Tea Industry News for the week of April 27

- The Pandemic’s Impact on Specialty Tea

- Starbucks Reports 60-70% Decline in US Sales

- McKinsey & Co.: Consumers Are Readily Abandoning Brands

- Sri Lanka: March Tea Exports Drop by Half

- Retail Innovations: Samovar Tea Lounge Offers Free Meal Monday.

It is too early to predict the impact of a looming economic downturn with accuracy. Still, a mid-April survey of U.S. tea retailers by Sinensis Research found that 81.8% of the specialty tea business has laid off staff, with 31.7% of American tea shops temporarily closed.

Abraham Rowe, who conducted the survey, reports 2.3% of tea businesses are permanently closed two months into the crisis. “I expect this number to increase if the lockdowns last through the end of May,” he said.

“Many of the businesses still operating report that they expect to close if sales do not pick up, or if they are unable to secure assistance in the form of loans or grants to continue operations,” according to Rowe.

“Specialty tea business revenue is expected to decline to 65% of 2019 sales, suggesting an overall loss of about $133 million to $154 million in tea sales by specialty tea vendors, and likely much greater losses from coffee shops and cafes that sell specialty tea,” writes Rowe.

“The coronavirus pandemic has devastated people and businesses across the world,” says Rowe, but “it’s too early to get a complete picture of the pandemic’s damage to the industry.”

- Around 9,200 of the jobs held by tea professionals are gone. The average number of staff laid off at closed business is approximately 10, and at open businesses around 5. Layoffs and store closures represent a “devastating loss of talent and expertise” since the crisis first curtailed business activities in March, according to Rowe.

- Most tea business owners remain optimistic. Rowe found that 93.3% of shop owners expect to reopen after the pandemic has ended and restrictions are lifted.

- The number of businesses selling online has increased by 7%, and many companies have noted a significant increase in online sales and curbside pickup.

- Shops that weather the initial lockdowns “can expect sales to decline between 20% and 80% this year, depending on their region and the extent to which the shop had to close or change their business model.”

- Supply is becoming a challenge: 31% of open businesses report supply chain interruptions.

Revenue Forecast

Assuming that restrictions limiting normal operations last six months, “I predict 2020 revenue to decline to about 65% of the estimated $340 million to $400 million in 2019 sales,” said Rowe, adding that 96% of businesses that remain open expect revenue to decline for the year. “Very few of these businesses expect to grow in 2020,” he said.

A massive portion of specialty tea is sold by cafes and coffee shops, many of which are currently closed. “The number of businesses doing in-store bulk tea retail has declined by almost 50%, and the number of businesses serving prepared specialty tea has declined by more than 50% — afternoon tea service has ended almost entirely in the United States,” he said.

Rowe cautions, “these data only represent the impact on the retail market, and not the wholesale market, though a few comments on the impact on the wholesale market are included in his report.”

“I suspect that the wholesale tea market has seen even more damage than the retail market because of this, with revenue declining perhaps as much as 75% or more,” he said. Tea shops have reported that tea wholesale to foodservice clients has declined to zero, and it seems possible that larger wholesalers are feeling this same impact.

Rowe, who founded Sinensis Research in 2019, said his firm is providing research on the pandemic and its impact on the tea industry at no cost.

“Please support this research by exploring our products, such as the State of the Industry Report ($29.95). If you’d like to work with us to get up and running as an online store and get sales moving again, get in touch,” he said.

See related: Tea Shop Closings.

Starbucks Comps Decline

While Starbucks reported a decline of only 3% in comparable U.S. store sales for the quarter ending March 29, same-store sales plummeted 65-70% as the new quarter began, according to executives. Half of the company’s U.S. stores are now closed, leading to a 46% decline in earnings. Most workers will return to cafés in May, and the chain expects to reopen most closed locations in June, according to Good Housekeeping Magazine. Full-year revenue is expected to decline by almost 10%. In 2019 same-store fourth-quarter growth was a positive 6% for the U.S. division.

Consumer Behavior Insights

McKinsey & Co. is closely tracking changing consumer behavior in response to the COVID-19 crisis.

“Consumer behavior has changed across several dimensions: consumption by category, channel selection, shopper trip frequency, brand preference, and media consumption. These shifts, combined with forecasts for virus containment and economic recovery, are critical for commercial strategies,” according to McKinsey. Beverage sales in the grocery channel were up 36% during the period March 1-21, a situation that has led to restocking issues as consumers stocked up. Consumers are making 15% fewer shopping trips and buying enough for two or more weeks.

“Our research found that 30 to 40% of consumers have been trying new brands and products. Almost half of these consumer switches are because the desired product is unavailable, while an additional 19% decided to purchase cheaper available options. Of the consumers who switched brands, 12% expect to continue to purchase the new brands after the pandemic,” writes McKinsey.

Sri Lankan Tea Exports Decline

The bottom fell out of Sri Lanka’s generally robust tea export market in March following dismal yields in February. Tea export volume and value each declined by half compared to March 2019. Tea in packets dipped to 6.3mn kgs from 12.7mn kgs in 2019. Production of teabags dropped more than 1 million kilos from 2.4mn kgs in 2019 to 1.3mn kgs in March 2020. Revenue for all categories of tea was SLRs11.6 billion ($60.1 million) in March 2020 compared to SLRs22.5 billion ($116.7 million) in March 2019, as reported by the Daily News. Anil Cooke, managing director at Asia Siyaka brokers, explained that export activity virtually came to a halt before the government agreed that growing and processing tea is an essential industry.

Retail Innovations

Samovar Tea Lounge in San Francisco introduced Free Meal Monday in April and has since served 1,100 customers a free lunch of rice stew with vegetables, eggs, and tea. The give-away promotes sophisticated Samovar Life subscription meals starting at $19 for breakfast, $27 for lunch, and $37 for dinner. Meals are delivered Thursday through Sunday, and pickup service is available at all three of the 20-year-old tea room’s locations. Shipping is free from the company’s online tea store. The company is also delivering groceries.

“We’ve never launched so many programs in such a compressed amount of time and while facing so many challenges.”

Samovar Founder Jesse Jacobs

From its inception, Samovar founder Jesse Jacobs viewed customers as a community celebrating the tea lifestyle. That is why he chose the URL: www.samovarlife.com.

Jacobs generates more than $1 million a year at his tea lounges, which feature wholesome food and superior tea. He is grateful to customers, rewards loyalty, and is genuinely concerned with their well-being. He will soon launch a virtual meditation and tea tasting. “I just keep waiting for word that the covid-19 situation has a clear solution, some clean exit plan that gets things “back to normal.” But the reality is, well, more sobering,” he writes. Check out his latest blog post: Reality As It Is: What a U.S. Admiral and Burmese Meditation Master Taught Me About Surviving the COVID-19 Pandemic.

Upcoming Events

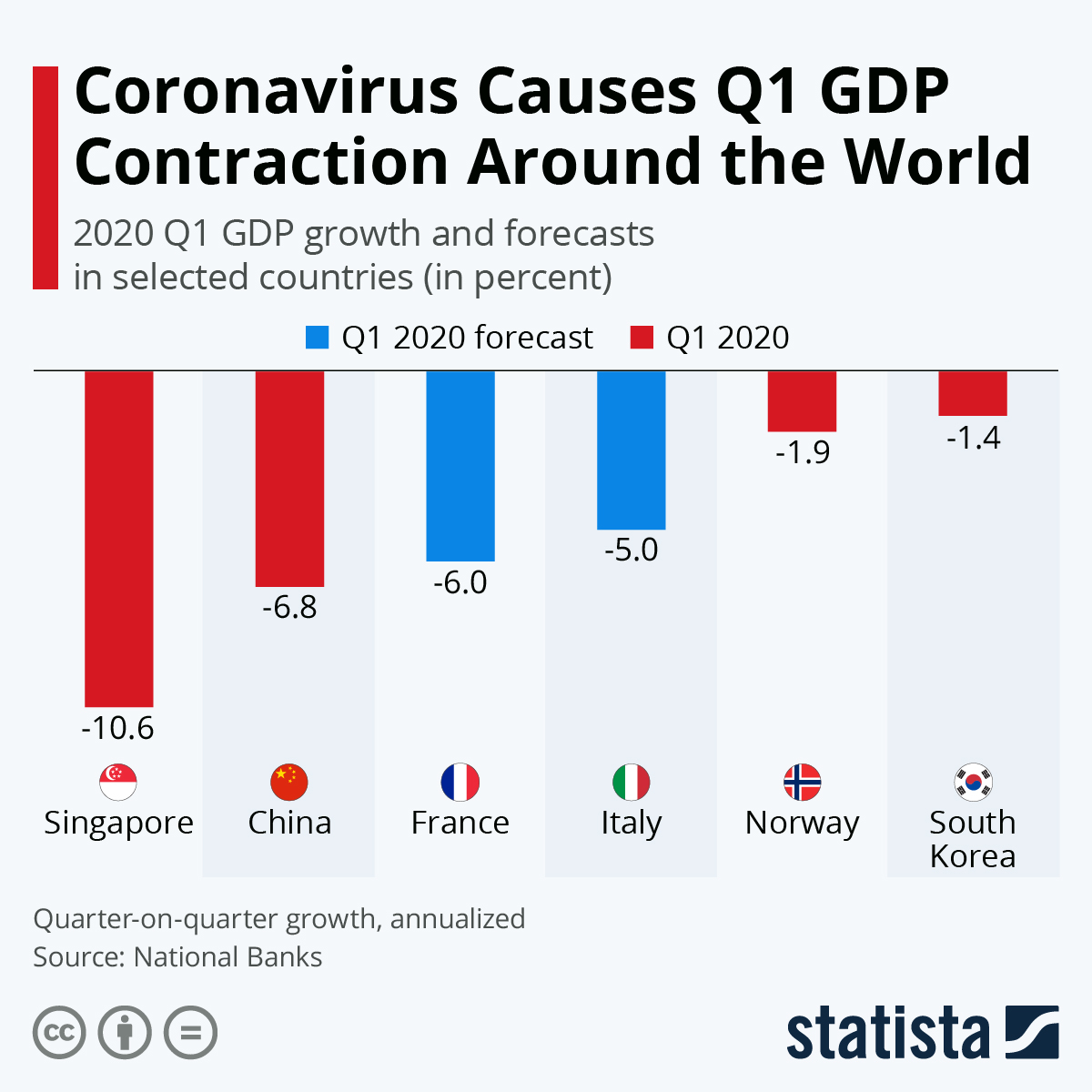

The U.S. will report 1QTR GDP on May 1. Globally the impact on economies is “fairly catastrophic” writes market researcher firm Statista.

Singapore reported its economy contracted by 10.6% between January and March despite having initially kept the virus in check. The historic and unprecedented drop in Chinese GDP of 6.8% already made headlines. Japan’s economy contracted by an annualized 7.2% in 4QTR 2019 and is expected to decline another 5% in 1QTR 2020.

Central Banks in France and Italy have projected quarterly losses between 5% and 6%. Experts expect the U.S. economy to contract by 5-10% and the UK economy by as much as 13%.