What tea professionals need to start the week. —

Teavana is on a roll a year after its acquisition by Starbucks… registration is now open for the World Tea Expo… Turks are tops in per capita tea consumption… scientists discover plant part that generates tea’s pucker… Kenya study points to gender inequality and shows that women make better tea… Ito En offers decaffeinated Teas’ Tea.

Teavana Update

Hard numbers are hard to find but a year after it was sold to Starbucks Teavana appears to be on a roll.

Last week during the company’s first quarter earnings call, CEO Howard Schultz, in his opening remarks, enthusiastically said: “A year after the acquisition of Teavana, we are more convinced than ever that we have the opportunities to transform the tea category in the way we have transformed coffee all around the world.”

It appears that Teavana’s two flagship stores in New York and Seattle are demonstrating that Starbucks’ single largest investment to date is beginning to pay off.

“Recent research confirms that Teavana now enjoys the highest level of awareness of any super premium tea brand and like Starbucks, Teavana had a solid Q1,” Schultz told analysts.

“Recent research confirms that Teavana now enjoys the highest level of awareness of any super premium tea brand and like Starbucks, Teavana had a solid Q1,” Schultz told analysts.

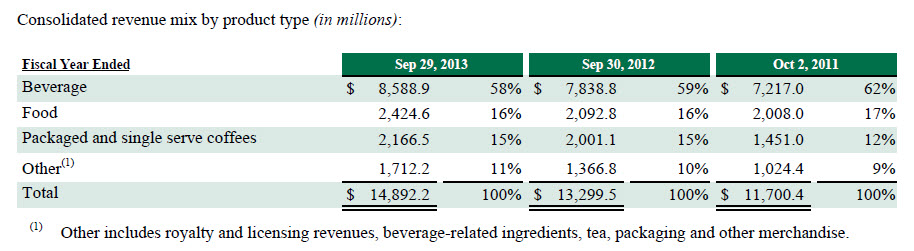

Starbucks reported a record $4.2 billion in revenue during the quarter including $159.2 million in the segment that includes Teavana. Overall the company grew revenues 12% with comparable store sales rising 5% in the Americas where store traffic increased 4%.

Financial record footnotes* state that an increase of 174% over Q1 FY13, “is primarily due to the addition of Teavana retail store revenues beginning in Q2 of FY13.” The $159.2 million combines revenue from Seattle’s Best, Evolution Fresh, Digital Ventures and Teavana. The first quarter includes holiday spending and is always strong but revenue in the segment is on track to post $630 in combined sales, most than half of which will be from Teavana.

In the company’s annual report, released in September, the financial segment that includes Teavana grossed $393.7 million for the year which was up 88.7% compared to the previous year largely due to the contribution from Teavana, but the exact amount Teavana contributed was not stated. Net revenue for the segment increased $185 million during the year, “driven by incremental revenues from the acquisition of Teavana in the second quarter of fiscal 2013 (approximately $156 million),” according to the financial filings.

In the company’s annual report, released in September, the financial segment that includes Teavana grossed $393.7 million for the year which was up 88.7% compared to the previous year largely due to the contribution from Teavana, but the exact amount Teavana contributed was not stated. Net revenue for the segment increased $185 million during the year, “driven by incremental revenues from the acquisition of Teavana in the second quarter of fiscal 2013 (approximately $156 million),” according to the financial filings.

Prior to the Starbucks acquisition Teavana reported quarterly earnings of $43 million and estimated annual sales of approximately $250 million. The company operated 284 stores at that time so a useful guesstimate is annual sales of at least $350 million. The final number will depend on how many stores are built. Teavana’s mall venues typically gross $850,000 to $1 million in sales. Going forward analysts will be able to compare year-over-year results.

Schultz said that “one year into the integration of Teavana, we are poised to begin the roll out of additional stores on the heels of the successful opening of our first two Teavana tea bars in New York City and Seattle.” The company, which currently operates 366 stores, intends to open 1000 more in the next five years. This averages 4 to 5 stores per week, a threshold easily met by a company that currently opens 1,500 coffee shops a year.

As it did with coffee, Starbucks is building gorgeous Tea Bars to showcase the brand in highly visible locations like New York City’s Central Park and Seattle. It will then roll out smaller venues in major cities around the country. These stores are cost-efficient and designed to drive profitability.

As it did with coffee, Starbucks is building gorgeous Tea Bars to showcase the brand in highly visible locations like New York City’s Central Park and Seattle. It will then roll out smaller venues in major cities around the country. These stores are cost-efficient and designed to drive profitability.

“These two beautiful new stores are already providing us the key insights that will help us achieve our goal of combining and leveraging Teavana’s strength and authority around loose-leaf tea and tea merchandising and Starbucks for entertaining its prudential consumer environment, innovative, handcrafted beverages and a retail store development to create a new retail platform and a unique international premium tea house experience.

Reading consumer response online offers a glimpse of these insights:

On Yelp! Jackie F. from Miami writes: “I had heard about this store opening and made sure that I visited on my weekend trip to NYC… love the environment, service and choices that were available. I have purchased my first three loose teas and sugar and looking forward to buying more in the future. Emily was extremely attentive and helpful during my selection process… she wasn’t pushy or overbearing. Can’t wait to get home and make it on my own.”

Nathali Z. from Brooklyn writes: “I came here led by my cousin who is a Teavana aficionado. I was excited to be in this new space and have my first Teavana Tea. The place was busy with people being helped by sales associates. When we ordered our tea the staff was very friendly, cheerful and attentive. There is an area to sit down and have our “bites”. My cousin got a chocolate brioche and I had a croissant. They were yummy but not spectacular. The tea on the other hand delicious! It was very calm and my cousin and I were excited to be one of the first people here. Definitely coming back!”

Katie R. in New York writes: I LOVE THIS PLACE! I’m so glad that Starbucks has finally opened up its first tea location… Long overdue… I’d visit this over a Starbucks coffee shop any day. I’m tea obsessed and Teavana has the best teas, hands down. The chai latte was incredible. The food selection looked great, too! I just hope they expand to other locations in Manhattan, so I don’t have to make the trek to the Upper East Side.”

This is Yelp! after all, so there were also complaints: “Plenty of cash registers, not enough tables and chairs… “NO where to sit…. and “I really wanted to like this place, but my gut is that it is a concept that won’t work… and “Because there is no coffee, it is not a place to be patronized by groups of people together, because some will inevitably prefer coffee… but overall positive or benign: “Pretty spot! I got the coco caramel sea salt latte, which ended up being too sugary and sweet for me, even after they remade it without putting any syrup in it!! The jasmine silver needle in a pot was good, though!”

Marketing is much stronger under mighty Starbucks and the public relations team that handles the account at Edelman is first-rate. In January the timely introduction of Golden Dragon Yellow tea drew attention and the Chinese New Year loyalty card and teaware are further evidence of integration of the brand. Customers loaded $1.4 billion onto Starbucks cards last quarter, up $260 million from the previous year. Teavana branded cards are interchangeable with the familiar mermaid which means that 40 million cardholders can conveniently charge a drink. Customers activated more than 2 million new cards a day in the week before Christmas.

Premium single cup is the fastest growing segment in at home coffee and Starbucks has grown its share to 18% of the segment over the last two years, said Schultz. Last spring the company introduced Teavana flavors in K-Cups™ and this fall Teavana chai launched in Starbucks’ Verismo single-cup format.

The website has not undergone a lot of visible changes, but a close look shows an upgrade in teaware including an expanded number of exclusives. Porcelain and bone china are featured along with a packaging refresh with a QR Code and new graphics. The Teavana smartphone app has been updated to make it easier to locate stores. Teavana has 328,000 Facebook likes (Starbucks has 36 million and 5.6 million Twitter followers).

The website has not undergone a lot of visible changes, but a close look shows an upgrade in teaware including an expanded number of exclusives. Porcelain and bone china are featured along with a packaging refresh with a QR Code and new graphics. The Teavana smartphone app has been updated to make it easier to locate stores. Teavana has 328,000 Facebook likes (Starbucks has 36 million and 5.6 million Twitter followers).

Mall-based stores as a whole were hard hit by a 15% slowdown in retail foot traffic and since the majority of Teavana stores are located in malls that had to hurt. Most of Teavana’s 366 stores in the U.S. and 62 shops in Canada are company owned. It also has 28 franchised stores in Mexico.

The tea market is a huge opportunity for the company. Globally tea is estimated at $90 billion with only a fraction of the tea sold as “value-added.” In fact, the majority is not even packaged. The success of the flagship stores means the company will expand more quickly now.

Two developments hint at the future for Teavana. During a major reorganization of the senior management last week it was announced Schultz “will expand his focus on innovation in coffee, tea and the Starbucks Experience as well as next generation retailing and payments initiatives in the areas of digital, mobile, card, loyalty and e-commerce.”

In his remarks Schultz promised “to bring breakthrough innovation to the tea category in the U.S. and Canada this spring and summer and to the international markets in the years ahead.”

A second clue is that Teavana is under the direction of Cliff Burrows, who is group president, U.S., Americas and Teavana. Burrows, 54, joined the company in 2001 and previously worked as managing director of the U.K. division where franchising is common.

Look for Teavana to expand overseas via traditional franchising. The EMEA region now has 2,033 stores of which 1,177 are franchised. Starbucks has very strong franchise relationships in both Europe and the Middle East. Sales growth in the region was 11% last quarter with revenues of $339 million. A turn-around in the EMEA results, which were previously slack, suggests an opportunity for expansion that would include Teavana.

Financial Footnotes:

Financial Footnotes:

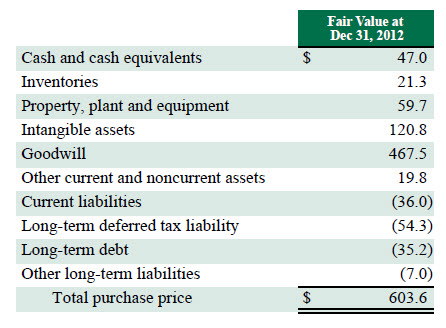

The Teavana sale closed Dec. 31, 2012. The final accounting states that Starbucks paid $615.8 million in cash. At closing the company repaid $35.2 million in long term debt. Intangible assets such as the Teavana name were valued at $105.5 million. Teavana’s proprietary tea blends were valued at $13 million. An astounding $467.5 million of goodwill represents the intangible assets that do not qualify for separate recognition, such as established global store presence in high traffic malls and high-sales-volume retail venues, Teavana’s global customer base, and Teavana’s “Heaven of tea” retail experience in which store employees engage and educate customers about the ritual and enjoyment of tea.

Pucker Up: Finding Tea’s Tannins

Tea drinkers are familiar with the concept of astringency, that mouth-drying, puckery feeling after drinking a cuppa. That sensation is the result of chemicals in the leaf called tannins. Those tannins help prevent many creatures, including birds and insects, from consuming the plants.

Tannins are very powerful. They are able to denature proteins, protect plants from ultraviolet light, and prevent bacteria, microbes and fungi from having a negative effect on the plants. But the strength of tannins could also be a weakness. Their powerful impact must be minimized inside the plant so they do not destroy it. Scientists have come to understand that tannins must be isolated in the cells by structures called vacuoles. But how do they get there?

Scientists in France and Hungary have finally discovered more about the origin of tannins and their story begins with a previously unknown organelle called the tannosome. In the cells there are chloroplasts, the part of a plant cell where light is captured and photosynthesis occurs. The chloroplasts are lined by membranes called thylakoids. Jean-Marc Brillouet and his research team discovered that tannosomes emerge from this membrane and then group together within a new membrane called shuttles. From there they move on to a protective vacuole, making tannins along the way. These multiple layers of membranes, the tannosome membrane along with membranes in the shuttle and vacuole, offer the protection the cell needs from the tannins.

It is also interesting to note that because tannosomes are formed from chloroplasts, they are green, not brown as some might expect.

Source: Scientific American and Annals of Botany

World Tea Expo

World Tea Expo is an outstanding conference and the leading tradeshow focused exclusively on tea. Registration is now open for this year’s event which moves to California at the Long Beach Convention & Entertainment Center, May 29-31.

The Expo is co-located with the Healthy Beverage Expo. Together these events attract 5,000 businesses and professionals from more than 50 countries to meet face-to-face with 260 exhibiting companies.

The education program is designed to meet the specific needs of retailers, distributors and developers with different levels of experience, according to George Jage, group director of The Beverage Group @ F+W Media, Inc.

Tea Biz has attended for years and finds this year’s program more relevant than ever.

Educational topics include: Current Trends and the Future Outlook for Tea; How to Source & Select Teas; Cultivating the Next Generation of Tea Connoisseurs; Current and Emerging Regulatory Issues in the Tea & Infusion Products Industry; Building Your Own Successful Tea Business Close to a Teavana; The Science Behind Health Claims on Tea Beverages; and Why Ignoring Herbs Could be Costing Your Business, among many others.

“The U.S. tea market is undergoing a transformational change driven by flavor, variety and quality innovation,” says World Tea Expo presenter David Sprinkle, research director for MarketResearch.com and publisher of Packaged Facts.

“At the heart of the change lies specialty tea. Competition by product type and retail channel is fierce, but ultimately the tea industry as a whole is the winner, because specialty tea products translate to more consumer enthusiasm, as well as higher prices at the cash register, than the more commoditized products they are replacing.” Sprinkle will present new research from Package Facts, including data collected specifically for World Tea Expo on specialty tea use by mainstream U.S. consumers.

“World Tea Expo is a vibrant community that’s at the helm of tea’s massive growth in the marketplace,” says Jage.

Register at WorldTeaExpo.com and HealthyBeverageExpo.com.

Gender Imbalance Hampers Kenya’s Tea Industry

MOMBASA, Kenya – Kenya’s ministry of Agriculture has published a thought-provoking report describing the gender imbalance in agriculture and food production and recommending a sensible solution: share decision-making with women.

Globally 70% of the world’s food is grown by women, toiling on five-acre and smaller plots to feed their family and earn a living. In Kenya small gardens produce 60% of the country’s harvest.

“While women provide the majority of the labor in agricultural production, their access and control over productive resources is greatly constrained due to inequalities constructed by patriarchal norms,” according to the report which was drafted with the assistance of Kenya’s Food and Agriculture Organisation.

Researchers found that when their decision-making ability is limited, and women do not have access to resources and household income, they are more likely to accept lower wages.

The report finds that women are over-represented in jobs characterized by high job insecurity and low labor standards. This has become more acute as “youth are not significantly engaged in agricultural activities.”

Young people are seeking white collar jobs and other fast income-generating activities, according to the report.

“The key gender concern is the limited power over and ownership of assets and resources despite producing about 65% of the food consumed in the country,” according to Standard Media.

Kenya’s tea industry is experiencing a pivotal moment. Upheaval in traditional export markets such as Egypt and overproduction following a lackluster year drove auction prices to new lows. Since a majority of growers tend small gardens and sell their tea through the Kenya Tea Development Agency, there was little to be done when KTDA reduced its orders.

In response, middlemen began approaching growers directly, offering 25 cents a kilo, which a significant premium over the 16 cents per kilo is paid by KTDA. Several farmers in Central and Rift Valley regions have entered into contracts with multinational tea processors.

Chege Kirundi, the director in charge of KTDA Zone Three told The Star that, “Tea hawking is dangerous and no one should be allowed to buy the commodity directly from farmers because this will affect KTDA.”

Although prices are down 30% the auction still presents the best avenue for marketing the commodity, Kirundi told the newspaper. Farmers have in the past raised concerns over its inefficiency and costs, forcing them to seek alternative ways to sell their produce.

Because of their diminished position, women are less likely to benefit from technical training and extension programs. Yet, researchers have found that women tend to produce better-quality tea due to their greater diligence, attention to quality controls and willingness to invest in the long-term interests of their families, reports In2 East Africa (www.intoeastafrica.net).

Though small-scale tea farmers produce about 60% of the country’s output, they have few women representatives in their management authority, the Kenya Tea Development Agency, observes In2 East Africa. Only 20 of the 109 tea factories in Kenya are managed by women and there are no women on the KTDA’s board of directors.

The Journal of Management and Sustainability in May 2012 published a study warning that the tea sector is likely to face future challenges if women’s participation is not actively supported.

“At a time when women’s rights are regarded as criteria for trade, their violation might lead to denied entry of Kenyan tea in some export markets,” according to researchers at Africa Nazarene University, whose work was published by the Canadian Center of Science and Education.

If Kenya’s tea sector is to continue being one of the country’s biggest foreign exchange earners, more women will need to be involved in decision-making, according to the publication.

Per Capita Tea Consumption

It used to be that tea was just tea – 2 grams to be precise, neatly packaged in a 100-count box of tea bags on the grocery shelf.

Lipton, Tetley, Red Rose, Twinings, PG Tips, Yorkshire… the brands are too numerous to list but all weighed the same. The 2-gram teabag dictated uniformity. It also made it a lot easier to calculate just how much tea was consumed.

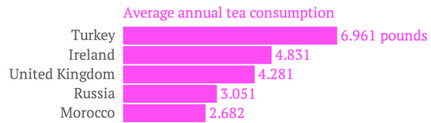

Quartz, a digitally native news outlet that compares global data sets, recently published a flawed but nonetheless helpful visualization of the world’s tea drinkers by country. The stats on per capita consumption were supplied by Euromonitor International and were calculated as tea imports divided by population.

The world leader is Turkey with Ireland and England trailing. While India (.72 lbs.) and China (1.25 lbs.) each produce more than a billion metric tons of tea, neither has a high per capita count since rural populations outside the tea growing regions find it expensive. Tea in these countries is mainly sold at market stalls, not grocery aisles. Only 2% of India’s domestic tea is sold in supermarkets.

The world leader is Turkey with Ireland and England trailing. While India (.72 lbs.) and China (1.25 lbs.) each produce more than a billion metric tons of tea, neither has a high per capita count since rural populations outside the tea growing regions find it expensive. Tea in these countries is mainly sold at market stalls, not grocery aisles. Only 2% of India’s domestic tea is sold in supermarkets.

And what happened in Pakistan, which does not appear on the list, asks French Tea Export Barbara Dufrene.

Pakistan is a relatively small tea producer but one of the world’s top consuming nations. Estimates place per capita consumption at more than a kilo, double the United States and greater than neighboring India. But it is a hard number to calculate because the price of tea is so high in Pakistan that much of the tea consumed is smuggled into the country to avoid taxes. Pakistan officially imported about 170,000 metric tons in 2010, making it the fourth largest tea importer in the world. Estimates of the tea smuggled into the country that year range as high as 100,000 metric tons.

Dividing population into the annual harvest (minus exports) is a good approximation of consumption in China, for example, where tea is consumed as loose leaf with few added ingredients to distort the weight/volume. It is more difficult to count cups but results in a more accurate measure of tea’s popularity.

The Chinese use six grams of tea per cup, as do the Turks. However the Chinese steep their green tea three to five times for a minute or two yielding at least three cups for two grams. Asians drink six to eight cups a day. The Turks in contrast steep their black tea once. Countries like Ireland and UK average two grams per cup (equivalent to a tea bag). Tea drinkers in these countries typically consume four to six cups a day.

In Europe and North America tea is blended with fruits, florals and herbs. A cup of tea in these countries is made with very little tea by weight.

Counting cups also has limitations. In Canada (1.12 lbs. per capita) and in the United States (.503 lbs. per capita) the totals are also distorted due to the large amount of bottled tea. While the majority of tea drinkers in both countries choose traditional tea bags, between a third and one half tea drinkers consume specialty blends including whole leaf tea. Much of this tea is bottled.

The Foreign Agricultural Service keeps tabs on tea imports for the U.S. Department of Agriculture. In the 12-month span from January to November 2013 (December numbers are not yet available but are likely to be the about the same as the 13 million kilos imported in December 2012) the U.S. imported an estimated 217,221,887 kilograms of tea for domestic consumption which is equivalent to 452 tea bags per person.* If this sounds too high, consider that a great deal of the tea that you drink is brewed in large quantities then powdered or concentrated and bottled.

When you exclude bottled tea, it does not seem unreasonable to assume a household with two tea drinkers buys 9 boxes of 100-ct tea bags a year – averaging about a box a month or enough tea bags for 1.2 cups a day.

Statistics Canada provides a very reliable measure of tea leaf consumed. Their count in 2011 was 2.65 lbs. per person or the equivalent of 600 tea bags a year. This compares favorably with the findings of market research firm Nielsen whose survey of 4,205 Canadians discovered 54% drink at least a cup of tea a week. The national average is 8.3 cups weekly with heavy tea drinkers consuming 16.4 cups a week (2.3 cups per day); moderate drinkers average a cup a day and light tea drinkers 1.5 cups a week. The Tea Association of Canada estimates Canadians drink 9.7 billion cups a year, a number that has climbed by 120 cups per year since 2006.

Since the population of Canada is about one tenth that of the U.S. Consumption is about double the per capita. An estimated 18.9 million Canadians drink tea on any given day. In the U.S. annual consumption was 79 billion cups in 2012. On any given day about 158 million Americans are drinking tea, according to the Tea Association of the USA.

The encouraging image portrayed by Quartz is that all the world drinks tea.

*The total excludes herbals and tea that landed in the U.S. but was exported to another country. The 217,000 metric tonnes is the equivalent of 239,446 short tons or 479 million pounds. Divide that by a population of 240,185,952 over 18 years and the per capita consumed is 1.99 pounds (452 tea bags). This falls to 1.53 pounds if you calculate consumption using the entire population of 314 million (2012 US. Census estimate) conforming to method used by Quartz with Euromonitor International data. Sources: Nielsen 2013 Tea Time Survey (Tea Association of Canada). USDA FAS. Statistics Canada. Tea Association of the USA.

Decaffeinated Teas’ Tea

SAN FRANCISCO, Calif. — ITO EN has launched an Unsweetened DECAF tea and slightly Sweetened TEAS’ TEA®, offering new alternatives to their line-up of award-winning ready-to-drink teas.

The unsweetened decaf was developed for caffeine-sensitive consumers. It is authentically brewed from premium loose leaf teas and carefully decaffeinated to preserve the tea’s true taste and available in Green Tea and Black Tea flavors. The teas offer zero calories with naturally occurring “catechin” tea antioxidants in a 16.9 fl. Oz. recyclable PET bottle.

The slightly sweetened tea has a clean finish and clarity with only 120 calories per bottle (16.9 fl. oz.). The top selling Green Tea and Jasmine flavors are sweetened with cane sugar. The newest addition to the TEAS’ TEA® family is an option for the health conscious consumer, who is not yet ready for the pure green tea, but prefers quality tasting tea that is sweetened but low in calories.

“We are pleased to offer new dimensions to meet consumer requests. The new DECAF tea meets our taste standards and affirms our commitment to the purity of the tea leaf.” said Rona Tison, Sr. Vice President of Corporate Relations. With more Americans embracing a healthier lifestyle, TEAS’ TEA® is gaining rapid distribution for its tea innovation and expertise in creating Only The Purest Tea™. Learn more: www.teastea.com

— — —

Tea Biz serves a core audience of beverage professionals in the belief that insightful journalism informs business decision making. Tea Biz reports what matters along the entire supply chain, emphasizing trustworthy sources and sound market research while discarding fluff and ignoring puffery.

Tea Biz posts are available to use in your company newsletter or website. Purchase reprint and distribution rights for single articles or commission original content. Click here for details.