—

Hard numbers are hard to find but a year after it was sold to Starbucks Teavana appears to be on a roll.

At the company’s annual meeting in March CEO Howard Schultz introduced Oprah Chai Tea in a surprise announcement that brought the celebrity on stage to discuss her love for tea.

The audience was treated to samples and Schultz said $1 from every 2 ounce package would support Oprah’s favorite charities. He announced the construction of 20 new Teavana tea bars in 2014 with major cities including Chicago and Los Angeles. The tea goes on sale Apr. 29.

The audience was treated to samples and Schultz said $1 from every 2 ounce package would support Oprah’s favorite charities. He announced the construction of 20 new Teavana tea bars in 2014 with major cities including Chicago and Los Angeles. The tea goes on sale Apr. 29.

Schultz reasserted that “a year after the acquisition of Teavana, we are more convinced than ever that we have the opportunities to transform the tea category in the way we have transformed coffee all around the world.”

Earlier in the year, during the company’s quarterly earnings report, Shultz said that Teavana’s two flagship stores in New York and Seattle are demonstrating that Starbucks’ single largest investment to date is beginning to pay off.

“Recent research confirms that Teavana now enjoys the highest level of awareness of any super premium tea brand and like Starbucks, Teavana had a solid Q1,” Schultz told analysts.

“Recent research confirms that Teavana now enjoys the highest level of awareness of any super premium tea brand and like Starbucks, Teavana had a solid Q1,” Schultz told analysts.

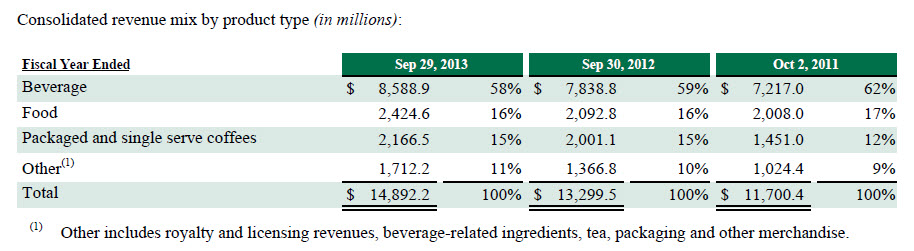

Starbucks reported a record $4.2 billion in revenue during the quarter including $159.2 million in the segment that includes Teavana. Overall the company grew revenues 12% with comparable store sales rising 5% in the Americas where store traffic increased 4%.

Financial record footnotes* state that an increase of 174% over Q1 FY13, “is primarily due to the addition of Teavana retail store revenues beginning in Q2 of FY13.” The $159.2 million combines revenue from Seattle’s Best, Evolution Fresh, Digital Ventures and Teavana. The first quarter includes holiday spending and is always strong but revenue in the segment is on track to post $630 in combined sales, most than half of which will be from Teavana.

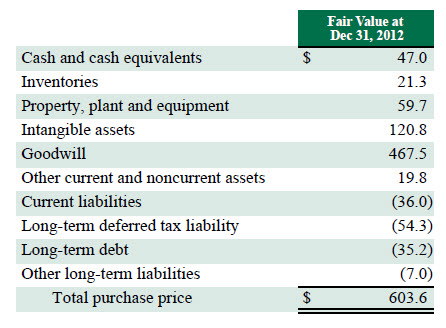

In the company’s annual report, released in September, the financial segment that includes Teavana grossed $393.7 million for the year which was up 88.7% compared to the previous year largely due to the contribution from Teavana, but the exact amount Teavana contributed was not stated. Net revenue for the segment increased $185 million during the year, “driven by incremental revenues from the acquisition of Teavana in the second quarter of fiscal 2013 (approximately $156 million),” according to the financial filings.

In the company’s annual report, released in September, the financial segment that includes Teavana grossed $393.7 million for the year which was up 88.7% compared to the previous year largely due to the contribution from Teavana, but the exact amount Teavana contributed was not stated. Net revenue for the segment increased $185 million during the year, “driven by incremental revenues from the acquisition of Teavana in the second quarter of fiscal 2013 (approximately $156 million),” according to the financial filings.

Prior to the Starbucks acquisition Teavana reported quarterly earnings of $43 million and estimated annual sales of approximately $250 million. The company operated 284 stores at that time so a useful guesstimate is annual sales of at least $350 million. The final number will depend on how many stores are built. Teavana’s mall venues typically gross $850,000 to $1 million in sales. Going forward analysts will be able to compare year-over-year results.

Schultz said that “one year into the integration of Teavana, we are poised to begin the roll out of additional stores on the heels of the successful opening of our first two Teavana tea bars in New York City and Seattle.” The company, which currently operates 366 stores, intends to open 1000 more in the next five years. This averages 4 to 5 stores per week, a threshold easily met by a company that currently opens 1,500 coffee shops a year.

As it did with coffee, Starbucks is building gorgeous Tea Bars to showcase the brand in highly visible locations like New York City’s Central Park and Seattle. It will then roll out smaller venues in major cities around the country. These stores are cost-efficient and designed to drive profitability.

As it did with coffee, Starbucks is building gorgeous Tea Bars to showcase the brand in highly visible locations like New York City’s Central Park and Seattle. It will then roll out smaller venues in major cities around the country. These stores are cost-efficient and designed to drive profitability.

“These two beautiful new stores are already providing us the key insights that will help us achieve our goal of combining and leveraging Teavana’s strength and authority around loose-leaf tea and tea merchandising,” according to Schultz. Starbucks understands consumers and what it takes to profit from innovative, handcrafted beverages and a retail store development to create a new retail platform and a unique international premium tea house experience.

Reading consumer response online offers a glimpse of these insights:

On Yelp! Jackie F. from Miami writes: “I had heard about this store opening and made sure that I visited on my weekend trip to NYC… love the environment, service and choices that were available. I have purchased my first three loose teas and sugar and looking forward to buying more in the future. Emily was extremely attentive and helpful during my selection process… she wasn’t pushy or overbearing. Can’t wait to get home and make it on my own.”

Nathali Z. from Brooklyn writes: “I came here led by my cousin who is a Teavana aficionado. I was excited to be in this new space and have my first Teavana Tea. The place was busy with people being helped by sales associates. When we ordered our tea the staff was very friendly, cheerful and attentive. There is an area to sit down and have our “bites”. My cousin got a chocolate brioche and I had a croissant. They were yummy but not spectacular. The tea on the other hand delicious! It was very calm and my cousin and I were excited to be one of the first people here. Definitely coming back!”

Katie R. in New York writes: I LOVE THIS PLACE! I’m so glad that Starbucks has finally opened up its first tea location… Long overdue… I’d visit this over a Starbucks coffee shop any day. I’m tea obsessed and Teavana has the best teas, hands down. The chai latte was incredible. The food selection looked great, too! I just hope they expand to other locations in Manhattan, so I don’t have to make the trek to the Upper East Side.”

This is Yelp! after all, so there were also complaints: “Plenty of cash registers, not enough tables and chairs… “NO where to sit…. and “I really wanted to like this place, but my gut is that it is a concept that won’t work… and “Because there is no coffee, it is not a place to be patronized by groups of people together, because some will inevitably prefer coffee…” comments overall were were positive or benign: “Pretty spot! I got the coco caramel sea salt latte, which ended up being too sugary and sweet for me, even after they remade it without putting any syrup in it!! The jasmine silver needle in a pot was good, though!”

Marketing is much stronger under mighty Starbucks and the public relations team that handles the account at Edelman is first-rate. In January the timely introduction of a limited edition Golden Dragon Yellow tea drew media attention and the Chinese New Year loyalty card and teaware are further evidence of integration of the brand. Customers loaded $1.4 billion onto Starbucks cards last quarter, up $260 million from the previous year. Teavana branded cards are interchangeable with the familiar mermaid which means that 40 million cardholders can conveniently charge a drink. Customers activated more than 2 million new cards a day in the week before Christmas.

Premium single cup is the fastest growing segment in at home coffee and Starbucks has grown its share to 18% of the segment over the last two years, said Schultz. The company has now sold 2 billion K-Cups. Last spring the company introduced Teavana flavors in K-Cups™ and this fall Teavana chai launched in Starbucks’ Verismo single-cup format.

The website has not undergone a lot of visible changes, but a close look shows an upgrade in teaware including an expanded number of exclusives. Porcelain and bone china are featured along with a packaging refresh with a QR Code and new graphics. The Teavana smartphone app has been updated to make it easier to locate stores. Teavana has 328,000 Facebook likes (Starbucks has 36 million and 5.6 million Twitter followers).

Mall-based stores as a whole were hard hit by a 15% slowdown in retail foot traffic and since the majority of Teavana stores are located in malls that had to hurt. Most of Teavana’s 366 stores in the U.S. and 62 shops in Canada are company owned. It also has 28 franchised stores in Mexico.

The tea market is a huge opportunity for the company. Globally tea is estimated at $90 billion with only a fraction of the tea sold as “value-added.” In fact, the majority is not even packaged. The success of the flagship stores means the company will expand more quickly now.

Two developments hint at the future for Teavana. During a major reorganization of the senior management last week it was announced Schultz “will expand his focus on innovation in coffee, tea and the Starbucks Experience as well as next generation retailing and payments initiatives in the areas of digital, mobile, card, loyalty and e-commerce.”

In his remarks Schultz promised “to bring breakthrough innovation to the tea category in the U.S. and Canada this spring and summer and to the international markets in the years ahead.”

A second clue is that Teavana founder Andrew Mack has retired from Starbucks. Teavana named Starbucks Vice President Annie Young-Scrivner the new President of Teavana and placed Teavana under the direction of Cliff Burrows, who is group president, U.S., Americas and Teavana. Young-Scrivner previously led the Tazo Tea division and was in charge of Starbucks Canada. Burrows, 54, joined the company in 2001 and previously worked as managing director of the U.K. division where franchising is common.

Look for Teavana to expand overseas via traditional franchising. The EMEA region now has 2,033 stores of which 1,177 are franchised. Starbucks has very strong franchise relationships in both Europe and the Middle East. Sales growth in the region was 11% last quarter with revenues of $339 million. A turn-around in the EMEA results, which were previously slack, suggests an opportunity for expansion that would include Teavana.

3 responses to “Teavana Update”

[…] See: Teavana update. […]

[…] See: Teavana update. […]

[…] “We’re going to do in the long term for tea what we have done for coffee,” Schultz said, noting that he sought a like-minded partner to promote Starbucks’ refocus on tea. […]