China is making its biggest splash in tea in modern times this summer at Expo Milano 2015 the world’s largest food and beverage tradeshow.

“Never before has Italy hosted so many tea experts from China all together with so many companies representing the excellence of Chinese tea,” writes Marco Bertona, chairman of the Tea Association of Italy. The China Pavilion in Milan is shaped like fields of wheat rippling in the wind to reflect the theme, “Land of Hope, Food for Life.” It has been visited by almost 250,000 tourists since it opened in May.

“Never before has Italy hosted so many tea experts from China all together with so many companies representing the excellence of Chinese tea,” writes Marco Bertona, chairman of the Tea Association of Italy. The China Pavilion in Milan is shaped like fields of wheat rippling in the wind to reflect the theme, “Land of Hope, Food for Life.” It has been visited by almost 250,000 tourists since it opened in May.

“Chinese Tea Culture Week” which ended Sunday brought to light a political mandate to make China the world’s greatest tea exporter.

In 2013 Xi Jinping, China’s new president, proposed The Belt and Road Initiative, a modernization of the Silk Road Economic Belt and the 21st Century Maritime Silk Road. The goal is reviving ancient trade routes between Asia and Europe. The proposed trade and infrastructure network passes through more than 60 countries and regions, with a population of 4.4 billion. Nations along the route produce more than 80% of the world’s supply of tea.

Unlike past initiatives which emphasized quantity over quality, this time China is determined to dominate the global market for premium tea.

In 2014 more than 80% of China’s tea exports were low grade green tea destined for Africa, Europe and Russia. Right now there is a surplus of commodity tea and a scarcity of premium tea making this a good time to export fine tea. During the past decade the green tea that China exported sold for between $1 and $2 per kilo. In December 2014 the world average price for tea sold at auction was $2.56/kg down from $2.72/kg the previous year. The average dropped an additional 30-cents to $2.42/kg by the end March 2015, according to statistics compiled by the Central Bank of Sri Lanka.

China Daily reports that the average price of Chinese tea increased to $4 per kilo during the past few years. Last year Chinese tea exports $4.19 per kilo. This is a big improvement but is still not enough to be profitable, according to Chinese traders.

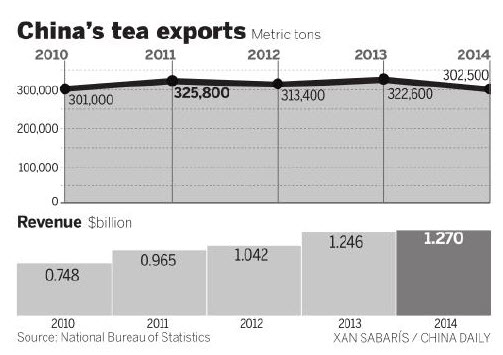

China’s tea market was valued at $56 billion (RMB 350 billion) in 2014. Exports comprise only $1.27 billion of market value, but were up 2.1% compared to 2013. Export volume declined 7.5% during that same period, an indication that China is shipping greater quantities of higher-value tea.

China’s tea market was valued at $56 billion (RMB 350 billion) in 2014. Exports comprise only $1.27 billion of market value, but were up 2.1% compared to 2013. Export volume declined 7.5% during that same period, an indication that China is shipping greater quantities of higher-value tea.

Sri Lanka, the world’s second largest tea exporter, gets the highest average price for commodity teas auctioned anywhere in the world. But the Colombo Tea Auction average is still less than $5 per kilo. Asia Syaka, a global commodities brokerage notes “Sri Lankan orthodox black tea continues to command premium pricing in the international market with prices averaging $4.97 per kilo.”

Specialty teas, in contrast, sell for $150 a kilo with some bringing $350 to $400 per kilo.

Untapped Capacity

In 2013 China was the world’s second-biggest tea exporter at 322,600 metric tons behind Kenya’s 494,400 tons. That year Sri Lanka exported 319,600 metric tons. In 2014 Sri Lanka stepped up exports, setting a record at 327,800 metric tons and China fell to third.

China is without doubt capable of meeting global demand for premium tea. It is the only large tea producing country capable of mass producing all six kinds of tea. China already produces 40% of the world’s tea and is developing thousands of additional acres per year. Tea is grown there on 6.7 million acres (2.7 million hectares) and it is exported to 120 countries. China’s tea is marketed by more than 200,000 companies representing the work of 30 million growers.

China retains its customary lead in the production of green tea, exporting 79% of the global total and accounting for 80% of value. In most instances exported Chinese tea is blended with herbs and fruits. In the US sales of green iced tea have increased significantly as national restaurant chains promote green tea’s health benefits. At least 10% of the nation’s restaurants now serve green tea alongside traditional black.

Despite its massive production capability “China is not strong enough in exports of tea leaves, tea extracts and deep-processing elements which are fundamentals of the tea industry,” according to Wu Zhibin, vice chairman of the Chinese Tea Culture International Exchange Association told Taiwan-based Want China Times. Deep-processing is the Chinese term for what in the west is known as value-added tea.

“The domestic market values low-production, handmade teas but the global tea market prefers mass-produced teas that are standardized in quality and taste,” according to Wu Jing, editor-in-chief of tea portal chayu.com. He told China Daily that “export teas are grown specifically for that purpose and not consumed domestically.”

Tea Culture Week at the Chinese Pavilion is an opportunity “to support top brands of Chinese tea industry in their path towards growth and worldwide development,” said Zhibin. He praised the top Chinese exports brands which were recognized at as special award ceremony in Milan.

“With rising production costs in China and competition that is likely to intensify, Chinese tea producers have to find new strategies to boost Chinese brands and their sales on the global stage,” says Ji Xiaoming, president of Jingwei Fu Tea Co and chairman of the Shaanxi Tea Association.

“Only if the Chinese tea industry is strong, the Chinese tea culture can be innovative and can be promoted all around the world,” Wu told Xinhua News Service.

Unprecedented opportunity

China Daily reports that “One Belt, One Road” is a rare opportunity to turn Chinese tea consumption into a global phenomenon.

“That is the dream of the country’s tea companies – which are still largely unknown to the world. They are ready to grab a piece of the action in an anticipated market boom,” according to the newspaper.

“The Belt and Road Initiative is not just a rejuvenation of the ancient silk road, but also a comeback of the ancient tea road,” said Jiao Jialiang, chairman of LongRun Group, a Chinese conglomerate specializing in food and health products.

Jiao, who is also a member of the 12th Chinese People’s Political Consultative Conference, told the newspaper that “China’s tea industry will embrace an unprecedented window of opportunity as the Initiative presses ahead.”

Growers and producers spent generations refining the Chinese way of manufacturing tea with its many unique regional variations,” according to the newspaper: “Tea is not simply beverage, but a unique opportunity to share China’s culture.”

“It’s believed the practice of tea culture can take the spirit and wisdom of humans to a higher level, and its study covers a wide field with rich content,” the paper reported.

Tea culture will lead the way boosting the Belt and Road Initiative, said Jiao, “as tea culture spreads around the world, the whole industry will take off,” he said.

Although export figures may continue to trough in the short term, says Wang Jianrong, director of the China National Tea Museum: “The future of Chinese tea exports will be bright if we continue to penetrate overseas markets with tea culture, something that is not reflected in trade figures.”

? ? ?

An informal assessment of China’s export market for tea.

STRENGTHS

China has the land, tea varieties, tea quality, government incentives and motivation to excel in tea exports. The growth of tea retail outlets (T2, Teavana, DavidsTea, TenRen) is a very promising development. 1400 years ago China was the top tea exporter and even after India replaced it as a quantity supplier China always offered more varieties and higher quality orthodox, remaining dominate for centuries. India is the only producing country with similar capacity and it cannot effectively compete. Kenya will remain the dominate commodity supplier of black tea, but remains an insignificant supplier of green. Anything the Chinese can do with green they can industrialized and scale for black, but doing so is not profitable with Sri Lanka, India and Kenya in the picture. China is expert at orthodox green and while it will step up its black tea production for Asian consumption, European and US export, it will make its greatest gains in premium green/white, pu-erh and oolongs. China’s RTD tea market is valued at about $29 billion. China’s Ting Hsin International Group not only dominates China’s RTD market but the international RTD market as well with a 10% global market share, according to a financial report by LD Investments, published by Seeking Alpha. Look for breakouts in RTD and value-added tea products from concentrates and extracts to supplements and cosmetics. These are more likely to be developed in collaboration with Japan (ITO EN) and Taiwan (TenRen, Tingyi and Master Kong) using inexpensive Chinese tea from the mainland. Right now China is primarily developing extracts and “deep-processed” tea for its own domestic market.

WEAKNESS

Globally the demand for black tea is much greater than green. Right now there is a glut of commodity black teas and a shortage of “quality” CTC that is clean, certified and reasonably priced. China loses money producing cheap green and loses volume if they focus only on premium. Conversion to a dominate black tea supplier offers little financial incentives. Ultimately demand for fine green teas will grow due to its health benefits and the adoption of green by foodservice (in US Wendy’s green iced tea at 6,000 stores). Tea exports represents such a tiny fraction of foreign trade that the Chinese government stands to gain very little (other than prestige) from the increase in tea exports. Tea exports earned $1.27 billion which represents about .056% of China’s $2.25 trillion exports. Electronics and other agricultural products generate a lot more money than tea. Unlike the more profitable exports which receive significant government support, much of the investment on outbound marketing will be made by the 200,000 existing tea companies, none of whom are well known brands. Even the largest holds minuscule market share compared to multi nationals like Unilever, Tata Global Beverages or Nestle.

OPPORTUNITY

Chinese tea culture is fascinating, varied and universally appreciated. China exports tea to 120 countries. The country will more fully develop its impressivle portfolio of prized teas (premium green, oolongs and pu-erh) and that will generate significant income for regional producers willing to undertake mass production. Ultimately these firms will spend the money it takes to promote their offerings in Europe and North America. China’s domestic market currently values low-production, hand-made teas. The global tea market prefers mass-produced teas that are standardized in quality and taste. In time China will show the benefit of its hand-made teas by making them more available in the global market while at the same time collaborate with Western ventures such as Starbucks/Teavana and Unilever/T2 to produce more commercially successful mass-market teas. In sharing its finest teas China gradually transitions from a commodity producer earning $4 per kilo to a quality producer capable of marketing teas at 10-times that rate and with the capacity to supply the entire world’s demand for premium teas.

THREAT

A slowing economy makes it more difficult for Chinese firms to invest the marketing dollars it takes to win share in export markets, but its own domestic demand for cleaner tea will help offset these costs. Learning to market value-added tea domestically is a precursor to global expansion and tolerance for the millions it takes to promote a Lipton or Tetley brand (ie. its latest global ad campaign cost Lipton $40 million, no Chinese company has ever invested that kind of money to promote a tea brand). Another threat is global instability that impacts trade (China territorial expansion, tension with Japan, aggressive behavior by surrogate North Korea) are factors. However, the single greatest threat in my view (and a primary motivation for exports) is the fact that young people in China consider traditional tea “old fashioned” and are not practicing the tea traditions of their parents. Consumer surveys reveal that nearly 70 percent of those born in the 80’s do not like to drink tea. This rises to 95% for those born in the 90’s. Tea is not cool, shops are largely antiquated and there is no marketing beyond basic grocery display. Relatively little good tea is purchased in grocery. Ultimately tea must appeal to a new generation of consumers. As one critic noted: “if all the tea stores look like archaeology dig sites and antique stores, then it won’t attract a lot of customers.” Revenue from a lively domestic market is essential to expansion of exports.

? ? ?

Tea Biz serves a core audience of beverage professionals in the belief that insightful journalism informs good decision-making in business. Tea Biz reports what matters along the entire supply chain, emphasizing trustworthy sources and sound market research while discarding fluff and ignoring puffery.

Tea Biz posts are available to use in your company newsletter or website. Purchase reprint and distribution rights for single articles or commission original content. Click here for details.

One response to “China’s One Belt, One Road – Need to Know”

Reblogged this on greentealicious and commented:

An interesting article about China’s tea market.

The green tea craze is growing… and I wouldn’t be surprised if it does surpass the popularity of black tea.