Tea Industry News for the Week of July 13

- DAVIDsTEA Reorganizes in Bankruptcy

- US Retail Reopenings Stall

- World Tea Expo Postponed Until 2021

- Samovar Tea Lounges Begin “Hibernation”

- Kenya Court Halts Tea Reforms

DAVIDsTEA Reorganizes in Bankruptcy

The largest specialty tea retailer in North America will permanently shutter all but 18 of its 231 outlets in the US and Canada following bankruptcy filings in both countries.

In March, following Canadian stay-at-home orders, Montreal-based DAVIDsTEA, a pioneer in specialty tea retail, closed its downtown storefronts and suburban mall locations and furloughed most of its staff. As Canada cautiously began re-opening, the company’s retail stores remained closed.

By June eviction proceedings had begun against some of the company’s stores for failing to pay rent. In July the company closed all 42 of its US locations and 82 Canadian locations.

Negotiations with landlords led to more favorable lease terms, according to the company. Seven of the stores are in Quebec, five in Ontario and the rest in Alberta, British Columbia, Manitoba, and New Brunswick. All are located in major shopping malls where foot traffic is sufficient to enable profits.

The company sent lease termination notices to the remaining locations and expects they will be closed by summer’s end.

“We believe that a select group of our best-performing stores, complementing our growing online and wholesale business model and supported by an entrepreneurial organization, will enhance DAVIDsTEA’s ability to emerge from the Companies Creditors Arrangement Act (CCAA) restructuring process as a more sustainable and resilient organization,” stated company founder, chairman and interim CEO Herschel Segal.

Frank Zitella, who is both CFO and COO said in July “we are fully committed to continuing to serve our loyal tea-loving customers with passion and ensuring that their favorite blends of tea are available online and in grocery stores and pharmacies, both during and after this restructuring.”

During the fiscal quarter ending May, DAVIDsTEA reported sales decreased 27.3% down $12.1 million to $32.2 million. “Sales in grocery stores and pharmacies across Canada continues solid growth,” according to the July 31 filing. Zitella wrote that “with first quarter sales growth of over 120% year-over-year, we are extremely pleased that our loyal tea-loving customers have shifted to buying our teas online, and in supermarkets and drugstores. The strong performance of these sales channels provided us with the confidence that we are on the right path for the future.”

In an April 27 update, Zitella wrote that “before COVID-19, our path to profitability was predicated on making the business more productive, expanding our product portfolio, and optimizing our sales channels.”

“The post-COVID-19 retail environment creates significant challenges for our unique in-store customer experience,” writes Zitella, who announced a pivot to online sales and expansion of wholesale distribution in grocery stores. The decision follows a multi-year decline in brick & mortar sales.

In the US “we will focus exclusively on our very successful e-commerce sales

“We ended the fiscal year with a solid financial position, and we have taken decisive action to align our operations with our growing online and wholesale channels. In adapting our business strategy to this new reality, we expect to emerge from this crisis as a leaner and more effective company, able to seize opportunity from a landscape ready for health and wellness tea,” according to Zitella.

Full-year revenue was $196.5 million, down 7.7% compared to FY 2018 but wholesale sales up 86% compared to fiscal 2019. The wholesale side of the business supplies 1,500 Loblaws grocery stores and 1,000 other grocery locations.

“This could represent a turning point for DAVIDsTEA and accelerate substantially the anticipated evolution towards online sales to drive long-term profitability and connect with a bigger audience than ever,” writes Zitella.

The company has a market capitalization of $23.5 million Aug. 1 and was trading at 90-cents per share. Shares were valued at $19 in 2015, rising to $35 following an initial public offering, but have since been in decline.

EDITOR’S NOTE: This story was updated Aug. 1

US Retail Re-openings Stall

The largest restaurant chains are reopening to a new normal that includes tea. Dunkin’ for example, is testing a bubble ice tea at some locations.

A study of credit card spending by Bank of America reveals a big gap between sales at independent and small chain restaurants and the 200 largest restaurant chain operators (500+ locations). Prior to the pandemic, Nations Restaurant News, reported that consumer spending was comparable in the two categories.

Green iced tea with strawberry popping bubbles at Dunkin’

“But by mid-April, although the entire restaurant industry was seeing negative year-over-year consumer trends, the spending gap between large and small restaurant chains had widened to nearly 35%,” NRN reports.

In July credit card spending at large chains was positive (compared to last year) for the first time while spending at smaller operations was down 20%. Reporter Joanna Fantozzi noted that smaller chains are more likely to be casual and quick-casual concepts, while large chains are often limited or full-service concepts. “Casual dining and quick-casual have been hit harder by a shift to social distancing, which explains some of the gap between big chains and other restaurants in the data,” according to Bank of America.

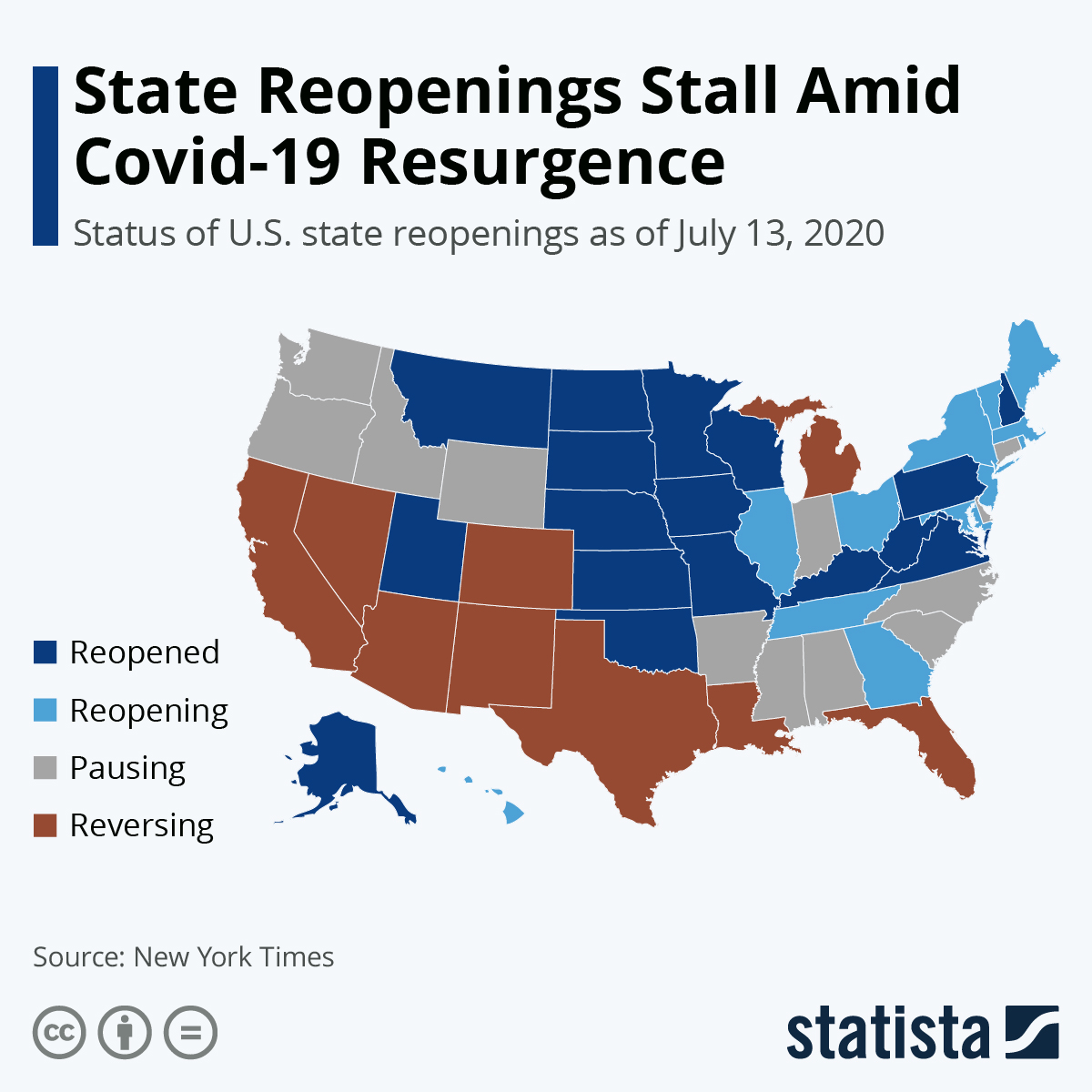

While restaurants in all 50 states are in the process of re-opening, those in Arizona, California, Texas, and Florida reversed course and 12 states have paused re-openings amid a resurgence in Covid-19 infections. The New York Times reports a mix of local and state government restrictions in Nevada, Colorado, New Mexico, Louisiana, and Michigan. Colorado reversed its policy and now mandates the wearing of non-surgical masks in situations where social distancing is not possible. Alabama, Arkansas, and Montana also made masks mandatory this week.

Georgia’s governor suspended all mask mandates, saying they are unenforceable, but major retailers including Walmart, Kohl’s and Kroger now require customers to wear masks regardless of local regulations.

East Coast and Mid-Atlantic states are mostly continuing or have completed reopening, showing how the COVID-19 resurgence in the U.S. has affected the Southern and Western States disproportionally (see map).

New Bubble Tea Emoji

Speaking of bubble tea, Friday July 17 is World Emoji Day when Apple releases its version, described as representing a tea originating in Taiwan and commonly served with tapioca pearls, also known as boba, in a plastic cup with a wide straw.

World Tea Expo Postponed Until July 2021

The June 2020 World Tea Conference + Expo that was postponed until October has been canceled, according to Questex, organizers of the event. In a release, Questex explained that due to the COVID-19 pandemic, the Colorado Convention Center in Denver declared that no large-scale events can take place in the building for the rest of 2020. This is the show’s first cancelation in 18 years.

“Our thoughts go out to everyone who has been affected by the current situation,” said Questex CMO Kate Spellman. “Our number one priority remains keeping the entire community safe,” she wrote in the press release.

“Our team is working through all of the logistics that are involved with cancelling an event,” she continued. “We understand that you will have questions and concerns. All attendee registration tickets purchased for the original World Tea Conference + Expo 2020 dates will be honored for a full credit towards the 2021 event,” according to Spellman.

Questex derived 70% of its revenue from live events until this spring. The company’s CEO Paul Miller told Folio Magazine “it takes a lot of webinars to make up for the revenue lost when a single conference is cancelled, especially because attendees aren’t accustomed to paying for access to online editions of physical events.” The pause has provided an opportunity to reevaluate every aspect of the business, from minute details to bigger questions, he said.

“Coronavirus or not, I think it was time probably for a change,” Miller told the magazine. “Is a one-location, three-day event really the future? Or is it 12 locations, with a keynote broadcast live and a breakaway for local programming? Are these the things that people might appreciate, not having to get on a plane or give up five days of their week? We’re in a crisis, let’s not waste it. Let’s rethink everything.”

World Tea Expo is the largest gathering of tea professionals in North America, attendance has varied from a few hundred in the early years to more than 5,000, including many international tea suppliers. In recent years the show has attracted 150 exhibitors and 3,500 attendees. Questex purchased the event last December and relocated it from Las Vegas to Colorado.

The 2020 edition was originally scheduled for June but stay-at-home orders and the general disruption that marked the initial months of the pandemic led Questex to postpone the event until Oct. 15-18.

Samovar Tea Lounges Begin Hibernation

Samovar founder Jesse Jacobs announced cafe and restaurant operations at the company’s San Francisco stores “will enter a hibernation period until the current health crisis turns around.”

The company’s Yerba Buena Gardens and SF International Airport locations closed during the first wave of the pandemic. All four locations will enter “hibernation” Sunday, July 19. Pickup and delivery at the Fillmore Street and Valencia Street cafes are available until then and retail products are half off. Operations continue as before at the company’s e-commerce tea shop.

“It’s with misty eyes and a heavy heart that I am announcing a major transition for Samovar,” Jacobs writes on the company’s home page, but he stressed “This is NOT goodbye…”

Jacobs founded the company 17 years ago after a career in high-tech consulting. “When I started Samovar Tea Lounge I realized that tea would be the perfect vehicle to satisfy just what the world needs today: to slow down, unplug, and wake up,” said Jacobs.

Jacobs will host tea-inspired, real-time virtual experiences “to keep the human connection alive.” First in the series is “Mindful Tea Tasting Mediation“, 7 am (PST), Monday, July 27. Click here to register.

Kenya Court Halts Tea Reforms

The Nairobi High Court halted the immediate implementation of controversial government-ordered tea industry reforms pending judicial review in September.

In April Agriculture director C.S. Peter Munya, acting on behalf of President Uhuru Kenyatta, intervened to curb predatory behavior amid falling prices. Kenya is currently record levels of production due to fair weather with little impact from the contagion in rural areas until recently.

Kenyatta’s reforms require the Kenya Tea Development Agency to pay 50% of the price of monthly deliveries. The remainder is to be paid as an annual bonus. In the past, KTDA factories paid farmers Ksh14-16 (1Ksh = USD$0.01) per kilo. Buyers will now pay 10% down with the balance due before export. Factories must pay farmers within 30 days after receiving auction proceeds. Also, brokers representing factories will be limited in the number they represent (no more than 15 factories in the current proposal).

Once an outline of the reforms was announced, Munya named a committee of industry executives, brokers and media to evaluate policy and review regulations and administrative reforms curtailing the powers of the Kenya Tea Development Agency (KTDA).

KTDA responded with a suit alleging bias and conflicts of interest, citing specific committee members. In her ruling, Lady Justice Pauline Nyamw- eya said KTDA’s concerns “met the threshold of an arguable case” and scheduled a judicial review to begin in September.

Kenya’s exports fell by six million kilos during the first five months of the year, and auction prices continue to decline, influenced by disruptions in demand and a global tea surplus.

Accessing markets is challenging, according to industry brokers. Demand for Kenya’s black CTC (cut, tear, curl) tea fell or remains flat among critical trading partners including Iran, Afghanistan, Yemen, and Egypt (down 15%).

The unit price of KTDA marketed teas fell by 6.8% during fiscal 2019/20 reaching a 12-year low of $2.42 per kilo. July 1 ended a fiscal year. Export earnings during the first five months of the year declined by Ksh1.3 billion (USD$12 million)

Need to Know

Tea Industry News for the Week of July 6

- Tea Sales on Amazon

- D2C Lifeline for Small Retail

- Global Restaurant Report Grim

- FDA’s New FSMA Portal

Tea Sales on Amazon

Overall, consumer spending in the US and Canada is down, but tea sales online and on Amazon have increased, according to market research firm JungleScout.

At the height of the lockdown, Amazon customers were spending $11,000 per second on virtually anything carried in grocery, apparel, housewares, even automotive. The company hired thousands to meet demand and earned the loyalty of hundreds of thousands of new Prime members despite the inability to guarantee same day deliveries. Prime membership rose to 52.4% from 45.2% during April largely due to COVID-19.

Grocery was one of the top sales categories and as a staple, tea fared well. Kathy Cummins, Head of Data Analysis at HINGE GLOBAL said the US Amazon total tea category (counting bagged tea, loose-leaf, and ready to drink) is $29 million. This is small compared to the $1.2 billion of coffee sales which consists mainly of single-serve capsules and pods generating $929 million. Hinge is a Cincinnatti, Ohio-based e-commerce consultancy founded in 2015 with deep expertise in sales and marketing on Amazon.

“Like coffee, we have seen an average 34% annual growth rate for tea on Amazon, suggesting that consumers are adopting this channel for this category.” said Cummins, adding, “The Subscribe and Save program, as well as the huge assortment of flavors, options, and product formats, are contributing factors.”

The “teas” category on Amazon consists of ready-to-drink, bagged, loose-leaf, capsules & pods, powders, and liquid concentrates, explains Cummins.

“Because of this diversity, sales for tea tends to be more volatile than coffee, and there is more head-to-head competition/switching with non-teas (such as flavored waters, water flavor enhancers, and non-tea ready-to-drink alternatives), according to Cummins.

“Sellers competing in teas should take special care to have strong copywriting and efficient paid marketing to stand out in the crowd,” she said.

Brand Discovery

A June survey of Canadian consumers revealed that almost half (45%) reported discovering new brands through online resources while researching COVID-19. Website visitors are seeking products that keep them and their families safe, while also seeking the easiest way to purchase them, according to Google Think. “More than 20% of Canadians purchased a brand that was new to them during COVID-19 that they plan to continue to buy,” according to Deloitte State of the Consumer Tracker (April 2020).

In its report on consumer trends, JungleScout writes that COVID-19 has the potential to solidify consumers’ e-commerce brand loyalty. During the pandemic 63% of consumers increased or maintained their online spending and 61% increased or maintained their Amazon spending.

“About 50% of customers are buying more groceries and cleaning supplies with 30% or more buying fewer electronics, office supplies and clothing. JungleScout found that 61% of consumers plan to reduce their spending on non-essential items in the future.

The report found 90% of customers have shopped on Amazon and 65% do so monthly. Thirty-nine percent of respondents said they would be fine if they never had to shop in a physical store again.

Walmart

Amazon grabbed the headlines but online sales at Walmart grew 74%, contributing to a $134.6 billion first quarter. Comparable sales rose 10% from a very large base, indicating many new customers.

“During the pandemic, customer loyalty went out of the window as consumers shopped around much more … in order to find the supplies they needed,” GlobalData Retail Managing Director Neil Saunders told Retail Dive.

“As the largest grocer with a massive footprint, it (Walmart) became a destination for all kinds of shoppers. This included many people who don’t usually visit the store much for groceries,” said Saunders.

Walmart is soon expected to rollout unlimited same-day delivery without a per delivery fee for Walmart+ consumers willing to pay $12.95 per month ($98 annual).

“Overall, the pandemic has helped Walmart,” Saunders said. “Before the crisis it was the nation’s retailer and that position has only become more entrenched.”

Global Restaurant Report Grim

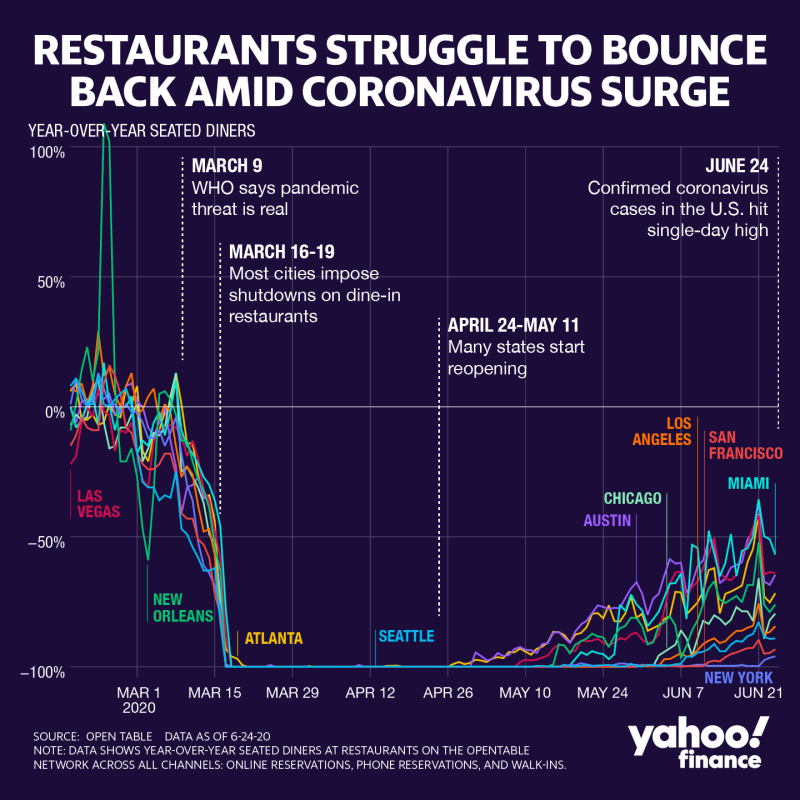

Restaurant owners globally are assessing retail carnage in the wake of the coronavirus pandemic that will likely claim 2.2 million restaurants in 2020.

In the US the National Restaurant Association estimates a shortfall of $120 billion in restaurant and foodservice sales from March through May.

Bloomberg News reports that the pandemic is permanently reshaping the restaurant industry. Consulting firm Aaron Allen & Associates estimates 10% of restaurants globally will disappear with an additional 20% forced to go through a financial restructuring. The report quoted an even more pessimistic OpenTable which notes the US restaurant industry, which employs 15.6 million workers, was already suffering from rising debt and excessive competition “before the global pandemic caused a dramatic and unprecedented shift in consumer behavior.”

Delivery and curbside service are now common, but currently bring in only 35-40% of prior sales, forcing chains including Panera Bread and Tijuana Flats to offer groceries for the foreseeable future. Estimates place grocery orders at 10-25% of total sales.

OpenTable CEO Steve Hafner predicts 25% of US restaurants might close permanently. “Even in the best of times, restaurants operate on really thin margins. So if you add on capacity restrictions, new safety, and service protocols, it’s really tough for a restaurant to make it,” he told Yahoo! Finance. On May 14 total reservations and walk-ins on OpenTable were 95% below reservations on the same date the previous year. Nationally, year-over-year restaurant sales are now about 65% of sales during the same period in 2019. OpenTable tracks 60,000 restaurants globally.

YELP! which lists 140,000 businesses large and small, reports 41% of its listings have shut down for good. Los Angeles experienced the largest number of closures at 11,774 but Las Vegas was much harder hit per capita with 1,921 closures, according to YELP! which counted 23,981 restaurant closures along with 27,663 retail shops. Approximately 20% of the businesses that were closed in April have reopened.

There are about 22 million restaurants worldwide. The greatest concentrations are in cities like New York where there are 27,000 restaurants of which 4,800 are now open for outdoor dining.

D2C Lifeline for Small Retail

Online-only tea retailers such as London’s offblak.com launched as direct-to-consumer (D2C) ventures but more recently D2C has become a business-saving lifeline for brick & mortar retailers during the pandemic.

Online tea sales increased during the past six months as home-bound consumers spent the most on everyday household goods, groceries, and medicines. A survey of Canadian consumers found that 30% reported going online in April to purchase for the first time products they would normally buy in-store.

Retailers with close ties to their customers benefit most as their cost of acquiring individuals to sell to is low. Those who are thriving are going beyond e-commerce sites. Jesse Jacobs, founder of Samovar Tea Lounge, launched tea-tasting sessions via Zoom after closing the company’s four cafes.

A first-party data strategy is critical to learning about customers and delivering a personalized experience, which can result in a greater return from marketing investments, according to Google Think. A direct link with customers means retailers can offer more flavors and ranges not available in supermarkets and storefronts with limited shelf space. A cafe, for example, might offer six or eight teas on its menu but easily double that number of offerings online. Those with blending skills can offer exclusive, limited-edition, low-run teas at a premium delivered directly to your home.

Bundling is also an attractive option.

In Canada, Unilever introduced bundles of commonly purchased groceries that include shelf-stable Tazo tea and boxes of Lipton Yellow Label and Rejuvenate herbal tea along with Knorr soup and seasoning multipacks. An enclosed recipe card explains how to make an entire meal. The U-Shop is integrated with Google’s Merchant Center and Shopify.

“The site features product bundles to help get around the low unit cost vs. higher shipping costs — a challenge for most CPGs,” according to Google Think.

Home cleaning, laundry, and home hygiene bundles are currently available at discount in the UK via leverdirect.co.uk. Delivery is free.

During the past few months breakfast shifted from drive-thru to home-cooked while dine-in dinners and restaurant lunches declined. Since few tea drinkers order hot tea with their restaurant takeout (75% prefer beverages from home) providing a packaged single-serve option is good business. Offer larger format teabags for making iced tea — a family favorite given that for the first time in decades, the number of meals shared by family members is on the rise.

The Huffington Post reports that 30-35% of families share fewer than three meals a week together prior to the pandemic.

Building an omni-channel strategy is likely to pay off. A 2017 survey among U.S. consumers showed that 23% of respondents drink tea every day, while only 10% never drink tea at all.

FDA’s New FSMA Portal

The US Food and Drug Administration (FDA) unveiled a web portal describing in detail a 10-year blueprint for implementation of the Food Safety Modernization Act (FSMA).

Download the blueprint (152mb)

In a press release FDA Commissioner Dr. Stephen Hahn MD, writes that “Many believe we will see more changes in the food system over the next 10 years than we have in decades. Foods are being reformulated; there are new foods, new production methods, and new delivery methods; and the system is becoming increasingly digitized.” ?

“To keep pace with this evolution, FDA is taking a new approach to food safety, leveraging technology and other tools to create a safer and more digital, traceable food system,”? he said.

“Smarter food safety is about more than just technology. It’s also about simpler, more effective, and modern approaches and processes. It’s about leadership, creativity, and culture,” said Hahn.

The ultimate goal is to reduce the number of food-borne illnesses in the US.

The blueprint identifies four objectives:

- Smarter tools and approaches for prevention and outbreak response.

- New business models and retail modernization

- Tech-enable traceability

- Food safety culture

FDA said it intends to push for a transformation of food and dietary ingredient record keeping. Much of this is still done on paper, which hinders the Agency’s timely response to outbreaks of food borne illnesses. The Agency said it also intends to push for greater transparency in the supply chain, while still being mindful of confidentiality and proprietary interests, writes Hank Schultz in Nutra Ingredients USA

FDA announced it will convene a summit to foster new food ingredients and production technologies. Mankind can safely ingest 200,000 of the world’s 400,000 species of plants but the world’s population commonly eats only about 200 plant species. Three crops, maize, rice, and wheat account for more than half the calories and proteins humans derive from plants. Humans require one million calories a year to thrive. Corn produces roughly 15 million calories per acre, enough that if the US harvest of 14.2 billion bushels were used to feed people it would supply 17% of the world’s caloric needs.

Bankruptcies are accelerating. Commercial Chapter 11 filings are up 43% over June 2019 with 609 new filings compared to 424 in June of last year. Prior to the pandemic, about 95% of all bankruptcy cases were filed by individuals, rather than businesses, according to a brief by the Poynter Institute. The 2019 Small Business Reorganization Act (SBRA) became law in February helping small businesses move through the bankruptcy process more quickly and with lower costs. During the first half of the year, 3,604 companies filed under Chapter 11, up 26% compared to 2019. These include 30 US companies with liabilities greater than $1 billion. Z-Score, a formula for predicting insolvencies developed by NY University professor Edward Altman, predicts the total will exceed 60 by year-end, according to a Bloomberg Business report.