India Tea News for the week ending December 13, 2024

Powered by RedCircle

India Tea Exports See Big Increase

The Tea Board has released data on tea exports for the April – September period, which has indicated an increase in value by 13.18% ($410 million) compared to the same period last year. This corresponds to an increase of 8.67% in volume, to 122.55 mn kilos as against 112.77 mn kilos last year. Data from January to September 2024 shows exports at 190.08 million kg, with 110.69 mn kilos from north India and 79.39 mn kilos from south India. The increase from last year is 28.82 mn kilos. The average price was at Rs 266.45 per kg.

The First Assam Type Indian Tea Genome Decoded

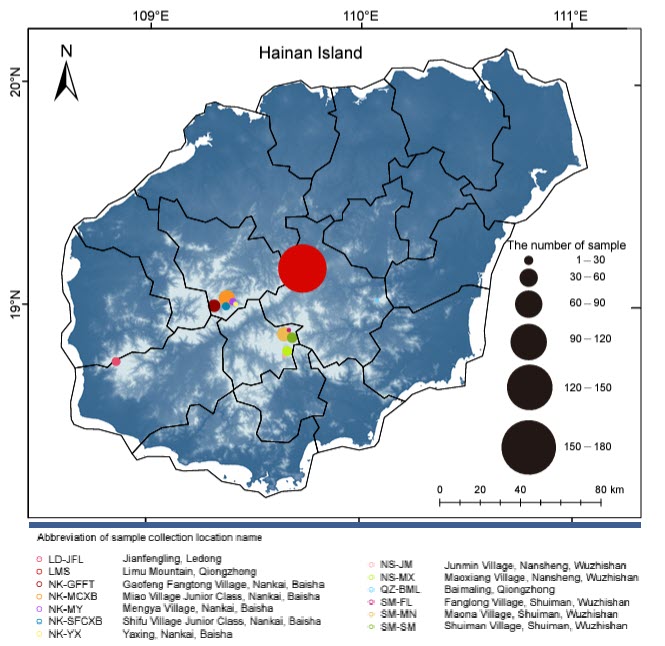

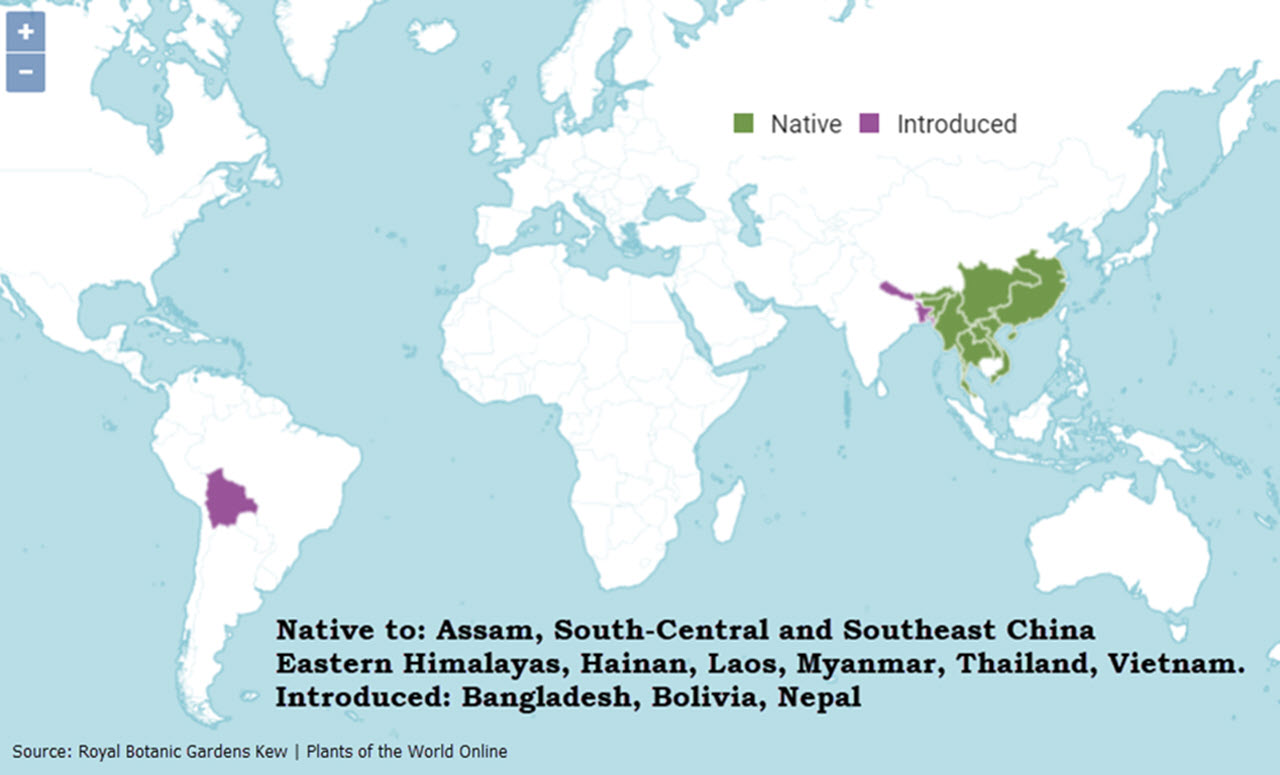

In a landmark discovery, a team of scientists from different institutions in India has decoded the first chromosome-scale genome sequence of India’s Assam tea variety TV 1(C. sinensis var assamica), marking a significant advancement in our understanding of tea genetics. The cultivar was released by Tocklai TRI in 1949.

The study, published in the journal Industrial Crops and Products, provides insights into how Assam tea evolved, developed its distinctive traits, and synthesized caffeine, revealing the genetic adaptations that differentiate it from China tea (C sinensis var. sinensis). By analyzing 150 tea genotypes worldwide, the team identified that Assam and China tea diverged approximately 5.5 million years ago, each adapting to its specific growing conditions—Assam tea in tropical lowlands and China tea in mountainous regions.

The research revealed over 500 genes in Assam tea shaped by domestication, including genes linked to caffeine production, leaf size, and branching patterns. These traits help explain Assam tea’s robust flavor and adaptability to warm climates. The team also found unique gene fusion events in Assam tea, adding to the understanding of tea’s complex evolutionary mechanisms. This breakthrough can potentially aid tea breeders in developing climate-resilient, high-yielding, and high-quality varieties.

The multi-institutional collaborative study was funded by the National Tea Research Foundation, Tea Board of India and led by Dr Tapan Kumar Mondal, Principal Scientist Indian Council of Agricultural Research-National Institute for Plant Biotechnology (NIPB), New Delhi; TRA – Tocklai Tea Research Institute (TTRI) Jorhat, UPASI Tea Research Foundation, TRI, Valparai and Darjeeling Tea Research and Development Centre, Tea Board, Kolkata West Bengal. The results of this study are now accessible through the Tea India Genome e-Resource (TIGeR) database.

— Roopak Goswami

Episode 198

Powered by RedCircle

Latest Tea News

- The History of Tea at Christmas

- Tea Exports on a High | The First Assam Type Indian Genome Decoded |

- Top Buyer Cargill Exits the Mombasa Tea Auction after 40 Years | Tea Importers Oppose Pakistan’s Minimum Retail Price | Nonprofit True Pricing Releases Food and Beverage Report

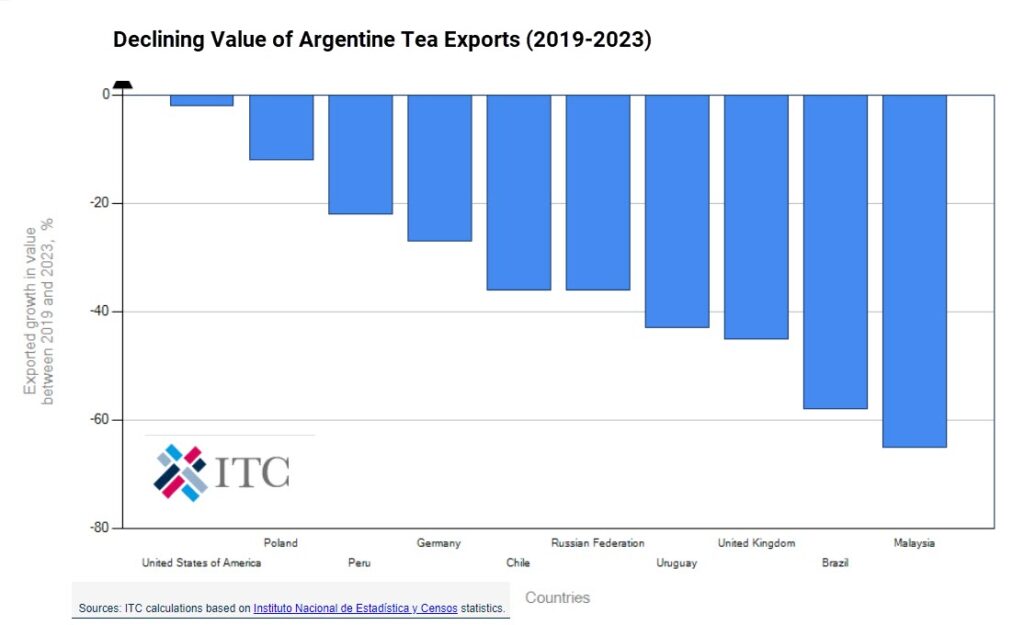

- Argentina’s Tea Harvest is Off to a Good Start but Overall Demand is Falling

- US Climate Commitment Questioned at COP29 | Argentina’s Tea Harvest is Off to a Good Start | FAO Food Outlook Reveals Rising Coffee and Tea Prices