Tea Industry News for the week of September 28, 2020

- Tea Sales Accelerate in Canada

- Tea Retailers Cope with COVID

- Delivery and Takeaway Boost Market Share

Tea Sales Accelerate in Canada

Retailers of Fast Moving Consumer Goods (FMCG) are still playing catch-up after six months of record sales while foodservice operators struggle following a 27% decline in visits during the past six months. Canada’s economic recovery has begun, but it will be slow, advises Vince Sgabellone, Foodservice Industry Analyst at The NPD Group.

One of the best performers in FMCG is tea, according to Carman Allison, Vice President of Consumer Insights for Nielsen Canada. “Tea has reported an even higher bump in sales in 2020, than FMCG as a category,” he told 60 online attendees.

Year-to-date (Aug. 15) sales are up 19.6% compared to 2019, a full seven points greater than FMCG overall. Tea sales peaked earlier than total FMCG and have been consistently growing faster, he explained. This pace is an unprecedented 5.4 times greater than fiscal 2019, reaching $28.8 million. COVID contributed 80% of the year-to-date increase adding $25.5 million for an 89% increase in growth above expected, according to Allison.

Both Sgabellone and Allison shared valuable insights with tea industry leaders this week during the “The Present: Reimagined”, a two-day virtual gathering hosted by the Tea & Herbal Association of Canada (THAC).

Sgabellone observed that the Canadian restaurant industry was “growing slowly” in late 2019, with restaurant traffic up 1% for the year and restaurant dollars up 3%, citing NPD Group/CREST statistics through August. Within weeks restaurant traffic decline by 27% and revenue dropped 31%. The restaurant industry has been devastated by the COVID-19 crisis,” he said.

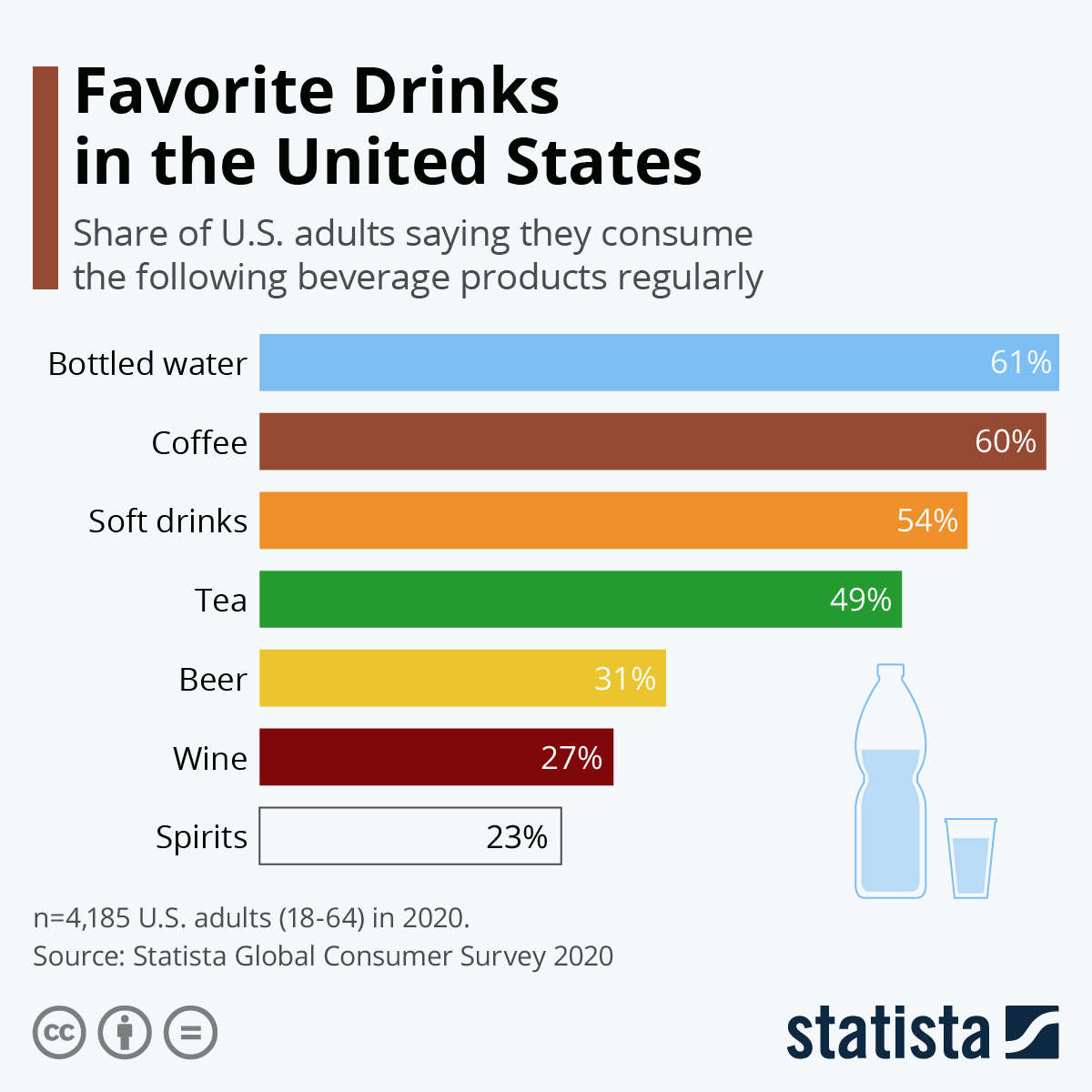

Coffee is flat, carbonated drinks are down as well as beverage alcohol but “hot tea is the category-leading growth on the year” with a 9% growth in spend through August compared to the previous year. Coffee and soft drinks account for a greater share of beverage servings but tea now accounts for a 7% share, according to Sgabellone.

Tea in the Time of COVID

By Jessica Natale Woollard

The reason tea sales should not decline during COVID is that tea is a food product found in virtually every Canadian home, and “food companies should be okay,” says Sameer Pruthee, CEO of wholesale distributor Tea Affair based in Alberta, Canada.

And yet, his business, which distributes around 60 metric tons of tea and blends every year to more than 600 wholesale clients in Canada, the United States, and Asia, has declined approximately 30% every month since the March shutdown. The decline, he noted, is most significant among his retail clients in Canada, where the lockdown was widespread and uniformly enforced from mid-March until the end of May.

Pruthee’s theory for why tea sales are down is that tea is not an “online thing. Tea is social,” he explains.

Customers buy tea after the experience of visiting a tea shop, talking to staff, smelling the varieties, and learning about the leaves and their origins. “If nobody can smell the tea, nobody will buy tea,” he says.

Beginning in March tea retailers supplying local restaurants and cafes watched helplessly as re-orders vanished. Local tea shops with online stores initially reported strong sales, largely to existing customers during lockdowns, but without face-to-face opportunities to introduce new teas, tea retailers must innovate to attract new customers.

DAVIDsTEA provides a vivid example. The Montreal-based firm, the largest tea retail chain in North America, was forced to restructure, closing all but 18 of its 226 stores in the US and Canada due to COVID-19. To survive, the company adopted a “digital first” strategy, investing in its online customer experience by bringing its tea guides online to provide human and personalized interaction. The company also upgraded the capabilities of DAVI, a virtual assistant that helps customers shop, discover new collections, stay in the loop with the latest tea accessories, and more.

“The simplicity and clarity of our brand is resonating online as we successfully bring our tea expertise online, by providing a clear and interactive experience for our customers to continue to explore, discover and taste teas they love,” said Sarah Segal, Chief Brand Officer at DAVIDsTEA. The physical stores that remain open are concentrated in the Ontario and Quebec markets. Following a disastrous first quarter, DAVIDsTEA reported a 190% second-quarter increase in e-commerce and wholesale sales to $23 million with a profit of $8.3 million largely due to a $24.2 million decrease in operating costs. Still, sales overall are down by 41% for the three months ending Aug. 1. Still, when compared to the previous year, profits decreased by 62% with gross profit as a percentage of sales declining to 36% from 56% in 2019. Delivery and distribution costs increased by $3 million, according to the company.

“We expect that the increased cost to deliver online purchases will be less than the selling expenses incurred in a retail environment that have been historically included as part of selling, general and administration expenses,” according to the company.

COVID has changed consumer habits, Pruthee says. COVID first cut off in-person shopping, and then transform the shopping experience due to social distancing. For the tea industry to bounce back, tea companies need to find ways to be part of new customer habits.

Below, Tea Biz looks at how three Canadian tea businesses have adjusted to the new normal of COVID-19.

Enhanced customer service

Free home delivery was Suzanne Tsai’s first response to COVID.

Co-owner of the Tea Centre in Courtenay, B.C., along with her husband, Marny, Tsai sensed at the start of the lockdown in March that it would be important to keep connected with their loyal and local customers. The shop started offering free delivery around the region, even driving to nearby towns to bring people their “creature comforts.”

Delivery was worth the investment in gas and wear and tear on their vehicle, Tsai says. “We were able to maintain our business and our customer base.”

Since March, business has been down approximately 10% to 15%, Tsai says, noting, that their expenses have also been less — the shop had to layoff staff after closing the physical store in March. Since then Tsai and her husband have been working extra hours to fill orders.

Tsai attributes the decreased sales with customers’ inability to visit the store, chat with staff, and smell the teas. “Those days are over,” she says.

The shop reopened with reduced hours on June 1, but the size of their store and social distancing requirements has meant customers can’t go inside the shop; instead, service is offered outside the front door.

People are lined up every day, Tsai says, but they can’t experience the loveliness of the shop and that affects sales, particularly of teawares. “People want to see them, touch them, hold them,” she explains. “And they don’t like the pressure of trying to buy a teapot when there is someone behind them waiting in line to pick up an order.”

But delivery orders and online sales have kept the business afloat. “We did get some new customers because many other tea stores were closed down,” she says, adding that the company nearly reached Christmas-level orders between mid- March and May, when Canada was shut down.

“For a small tea business, we feel like we’ve really held our own.”

Wellness tea promotions

The tourist town of Banff, Alberta, in the Canadian Rocky Mountains faced 85% unemployment during the lockdown. Banff National Park, Canada’s oldest national park, attracted 4 million visitors last year and has received more than three million visitors annually since 2010/11. The Banff Tea Company, typically attracts tens of thousands of visitors from around the world, shop owner Siona Gatshore says, and those visitors frequently turn into online customers.

When the shop shut its doors in March, Gartshore laid off staff and moved the business fully online. But, online sales soared, so she rehired two employees within a few days. Though the Banff Tea Company doesn’t ship many tea wares — shipping costs are prohibitive when mailing breakables, Gartshore explains — tea sales, like at the Tea Centre in Courtenay, reached Christmas levels.

“It didn’t make up for not having the store open, but it was enough to pull us through and pay the bills and keep us moving,” Gartshore says.

Banff Tea Company also increased its customer engagement activity on social media, posting more regularly, sharing information, and doing prize draws for products, something Gartshore had not done before.

She invited people to vote to name a new tea blend, choosing between Uncertain Tea and San-i-tea, a new herbal wellness tea with anti-viral and immune boosting ingredients.

“We highlighted our wellness teas (in our online marketing) straight off the bat,” Gartshore explains, noting sales of wellness teas increased when COVID hit. For the first time, Banff Tea Company also sold dried elderberries, a natural antiviral, which sold well.

“Everyone’s feeling uncertain and stressed. Our Knock Yourself Out! sleepy tea has been our best-selling tea for nine years, and our second is Anx-i-e-Tea. People were buying them to comfort them through lockdown,” she explains.

Ironically, the vote between Uncertain Tea and San-i-tea came out even. “We ended up going with Uncertain Tea since no one could decide,” Gartshore laughs.

With fall concerts, festivals, events and conferences cancelled, Banff Tea Company is anticipating a quiet fall. Gartshore will be focused on planning holiday promotions to boost online sales.

“Our customers will get us through,” she says. “I’m so grateful for our customers. We wouldn’t be here without people thinking, buy local.”

Opportunity for innovation

COVID provided the right timing for Tea Haus owners Stefanie Stolzel and her husband to implement new business development strategies.

The London, Ontario, tea shop, has been located in the downtown Covent Garden Market since 2000. Normally the market is busy with office workers, tourists and shoppers, and Stolzel has an established online shop that has been operating since 2003.

Like the Banff Tea Company, Stolzel laid off staff at the start of the lockdown, only to call them back two days later to help with a surge in online sales.

“Without any additional advertising, our customers seemed to go online and order,” says Stolzel, noting that staff include a handwritten thank you note with each order.

In early 2020, Tea Haus won a $2,500 grant from Digital Main Street, a program of the Province of Ontario and the Government of Canada that helps small businesses boost their digital presence.

“The timing was perfect,” Stolzel says. “The funding had to be spent by May 31, so we invested that funding and our own capital (during COVID) to expand our (digital marketing) efforts.”

Primarily, Tea Haus invested funds into social media ads.

In addition, Stolzel participated in a program in early 2020 through Riipen, a company that matches post-secondary students with companies to help them solve problems. Three marketing classes tackled business challenges for Tea Haus, offering solutions and providing ideas to implement, for example, a social media strategy.

“COVID allowed me to focus on these ideas and read them properly,” Stolzel explains, adding she hopes to implement more of the students’ recommendations this fall.

Like Tea Centre in Courtenay, Tea Centre is operating a booth in front of their store, setting up displays so people can see products up close rather than just online.

Says Stolzel, “People still have money to spend, and they want something nice to treat themselves.”

A time to learn

Despite differences in approaches to selling tea during COVID, the company owners interviewed agree that the COVID experience is a time of learning and trying new things.

“There’s no clear direction right now,” Tea Affair’s Sameer Pruthee says. “We try to see what’s happening and what direction we have to take our companies in. Nobody has an answer right now.”

As Canada adjusts to the new normal, now is a good time to sit back, relax, and have a cuppa. Perhaps the answer will be revealed in the tea leaves.

Tea in Foodservice

Research and Markets projects a 4% increase in tea sales in foodservice during the next four years, a revision accounting for the impact of COVID-19 on sales.

“The growth of food delivery and the takeaway market is one of the prime reasons driving the foodservice tea market in US growth during the next few years,” according to the report Foodservice Tea Market in the US 2020-24. “The market is driven by rising demand for mobile foodservice and the functional benefits of tea as well,” according to the newly released report.

Research and Markets estimates the market will increase by $2.66 billion during the forecast period.

Subscribe and receive Tea Biz weekly in your inbox.