What tea professionals need to start the week of Dec. 3, 2014 —

Connected smallholders… Qi Teamaker… Crowdfunding tea ventures… Many faces of Vietnam… “chai if by land, tea if by sea.”

Tocklai Tea Research Institute App

No matter how deep you travel into tea country, India’s 900 million cell phones are readily visible. Whether riding in rickshaws, farm trucks or bajaj (tricycle taxis) tea workers, especially young tea workers, rely on their cells as much as their peers in urban settings.

That is why the Tocklai Tea Research Institute, the hub of India’s Tea Research Association (TRA) created an iPhone and Android application that gives ready access to the oldest and largest tea research and development organization in the world.

Joydeep Phukan, secretary, principle officer and CFO at TRA Tocklai, in Jorhat, Assam, writes that the application is “running well. Currently we are upgrading to IOS8. The feature on asking questions has become quite a hit with small tea farmers and planters.”

Tea farmers can get answers in real time. They can select images of pest damage taken by their phone camera, for example, upload the image and the team at Tocklai will recommend the proper action.

Phukan said the application enables researchers to connect with small holders who can study Agronomy, Botany, Engineering & Manufacturing, Meteorology, Soils & Fertilizers and Water Management & Irrigation.

The application also includes sections with very specific instructions on how to identify and deal with plant diseases, pests and weeds. The encyclopedia of research & development alone contains 1,000 pages of information.

Tocklai Experimental Station was founded in 1911. It became a part of TRA in 1964. Researchers there are in the forefront of developing drought-resistant tea cultivars; improvements in tea cultivation and processing. The institute is part of a network of 1,076 tea estates covering 6 million acres of Assam, Tripura, Dooars, Darjeeling and Terai.

Tocklai Experimental Station was founded in 1911. It became a part of TRA in 1964. Researchers there are in the forefront of developing drought-resistant tea cultivars; improvements in tea cultivation and processing. The institute is part of a network of 1,076 tea estates covering 6 million acres of Assam, Tripura, Dooars, Darjeeling and Terai.

You can download the Tocklai App for iPhone here or download the Android version here.

Learn more at: TRA Tocklai Tea Research Institute

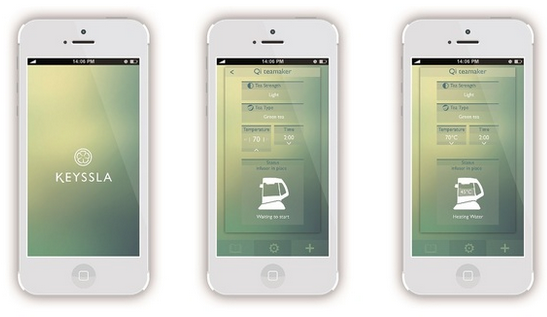

There’s an App for Everything

Keyway Innovations in Hong Kong and Shanghai recently introduced the Qi teamaker, the world’s first app-enabled kettle with a unique brewing system.

“What makes the Qi teamaker truly unique is its patent-pending brewing system that does not use a water pump or mechanical agitator to create the necessary water flow. This allows for a hassle-free automatic brewing process with simple preparation and cleanup,” writes Rick Ha, PhD, Founder and Keyway CEO.

Press the correct temperature setting for floral, green, black, oolong, or iced tea (cold brewed). Next, select tea strength. The hot water flows over tea placed in a basket in the top of the teamaker and into the clear glass body. The kettle regulates water temperature, brewing time, and water flow and tea leaf expansion.

Press the correct temperature setting for floral, green, black, oolong, or iced tea (cold brewed). Next, select tea strength. The hot water flows over tea placed in a basket in the top of the teamaker and into the clear glass body. The kettle regulates water temperature, brewing time, and water flow and tea leaf expansion.

It even makes bubble tea and milk tea popular in Asia.

Pre-set temperatures range from 75- to 95-degrees Celsius and brew times range from 2 minutes to 10 minutes. The smartphone application enables tea drinkers to customize the auto sets.

The kettle is easily disassembled and cleaned.

See it in action on YouTube: Keyssla

I’ve been watching the progress of the design team now lead by Nicholas Roux for the past three years during which the prototypes have steadily improved. The project dates to 2010 with Keyway Innovations launching in October 2012. The Kickstarter project has generated $25,000 in contributions toward its $100,000 goal (as of Dec. 7) with 17 days to go. A $149 contribution earns backers a Vita model and for $199 Keyway will send you the Maestro model, expected to retail for $249.

Speaking of Kickstarter, here is Katrina’s report on how tea ventures are faring in the crowdsourced financing arena.

Digital Investors Finance Tea Ventures

By Katrina Munichiello

In the past, future entrepreneurs saw their path forward as finding people with deep pockets – friends, family, investors – and the way to reach them was through dozens of meetings and personal contacts. Then came Kickstarter.

Kickstarter was launched as a way for individuals to share their creative projects online and to solicit small contributions from people who believed in their vision. The person seeking funding describes their project and establishes a funding goal and deadline. If the goal is reached, the project designer gets the money. To date, 73,000 projects (44% of concepts presented) have been funded.

Tea entrepreneurs have embraced the concept with new projects that include the launch of tea bars, new product lines and special projects.

Atlanta tea blender K-Teas needed funds to get FDA approval for their teas and blends so they could expand beyond local markets to national distribution. They launched their project on September 19 and by November 1 they had the support of 191 backers who helped them surpass their $5,000 goal by nearly $1,500.

Frank Horbelt from Zoomdweebie’s Tea/52 teas turned to Kickstarter several times this year, with four successful efforts raising nearly $35,000.

One of Zoomdweebie’s Kickstarter campaigns in 2014

In Horbelt’s first campaign he hoped to raise $500 for a label dispenser to make his new iced tea line more efficient to produce. Supporters came up with almost $18,000. Since that time he has raised money for custom printing projects, a packaging machine and exhibition fees for World Tea Expo.

“We chose Kickstarter because of what Kickstarter is. It’s a dream factory. I honestly believe that the one thing that people love almost as much as realizing their own dreams is helping someone else realize theirs,” said Horbelt. “You can spend a lot of time analyzing what makes a successful project and learn all kinds of tips and techniques that can help your project work better, but the bottom line is, Kickstarter is a market unlike anything else, because it is a market for dreams. You are selling a stake in your dream.”

Some recent successful tea-themed Kickstarter projects:

- Tea Spirits 2015 calendar – Raised $10,846 (against a goal of $6,500) – Illustrated wall calendar inspired by tea types

- Alchemy of Tea – Raised $16,716 from 380 backers (against a goal of $3,000) – poster of the famous tea recipes from around the world

- Loose Leaf Tea: Sip & Slip into the Leaves of a Story – Raised $5,070 (against a goal of $2,500) Development of a tea line with fairy tale themes. The launcher hopes to open a fairy-tale inspired tea room someday.

- Anthem Coffee & Tea – Raised $16,080 – To expand their Tacoma, Wash. tea shop and relaunch it as Puyallup’s Living Room

- The Honeysuckle Tea House – Raised $21,638 – To open an apothecary cafe, selling tea, kombucha, herbs and smoothies with a focus on wellness.

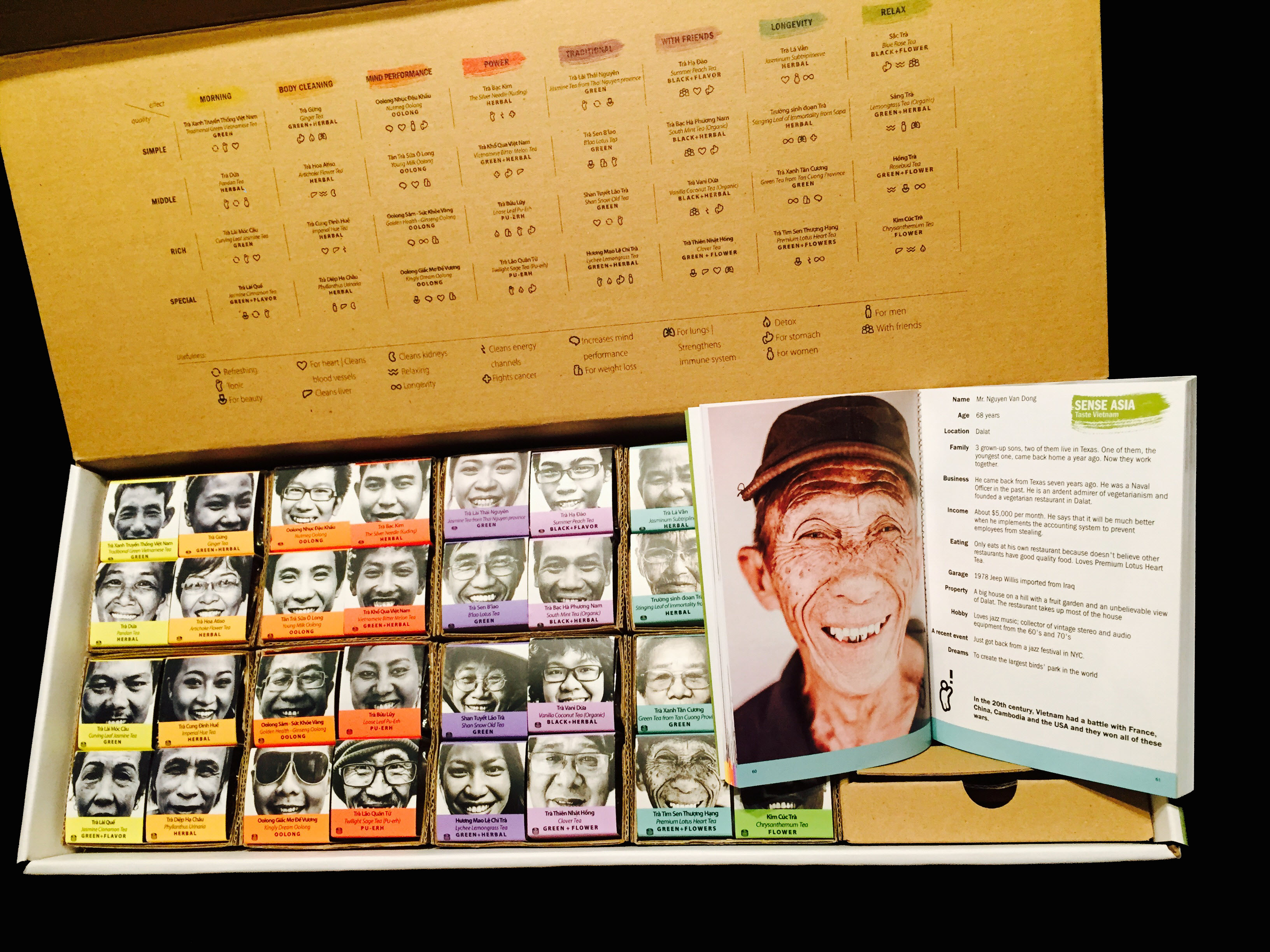

The Many Faces of Vietnam

Sense Asia Co. has released a gift set and tea sampler called “Taste Vietnam.” The boxed set features 32 artisan teas organized by function. A grid printed inside the box lid presents four teas in eight categories: morning, body cleaning, mind/performance, power, traditional, with friends, longevity and teas to relax. Along the x-axis at left the tea is further classified as simple, middle, rich and special.

Each sample is packed beneath the smiling face of growers and tea lovers along with those employed in various businesses. The mosaic of faces is telling. Some are quite young, others worldly and wise. They include seasoned masters, busy executives and several women who reveal their love for tea. The selection includes tea and herbal blends, herbals and traditional tea. Since these teas were mainly selected for their health benefits, most are green but the box also holds oolong, pu-erh and a couple of black teas.

The container brews 965 cups of tea, too many for me to evaluate since the box arrived last week but I tried several including the plastic sealed, gold foil wrapped small brick of pu-erh made by Bui Thanh Dung, an 82-year-old grower with 23 grandchildren and 12 great-grandchildren. He lives at Dak Lak and grows eight types of tea and enough vegetables, pigs, cows and chickens to feed his extended family. The tea brewed richly red-brown and sweet with forest-floor aromatics and pleasant, lingering aftertaste. The tea held up nicely through multiple steepings.

I learned about this grower and many other ordinary and extraordinary Vietnamese in a fascinating booklet enclosed with the tea. The collection is the work of 26 tea professionals who traveled 72 days in Vietnam, tasted 346 teas and interviewed 343 individuals from 28 farms and 17 towns and villages in both the north and south tea growing regions. Their subjects include dentists and fishermen, a fashion model, a cab driver, café owners, an engineering professor, and a bicycle racing champion with 220 bicycles in his garage. They range in age from their teens to 92 years and all love tea. The authors worked eight months on the project which resulted in the tales and curated selection of teas, most of which cannot be found in supermarkets or tourist shops.

The booklet is published in Russian, Japanese, Korean, French and Chinese.

“We hope that while spending time in the company of family and friends you will enjoy these delicious teas, and gain a deeper understanding the beautiful and welcoming country of Vietnam,” write the authors.

Learn more: www.senseasia.net

Tea if by Sea

There are hundreds of variants of the word tea and cha. Did you ever wonder why cha became the preferred spelling in places like India while tea and thé and tay are preferred in Europe and the Middle East?

“The word for tea in a country’s native language gives us an idea of how tea arrived at that country,” writes Stacey Geoffrey Tay in Quora.

The Amoy spelling tê originated in southern Fujian province and reached the West through the port of Xiamen (Amoy). Hokkien varieties of tea from the Southern coast of China and in Southeast Asia were grown by farmers who pronounced it teh.

Cha is from the Cantonese chàh of Guangzhou (Canton) spoken in the ports of Hong Kong and Macau where Portuguese shipments to India originated. The Mandarin chá was the name for tea that traveled overland to Central Asia and Persia.

Tay writes that current pronunciation “depends on whether its earlier speakers traded with China by land or by sea—chai if by land, tea if by sea.”

? ? ?

Tea Biz serves a core audience of beverage professionals in the belief that insightful journalism informs business decision-making. Tea Biz reports what matters along the entire supply chain, emphasizing trustworthy sources and sound market research while discarding fluff and ignoring puffery.

Tea Biz posts are available to use in your company newsletter or website. Purchase reprint and distribution rights for single articles or commission original content. Click here for details.

stores to $818 million. Drug stores showed a 13.6% gain to $25 million and multi-outlet chain locations reported an amazing $1.3 billion in tea sales, up 7%. A decade ago grocery stores and supermarkets were the dominate sales channel. Very little tea was sold in drug stores. IRI does not break out sales by format so it is not possible to identify precisely how much of these category gains

stores to $818 million. Drug stores showed a 13.6% gain to $25 million and multi-outlet chain locations reported an amazing $1.3 billion in tea sales, up 7%. A decade ago grocery stores and supermarkets were the dominate sales channel. Very little tea was sold in drug stores. IRI does not break out sales by format so it is not possible to identify precisely how much of these category gains  are from K-Cup sales, but it seems likely that most of the bump in multi-channel and drug is from capsule sales, typically big brands. Another clue is that the big jump in sales occurred after Lipton, Twinings, Celestial Seasonings, Snapple and Bigelow began selling

are from K-Cup sales, but it seems likely that most of the bump in multi-channel and drug is from capsule sales, typically big brands. Another clue is that the big jump in sales occurred after Lipton, Twinings, Celestial Seasonings, Snapple and Bigelow began selling  K-Cups. Several report earning more than $20 million annually in K-Cup sales. Another indication: sales of instant tea (typically in jars) is plummeting. In drug stores category sales fell 31%; in multi-outlet stores sales of instant tea are down 9.3% and in drug stores sales of instant are down 8.9%.

K-Cups. Several report earning more than $20 million annually in K-Cup sales. Another indication: sales of instant tea (typically in jars) is plummeting. In drug stores category sales fell 31%; in multi-outlet stores sales of instant tea are down 9.3% and in drug stores sales of instant are down 8.9%.