Tea lovers, not just athletes, are getting ready to take part in the Tokyo Olympics. Tea enthusiasts from around the world can participate in a marathon of their very own: a marathon of tea.

The Japanese Tea Marathon is a series of live, online events showcasing teas from 15 of Japan’s tea producing regions. The Zoom sessions, each open to 1,000 viewers, begin July 23 and will be held twice daily, concluding August 8. Two hundred people will enjoy a free flight of teas to accompany the events. The Japan Tea Marathon is a partnership between the Global Japanese Tea Association and the Japan Tea Central Council. The entire world of tea will have an opportunity to cheer their favorite tea to victory.

A Race for Tea Lovers

Tea Biz’s Jessica Natale Woollard speaks with Simona Suzuki, president of the Global Japanese Tea Association, about the Japanese Tea Marathon.

Tea Biz: How did you choose which teas to feature in the marathon?

Simona Suzuki: As you know, Japan makes green tea. However, there are many different kinds, many variations. We wanted to show the variety of Japanese tea, including the 15 tea producing regions, and show their unique teas, their regional teas. Some teas are common across Japan, and some are much less known. We wanted to give a good picture of what Japanese tea is like.

Tea Biz: Can you tell us about a few of the teas that will be on the menu?

Simona Suzuki: We are having 30 teas altogether, two from each region. For example, a very traditional, high-grade loose-leaf tea here in Japan, gyokuro. There are a few areas where gyokuro is made, so we are introducing it from Kyoto and from Fukuoka. It’s one of the really beautiful, umami-rich, sweet teas of Japan.

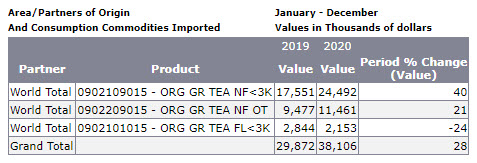

Also, organic has been a big topic recently. People are curious and interested in organic and healthy foods. We wanted to include that as well, even if Japan does not produce that much organic tea yet. But there are a few regions where organic tea is made. We are including organic matcha and organic sencha from Kagoshima and Nara.

Some of these teas are very well known, abroad as well. But there are also some regional teas that are lesser known. We are really excited to introduce a little-known tea from Kochi Prefecture called goishi-cha. It’s a post-fermented dark tea that has a totally different shape from the teas that people think Japan produces. It’s squares of pressed leaves and has a very unique taste. I hope people will be excited to try it.

Tea Biz: Will people be able to learn more about all the teas you’ve selected on your website?

Simona Suzuki: A big part of this project is to introduce the tea farmers, introduce their teas and the key regions themselves.

We do want to share a lot of this information on the website. People can look on our Japanese Tea Marathon website, and they will find information about tea regions and the teas themselves.

Tea Biz: Will some of the farmers be presenting at your online events?

Simona Suzuki: Definitely, that is our main feature, to introduce the tea farmers, the tea producers. Japanese tea is struggling a little bit; there are many challenges with decreasing demand and aging farmer population and so on. We want to focus on the farmers and producers who put all their heart into making the tea. We will be inviting one or two producers from every region to speak about their region and their teas, to share their stories with participants.

Tea Biz: Whenever it’s an Olympic year, there’s always a focus on the country hosting. You’re offering a different glimpse into Japanese culture, Japanese tea culture.

Simona Suzuki: We definitely feel the Olympic spirit in Japan, and we wanted to join in. Tea is a big part of the culture here, so I think it’s essential to introduce it.

Tea Biz: I’ve heard that you’ve already had many participants sign up for the tea tastings and events. Can you tell me a little bit about the people who are going to be participating?

Simona Suzuki: We can welcome up to 1,000 people to this event. So far we’ve had people registering from over 40 different countries around the world. This is going to be a really global event.

Tea Biz: Incredible! Forty countries represented already.

A marathon of tea sounds like one marathon I just might be able to complete.

Marathon Details

Visit the Global Japanese Tea Association for more information to sign up.

Event dates and times: The Japanese Tea Marathon will be held between 23rd July – 8th August. To account for the time difference each regional event will be held twice a day: 11am-1pm and 4pm-6pm (JST).

Event language: English will be the main language of the events with some translation from Japanese.

Participation fee: Participation in the Japanese Tea Marathon is free of charge.

Participation mode: Online through Zoom. Zoom information will be sent to registered participants before the start of the Japanese Tea Marathon.

Participation options:

- Ticket with a set of 30 teas (2 from each region)

- Registration deadline 30th May, 2021

- Limited up to 200 participants. If more than 200 people apply, priority will be given to those, who:

- can participate in the whole marathon

- can help promote the event (tea schools, tea shops, tea blogs, etc.)

- The tea set and shipping are free of charge, but depending on the country import taxes and duties may apply.

- Regular ticket

- Registration deadline 7th August, 2021

- Available up to 1000 people

Recording: The events will be recorded and may be displayed publicly. If you do not wish to be recorded, please have your video and audio off.

? Jessica Natale Woollard

The Japanese Tea Marathon is organized by and the Japan Tea Central Council PIIA and the Global Japanese Tea Association.

(?????????????, ?????????????, ?????????????)

Share this post with your colleagues.

Signup and receive Tea Biz weekly in your inbox.

Never Miss an Episode

Subscribe wherever you enjoy podcasts: