What tea professionals need to start the week —

Coca-Cola’s decision to collaborate with Keurig Green Mountain could put a soda fountain in every kitchen and divert billions of bottles from landfills. The combination presents a great opportunity for tea companies with concentrates… Cupid is torn this week between a desire for chocolate with tea and tea in scrumptious chocolate… a 15% decline in holiday foot traffic slowed mall tea sales… Rabobank predicts slowing beverage growth in the middle class in BRIC nations… former Starbucks executive Alix Box has been named CEO of Canada’s Second Cup which has been bolstered with a large investment by Tailwind Capital.

Coca-Cola Teams with Keurig Green Mountain

The 10-year collaboration agreement announced by Coca-Cola and Green Mountain Coffee Roasters last week represents a significant endorsement of cold beverage dispensers for the home.

Coca-Cola purchased 10% of GMCR’s shares for $1.25 billion as part of the deal which calls for the introduction of a Keurig-made carbonated cold drink dispenser for the kitchen before September 2015.

Public validation of the concept will lead to innovation and a race by brands to develop concentrates and instant beverages previously sold only in grocery or food service.

Public validation of the concept will lead to innovation and a race by brands to develop concentrates and instant beverages previously sold only in grocery or food service.

Last summer Green Mountain Coffee Roasters President & CEO Brian Kelley, a former Coke executive, unveiled plans for a drink dispenser designed to produce a range of cold beverages from tea to soda while diverting billions of plastic bottles from landfills.

Green Mountain will be Coke’s exclusive partner for production and sale of the Coca-Coca Co. branded single-serve, pod-based cold beverages.

Tea could benefit greatly from the move as concentrates gain favor. Coke owns several tea brands including FUZE, Gold Peak and Honest Tea. GMCR has licensed its K-Cups™ technology to several hot tea beverage partners including Twinings, Lipton, Celestial Seasonings and Snapple.

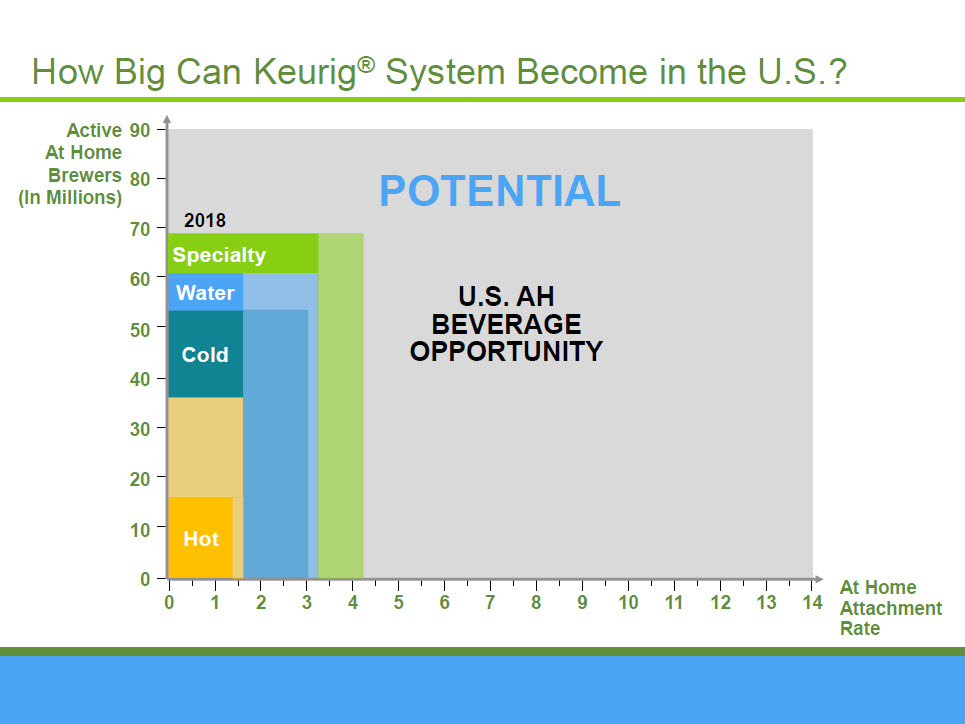

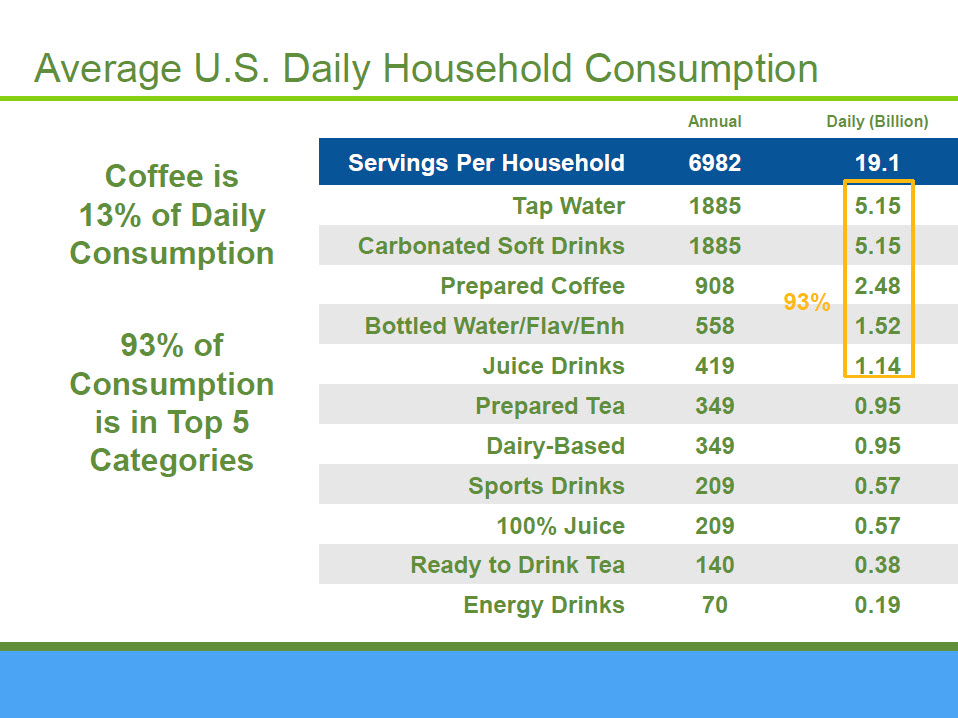

Keurig is a personal beverage system company with a mission to put a Keurig brewer on every counter and a beverage for every occasion, Kelley told investors. He estimates the U.S. beverage industry at $150 billion with 7.5 8 oz. servings per person per day. Total servings are approximately 768 billion (excluding alcoholic beverages). In this tally carbonated soft drinks tie with tap water at 1,885 servings per household.

He presented a chart showing 14 beverage occasions per household and estimated 90 million households own a coffee brewer. The company has sold 30 million hot beverage brewers expects to sell 4 million more per year. He projects a Keurig hot-cold combination in more than 50 million homes.

He presented a chart showing 14 beverage occasions per household and estimated 90 million households own a coffee brewer. The company has sold 30 million hot beverage brewers expects to sell 4 million more per year. He projects a Keurig hot-cold combination in more than 50 million homes.

Sales of carbonated soda have been declining for a decade as consumers question the health consequence of drinking heavily sweetened beverages. Sales of regular soda declined 3.3% in the year ending November 2013. Diet soda declined 7.2% during that same period. Coke’s entire range of brands will be available, a line that includes juices, colas and tea.

In home dispensers return control over calories to those seeking a refreshing drink. Younger drinkers welcome the ability to customize beverages and innovative manufacturers are already demonstrating the ability to deliver on the possibility of a soda fountain in every home.

Consumers have been warming to the idea of homemade cold drinks for some time. SodaStream International Ltd. is an Israeli company founded in 1903 with a growing reputation globally. Its in-home carbonation system is installed in 7million homes in 45 countries. Sales revenue has average 33% growth during the past five years but the company is relatively small with 2013 earnings of $562 million. Coca-Cola earned $47 billion last year and GMCR earned $4 billion. SodsStream spokesman Yohah Lloyd told the Wall Street Journal that the at-home carbonated beverage industry is worth $260 billion. SodaStream is currently sold in 15,000 U.S. stores.

The move will likely force SnappleDrPepper and PepsiCo to enter the category, perhaps as licensed partners with Keurig or allied with SodaStream. Last summer PepsiCo appeared ready to acquire SodaStream for $2 billion. An acquisition or big-soda partnership is more likely as it could quickly put big brand concentrates in homes. Currently SodaStream uses generic syrups consumers add themselves. To insure consistent results, the big bottlers like Coke want greater precision so that the drink delivered at home tastes the same as canned or bottled soda from the store.

Left to be seen is the ability of Keurig to produce a machine that makes 2 liters of soda for around $1. Coke will not mark down its concentrate and undercut its bottling business. (Coke recently purchased its network of bottling companies.)

Keurig is likely to sell its cold beverage dispenser for around $200. It will take a lot of soda servings to justify that price.

Sources: Seeking Alpha, GMCR, Wall Street Journal

Tea Treats for Valentine’s Day

Tea Treats for Valentine’s Day

Gift givers will spend $1.6 billion on candy for Valentine’s Day according to CNN, and that includes 58 million pounds of chocolate. Tea lovers prone to a love of these tasty treats are fortunate that they can double their pleasure with chocolate-infused teas and tea-infused chocolates.

Chocolate teas have become increasingly popular as an entire segment of “dessert teas,” has taken off. Harney & Sons has Chocolate Tea which was created as a commission from Chocolatier magazine. Mighty Leaf developed a Chocolate Truffle Tea Collection which includes an herbal concoction of chilies and chocolate chips and another with masala spices; a rooibos with mint and cacao nibs; pu-erh with cocoa; and a black tea with cacao nibs and orange and another with pear, caramel and chocolate chips. Numi Tea also offers its own version of Chocolate Pu-erh with cocoa, vanilla, and orange peel. Tea Forte’s Dolce Vita Ribbon Box is not only beautiful, but packs a chocolate punch with a Belgian Mint and Coco Truffle. The Art of Tea blended the flavor of bananas with chocolate and peppercorns in their Chocolate Monkey treat. Simpson and Vail will keep that sweet tooth satisfied with Chocolate Caramel Black Dessert Tea, Chocolate Chai and Cinnamon Chocolate Brownie Organic Black Dessert Tea.

The other side of the menu reveals the decadent category of tea-infused chocolates. The Tea Room has a wide array of tea and herbal chocolate bars to tempt tea lovers: milk chocolate with mint tea, jasmine tea, chai, or honeybush; white chocolate with chamomile and honey; dark chocolate with earl grey, raspberry rooibos or Lapsang Souchong; or extra dark with green mate. Chocolatier Thomas Haas also has a line called “Tea” which offers bars of matcha with white tea, milk chocolate chai, and dark chocolate rooibos. If truffles hold more appeal, Arbor Teas offers a truffle 6-pack. Ogunquit, Maine’s Harbor Candy Shop offers molded chocolate infused with tea as well. The most striking in this category may be Charles Chocolates’ Tea Collection created in collaboration with Teance Fine Teas packaged in a stunning edible chocolate box.

The kitchen savvy could can take matters into their own hands and try making their own earl grey truffles at home.

Surge in Online Buying Decreased Holiday Foot Traffic

Howard Schultz voiced a warning last week that beverage retailers should heed.

During the company’s First Quarter earnings call the Starbucks CEO noted that in-store foot traffic at traditional mall and well-known department stores declined 15% in December.

He does not believe the reason was harsh winter weather or fewer shopping days. Instead he points to a surge in online sales that thinned crowds of holiday shoppers. Fewer shoppers meant fewer visits to coffee shops in malls and retail outlets this year.

Holiday spending increased to 10% on desktop devices with mobile purchases accounting for an additional 2% of holiday sales, according to comScore (SCOR), an internet data tracking service. There were 10 days following Thanksgiving when online purchases exceeded $1 billion per day, according to comScore.

The U.S. Commerce Department estimates e-commerce accounts for about 6% of total U.S. retail sales. Three quarters of retail sales are still completed in-store. In fact, in-store retail sales increased 2.7% over the holidays, according to ShopperTrak. The bump was attributed to shoppers going online to research items and then visiting stores to complete the sale. Sales overall increased only 2.3% compared to 2012 according to data collected by MasterCard.

Of concern to beverage retailers are the number of mall anchors including Sears, J.C. Penny and Macy’s that announced hundreds of store closings in the aftermath, with Target eliminating jobs and even Wal-Mart reporting same-store sales declines at 100 stores in the U.S. Amazon was the top rated vendor in mobile satisfaction and had the highest web satisfaction rating, according to analytics firm ForeSee. Keurig.com ranked third.

According ForSee’s survey of 67,600 shoppers, “the most satisfied shoppers this holiday season were the ones that interacted with a retailer across multiple channels.”

The smaller crowds were certainly still interested in sharing a cup of coffee, Schultz observed.

Revenue rose substantially for the coffee chain with same store growth of 5%; an increase in store visits and the fact that customers loaded $1.4 billion onto loyalty cards – a sum $230 million greater than last year. Starbucks revenue grew 8% in the Americas to $3.1 billion for the quarter with the opening of 142 new stores. Operating income grew to $732 million and margins improved to 23.8%.

“There’s no question that the month of December was an inflection point in the U.S. retail business,” said Schultz. He predicts declining in-store visits due to the so-called “Amazon effect” has permanently changed in-store shopping behavior regardless of season.

“What I mean by that specifically is the “Amazon effect” the power of e-commerce all over the country and the world is going to have a significant effect on pedestrian shopping, mall shopping just as it had in December,” Schultz later told CNBC.

“We are navigating through what I believe to be a significant sea change,” Schultz told CNBC. “We’re going to be talking about this for quite some time. I would not want to be a traditional brick-and-mortar retailer that did not have mobile payments and that did not have social and digital media. Those companies are going to find themselves significantly challenged in 2014 and beyond.”

Loyalty is low. ForeSee found that only 12% of consumers surveyed considered one company when making a purchase and that 49% viewed the company they visited as no better than the several other companies they considered when shopping.

“Since customer service is one of the primary drivers of in-store satisfaction, retailers that provide the best in-store service will reap the rewards,” according to ForeSee.

Retail experts recommend that brick-and-mortar ventures establish smaller networks of stores situated in highly visible locations with fewer square feet of space. These stores benefit from an extensive e-commerce business and less inventory in store rooms. Fulfillment centers carry additional stock which is delivered direct to customers or to stores for pickup.

Indoor malls are less appealing than outdoor malls and stand-alone stores. The last indoor mall to open in the U.S. was in 2006.

Rabobank Predicts Beverage Growth to Slow

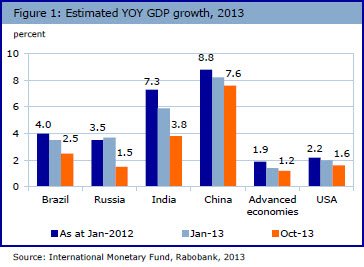

NEW YORK, NY – Slower expansion of the middle class in four fast-developing countries means the “tailwind is moderating, leaving global beverage companies with the task of finding new market opportunities and growth strategies,” according to Rabobank Food & Agribusiness Research.

“Back in 2001, when the world was first introduced to the term BRIC, an acronym for the four fastest growing emerging markets of Brazil, Russia, India and China, few beverage industry executives could envisage just how profound an impact these countries would have on the global beverage industry’s growth in the decade ahead,” according to the eight analysts who compiled the just released report: Beyond the Yellow BRIC Road: Finding Growth in Global Beverages.

The largest economic transformation in modern history established an entirely new middle class, according to the report. The outlook suggests beverage manufacturers consider smaller markets and accept that in North America and Western Europe soft drink sales will remain stagnant, providing an opportunity for water and ready-to-drink tea.

“Bottled water is the clear leader in global soft drinks volume growth, with over 242 billion liters which was 38% of total soft drinks volume in 2012,”according to the report. Growth of 5% per year is expected through 2017. Water will deliver 55% of projected volume growth in soft drinks.

Due to the negative health image of CSDs (Carbonated Soft Drinks), volume of carbonated beverages will continue to slide and value is projected to decline 1% in North America through 2017 with less than 1% growth in China, according to Euromonitor.

“Both Coca-Cola and PepsiCo are struggling to find any growth in CSDs as consumers shift to healthier alternatives, such as bottle water and ready-to-drink (RTD) teas,” according to the report.

“Growth of soft drinks will continue to move to lower priced, emerging markets meaning volume growth will continue to exceed value growth,” according to the report.

Fruit juice volume is expected to grow by 3% in 2014. This growth is dominated by BRICs, which together account for almost 60% of the total increase in liters.

“The global tea marketplace remains highly fragmented and therefore provides ample room for large tea companies to expand across international markets in 2014. This is especially so for China, which is forecast to account for half of global tea growth through 2017, according to the report.

There has been limited merger-and-acquisition activity and industry consolidation in the tea segment has been slow, according to Rabobank analyst Ross Colbert. The top ten global tea brands account for 30% of the total tea market, estimated at $40.7 billion. Unilever (Lipton) holds an 11.7% share of retail value with Tata Global Beverages (Tetley) with a 3.1% share and American British Foods (Twinings) with a 2.5% share.

“These three are the only truly global competitors in tea, and while they remain strong in mature markets across western Europe and North America, their challenge is to continue growing organically and penetrate the important tea markets of China, Russia and Japan,” according to the report.

China, which is the world’s largest tea producer has a low per capita consumption outside the tea growing regions. The country is forecast to account for half of global tea growth through 2017. Unilever’s market share in China is 1.6% “and neither Tata nor Twinings have any presence there today.” These companies will have to acquire or establish partnerships with local players and develop new lines to meet the demand for products like Strong Milk Tea (black tea sweetened with condensed milk) and Xiang Piao Piao (instant milk tea).

China, which is the world’s largest tea producer has a low per capita consumption outside the tea growing regions. The country is forecast to account for half of global tea growth through 2017. Unilever’s market share in China is 1.6% “and neither Tata nor Twinings have any presence there today.” These companies will have to acquire or establish partnerships with local players and develop new lines to meet the demand for products like Strong Milk Tea (black tea sweetened with condensed milk) and Xiang Piao Piao (instant milk tea).

“Beverage companies must now adapt to slower growth in BRIC markets by implementing new strategies to reach consumers more efficiently,” writes Colbert.

“Strategic initiatives such as direct-to-consumer selling, co-manufacturing and developing more efficient distribution platforms can help mitigate the impact of softer volumes in BRIC markets,” he said. Learn more: Rabobank Food & Agribusiness

Source: Rabobank

Alix Box Named Second Cup CEO

MISSISSAUGA, ON – Alix Box has been appointed President and Chief Executive Officer of Second Cup Inc., Canada’s largest independent chain of coffee shops.

Ms. Box, who will also serve on the board of directors, succeeds Stacey Mowbray, who will leave the company to pursue other opportunities. Box is a former Starbucks Coffee Co. executive responsible for managing 675 stores across Canada. Second Cup operates in every province and has more than 350 stores in Canada.

Tailwind Capital purchased 500,000 shares or about 5% of Second Cup’s shares after the announcement, paying $3.60 a share to Pheland Parties, the second largest investor in the chain at 28%.

During the past six years, Box has been a member of the senior leadership team at Holt Renfrew, most recently as senior vice president of retail at the luxury goods firm. During this period, she helped lead a strong resurgence of service and sales growth, according to a company press release.

During the past six years, Box has been a member of the senior leadership team at Holt Renfrew, most recently as senior vice president of retail at the luxury goods firm. During this period, she helped lead a strong resurgence of service and sales growth, according to a company press release.

Ms. Box worked at Starbucks for 10 years and was vice president of operations of both licensed and company stores.

“Alix possesses the ideal combination of related retail experience and leadership attributes to lead Second Cup into a new era of success,” said Second Cup Chairman Michael Bregman. “She has an extraordinary track record and is driven to deliver sustainable, long-term value for Second Cup shareholders and franchise partners,” he said.

“I am very excited to join Second Cup. Second Cup has an iconic Canadian history and I believe together we can build an even brighter future. I am eager to work with our loyal franchise partners to improve café performance while providing Canadian coffee lovers with an upgraded, modernized vision for the future,” said Box. She assumes her responsibilities Feb. 24. Learn more: www.secondcup.com

— — —

Tea Biz serves a core audience of beverage professionals in the belief that insightful journalism informs business decision making. Tea Biz reports what matters along the entire supply chain, emphasizing trustworthy sources and sound market research while discarding fluff and ignoring puffery.

Tea Biz posts are available to use in your company newsletter or website. Purchase reprint and distribution rights for single articles or commission original content. Click here for details.