 2005 to $3.10 per kilo on 2013,” he said. Government privatization grants are depleted and “investment in new tea areas is prohibitively high. Producers are reluctant to take the risk,” he said. A recent study for the Sri Lanka Tea Board predicted producers will need to get “$14 per kilo to sustain their businesses!!”

Darlington’s country-by-country assessment was insightful and not altogether bleak. There is oversupply in Africa and falling yields in Turkey, competition from alternate crops in Indonesia and a drought in Vietnam that will influence local markets.

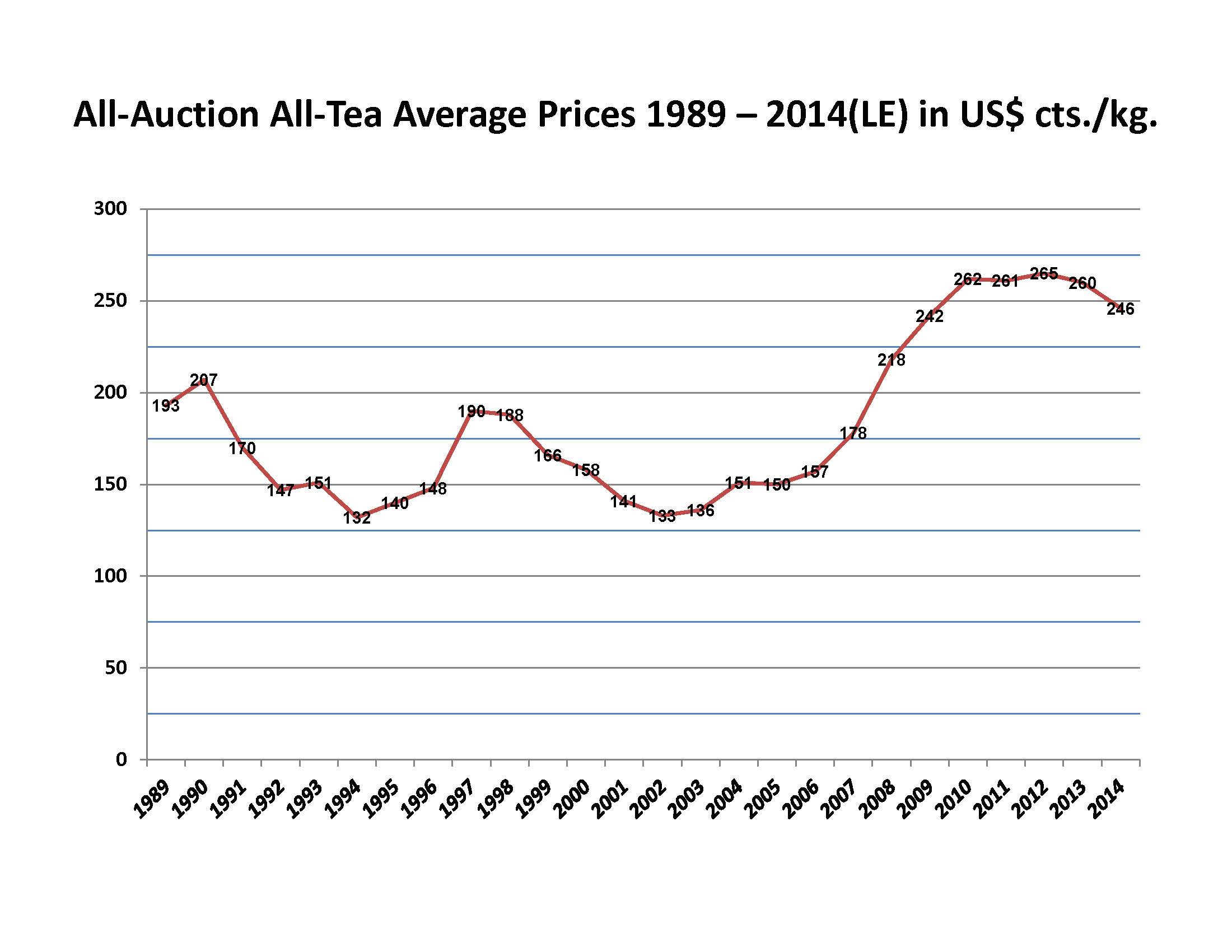

Averaging all tea sold at all the global auctions shows prices falling slightly from last year’s all-tea, all-auction average of $2.60 per kilo. Kelly’s ITC data indicates a $2.46 per kilo average for 2014 year-to-date.

In general supply exceeds demand and trends negatively impacting pricing will probably continue for some time, said Darlington.

Pesticides

Pesticide use, the challenges of reconciling conflicting and inconsistent global regulations and a growing unease with public disclosure of pesticide residues by groups like Greenpeace was the topic of the week. After-hours and during presentations open to the press, pesticides generated few impassioned debates. I placed it third in my reporting because production and pricing have a much greater day-to-day influence on the industry.

A talk by public relations expert Louise Pollock, who has advised the Tea Association of the USA for 20 years, included a slide or two on crisis management as she discussed marketing the health attributes of tea; the Eurofins presentation hinted at worry that a beverage touted for its health benefits could be tainted by pesticide residues is justified, but media attention and public concern is a long way from crisis levels.

The Tea Association of the USA was concerned enough to host a 1-1/2 day presentation on the topic following the conference.

No reporters were permitted to attend these sessions out of concern that delegates would not speak freely if their comments were made public. As a result I can only write about the events that I witnessed, but I listened to a lot of after-hours conversation and I have covered this topic for more than a dozen years.

Consider this the first in several installments intended to identify challenges and weigh solutions — not frighten the public into foregoing tea.

Tea is an agricultural crop and there is not a crop consumed in which the corresponding industry has not been faced with the task of explaining why various chemicals are necessary to cultivate and process these foods. Perhaps more importantly, the public increasingly demands to know which of these chemicals are necessary and why. The new generation of label readers is a far more formidable audience to appease. Straight talk, transparency and thoughtful explanations of its proven medical benefits will protect the reputation tea justly deserves.

There are no reported instances of people being harmed by tea, Peter Goggi reminded delegates. The discussion of pesticide residues is largely centered on bureaucratic procedure, conflicting regulations and the differing rules of various certifying bodies.

It has never been clear to me why apples were singled out when pears, grapes and other fruit tested high in Alar residue, but 25 years ago the disclosure of Alar (Daminozide) in apple juice practically destroyed the apple business. Alar had been approved for use since 1963 but growing evidence of its carcinogenic links led the EPA to propose a ban and the manufacturer withdrew the pesticide from the market.

Public outcry cost apple growers an estimated $100 million according to a lawsuit following a CBS News broadcast on the program 60 Minutes. There is no question Alar was a financial boon to the apple industry. Application improved fruit-set maturity, fruit firmness and coloring, reduced pre-harvest drop and improved market quality of fruit at harvest and during storage, but the threat to human health was too great. Eventually it was proven to be a carcinogen in humans but at a very high ingestion level. It would require drinking 5,000 gallons of apple juice per day to equal the dose that produced tumors in mice. The lifetime cancer risk was set at 5 per million for humans. Generally EPA considers lifetime cancer risks actionable at 1 per million.

Apples once again topped the list of the most pesticide-contaminated produce this year, the fourth in a row. The Environmental Working Group (EWG), a Washington DC based non-profit, annually publishes the “Dirty Dozen” list of produce and a corresponding list of “Clean 15” fruits and vegetables. The residues are from different chemicals, but the fact remains that chemical applications remain important in protecting this crop.

Tea makes neither list because it is not one of the 48 most popular produce products tested annually by the U.S. Department of Agriculture and the U.S. Food and Drug Administration. USDA conducts an analysis of 32,000 samples.

This is not to suggest government regulators should ignore the obvious lapses in enforcement. In the Greenpeace report on Indian tea, 78% of the samples showed DDT residue, a pesticide long ago banned for use on food.

The tea industry tests far more samples and routinely discards leaf that exceeds Maximum Residue Levels (MRLs) established by importing countries. China learned the hard way when European Union buyers found they could not land thousands of containers of tea, at great financial loss. EU inspectors adhere to tough maximums. Unfortunately these differ widely by country making it possible for growers in places like Vietnam to find a market for tea that could not pass inspection in Japan, the US or EU. Uniform MRLs is an important global initiative.

One of the key presentations during the conference was by Christine McIntosh of Eurofins Scientific, a company that analyzes food products for safety and compliance with a range of import regulations.

There are now 450 pesticides, a number so large that it is not financially practical to test for all. Given that many are exotic, a short list might suffice, but neither the US or Canada established MRLs for many of the common pesticides used in tea. This is because regulatory bodies in both countries give priority to pesticides used within their boundaries. Since little tea is grown by either nation, establishing MRLs for these pesticides is not a priority (or likely to suddenly become a priority). Until they are researched and listed, the US assigns a 1 part per billion “default” threshold.

As a result, McIntosh listed 26 pesticides commonly found in tea for which no MRLs exist. In each instance the European Union has tested these products and determined a maximum residue level. In many cases this threshold of safety is well above the 1ppb default used by the US.

McIntosh offered some constructive suggestions beginning with a database of global pesticide suppliers. This will help identify firms engaged in producing suspect chemicals. Reputable firms should have no concerns as they are regulated in the countries in which they operate.

Evaluate risk within the country of origin/use that takes into consideration combinations of pesticides used by farmers and impact on nearby crops.

- Consider regulations (many countries either do not have or do not enforce regulations)

- Establish specifications/acceptable limits (maximum safe residues clearly establish whether illegal, non-approved and unsafe combinations of pesticides are present)

- Implement routine testing programs universally with extensive baseline testing at the onset and less rigorous examination as these chemicals are proven safe)

- View trends over time

- Maintain a monitoring program

Next week I’ll go into greater depth using India’s new Plant Protection Formulations (PPF) rules and the Plant Protection Code (adopted but with enforcement postponed until January 2015).

Gebely Joins David Lee Hoffman

Tony Gebely, a social media favorite in the tea community; promising author and successful online retailer has joined Pu-erh expert David Lee Hoffman, founder of the The Phoenix Collection.

Gebely, the founder of Chicago Tea Garden, has 10 years of digital marketing and web development experience as well as a cornucopia of tea knowledge. He will work alongside Hoffman and his assistant Jeannie Freudenberger to first learn all aspects of the business including sourcing, fulfillment, tea tastings, and marketing.

“I am excited to have Tony join our team as he brings to the table the skills necessary to bring tea to the next generation” said Hoffman, “and he aligns well with the philosophy that I began my tea venture with a quarter of a century ago.”

“I’m excited to work side-by-side with such an esteemed pioneer in the American tea industry. David simply has the best Chinese teas and I could not be more proud to work with him to bring them to the burgeoning tea market” said Gebely.

The Phoenix Collection is a wholesale tea company founded in 2009. Hoffman, who has been called the “The Indiana Jones of Tea,” owned and operated Silk Road Teas which he started in 1990. He sold the business in 2004 but retained his vast inventory of Pu-erh teas which are now offered through The Phoenix Collection. Hoffman was also the subject of a feature-length documentary All In This Tea by Les Blank and Gina Leibrecht. Hoffman has shared his discoveries and techniques online and in YouTube videos with some success. Look for Gebely to supercharge the company’s online presence.

Gebely and his new bride Katie just moved to the Bay Area. His new book is due next year.

To learn more visit: www.thephoenixcollection.com.

Tea Sales in K-Cups

Every single single-cup manufacturer I spoke to at the North American Tea Conference confirmed that sales of tea in both licensed K-Cups and compatible non-licensed capsules are booming. As noted in last week’s post, Package Facts estimates capsules will account for 10% of sales in the bagged/loose category. Paul Higgins, Jr. at Higgins & Burke, Ron Sadler at Twinings North America, Harney & Sons, RC Bigelow, Keith Hutjens, the tea sourcing director at Starbucks and Jeff Allard, director of product development at Snapple, all praised the format as an opportunity for innovation and a means of enticing new tea drinkers.

Every single single-cup manufacturer I spoke to at the North American Tea Conference confirmed that sales of tea in both licensed K-Cups and compatible non-licensed capsules are booming. As noted in last week’s post, Package Facts estimates capsules will account for 10% of sales in the bagged/loose category. Paul Higgins, Jr. at Higgins & Burke, Ron Sadler at Twinings North America, Harney & Sons, RC Bigelow, Keith Hutjens, the tea sourcing director at Starbucks and Jeff Allard, director of product development at Snapple, all praised the format as an opportunity for innovation and a means of enticing new tea drinkers.

IRI Worldwide, a market research firm based in Chicago (www.iriworldwide.com), tallies sales in major retail channels such as drug stores, grocery and department stores like Target, Wal-Mart and Bed, Bath & Beyond. During the 52 weeks ending July 13, sales of loose leaf and bagged tea were up 6.2% in grocery

IRI Worldwide, a market research firm based in Chicago (www.iriworldwide.com), tallies sales in major retail channels such as drug stores, grocery and department stores like Target, Wal-Mart and Bed, Bath & Beyond. During the 52 weeks ending July 13, sales of loose leaf and bagged tea were up 6.2% in grocery  stores to $818 million. Drug stores showed a 13.6% gain to $25 million and multi-outlet chain locations reported an amazing $1.3 billion in tea sales, up 7%. A decade ago grocery stores and supermarkets were the dominate sales channel. Very little tea was sold in drug stores. IRI does not break out sales by format so it is not possible to identify precisely how much of these category gains

stores to $818 million. Drug stores showed a 13.6% gain to $25 million and multi-outlet chain locations reported an amazing $1.3 billion in tea sales, up 7%. A decade ago grocery stores and supermarkets were the dominate sales channel. Very little tea was sold in drug stores. IRI does not break out sales by format so it is not possible to identify precisely how much of these category gains  are from K-Cup sales, but it seems likely that most of the bump in multi-channel and drug is from capsule sales, typically big brands. Another clue is that the big jump in sales occurred after Lipton, Twinings, Celestial Seasonings, Snapple and Bigelow began selling

are from K-Cup sales, but it seems likely that most of the bump in multi-channel and drug is from capsule sales, typically big brands. Another clue is that the big jump in sales occurred after Lipton, Twinings, Celestial Seasonings, Snapple and Bigelow began selling  K-Cups. Several report earning more than $20 million annually in K-Cup sales. Another indication: sales of instant tea (typically in jars) is plummeting. In drug stores category sales fell 31%; in multi-outlet stores sales of instant tea are down 9.3% and in drug stores sales of instant are down 8.9%.

K-Cups. Several report earning more than $20 million annually in K-Cup sales. Another indication: sales of instant tea (typically in jars) is plummeting. In drug stores category sales fell 31%; in multi-outlet stores sales of instant tea are down 9.3% and in drug stores sales of instant are down 8.9%.

? ? ?

Tea Biz serves a core audience of beverage professionals in the belief that insightful journalism informs business decision-making. Tea Biz reports what matters along the entire supply chain, emphasizing trustworthy sources and sound market research while discarding fluff and ignoring puffery.

Tea Biz posts are available to use in your company newsletter or website. Purchase reprint and distribution rights for single articles or commission original content. Click here for details.